Hi Readers👩💻,

Decentralized Finance (DeFi) is a well-known, hot topic within the blockchain community. And when it comes to DeFi, Band Protocol is taking things to the next level — preparing blockchain for the Web 3.0. Stakin supported the Wenchang testnet and will be providing validation services on the Wenchang Mainnet, which launched the 10th of June, as well. In today’s article, we’ll be taking a look at this network and its possibilities.

🧐 Part 1 — What is Band Protocol?

In a nutshell, Band Protocol is a cross-chain data oracle platform that aggregates and connects real-world data and APIs to smart contracts. With the Band Protocol, users can build and manage on-chain oracles, reputation scores, token issuance, and token curated registries.

The network’s goal is to ensure interoperability between blockchain smart contracts and the rest of the world. Their mission is to connect blockchains and smart contracts to trusted real-world or off-chain data and services. So, how would that work? Smart contracts rely on external price feeds, events, and values that are provided via traditional web APIs to resolve its logic and enable secure transfers. The Band Protocol provides a data governance framework for Web 3.0 applications that operates as an open-source standard and offers a framework for decentralized data management. Therefore connecting smart contracts with trusted off-chain data and effectively creating a trusted information bridge between Web 2.0 and 3.0.

So, who will be using the Band Protocol? The primary focus is on users of DeFi applications that have integrated Band Protocol into their protocols and DApps. The focus on DeFi applications is that they have shown the highest amount of traction out of any public blockchain use cases thus far. Moreover, many DeFi applications rely immensely on price oracles to operate correctly, and often they form the most critical point of weakness in their design.

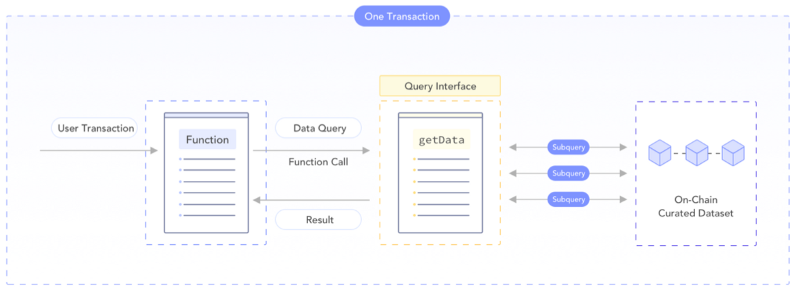

Already existing data provider networks often suffer from asynchronous interactions between smart contracts and data layers; this complicates the smart contract implementations and introduces a significant delay as two blockchain transactions need to be confirmed and executed sequentially. The Band Protocol’s solution provides an interface for DApps to receive real-world data as a simple function call to a static smart contract.

Data providers such as exchanges and data aggregators (CoinGecko or CoinMarketCap) are responsible for inputting and curating data to the blockchain. Making it ready for DApps to consume in 30–60 seconds as steps 3 and 4 are omitted. The image below illustrates the streamlined interaction between smart contracts and Band Protocol.

💻 Part 2 — Consensus and Governance

The Band Protocol has two primary forms of governance. The first is governance over the broader or complete Band Protocol. Secondly, the governance of each dataset and its parameters through its corresponding token curated dataset, which transfers into two different digital assets: BAND tokens and dataset tokens. The digital dataset asset represents the ownership stake in a particular dataset inside the Band Protocol. Use cases for this asset are staking to acquire data provider slots, staking for data provider curation, and voting. With the dataset token, you can vote to collectively decide dataset configurations, such as the number of data providers, cost of data query, or minimum stake requirement.

The BAND token is the native digital asset of the Band Protocol and has a fixed supply of 100.000.000 BAND. The BAND asset functions as collateral to issue dataset tokens. It is also used as a voting token for network governance decisions and participation in the BandChain consensus algorithm (after Mainnet launch).

- 👉 The current circulating supply is 20.494.033 BAND, the market cap is 32.691.962 USD (according to a third party, CoinMarketCap as of 10 June 2020).

🕵️♂️ Part 3 — Use Cases

The Band Protocol has many use cases, and over time more and more additional ones will develop. However, the current primary use of the Band Protocol Oracle — as stated by CEO Soravis Srinawakoon in an interview with Crypto Finder — is the possibility of incorporating and using the price feed oracle into new and existing DeFi protocols and applications.

Well-known DeFi applications like Compound, MakerDAO, and Synthetix, all rely on some price oracle, mostly ETH/USD price information, to inform their conduct. The security and maintaining decentralization are among the main issues that all these projects have when it comes to their oracles. The Band Protocol sees this as an opportunity to improve and create the best possible oracle solution and to work closely with partners to help integrate technology to improve the weaknesses of current solutions.

The Band Protocol is not only limited to the DeFi space, as there is a wide variety of use cases for oracles. Oracles are used every time a decentralized smart contract based application needs to access off-chain data. Meaning, secure oracles could facilitate new payment systems, decentralized gaming applications that interact with events in the outside world, cross-blockchain infrastructure, and more.

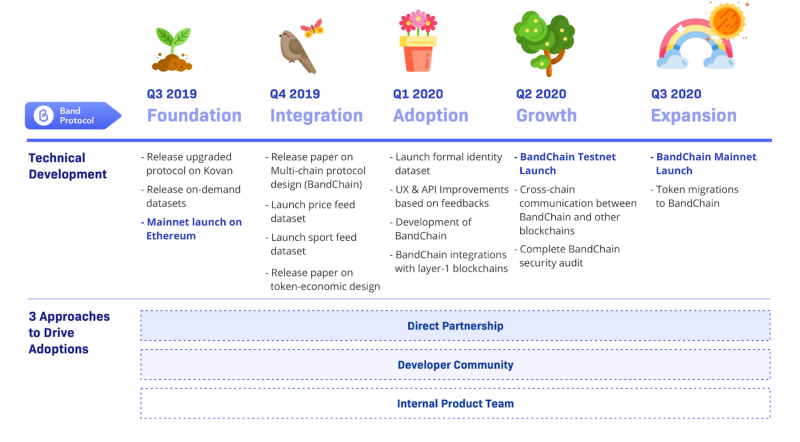

🛫 Part 4 — Roadmap and BandChain

Currently, The Band Protocol operates on the Ethereum blockchain. However, BandChain is the native blockchain that Brand Protocol will run on after the Mainnet launch of the 10th of June 2020. The Tendermint based Proof-of-Stake blockchain will facilitate reliable cross-chain communications between BandChain and most other smart contract blockchains. Furthermore, it will make sure Band Protocol can realize its vision to become genuinely interoperable with any ecosystem.

More Information & Sources

- Band Protocol Official Twitter

- Band Protocol Official Website

- Band Protocol Medium

- Check Stakin’s Official Website!

DISCLAIMER: This is not financial advice. Staking, delegation, and cryptocurrencies involve a high degree of risk, and there is always the possibility of loss, including the loss of all staked digital assets. Additionally, delegators are at risk of slashing in case of security or liveness faults on some protocols. We advise you to do your due diligence before choosing a validator.