Polygon, formerly known as Matic network, is an open-source, decentralized blockchain network with roots in India, founded by Jaynti Kanani, Sandeep Nailwal, and Anurag Arjun in 2017. Mihailo Bjelic was added as the fourth co-founder of the project when it rebranded to Polygon in early 2021. They were initially inspired by a paper by Vitalik Buterin and Joseph Poon titled: “Plasma: Scalable Autonomous Smart Contracts.”

Matic Network, now called Polygon PoS (Proof-of-Stake) chain, is just one of the many scaling solutions offered by Polygon to scale Ethereum. After the project expanded, Polygon opted to keep the ticker MATIC(now POL) for its native token. The native token POL is an ERC-20 token used to govern and secure the network.

WHAT IS POLYGON?

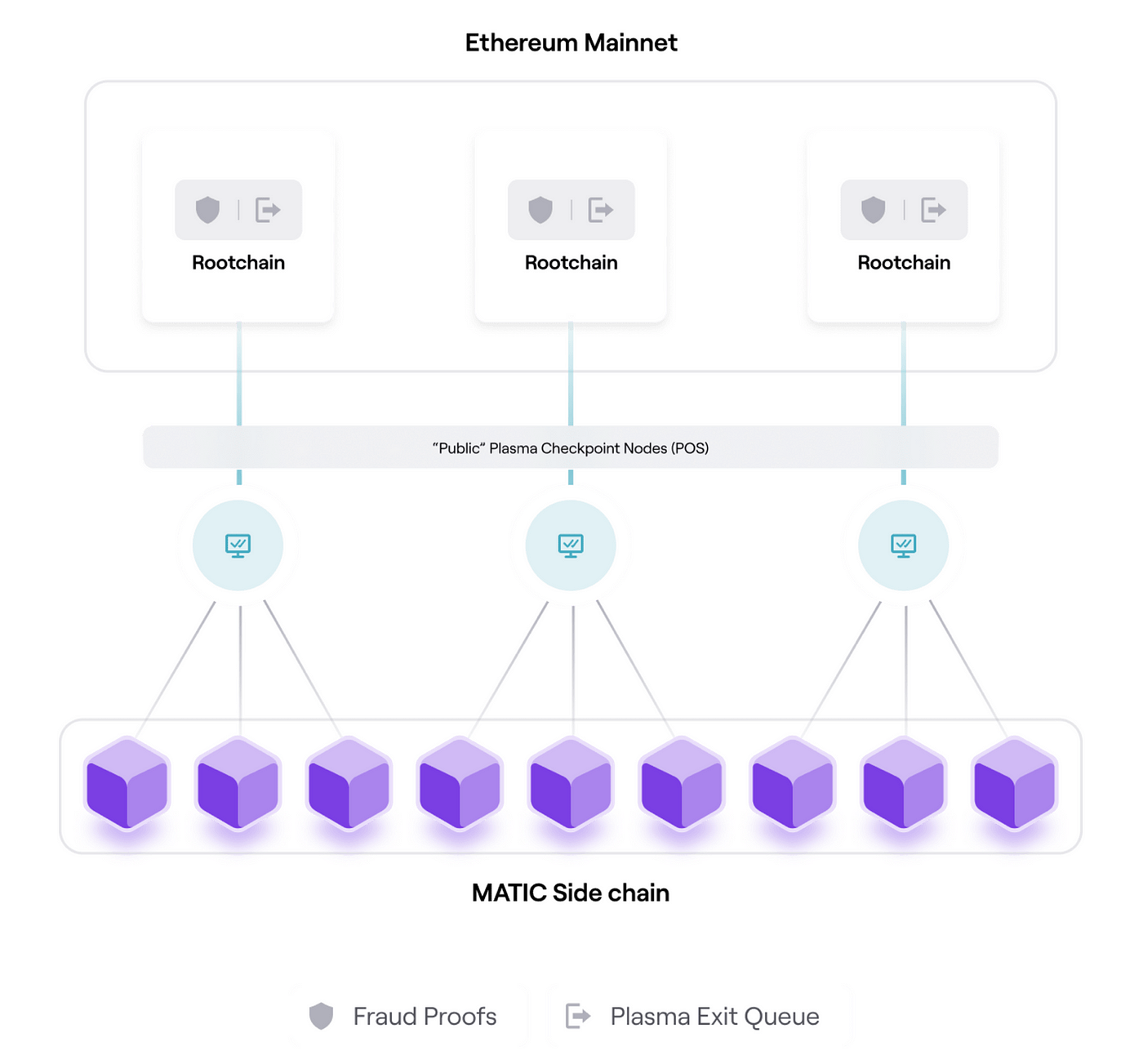

Polygon is a Layer 2 scaling solution that achieves scale by utilizing sidechains for off-chain computation and a decentralized network of Proof-of-Stake (PoS) validators.

