In this post, we’ll discuss motivations for the AggLayer, its advantages, its builders, and how it relates to Polygon’s vision.

Ethereum’s Liquidity Fragmentation Problem

One of the most pervading issues around Ethereum right now is fragmentation. We may need help to understand exactly what fragmentation means. Let’s explore what fragmentation and scaling, in general, mean.

Scaling is the ability to handle an increasing amount of work (transactions, users) or the potential of a blockchain to accommodate more growth. Efforts around scaling typically fall into two main categories: vertical scaling and horizontal scaling.

We can think of horizontal scaling as "scaling out". Essentially, the workload on a blockchain is distributed across many different rollups in the network. Increasing the number of rollups potentially helps to achieve unlimited scalability; however, it comes at the cost of fragmentation.

Thus, we enter Ethereum's rollup-centric ecosystem. Ethereum’s endgame is potentially reaching thousands or even millions of rollups, each utilizing Ethereum's base layer for security.

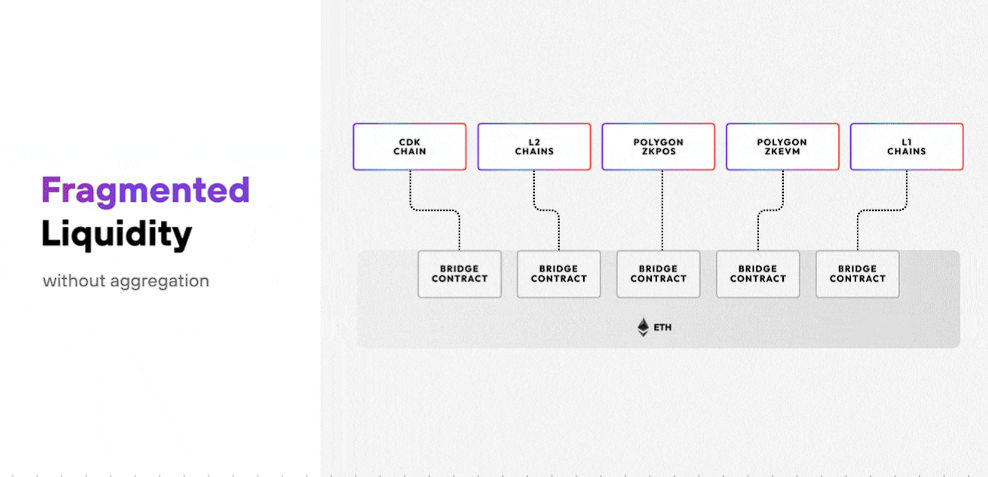

Your problem here is that each rollup is a separate chain. So, while all these rollups improve scalability in the short term, they can create isolated environments and user friction. Thus, we now have a fragmentation problem resulting from a network being separated into several smaller pieces.

While all these rollups share base-layer Ethereum security, the computation proceeds differently on each one through a sequencer. A sequencer is a centralized party that performs all of the computation for a rollup on a server.

This means the assets you hold on the rollups and the liquidity (trading volume) tied to them can become fragmented. Instead of being concentrated, liquidity is divided across multiple platforms, reducing overall efficiency. Therefore, users might have to transfer assets between different rollups to access dApps, liquidity, or other services. In turn, you'll likely incur more fees and time delays, making your user experience quite challenging.

This is where The AggLayer comes in as a possible solution.

What is The AggLayer?

