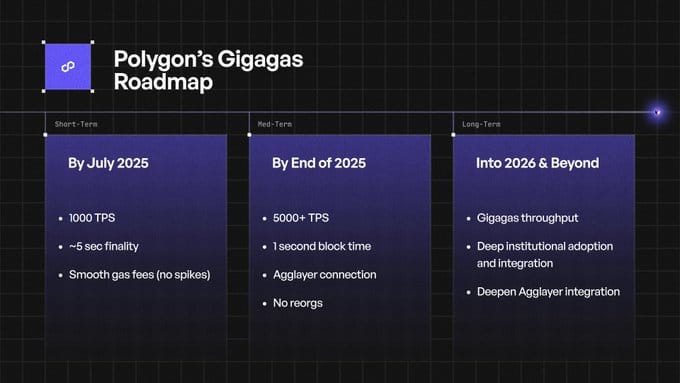

Polygon PoS has entered a new stage of technical advancement, led by the deployment of the Bhilai hardfork and the Heimdall v2 upgrade, the first milestones in the network’s long-term Gigagas roadmap. This roadmap, officially presented by Polygon Labs, aims to scale Polygon PoS to 100,000 transactions per second while maintaining low-cost execution, fast finality, and an improved developer experience. As of July 2025, Bhilai has increased the network’s throughput to over 1,000 TPS by raising the block gas limit and optimizing gas fee dynamics. It also introduced support for EIP-7702, enabling account abstraction and gasless transactions that simplify onboarding and allow users to interact with dApps without managing gas.

In parallel, Heimdall v2 modernizes Polygon’s consensus layer by replacing outdated components with CometBFT and Cosmos SDK v0.50, reducing transaction finality from 1–2 minutes to ~5 seconds. This upgrade also improves validator sync, minimizes chain reorgs, and ensures faster, more reliable settlement, an essential requirement for payments, stablecoins, and tokenized real-world assets (RWAs).

Together, these upgrades position Polygon PoS as a scalable, production-ready blockchain infrastructure capable of supporting institutional-grade applications.

In the sections that follow, we examine how each upgrade was implemented, what technical changes they introduced, and how they reshape Polygon PoS as a foundation for high-performance, blockchain applications

Bhilai Hardfork: Boosting Throughput and Enabling Gasless UX

Deployed on July 1, 2025, the Bhilai hardfork marks a foundational upgrade to Polygon’s execution layer (Bor). The primary goal was to increase processing throughput and modernize user interactions. Bhilai achieved this by:

● Raising the block gas limit from 30 million to 45 million, increasing TPS to over 1,000.

● Reducing gas volatility by adjusting the BaseFeeChangeDenominator (via PIP-58), resulting in consistently low transaction fees, typically well below $0.01.

● Upgrading Bor to Go-Ethereum v1.15.x, unlocking support for Ethereum Pectra EIPs, including EIP-7702.

The addition of EIP-7702 brings account abstraction to Polygon PoS, enabling gasless transactions and passkey-based authentication. This allows developers to create Web2-like experiences in Web3 environments, removing friction for new users and streamlining onboarding processes. Applications like Polymarket have already leveraged this functionality to offer seamless, scalable services.

Heimdall v2: Consensus Finality in ~5 Seconds

Just ten days after Bhilai, Polygon Labs rolled out Heimdall v2 to mainnet between July 10, 2025, successfully upgrading the consensus layer of the network. According to the official release, this was the most technically complex upgrade since the launch of Polygon PoS in 2020 and one of the most intricate in blockchain history, second only to Ethereum’s Merge.

The upgrade includes:

● Replacement of Tendermint with CometBFT v0.38.x (PIP-43)

● Migration to Cosmos SDK v0.50 (PIP-44)

● Activation of the new consensus engine via PIP-62

The impact is profound:

● Transaction finality dropped from 1–2 minutes to ~5 seconds

● Reorg depth was reduced to a maximum of two blocks

● Consensus synchronization and stability were significantly improved

This acceleration is critical for applications in payments, DeFi, and real-world assets (RWAs), where fast and final settlement is a hard requirement. Centralized exchanges can now confirm deposits faster, fintech applications can move user funds in real time, and developers can deploy latency-sensitive use cases with greater confidence.