Polygon’s thesis is that Ethereum will become the global settlement layer for a suite of different scaling solutions. In other words, users will only be interacting with L2 solutions in the future while preserving the same level of security through the Ethereum network.

SCALING SOLUTION

Polygon is a Layer 2 solution, which means it sits on top of Layer 1 blockchains like Ethereum. Another example of a Layer 2 includes the Bitcoin Lightning Network, which reduces the fees of Bitcoin transactions. Polygon is now home to some of the most significant Web3 projects such as Aave, OpenSea, Uniswap, and well-known behemoths, including Meta, Stripe, Adobe, and Disney.

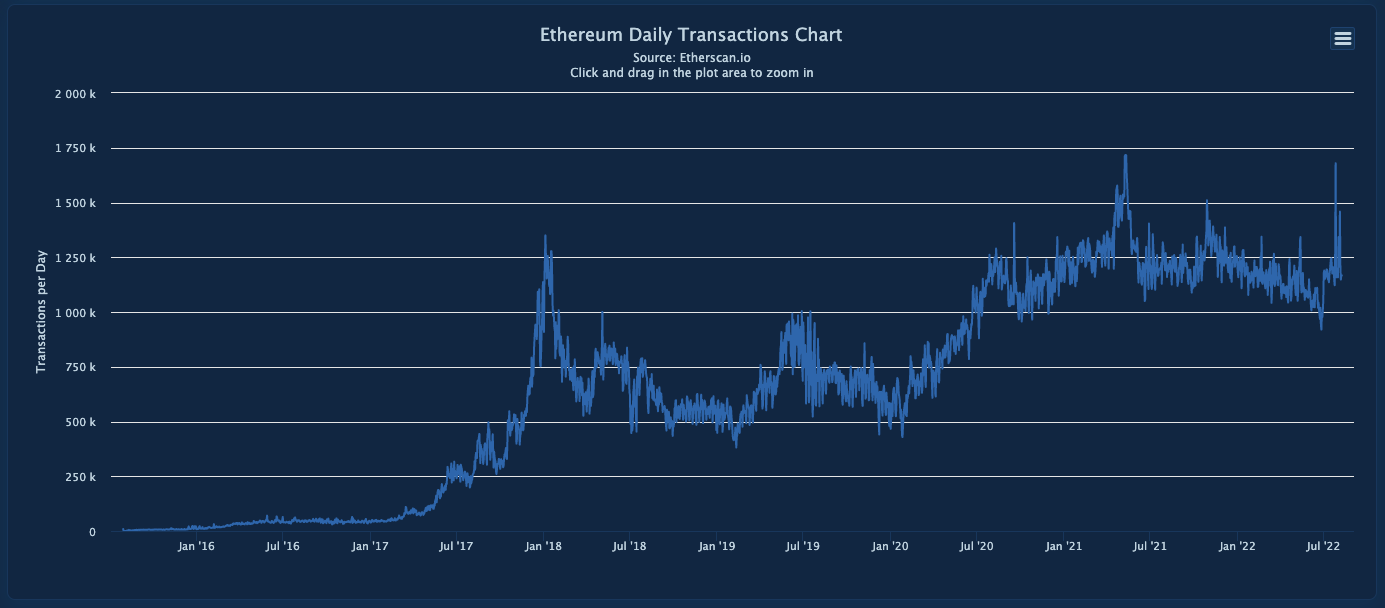

Most developers favor Ethereum because of its vast and secure architecture, which in turn causes congestion on the network, raising gas fees. Layer 2 solutions are essential in enabling Ethereum to grow.

