The Ethereum blockchain has experienced profound changes with the introduction of Proof of Stake (PoS), where staking has become a cornerstone of network security. Staking involves locking in cryptocurrency to support the network, and in return, participants earn rewards. This method, while effective, posed liquidity challenges, which led to the evolution of liquid staking solutions like Lido, where staked ETH is converted into liquid stETH.

Restaking builds upon this foundation, offering a way for participants to reinvest their staking rewards back into the network, enhancing potential returns through a compounding effect, and securing additional resources on top of Ethereum. This concept has been further advanced by the integration of platforms like EigenLayer, which provide additional dimensions to staking by allowing assets to be restaked across multiple applications, enhancing both yield and network security.

As we dive deeper into restaking, it’s crucial to understand its mechanics, the role of platforms like EigenLayer, and the broader implications for the blockchain ecosystem. This exploration is not just about comprehending a new technology but about envisioning the future of blockchain as a more interconnected, efficient, and versatile domain where the principles of decentralized finance are pushed to new heights.

Deep Dive into EigenLayer

As of January 16, 2024, more than $1.7B in TVL has been achieved on the EigenLayer platform. Launched in June of 2023, EigenLayer has quickly become one of the most dominant players in the Ethereum restaking landscape.

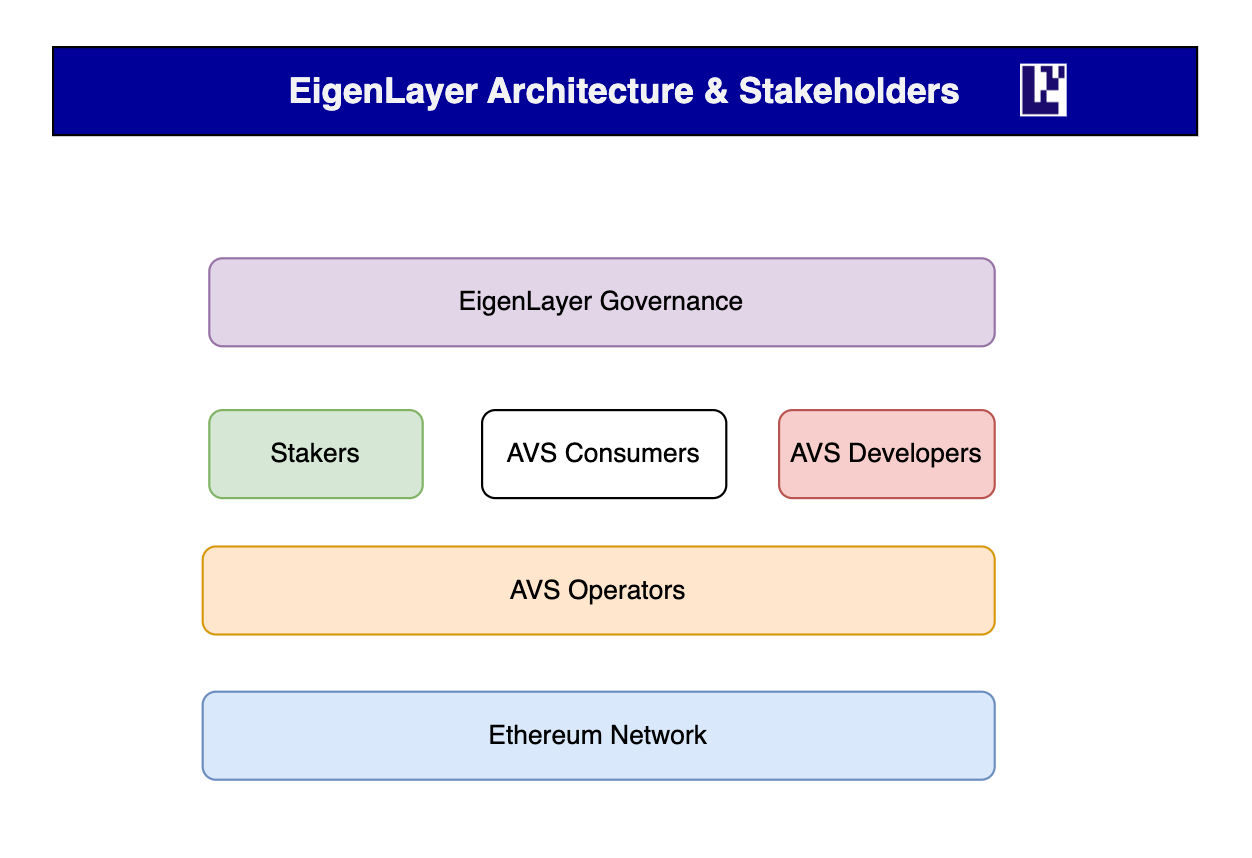

EigenLayer represents a set of smart contracts, fundamentally altering how staking and validation work. It enables Ethereum stakers and holders of various Liquid Staking Tokens (LSTs) like stETH and cbETH to engage in a novel form of restaking, thereby amplifying the security and functionality of various blockchain components, including consensus protocols, data layers, sequencers, and oracle networks. This restaking also enhances the security framework for decentralized applications (DApps) and leverages Ethereum's robust security for more decentralized and permissionless validation.

What sets EigenLayer apart is its mechanism for pooled security, integrated with a market-driven governance model. This mechanism extends Ethereum's security reach, allowing validators to contribute more comprehensively to the blockchain's operations. By linking their beacon chain withdrawal credentials to EigenLayer’s smart contracts, validators can opt into diverse modules, each offering new opportunities for revenue generation through smart contract-enforced ETH slashing conditions. EigenLayer supports an array of staking methodologies, including Liquid, Superfluid, and Restaking, each addressing the unique needs of the transition between Layer 1 (Ethereum) and DeFi platforms, thereby enriching the entire ecosystem's security and versatility.

The Challenge Addressed

The primary issue EigenLayer resolves is the decentralization of trust in the Ethereum network, particularly critical in the evolving landscape of Ethereum Layer 2 solutions. Layer 2 protocols, such as Optimistic and ZK Rollups, secure their operations via Ethereum's mainchain. However, other essential blockchain elements like sidechains and data sequencers have been unable to integrate seamlessly with Ethereum's validation mechanism, leading to scattered trust models and inefficiencies in the blockchain ecosystem.

Ecosystem Impact

