The Current State of the Network

According to Aptos H1 2025: The Global Trading Engine Accelerates (Messari), Aptos entered the second half of 2025 positioned as a “global trading engine,” supported by strong user activity, expanding DeFi infrastructure, and major protocol upgrades. Monthly active users remained above 10 million throughout H1 2025, up from 2.5 million a year earlier, while average transaction fees fell 61.1% QoQ to 0.00011 APT (~$0.00052), up to 100× cheaper than other top Layer-1 blockchains.

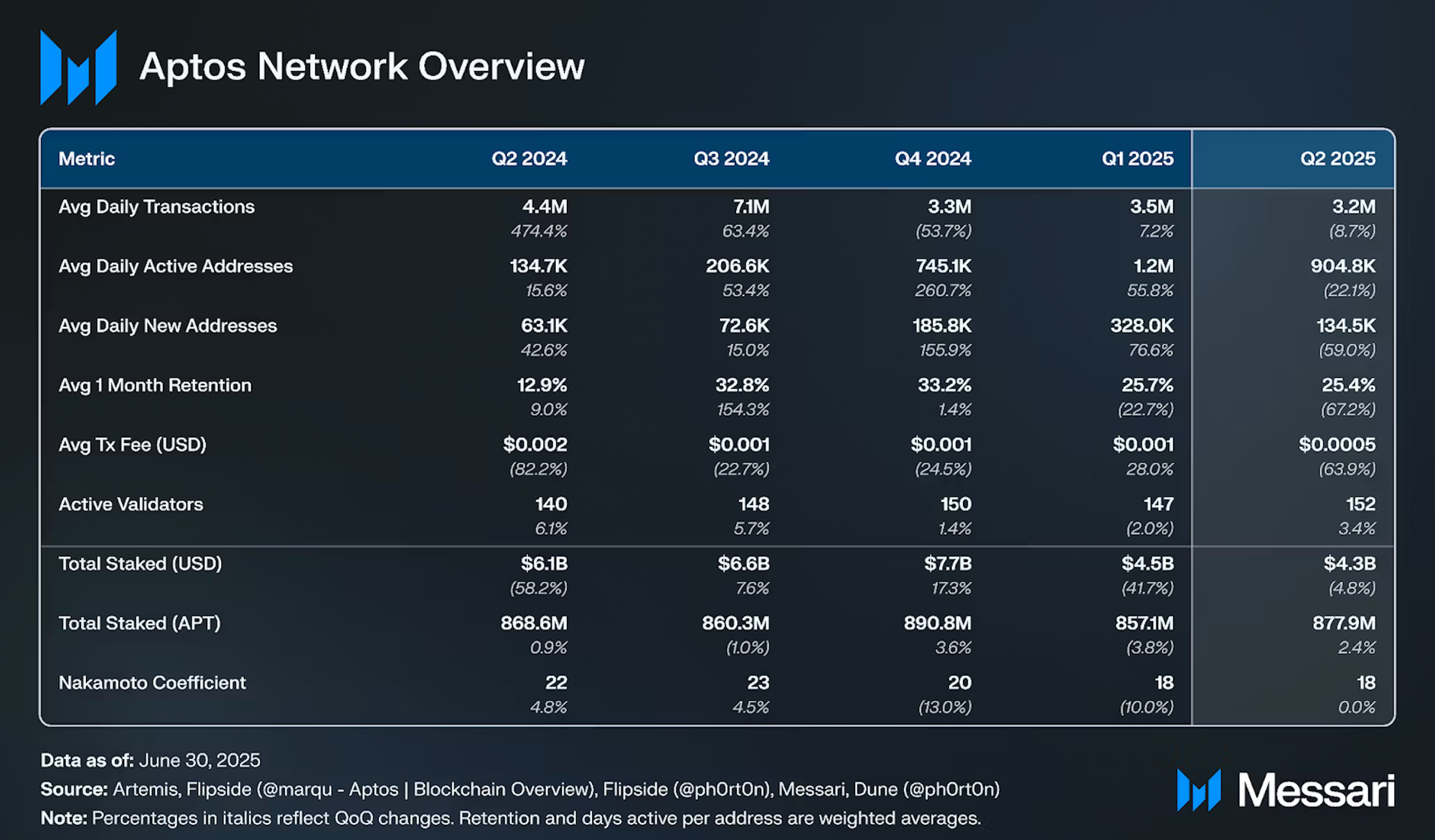

The network’s stablecoin market cap reached $1.2 billion, an 85.9% increase in H1, driven by native deployments of USDT and USDC alongside the launch of USDe. On the infrastructure side, Aptos closed Q2 with 152 active validators and 877.9 million APT staked, ranking ninth by staked market cap.