So, how does Polygon make transactions cheap and fast? Designed to fix Ethereum’s scalability issues, the Polygon network mitigates congestion by handling transactions on a separate Ethereum-compatible blockchain. Polygon then returns transactions to the main Ethereum chain post-processing. This effectively speeds up transactions and lowers the fees to less than a cent. In contrast, the average transaction fee on Ethereum is around 15 dollars. By batching transactions off the main chain, Polygon makes Ethereum lighter and faster.

Often referred to as the swiss army of Ethereum scaling by its suite of different protocols, including the zero-knowledge (zk) proof variety, users get to choose the best scaling option for their specific needs. A zk proof is used to verify whether a particular statement is valid to another party. At the same time, the prover is not required to provide any additional information other than the fact that the statement is true. As of today, Polygon’s Commit Chain has attracted more than 80 Ethereum dApps.

Polygon offers developers a stack of solutions on a single network offering a higher level of freedom when choosing a scaling solution best suited for specific project needs. Polygon SDK, short for Software Development Kit, which was recently renamed Polygon Edge, makes building a multichain network much more accessible for developers. With it, anyone can build standalone chains fully responsible for their security with a dedicated PoS bridge network connecting them to Ethereum.

Next to SDK, we have the well-known Polygon Proof-of-Stake chain, where most projects on Polygon are currently deployed. What sets it apart from other PoS chains is that it sits directly on Ethereum, leveraging its security.

Recently released, Polygon Supernets powered by Polygon Edge, is a development framework for projects that want to create and deploy their blockchains. It allows developers to build their projects in a customizable environment without hosting or operational costs by deploying on either a Supernet Sovereign Chain or Supernet Shared Security Chain. To facilitate the adoption of Supernets, Polygon has allocated $100 million to developers who want to build on the network. Viewed as a crucial piece of software for the path towards multi-chain Polygon.

- Supernets are dedicated and designed to run for a specific application, project, or use case.

- With a shared security option, users can use Proof of Stake as a security mechanism in the form of a POL-staked validator marketplace. They are allowing developers to skip through the challenges of bootstrapping a validator network.

- Supernets are interconnected between each other and Ethereum with plans to connect with other Ethereum ecosystem networks.

- Polygon offers support in the form of certified Edge partners to assist in the complexities of launching, running, maintaining, and upgrading the projects.

- Supernets have been referred to as “blockchain legos” for their modularity, just as offered in Polygon Edge; the following are four typical types of Supernets:

- Rollup - Network that relies on Ethereum for both security and data availability

- Shared Security - Network validated by POL-staked validators, optionally managed by Certified Partner

- Sovereign - Network with its own set of validators (Proof of Stake or Proof of Authority), optionally managed by a Certified Partner

- Validium - Network that relies on Ethereum for security, but not for data availability (data can be stored on the Supernet itself or on Polygon Avail)

It is important to note that any Supernet can modify its underlying architecture at any point.

