When it comes to cryptocurrencies, there remains little doubt that Bitcoin is, and probably always will be, the gold standard. With a total market cap hovering around the 2 trillion dollar mark, Bitcoin dwarfs even its closest competitors in terms of total value stored within its ecosystem.

Bitcoin staking protocols have already laid a proven foundation for transforming the world's largest cryptocurrency from a pure store of value into a productive financial asset. Now, with the advent of Bitcoin liquid staking, that transformation is poised to accelerate, with emerging protocols hard at work creating a new and potentially lucrative ecosystem of opportunities for Bitcoin holders to earn yield while maintaining liquidity and exposure to BTC.

Exactly what this transformation will mean for the larger cryptocurrency ecosystem and the multitude of bitcoin holders within it remains to be seen, but there’s little doubt that bitcoin liquid staking holds tremendous promise for the future utility of the world’s most dominant cryptocurrency.

Let’s take a look at Bitcoin liquid staking and the protocols rising up to bring it to life in 2025…

Bitcoin's Staking Infrastructure - The Foundation

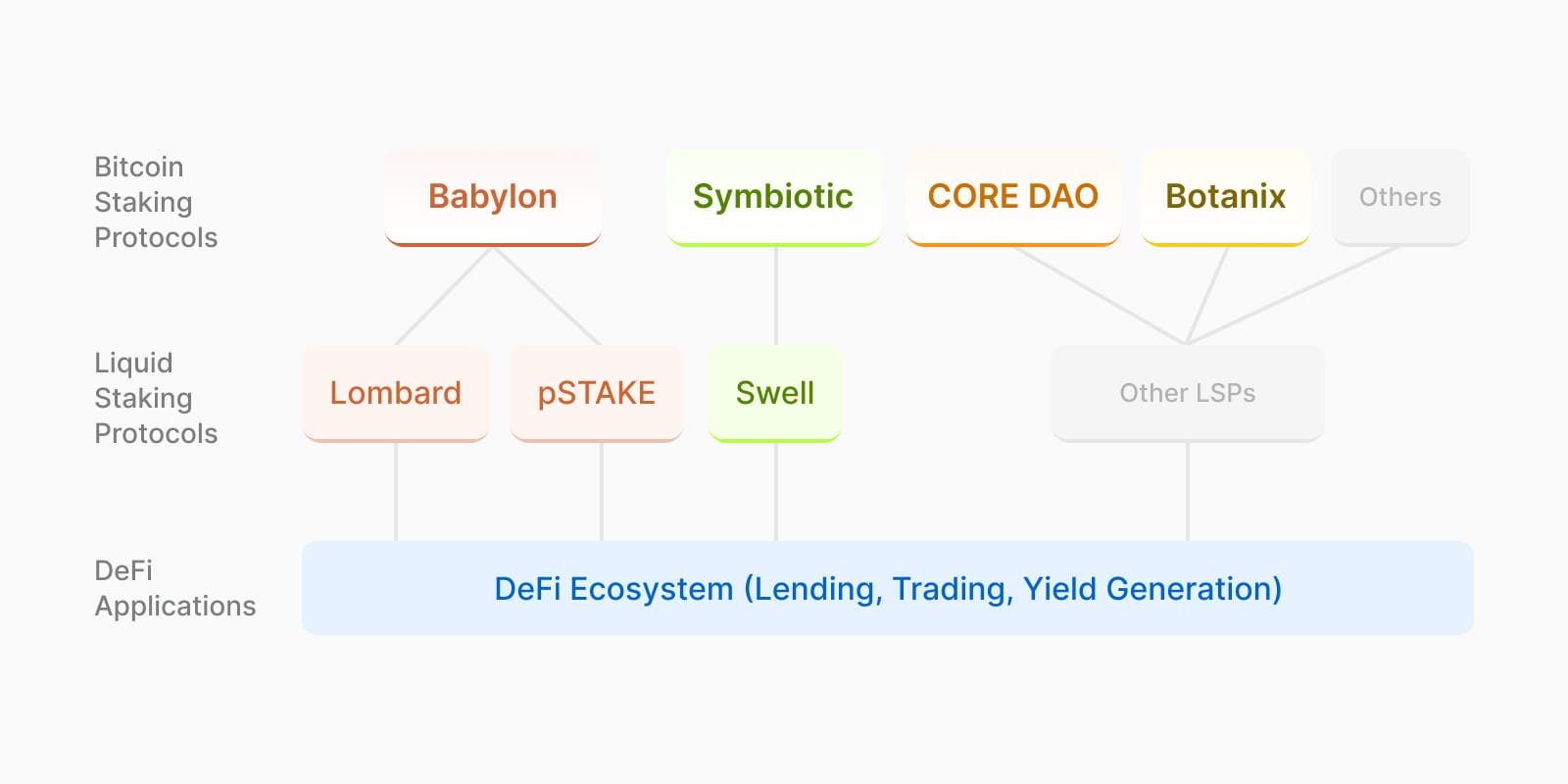

Bitcoin staking protocols like Babylon, Symbiotic, Botanix Labs, and Core DAO provide the foundational infrastructure for Bitcoin holders to stake their assets across different proof-of-stake networks. These base layer protocols establish the technical foundation for yield generation and form the backbone of the Bitcoin liquid staking ecosystem.

Bitcoin Liquid Staking: The Next Layer

Building upon the foundation laid by the staking protocols that have emerged within the Bitcoin ecosystem, Bitcoin liquid staking solutions create an additional layer of functionality. Protocols like Lombard, Swell, and pStake issue tradeable tokens that represent staked Bitcoin, similar to how Lido operates on Ethereum. When users stake their BTC through these protocols, they receive liquid tokens that can be deployed across DeFi applications while their underlying Bitcoin remains staked through the base protocol.

At its core, liquid staking introduces a layer of flexibility by issuing derivative tokens that represent staked assets. These derivative tokens, often called liquid staking tokens (LSTs), maintain a 1:1 peg with the underlying staked asset. When users deposit their assets with a liquid staking protocol, they receive these LSTs in return. The underlying assets are then staked through base staking protocols, while users retain the freedom to trade or utilize their LSTs while continuing to earn staking rewards.

Why Liquid Staking Matters

The introduction of liquid staking into the larger Decentralized Finance (DeFi) space has transformed how users approach yield generation. By enabling simultaneous participation in staking and DeFi activities, liquid staking dramatically improves capital efficiency. Users no longer need to choose between earning staking rewards and pursuing other financial opportunities. This dual functionality has significantly reduced the opportunity costs associated with traditional staking.