Polygon now offers faster finality than Venmo, with decentralized security guarantees. Combined with Bhilai, this makes Polygon a top-tier platform for regulated financial flows, tokenized assets, and Web3-native payments infrastructure.

Strategic Impact: Payments, RWAs, and Beyond

Polygon’s roadmap is centered around scaling not just throughput, but also real-world usability. The combined effect of Bhilai and Heimdall v2:

● Supports over 1,000 TPS with sub-cent fees

● Offers ~5-second finality, drastically improving settlement assurance

● Enables gasless onboarding via account abstraction

● Lays a robust technical foundation for regulated financial products, tokenized assets, and consumer payments

Institutional integrations from Stripe, Nexo, Reliance Jio, and BlindPay are already taking advantage of Polygon’s infrastructure. The network currently hosts $2.7B in stablecoin supply and facilitated over $1B in stablecoin payments in the first half of 2025.

With these upgrades live, Polygon is poised to become the premier blockchain for payments and RWAs, outpacing alternatives in speed, cost-efficiency, and reliability.

What’s Next for Polygon PoS: Toward 5,000 TPS and Instant Finality

With the successful deployment of the Bhilai hardfork and Heimdall v2, Polygon PoS has met all of its short-term milestones outlined in the Gigagas roadmap: over 1,000 TPS, ~5-second finality, and smooth, predictable gas fees. These upgrades establish the foundation for the network’s next evolution, driving toward institutional-grade performance and cross-chain interoperability.

Scaling to 5,000+ TPS with 1-Second Block Time

By the end of 2025, Polygon Labs aims to push network performance even further by introducing 5,000+ transactions per second and reducing block time to just one second. This increase in throughput will enable applications to process thousands of transactions in real-time, while maintaining decentralization and low costs. According to Polygon’s engineering team, this will be achieved through ongoing improvements to both the execution and consensus layers, building on the groundwork laid by Bhilai and Heimdall.

Joining Agglayer for Unified Liquidity and Interoperability

Polygon PoS is also scheduled to connect with Agglayer, Polygon’s aggregation framework for multichain interoperability. This connection will enable unified liquidity, cross-chain messaging, and seamless asset transfers between Polygon PoS, zkEVM, and future L2s. Once integrated, Agglayer will allow developers to build applications that operate across multiple chains with the simplicity of a single-chain environment.

Eliminating Reorgs for Secure Financial Applications

The roadmap also targets eliminating reorgs entirely. While Heimdall v2 already limits chain reorganizations to a maximum of two blocks, future upgrades aim to provide deterministic finality. This is essential for high-trust use cases like stablecoin settlement, tokenized securities, and other regulated real-world assets (RWAs), where transaction immutability must be guaranteed.

Preparing for 2026: Gigagas Throughput and Institutional Integration

Looking beyond 2025, Polygon’s focus shifts to achieving full gigagas throughput, targeting 100,000 TPS over time. This long-term vision includes deeper support for institutional adoption, expanding the range of RWA partners, custodians, and compliance-friendly infrastructure. As more fintech and TradFi entities adopt blockchain rails, Polygon positions itself as the high-speed, low-cost, Ethereum-aligned solution.

Polygon PoS is no longer just scaling throughput, but evolving into a modular, institution-ready network, optimized for real-time payments, enterprise-grade security, and multichain composability. With the technical milestones for July 2025 achieved, the next phase: 5,000 TPS, Agglayer integration, and single-block finality is already underway, marking a pivotal moment in Polygon’s role as the go-to chain for payments and RWAs.

Conclusion

With the Bhilai and Heimdall v2 upgrades now live, Polygon PoS has advanced into a new category of blockchain infrastructure, one designed to meet the performance and reliability standards required for payments, tokenized assets, and high-volume applications.

The network now combines low-cost execution, fast and predictable finality, and a significantly improved developer environment. For teams building in production, Polygon PoS offers the tools and guarantees needed to support real-world adoption. These upgrades mark a strategic shift, positioning Polygon as a network capable of delivering the throughput, stability, and user experience expected in financial and enterprise contexts.

DISCLAIMER: This is not financial advice. Staking, delegation, and cryptocurrencies involve a high degree of risk, and there is always the possibility of loss, including the failure of all staked digital assets. Additionally, delegators are at risk of slashing in case of security or liveness faults on some protocols. We advise you to do your due diligence before choosing a validator.