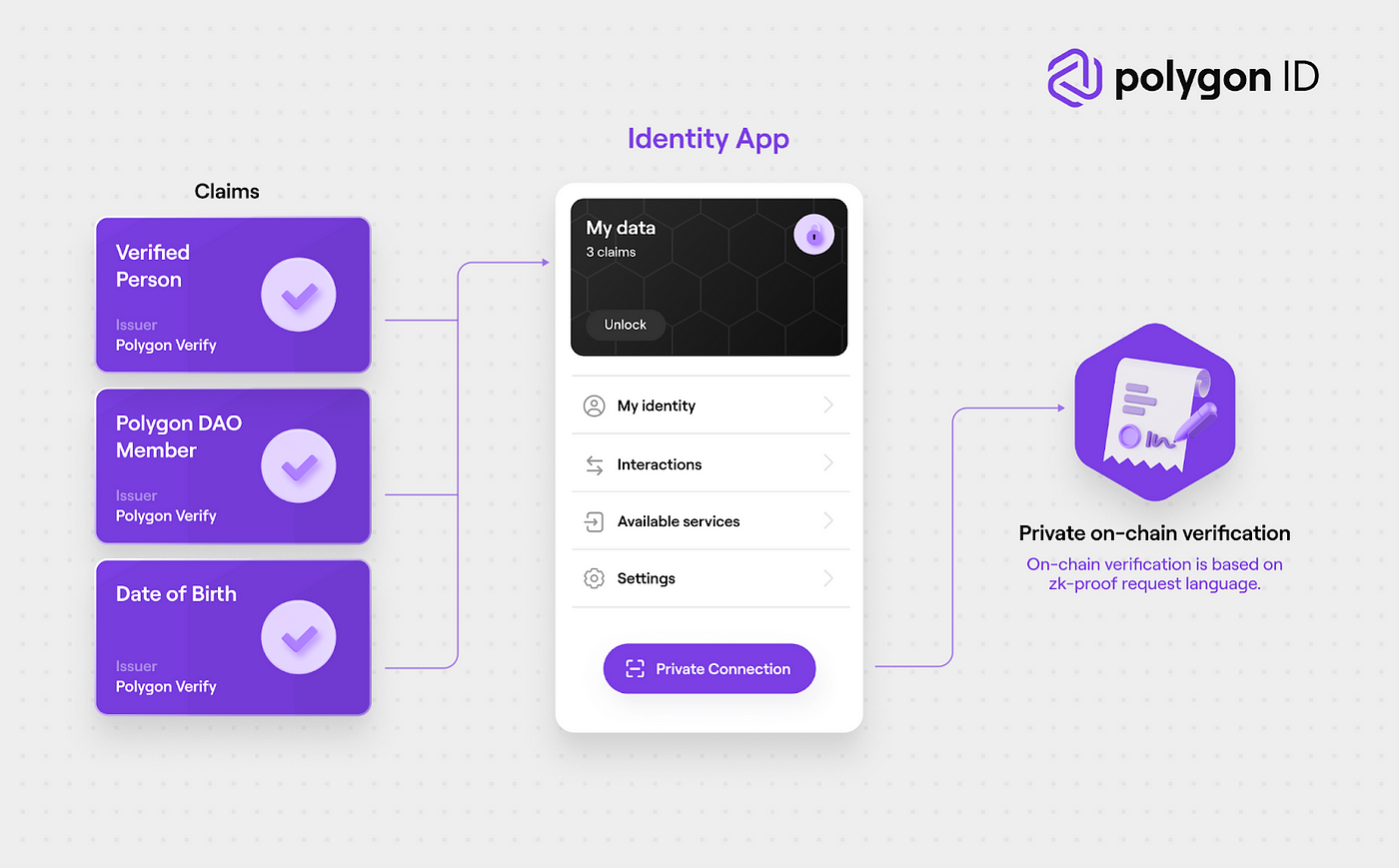

On the path towards a private-by-default future, the Layer 2 scaling solution has recently deployed Polygon ID, a self-sovereign, decentralized and private identity. It offers on-chain verification and permissionless confirmation. In other words, you can prove your identity without revealing your data. This application is beginning to be used in governance proposals such as the Bounty Competition, where in place of tokens, a one vote one person is the norm.

Polygon ID has the following properties:

- Blockchain-based ID for decentralized and self-sovereign models

- Zero-knowledge native protocols for ultimate user privacy

- Scalable and private on-chain verification

- Open to existing standards and ecosystem development

Polygon has ambitious plans for its future beyond fast and cheap transactions. The protocol aims to link all Ethereum Virtual Machines (EVM) compatible blockchains, allowing developers to move freely across blockchains without friction.