With substantial funding and a significant total value locked (TVL) of more than $1.7B, EigenLayer is rapidly emerging as a trusted and influential player in the blockchain space. It underpins a variety of pioneering projects, offering them a decentralized and secure foundation. These projects span multiple applications, from high-throughput data services to decentralized rollup solutions, showcasing EigenLayer’s versatility and reach in the blockchain domain.

Potential Risks

However, EigenLayer's innovative approach is not without risks. Challenges such as the potential for collusion among operators and the risk of unfairly slashing honest nodes are concerns that need addressing. The reliance on smart contracts necessitates rigorous testing for reliability and security. Notably, concerns have been raised by influential figures in the blockchain community, including Vitalik Buterin, about the possible implications for Ethereum's consensus mechanism.

Technical Insight

To fully appreciate the nuances of EigenLayer's approach, a closer examination of its technical aspects is essential, let’s have a look.

EigenLayer introduces significant technical advancements in the Ethereum ecosystem, focusing on enhancing network security and efficiency through innovative approaches. This section will get into the specifics of EigenLayer's security model, consensus mechanism, and its unique integration with Ethereum, while briefly touching upon its impact on security and decentralization.

Security Model: EigenLayer's security model is multi-layered and adaptable, designed to extend the inherent security of Ethereum’s consensus layer. As mentioned it enables users to restake Ethereum or liquid staking tokens (LSTs) across various applications, thereby amplifying the network's overall security. This model allows for secure participation in Actively Validated Services (AVS), providing rewards that surpass traditional staking yields. This approach not only enhances network stability but also fosters a more resilient ecosystem.

Consensus Mechanism: Diverging from conventional Proof of Stake systems, EigenLayer employs a dynamic consensus model. It synergizes with Ethereum’s native consensus by allowing staked assets to validate additional protocols and applications. Validators, known as operators within EigenLayer, have the flexibility to secure AVS transactions, earning fees for their services. This mechanism creates a reinforcing effect on the security of both the Ethereum main chain and the interconnected AVS ecosystem.

Ethereum and Cosmos Convergence through EigenLayer: EigenLayer is spearheading an initiative to bridge Ethereum and Cosmos, targeting challenges such as maximal extractable value (MEV), liquidity fragmentation, and achieving broader decentralization. While Ethereum is evolving into a global settlement layer, Cosmos is nurturing a network of digital sovereignties. This initiative is poised to grant Cosmos access to Ethereum's well-established security mechanisms.

Cosmos will benefit from Ethereum's decentralized security infrastructure, and in return, Ethereum can leverage the innovative and modular nature of Cosmos. The fusion of these two ecosystems is designed to enhance shared security protocols, contributing to improved scalability and robustness in blockchain infrastructure. The integration also aims to amplify Ethereum's economic security within the Cosmos network, utilizing Ethereum's extensive validator set to fortify the Proof of Stake networks across both platforms.