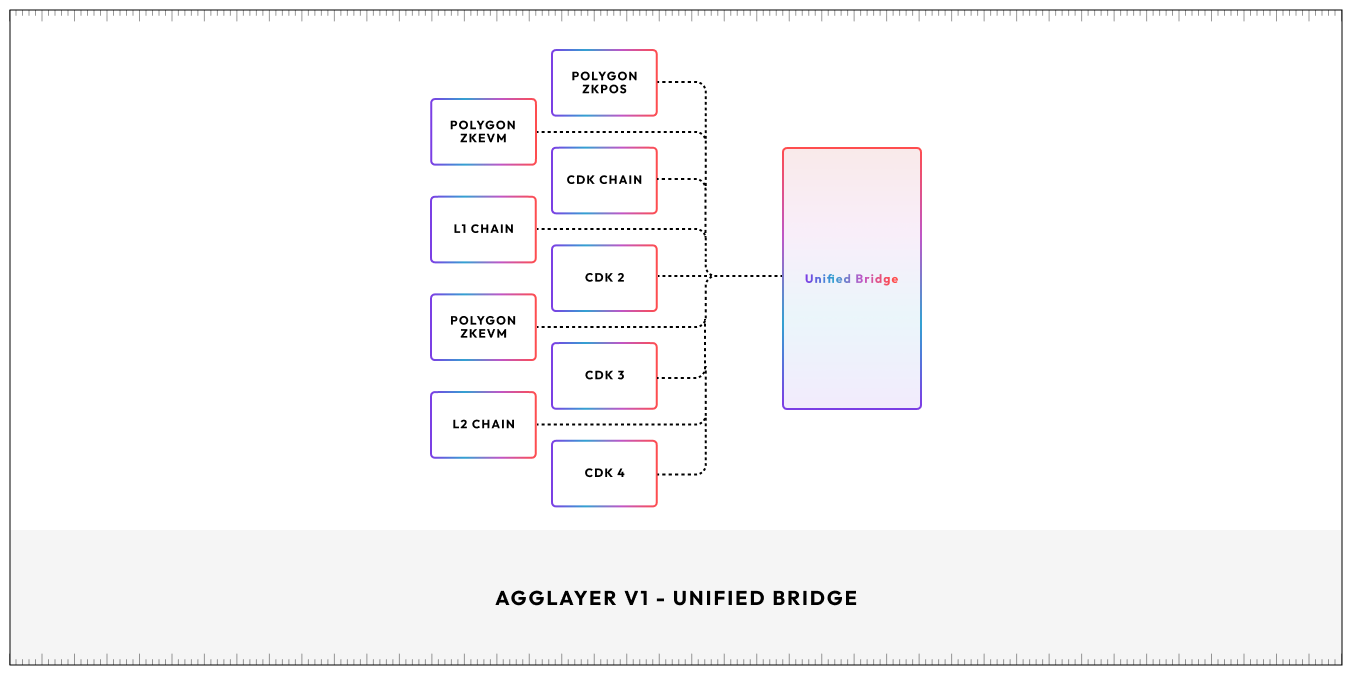

At the core, the AggLayer is a decentralized protocol comprising a common bridge and a ZK-powered proof validation and aggregation mechanism. It aims to serve as a single environment unifying EVM and non-EVM chains, unlocking fragmented liquidity while retaining Ethereum’s security properties via ZK proofs with seamless UX.

In other words, if you’ve ever used a bridge, the AggLayer seeks to become a bridge for moving assets to and from other EVM and non-EVM chains. Moving assets to another network will incur long delays and fees, and you may even have to use multiple bridges depending on your target destination.

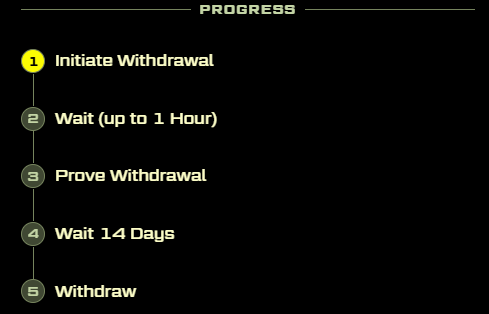

Let’s put this more into perspective. Heading over to a popular rollup called Blast, users may want to earn more yield on their ETH or stablecoins. Well, you’ll first need to bridge over there, and that can potentially cost a lot in fees and take anywhere from a few minutes to hours, depending on whether you’re coming from Ethereum.

Let’s say you finally get there. Maybe you play around with it and want to move your funds off it. After initiating a withdrawal, you’ll be presented with the above interface. For reference sake, this has been shortened to 7 days after the time of this writing. Still, you get the idea. That’s a strenuous process for a user regardless of half the time being cut.

The AggLayer aims to provide a single environment where frequent bridging will become a thing of the past, and cross-chain interactions will be effortless. It comprises the following components:

- Unified LxLy Bridge

- AggLayer v1

- Bridge and Call

The Unified LxLy Bridge allows connected EVM and non-EVM chains to exchange information safely. A new smart contract called RollupManager makes this possible. Through this, new and existing rollups can now be integrated for unified management.

Blockchains connected to the LxLy bridge can transmit proofs back to Ethereum for safety. At the same time, the AggLayer v1 acts as a security layer, serving primarily CDK chains, and checks proof validity before settling to Ethereum.

Bridge and Call is an important feature of the LxLy bridge. This smart contract framework allows a single call to bridge an asset and send a message. So, you're not only bridging a token, but you're also sending call data to execute right after.

Key Advantages of The AggLayer

Let’s highlight some key advantages of the AggLayer:

- Native Tokens: Utilizes a single bridge smart contract, ensuring assets remain native without intermediaries.

- Unified Liquidity: Shares TVL across connected chains, focusing on use-case and product-market fit.

- Sovereignty: Compatible with shared sequencers and third-party DA solutions, allowing chains to use their native tokens for gas.

- Chain Aggregation: Facilitates cross-chain interoperability without first settling to Ethereum.

- Shared Sequencing: Supports synchronous cross-chain transactions for near-instant finality.

- Low-cost Operations: Operates without fee-extracting intermediaries, with ZK proof verification costs gradually reduced among chains.

Who’s Building The AggLayer?

One of the main provisions of the AggLayer revolves around its nomenclature. It’s not “Polygon AggLayer;” it’s just AggLayer, which is short for Aggregation Layer. The main reason is that Polygon Labs and associated core development teams are not solely building the AggLayer; it’s a collection of several different projects/collaborators.

In no particular order, here are a few notable projects/collaborators contributing to the AggLayer. By no means is this an exhaustive list.