The risk management capabilities of liquid staking have also proven compelling. Through secondary markets for LSTs, users gain the ability to quickly adjust their positions in response to market conditions. This flexibility, combined with the opportunity to diversify across different protocols and strategies, has created a more robust and resilient staking ecosystem.

Lido's success in Ethereum/EVM liquid staking, commanding nearly 70% of the more than $40 billion market with around $30 billion in TVL, has inspired a new wave of Bitcoin liquid staking protocols. While the Bitcoin liquid staking market is currently in its formative stages, with approximately $3.5 billion in total value locked across major protocols, it represents a significant opportunity given Bitcoin's massive market capitalization.

The potential for Bitcoin liquid staking extends far beyond its current $3.5 billion TVL. With Bitcoin's market capitalization already above $2 trillion, even a modest adoption rate could lead to significant growth in the sector. The enormous potential has driven the emergence of numerous bitcoin liquid staking protocols/solutions that are currently establishing themselves in this exciting and potentially lucrative new marketplace…

Notable Bitcoin Liquid Staking Protocols/Solutions

Stroom Network

Stroom Network functions as both a Bitcoin staking protocol and a Bitcoin liquid staking solution. Stroom has developed its own unique staking mechanism offering the possibility to earn rewards through the Bitcoin Lightning Network. At its base layer, it enables Bitcoin holders to earn Lightning Network routing fees without managing node infrastructure. Building on this foundation, Stroom has also entered the liquid staking fray by issuing stBTC, a liquid token on Ethereum that represents staked Bitcoin. These tokens can be used across the DeFi ecosystem while earning daily network fees from Lightning node operations. This hybrid approach demonstrates how liquid staking can be effectively applied to Bitcoin's Layer 2 solutions, expanding potential use cases beyond traditional proof-of-stake models.

Lombard

Lombard has emerged as a significant player with its LBTC token, designed as a security-first Bitcoin liquid staking solution. Built on top of Babylon's infrastructure, Lombard aims to bridge the gap between Bitcoin's immense economic value and DeFi opportunities. With backing from major institutions like Polychain Capital and Franklin Templeton, Lombard represents an institutional-grade approach to Bitcoin liquid staking.

SolvBTC

SolvBTC takes a universal reserve approach, addressing the fragmentation of wrapped Bitcoin solutions across different chains. Their tiered reserve system classifies assets into core and isolated categories, providing a flexible framework for managing different types of wrapped BTC. Through partnerships with Chainlink's CCIP, SolvBTC enables seamless cross-chain transactions and liquidity flow.