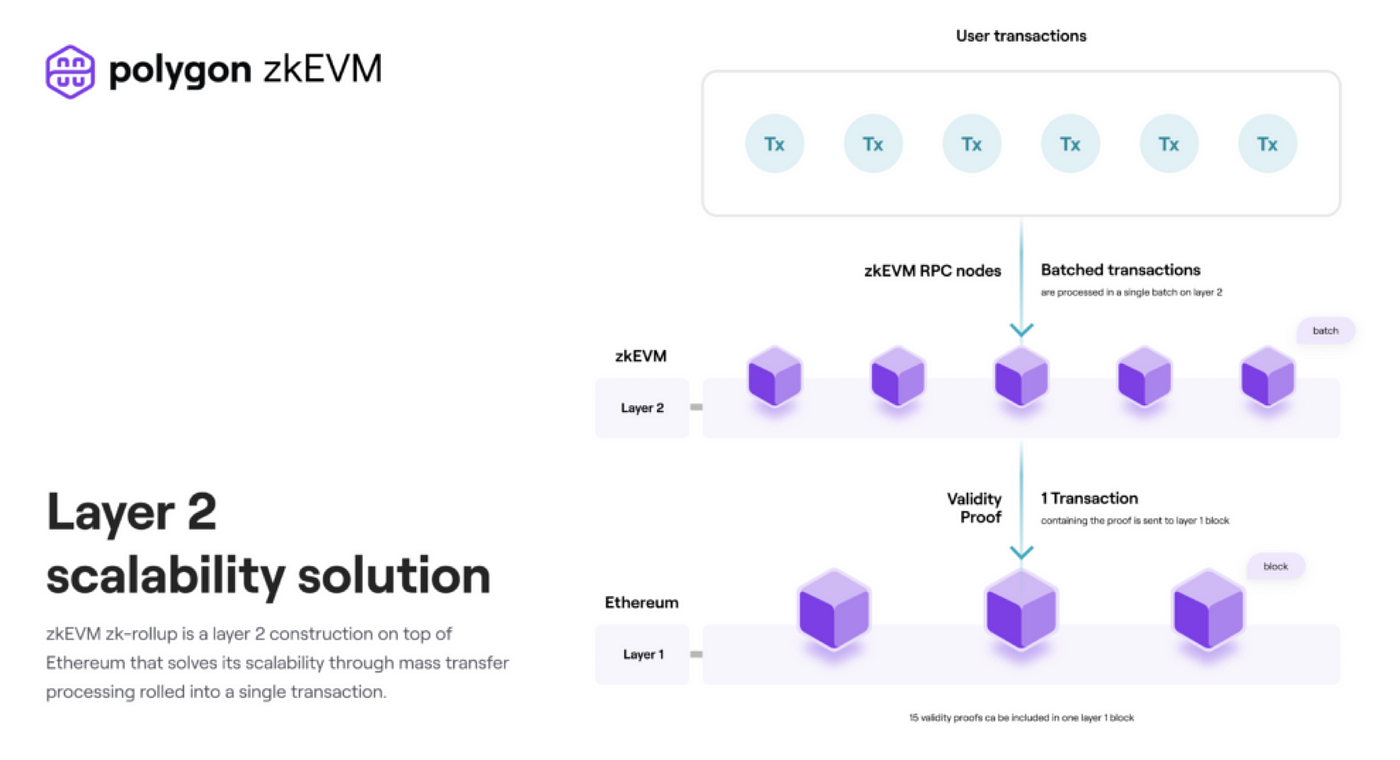

With the recent launch of Polygon zkEVM, Polygon is ready to scale Ethereum using ZK proofs. A Layer 2 protocol that “rolls up” a large batch of transactions and proves all of them to the Ethereum network with a single ZK validity proof. This means one transaction replaces many, increasing throughput, saving on fees, reducing latency, and more. Any tooling or dApp on Ethereum will be used the same way on a zkEVM, benefiting from the decentralization, security, and familiarity of Ethereum.

There is simply so much happening in Polygon; here are a few noteworthy mentions:

- According to Polygon’s documentation, a single Polygon side chain can theoretically handle 65,000 transactions per second.