Some key upgrades included the launch of Baby Raptr, reducing validator finality latency by 20%, and ongoing development of Zaptos and Shardines, designed to cut end-to-end transaction latency and enable sharded execution at scale.

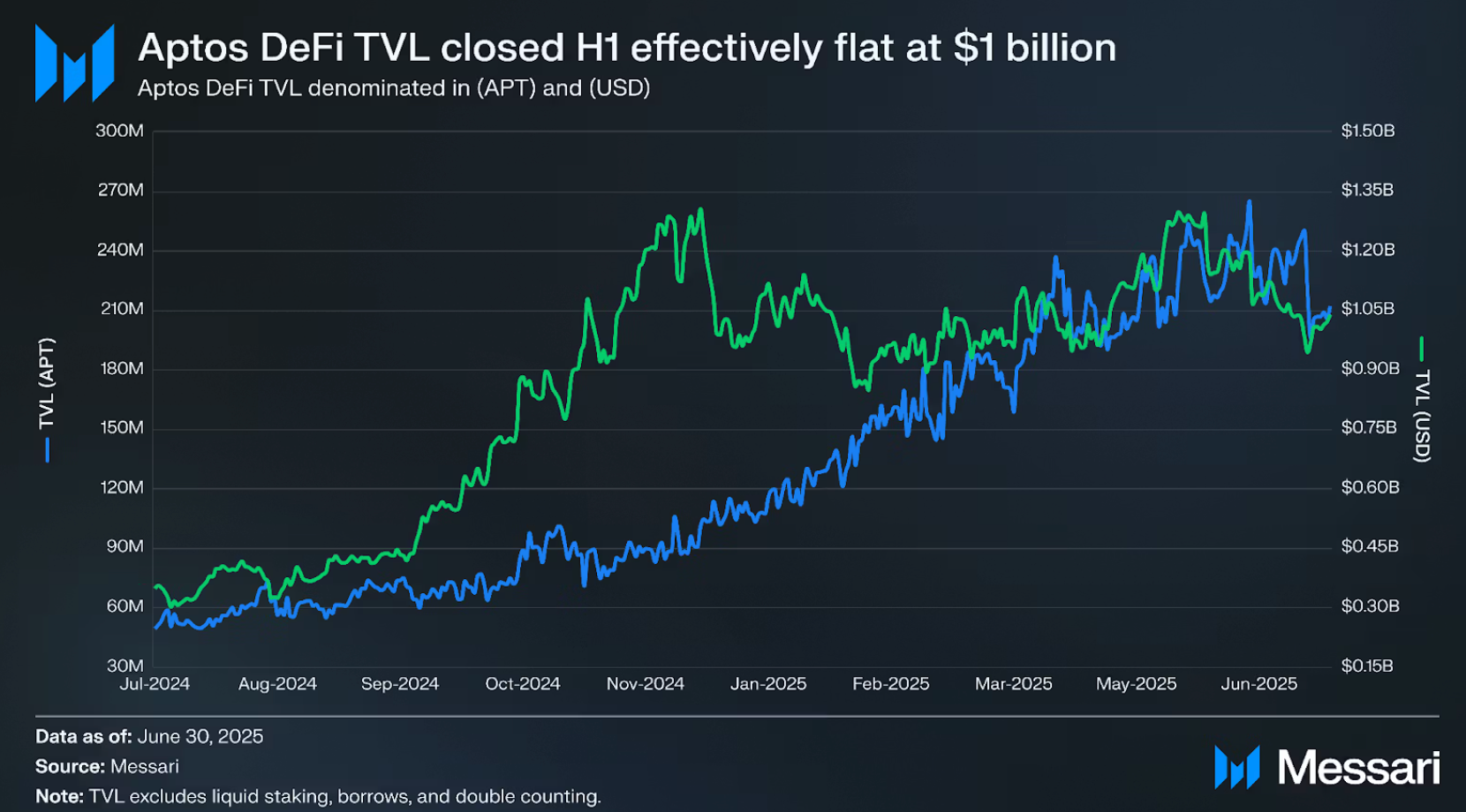

Together, these advancements, combined with low fees, high throughput, and a growing liquidity base, reinforce Aptos’s position as a high-performance Layer-1 built for global-scale transaction execution and directly fueled growth in Aptos’s decentralized finance sector, where liquidity, assets, and protocol innovation have all accelerated in 2025.

DeFi Ecosystem Expansion

DeFi on Aptos entered a phase of rapid maturity, marked by deeper liquidity, diversified assets, and protocol-level innovation. In H1 2025, the network’s stablecoin market cap grew 85.9% to $1.2B, driven by the native deployments of USDT and USDC, along with the launch of USDe. This made Aptos home to three of the four largest stablecoins by market cap, enhancing its position as a stablecoin hub. Demand has concentrated in yield-bearing variants such as sUSDe, with $39.4M bridged via Stargate, indicating strong user preference for productive stable assets.