Swell BTC Vault

Swell's BTC Vault represents an innovative approach to Bitcoin liquid staking by leveraging multiple restaking protocols. Built on Symbiotic's infrastructure, Swell issues swBTC tokens that earn yields not only from Bitcoin staking, but also from restaking opportunities across Ethereum's ecosystem through EigenLayer and Karak. This multi-protocol approach is supported by institutional-grade infrastructure. Users can deposit WBTC or swap native BTC through Garden Finance, with their assets being used to secure various Bitcoin L2 infrastructure services.

Bedrock

Bedrock offers a multi-asset liquid restaking protocol, supporting both brBTC and uniBTC tokens. Their non-custodial solution uniquely manages assets across multiple yield sources, including Babylon, Kernel, Pell, and Satlayer. Bedrock's non-rebasing token model means tokens grow in value rather than quantity over time.

pSTAKE

pSTAKE Finance offers a non-custodial Bitcoin liquid staking solution built on Babylon's infrastructure. Users can stake BTC to receive yBTC, a yield-bearing liquid staking derivative that generates returns through Babylon's security-sharing mechanism. pSTAKE features a unique dual-token model where PSTAKE token stakers can earn BTC rewards, with enhanced yields for users holding both PSTAKE and yBTC. The protocol emphasizes security through partnerships with firms like Halborn, Hexens, and Oak Security.

Echo Protocol

Echo specializes in bridging Bitcoin liquid staking to the Move ecosystem, particularly Aptos. Their unique approach combines bridging infrastructure with liquid staking and yield generation through multiple streams. Echo's security model utilizes Hash-Timelock contracts and a decentralized relayer system for maintaining integrity.

What’s Next For Bitcoin Liquid Staking?

Market Education and Adoption

As Bitcoin holders become more familiar with DeFi concepts and the security measures implemented by staking and liquid staking protocols, adoption should be expected to accelerate. Institutional interest, particularly from traditional finance entities entering the crypto space, could provide significant momentum. The success of Ethereum liquid staking serves as a proven model, demonstrating how yield opportunities can attract both retail and institutional participants.

Technical Innovation

The layered architecture of Bitcoin liquid staking creates opportunities for innovation at multiple levels. Base staking protocols may develop new consensus mechanisms and yield sources, while liquid staking protocols could create more sophisticated DeFi integrations. Cross-chain implementations and Layer 2 solutions like Stroom's Lightning Network integration suggest there's substantial room for technical advancement.

Yield Opportunities

As the ecosystem matures, we're likely to see more diverse yield-generating strategies emerge. Liquid staking protocols might develop specialized approaches for different user segments - from conservative institutional clients seeking stable yields to retail users interested in more aggressive DeFi strategies. This diversity of options could help drive adoption across different user groups.

Institutional Integration

The entry of established financial institutions into the Bitcoin liquid staking space could bring significant changes. These entities might develop their own liquid staking solutions or partner with existing protocols to offer staking services to their clients. This institutional adoption could help bridge the gap between traditional finance and DeFi while bringing additional legitimacy to the sector.

Regulatory Developments

The regulatory landscape for Bitcoin staking and liquid staking continues to evolve. Clear regulatory frameworks could provide the certainty needed for broader institutional adoption, while compliance-focused solutions might emerge to serve regulated entities.

Final Thoughts

Bitcoin liquid staking represents a sea change in how the world's largest cryptocurrency can be utilized in the DeFi ecosystem writ large. While the market is still in its early stages, the diversity of approaches and strong institutional backing suggest substantial growth potential. The success of Ethereum liquid staking provides a blueprint, but Bitcoin's unique characteristics are driving innovation in security models, yield generation, and cross-chain integration forward.

As Bitcoin liquid staking matures, it has the potential to bridge the gap between Bitcoin's store of value properties and the broader DeFi landscape. This evolution could not only enhance Bitcoin's utility, but also contribute to the overall maturation of the DeFi ecosystem, creating new opportunities for both retail and institutional participants while maintaining the security and decentralization that have made Bitcoin the world’s most dominant cryptocurrency.

DISCLAIMER: This is not financial advice. Staking and cryptocurrency investment involve a certain degree of risk, and there is always the possibility of loss, including the loss of all staked digital assets. Additionally, delegators are at risk of slashing in case of security or liveness faults on some PoS protocols. We advise you to DYOR before choosing a validator.