One that caught my attention was Espresso Systems. Joining forces with Polygon Labs, they have partnered to improve rollup interoperability using the AggLayer. This collaboration leverages “proof aggregation” for secure transaction validation and employs a shared sequencing marketplace to optimize coordination and finalization of cross-chain interactions, significantly improving the Ethereum L2 ecosystem.

The vision is that multiple sovereign chains are connected, sharing liquidity and state so that users feel they are using a single chain. All these collaborators mentioned, and more have contributed tech, engineering resources, time, and discussion to bring the AggLayer to life.

How Does The AggLayer Fit In Polygon’s Vision?

The AggLayer is a core piece of Polygon’s roadmap. We’ve shared a deeper dive into the Polygon 2.0 vision and have started seeing how it has evolved since then. For reference, that initial vision looked like this:

- Upgrading Polygon PoS chain to zkEVM Validium.

- New ZK-based protocol architecture.

- Upgrading the MATIC token to POL.

- A new proposed governance framework.

- Ability to launch ZK L2s on-demand with its new development kit.

Since those initial propositions, we’ve seen the release of the Type-1 upgrade to Polygon’s zkEVM prover and, of course, the AggLayer’s early stages. This technology suite has laid the foundation for Polygon’s latest theme: aggregation.

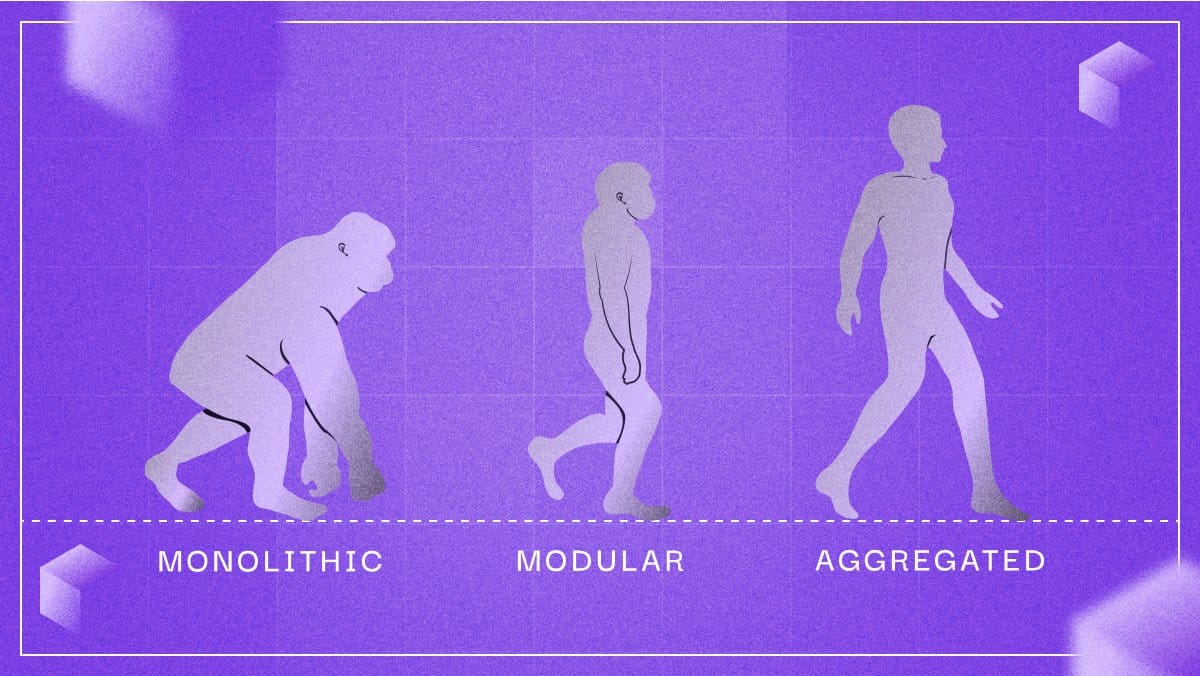

There are many approaches to how to scale for mainstream use, most typically fall under a modular or monolithic approach. Aggregation takes the best of both worlds and unlocks the resources/network effects tied to each chain that will become connected via the AggLayer. The idea isn’t so much an extraction method for Polygon (or any other network) to extract value away from activity on-chain. Instead, it’s about growing the amount of chains connected to one another and inheriting resources, TVL, etc.

The AggLayer thesis aligns with Polygon’s long-term vision of creating a unified, scalable blockchain ecosystem. By addressing the current limitations of cross-chain interactions and liquidity fragmentation, AggLayer paves the way for a more cohesive and efficient infrastructure, driving widespread innovation within the Polygon ecosystem and outside of it.

Final Thoughts

The AggLayer brings a new take on existing modular and monolithic approaches towards scaling, pursuing an entirely different approach called aggregation. As a central point in Polygon’s vision, the AggLayer will provide a common language for secure, atomic interoperability among EVM and non-EVM chains. Instead of needing to bridge frequently and incur high fees and delays, the AggLayer aims to provide a single environment unifying EVM and non-EVM chains, unlocking liquidity while retaining ETH’s security via ZK proofs with seamless UX.