Trading activity surged, with DEX volume up 310.3% QoQ to $9.0B in Q2, this growth was led by Aptos-native protocols Hyperion, whose volume grew 29× QoQ to $5.4B following its February launch, and ThalaSwap V2, which quadrupled to $2.9B in the same period. Perpetuals and CLOB-based exchanges also gained traction, with Merkle Trade surpassing $24B in lifetime volume and new entrants like Kana Labs expanding on-chain derivatives access.

While DeFi TVL remained steady above $1B, capital composition evolved. Stablecoins and wrapped BTC products now represent a larger share, supported by lending markets like Echelon and liquidity protocols like Echo. In parallel, Aptos has emerged as the third-largest network for real-world assets (RWAs), with $723M issued on-chain, 78% of which is attributed to PACT’s micro-lending and credit portfolios in emerging markets, this RWA footprint positions Aptos alongside Ethereum and ZKsync Era as a leader in tokenized off-chain assets, broadening its DeFi value proposition beyond trading and staking.

Aptos has quietly built one of the most dynamic financial ecosystems in Web3, money is moving faster, more assets are available to use and trade, and even real-world investments, like loans and credit portfolios, are now flowing through the network.

Development and Builder Ecosystem

Aptos’s builder community remains one of the strongest among non-EVM networks, supported by a comprehensive funding, tooling, and accelerator framework. According to Aptos H1 2025: The Global Trading Engine Accelerates, the network averaged 74 weekly active developers in Q2 2025, down from 108 in Q1, but still benefiting from sustained ecosystem investment and advanced development resources.

The Aptos Foundation has distributed over 200 grants to projects across DeFi, NFTs, infrastructure, and tooling. Notable programs include Registry Grants for vetted projects with audit credits up to $25K, the Gas Station program subsidizing user gas fees, and the Payments Grant launched in July 2025, offering up to $150K in milestone-based funding, audits, and promotional support. In March, the Foundation committed $200M in grants and investments to expand DeFi, alongside Movemaker’s $2M Hong Kong builder program and $200K in seed funding for a Move secure smart contract library.

On the tooling side, the protocol rolled out significant upgrades in H1 2025: Aptos Connect now supports one-click, keyless account creation with embedded gas-sponsored swaps and fiat on-ramps; X-Chain Accounts enable Aptos access using credentials from chains like Solana or Ethereum; and Account Abstraction allows custom Move-based authorization rules. Additional improvements include the Dynamic Script Composer for multi-call transactions, Confidential Transactions on devnet, and performance boosts through Code Loader V2 and optimized Move data structures.

This mix of targeted funding, accelerator programs, and developer-friendly infrastructure continues to attract high-quality teams, positioning the network as a competitive environment for building high-performance Web3 applications.

Infrastructure Upgrades Driving Performance

Baby Raptr Upgrade

In June 2025, Aptos Labs rolled out Baby Raptr, the first production-stage component of its next-generation Raptr consensus. Built on the prefix consensus model, Raptr was designed to deliver extremely high throughput and low latency, tested at 260,000 TPS with under 800ms latency. Baby Raptr improves mainnet performance by merging Quorum Store’s data availability checks directly into the consensus process, reducing the number of network hops from six to four. This results in roughly a 20% improvement in validator finality latency (100–150ms faster), helping transactions settle more quickly and consistently. While users won’t interact with Baby Raptr directly, they benefit from smoother, more responsive experiences across DeFi, gaming, and payments on Aptos.

Zaptos Upgrade

Introduced in January 2025 by Aptos Labs, Zaptos adopts a parallel, pipelined architecture that minimizes end-to-end transaction latency while maintaining high throughput. In geo-distributed tests across 100 validators, it achieved sub-second latency at 20,000 TPS, thanks to architectural innovations that decouple execution, consensus, and storage, even overlapping them for efficiency. This positions Zaptos to enhance execution speed for latency-sensitive use cases like real-time payments and DeFi, refining the user experience through faster block finality.

Shardines Upgrade

Aptos’s strategy also includes Shardines, a sharded execution framework designed to process transactions in parallel across multiple segments (shards). While your base text confirms Shardines is under development, no public source was found to fully verify its details. However, blockwork research recognizes Shardines among the suite of infrastructure enhancements (with Moves like Raptr and Zaptos) reinforcing Aptos as a high-volume backbone for real-world financial use cases

Projects You Should Be Watching

Aptos’s ecosystem in 2025 is defined not just by its infrastructure upgrades but by the protocols building on top of it. From DeFi and liquid staking to trading platforms and data infrastructure, a select group of applications is capturing the majority of liquidity, users, and developer attention, these projects demonstrate how Aptos’s low fees, high throughput, and Move-native programmability are translating into real adoption:

Merkle Trade

A gamified perpetual DEX on Aptos with $17B+ in lifetime volume and 170K+ users. It simplifies crypto derivatives trading through Walletless onboarding, allowing sign-in with Google, no private key management, and gas-free transactions via Aptos Keyless Authentication and Sponsored Transactions.