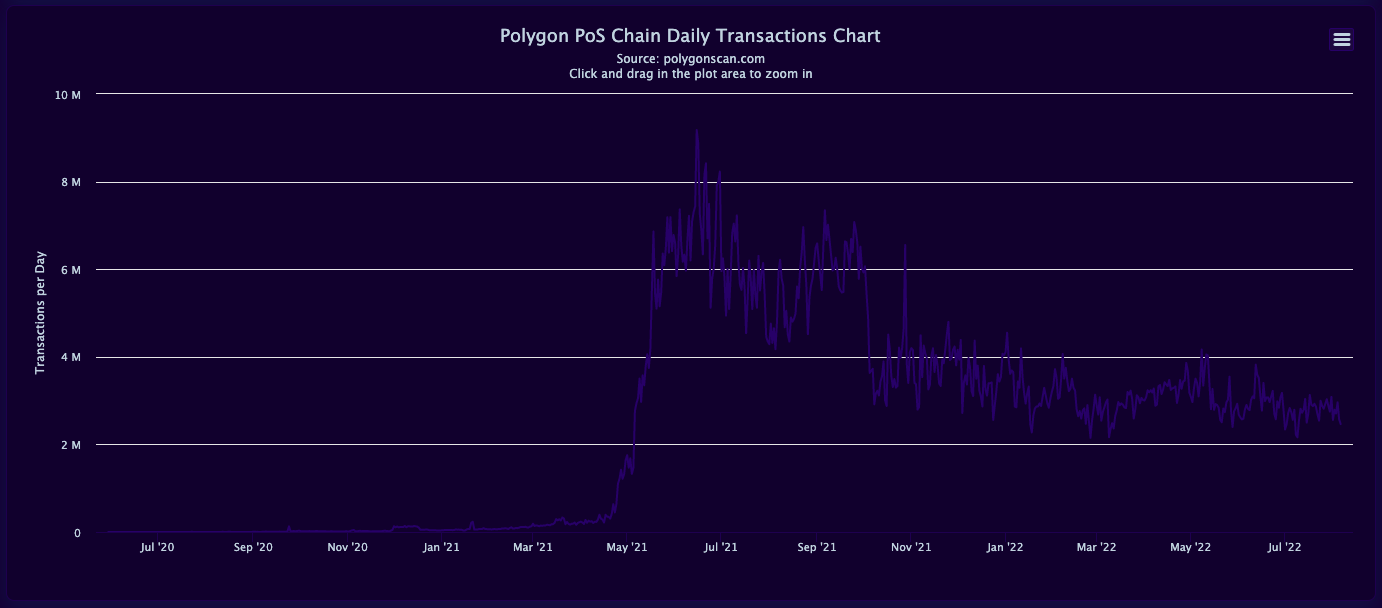

- Polygon has close to double the daily transactions as Ethereum.