EigenLayer's role then also extends to enhancing the accessibility of Cosmos' technological advancements for Ethereum's Layer 2 solutions. This includes empowering Layer 2 operators to utilize Ethereum's validator set.

AVSs and Operators: A closer look

AVSs are blockchain-based applications that operate outside the Ethereum Virtual Machine (EVM). They include layer-2 chains, data availability layers, sequencers, dApps, cross-chain bridges, and virtual machines, offering diverse utilities to the blockchain ecosystem. AVSs use decentralized consensus mechanisms like PoS or Proof of Work (PoW) for transaction validation. The key difference is that they handle consensus independently, rather than relying on Ethereum’s consensus layer.

Previously, AVSs had to establish their consensus mechanisms, leading to vulnerabilities due to the smaller size of validator pools and stakes compared to larger networks like Ethereum. This isolation made them susceptible to attacks and exploits.

AVSs on EigenLayer can leverage Ethereum's security and decentralization capabilities. By deploying on EigenLayer, these services bypass the need to set up independent validation mechanisms.

Operators play a crucial role in securing AVS transactions on EigenLayer. They are essentially Ethereum validators who participate in restaking their ETH on EigenLayer.

Operators can either directly secure AVS applications for additional validation rewards or act as service providers. They validate AVS-related transactions and earn fees, while Ethereum validators delegate their ETH stakes to them. This allows Ethereum validators to earn a share of the AVS validation rewards without being directly involved in the validation process.

ETH holders or those holding ETH-related tokens like LSTs, LPs, and LST LPs who are not Ethereum validators, can delegate their assets to operators on EigenLayer. In return, they receive a portion of the rewards related to AVS validation.

It’s worth noting that operators on EigenLayer are subject to slashing mechanisms to ensure security and prevent malicious behavior. This mechanism penalizes bad behavior by operators, thereby protecting the network from potential attacks.

Step-by-Step Guide: Participating in Restaking on EigenLayer

After learning more about restaking, we may wonder how to be able to restake on Ethereum. Let’s go through a simple walkthrough of using EigenLayer to restake your LSTs.

Initialize a Software Wallet

- Opt for an EVM software wallet extension like Rabby or Metamask, which is essential for engaging with DeFi applications. Preferably connect to a hardware wallet.

- Download and install your preferred EVM wallet either as a browser extension or a smartphone application, following the instructions on their website.

- After setting up your wallet, add funds to it. This can be either directly deposited Ethereum or LSTs like stETH.

- Remember, EigenLayer currently accepts stETH, rETH, cbETH, osETH, swETH, oETH, wBETH, ankrETH, and ETHx.

Connect to the EigenLayer Application

- Navigate to the EigenLayer platform at app.eigenlayer.xyz to initiate the restaking process.

- The interface will provide a summary of your holdings and existing positions within EigenLayer.

- To link your wallet, use the connection option located at the upper right corner of the webpage.

Select a Method for Restaking

- From the available choices, pick the asset you intend to restake.

- Direct restaking of ETH is more suitable if you are operating as a validator with your own nodes.

- Decide on the liquid staking token you prefer and specify the amount you wish to restake.

Confirm Your Deposit

- Double-check and confirm your chosen asset and the restaking volume on the platform.

- Execute the transaction by following the instructions that appear in your wallet interface.

- Keep track of your restaked asset

Final Thoughts

Restaking in Ethereum offers a promising advancement in DeFi, addressing liquidity challenges in traditional staking. It allows for the use of LSTs in multiple networks, boosting both liquidity and earning potential. Platforms like EigenLayer are in the leading row, enhancing Ethereum's utility across the blockchain ecosystem. Despite some risks, restaking's potential for higher yields, improved network security, and increased decentralization are worth noting. It will be worth witnessing other ecosystems incorporate restaking protocols and stride towards a more dynamic DeFi future.

Stake your ETH with Stakin on 0% Fee Model and Restake on EigenLayer

Stakin's new ETH Vault, integrated with StakeWise V3, offers a practical solution for Ethereum staking. By using Stakin Vault, users can stake ETH and receive osETH, a liquid staking token. This token reflects your staked ETH and also enables participation in EigenLayer's Restaking, potentially enhancing your earnings and contributing to network security. Since its launch, the vault has seen significant activity, with over 450 ETH staked in a short period. Visit Stakin ETH Vault on StakeWise V3.