Before we dive into Crescent, let’s take a step back and see how the chain originated. In early 2021, when the Decentralized Finance (DeFi) market exploded in popularity, the demand for a better user experience became more apparent. Thus, Cosmos contributors did what they do best, joined forces to work together on achieving this goal. B-Harvest and Ignite (formerly known as Tendermint) started collaborating on developing a blockchain-agnostic crypto portal and front-end web user interface called Emeris. B-Harvest pushed their efforts into building the Gravity DEX protocol, which is the liquidity module of the overall project.

Gravity DEX launched in July 2021 and provided the Cosmos community with a new way to enjoy cross-chain DeFi.

The Gravity DEX protocol migrated to a separate blockchain, Crescent Network, to realize its full potential. Thus, that’s how Crescent Network came about.

So, what is Crescent Network? In a nutshell, Crescent provides a connected DeFi functionality for Cosmos Ecosystem to enhance its capital efficiency and manage risks effectively. The network is committed to working toward the embodiment of the following objectives:

- Providing a marketplace for multichain assets with capital-efficient liquidity incentivization.

- Secure cross-chain collateralization protocol for users to effectively manage risks of their portfolio.

- An array of utilities will be created by the Crescent team and perfected through community governance and embracing the core fundamentals of the network.

With each of the three goals above in mind, the Crescent team has built out three “services” or “tools” that they offer: Crescent DEX, Crescent Boost, and Crescent Derivatives.

Crescent DEX

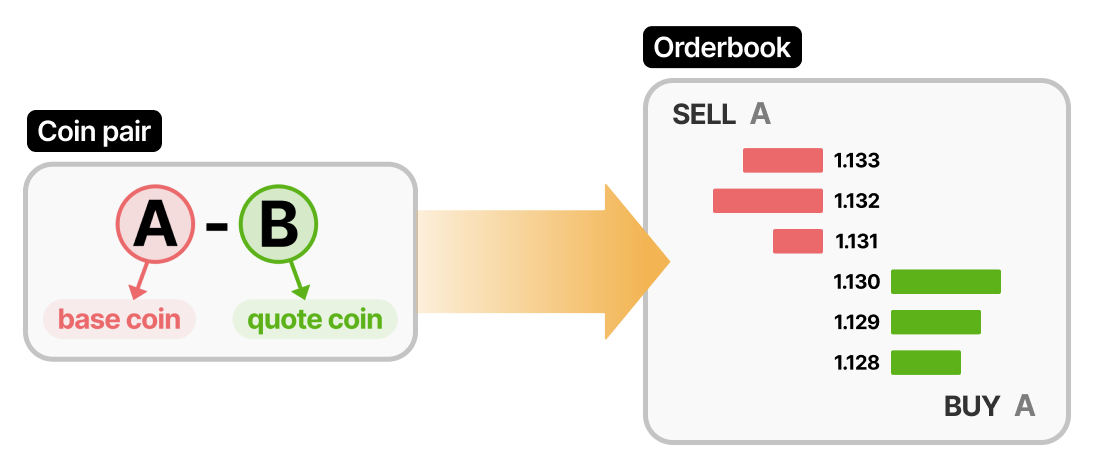

The Crescent DEX offers maximization of capital efficiency by having a hybrid AMM or Order book methodology with a fair order matching mechanism. This means, for a coin pair, a single order book is given. Users can then submit both limit and market orders and transparently observe existing limit orders on order books. If that sounds confusing, have a look at the illustration below for a clearer image.

Furthermore, the DEX also encourages healthy order price competition among traders and order book market makers, participation by market-makers, regardless of scale, and attraction of frequent traders, and arbitrageurs. Finally, the DEX aims to deliver an optimized trading fee distribution plan for LP, market making, and CRE staking rewards.

Crescent Boost

Crescent Boost will be a hybrid of lending, hedging, and leverage. Crescent Boost will offer Crescent DEX LP providers ways to hedge and leverage the LP position, allowing LP investors to tailor their risk-return profile, including a market-neutral strategy with increased farming rewards. Users will receive an ecosystem incentive to use other functions.

Staking, Liquid Staking and Native Asset

The native digital asset of Crescent Network is $CRE. The $CRE token serves as the governance token for all Crescent directions, ensuring the Crescent Hub's decentralized operation and evolution.

Crescent Network is a Proof-of-Stake consensus-based blockchain, hence the holders of the native staking token of the chain (which is $CRE) can become validators or delegate tokens to validators. By doing so, the holders ultimately decide the validator set for the system and ensure the governance and security of the blockchain. Assets used for staking, are locked and cannot be transferred, swapped or deposited. Therefore, the users lose the liquidity of that asset, until they’re unlocked.

To resolve this, Crescent Network utilizes liquid staking. Once a user stakes $CRE through the liquid staking module (on the DEX), the staked $CRE is locked. However, users receive $bCRE (pegged staked representative tokens) which they can utilize during the staked period. Kindly note that liquid staking is currently only available with the Genesis validators of the Crescent Network.

To learn more about staking or liquid staking, and to have a look at the step-by-step process, read the article below.

Stakin is an infrastructure operator for Proof-of-Stake (PoS) public blockchains, offering non-custodial delegation services. The company enables PoS cryptocurrency holders to earn interests on their holdings, and take part in decentralized governance while remaining in possession of their own cryptocurrencies.

🔹 Website: https://stakin.com/

🔹 Twitter: https://twitter.com/StakinOfficial

🔹 Telegram: https://t.me/stakinofficial

🔹 Blog: https://blog.stakin.com/

DISCLAIMER: This is not financial advice. Staking, delegation, and cryptocurrencies involve a high degree of risk, and there is always the possibility of loss, including the failure of all staked digital assets. Additionally, delegators are at risk of slashing in case of security or liveness faults on some protocols. We advise you to do your due diligence before choosing a validator.