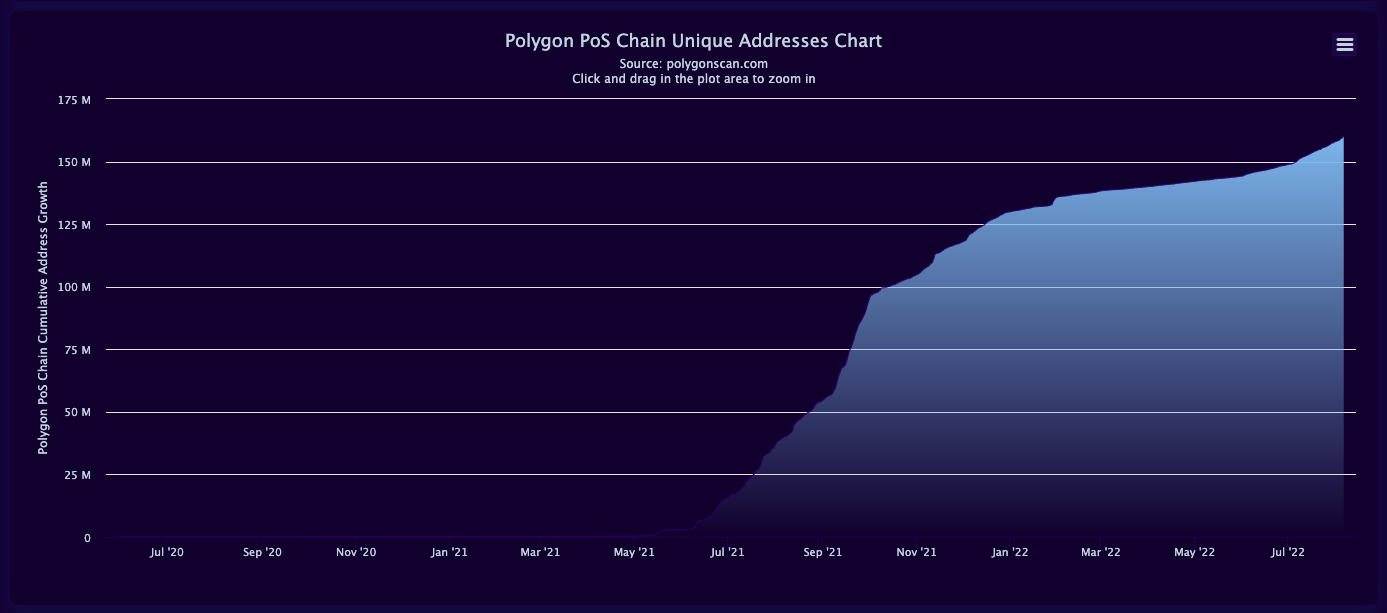

- As of August 2022, Polygon reached a new milestone of 160 million unique addresses.

- Over 37,000 DApps are running on the network, from 3,000 in October 2021

- Over 15,600 delegators with a total stake of $2.39B distributed over 100 global validators

- In December 2021, Uniswap, the #1 Ethereum App, went live on Polygon

- In 2021 Polygon introduced PolygonScan, a fast and scalable blockchain explorer powered by Etherscan

- Last year, Polygon announced the launch of Polygon Studios, committing $100 million to Game and NFT projects. Some projects involved are ATARI, OpenSea, Sandbox, Decentraland, and much more!

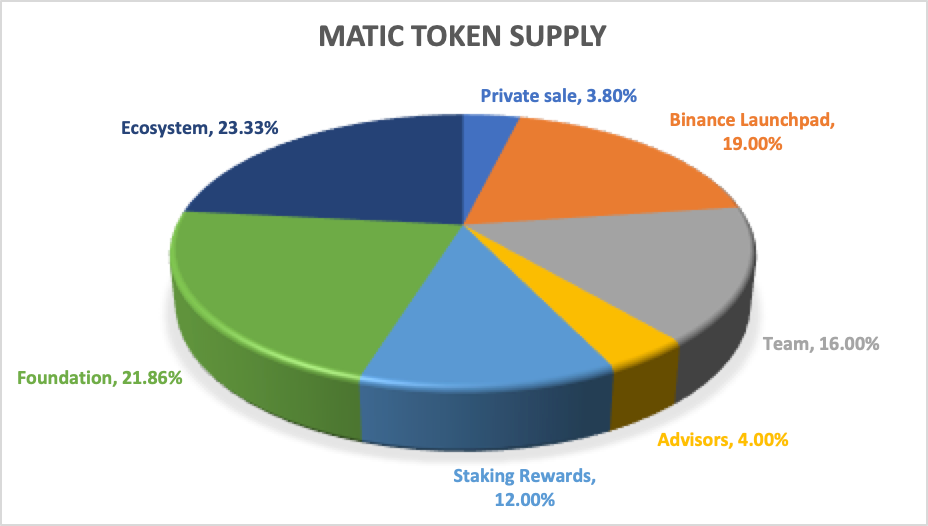

So, what about the POL Tokenomics?

Polygon has a total supply of 10 Billion POL with a circulating supply of 8 Billion. From inception, they have allocated 12% or 1.2 Billion POL as staking rewards over five years; we are currently in year 3. This was an effort to jump-start the Polygon PoS network until the network could generate sufficient transaction fees from its participants.

In April 2019, Polygon held its initial exchange offering (IEO) on Binance, where they sold 19% of their tokens at a rate of $.00263/MATIC through this launchpad.

The breakdown of the total supply is as follows:

o Private sale (seed round + early supporters): 3.8%

- Binance Launchpad: 19%

- Team: 16%

- Advisors: 4%

- Staking Rewards: 12%

- Foundation: 21.86%

- Ecosystem: 23.33%

EIP-1559 is here

Also known as the London hard fork, EIP-1559 went live on Ethereum in August last year. It has been effectively integrated into Polygon, which means a portion of the transaction will be burned out of circulation. The higher the adoption of the network, the more transaction fees get paid, and the more POL token gets burned. So far, nearly 300 million POL tokens have been burned.