Users can start trading from $2 with up to 150x leverage, while gamified features, streak rewards, loot boxes, and missions keep engagement high. Upcoming plans include mid-cap asset listings, enhanced market discovery, social profiles, and developer SDKs to integrate Merkle’s trading into third-party apps and AI agents.

Echelon

Echelon is the leading Aptos lending protocol and stablecoin liquidity hub, managing $200M+ in total value locked (TVL) across native USDC, USDT, yield-bearing assets, and modular collateral types. The platform dominates sUSDe stablecoin liquidity with over $90M in deposits and secures $100M+ in BTC-backed collateral through integrations with SBTC, xBTC, WBTC, and aBTC.

With its isolated markets architecture, Echelon enables the safe onboarding of volatile or long-tail assets without impacting core pools. As part of the Aptos Foundation’s LFM growth program, the protocol is preparing to launch a structured product layer delivering fixed-yield strategies, curated vaults, and advanced integrations, solidifying its position as the capital coordination layer for Move-native DeFi.

Shelby

Co-developed by Aptos Labs and Jump Crypto, is Web3’s first decentralized, cloud-grade hot storage protocol. It delivers sub-second reads, high throughput, and cost-competitive performance while transforming static files into live, monetizable assets served and rewarded in real time. Through its incentivized access model, Shelby rewards nodes for serving data, enabling new revenue streams for creators and supporting use cases from AI and gaming to streaming and user-generated content.

Running natively on Aptos, Shelby leverages 600ms finality, 30K TPS, ultra-low gas fees, and Move-native programmability to enforce real-time access control, route rewards dynamically, and process on-chain reads at scale. By combining cloud-grade performance with decentralization, Shelby lays the foundation for a high-value, on-chain data economy and positions Aptos as the execution layer for the next generation of interactive and revenue-generating applications.

AIP-119: How Aptos Adjusted Staking Rewards to Balance Growth and Decentralization

In H1 2025, Aptos governance was highly participatory, with stakeholders from across the ecosystem engaging in key protocol decisions. A major development was AIP-119, which proposed lowering staking rewards to align with competitor Layer-1 yields and encourage restaking into DeFi.

The initial plan called for a rapid cut to 3.79% APR over three months, but community feedback warned this could harm smaller validators and weaken decentralization. The final version reduced rewards from 6.54% to 5.26% APR over six months, giving participants time to adapt while enabling the Aptos Foundation to expand its delegated staking program to support smaller validators. This outcome highlights Aptos’s collaborative governance model balancing economic efficiency with validator diversity and long-term network health.

Key Takeaways

In 2025, the Aptos ecosystem is moving from rapid expansion into a phase of sustained maturity, now counting over 330 active projects supported by consistent user activity and a steadily advancing infrastructure stack. Core protocol upgrades, such as Baby Raptr, combined with the growth of high-liquidity DeFi platforms and targeted developer incentives, are positioning Aptos to compete more aggressively in both Web3-native and enterprise-grade markets.

For stakers, a larger and more diverse validator set, higher delegated participation, and stable on-chain activity are reinforcing the network’s security and ensuring predictable staking performance.

For builders, Aptos offers a fully developed support ecosystem: structured grant programs, advanced Move tooling, and integration pathways with major infrastructure providers. In H1 2025, the Aptos Foundation committed $200 million to ecosystem growth, funding DeFi grants, liquidity initiatives, and new protocol deployments. Among these, the governance-approved launch of Aave V3 on Aptos,its first deployment outside an EVM chain, marked a significant milestone, strengthening the network’s position as a high-performance hub for next-generation finance and trading.

For users, improved onboarding, lower participation barriers, and an expanding range of applications in DeFi, gaming, and digital assets are making the network more accessible and impactful.

With continued investment in scalability, developer enablement, and strategic partnerships, Aptos is solidifying its position as a high-performance, Move-based blockchain capable of supporting large-scale, production-ready use cases in the global digital economy.

Support the growth of Aptos, stake your APT with Stakin today and help secure the network while earning competitive rewards.

DISCLAIMER : This is not financial advice. Staking, delegation, and cryptocurrencies involve a high degree of risk, and there is always the possibility of loss, including the failure of all staked digital assets. Additionally, delegators are at risk of slashing in case of security or liveness faults on some protocols. We advise you to do your due diligence before choosing a validator.