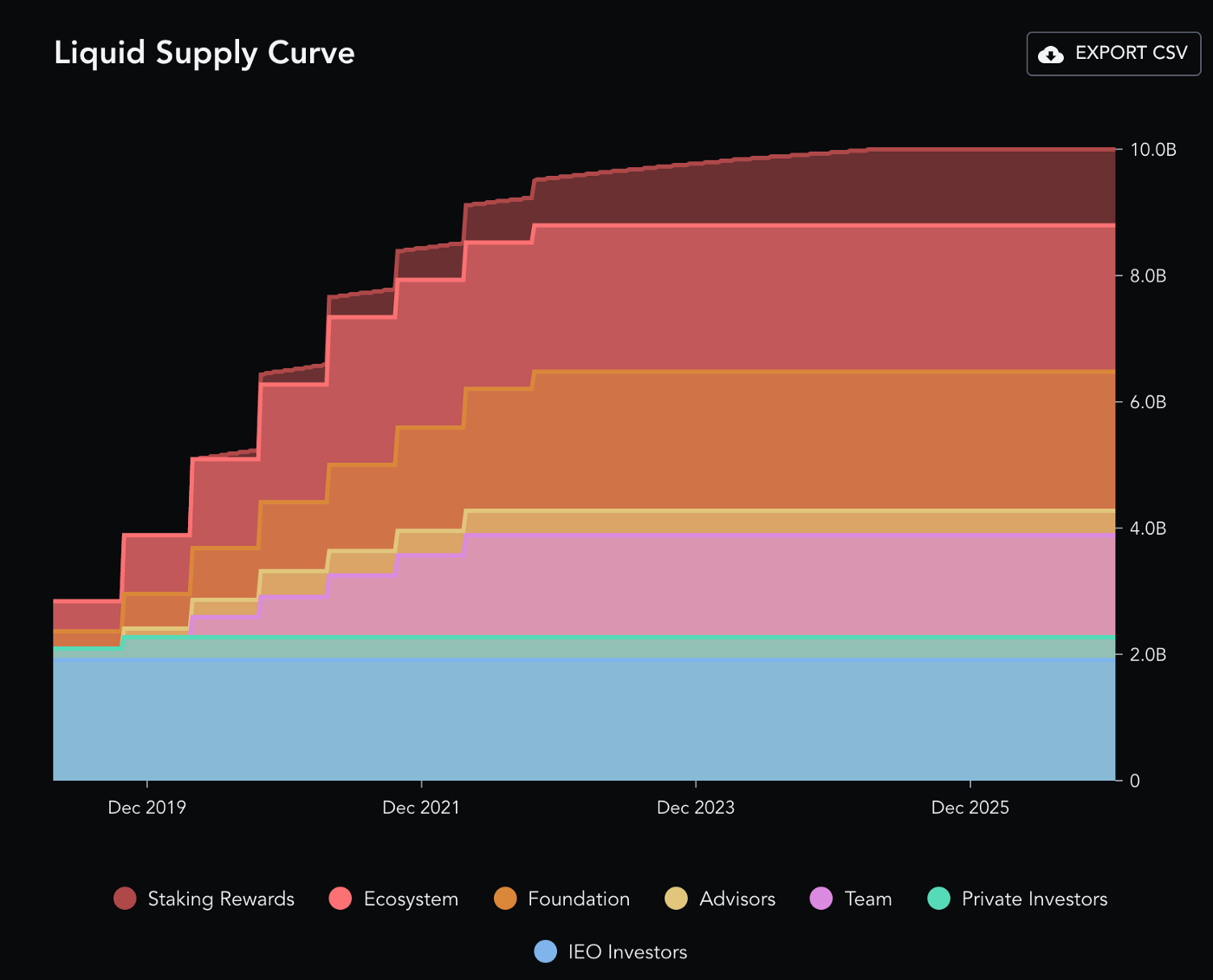

The remaining POL tokens that aren’t in circulation will be distributed over the next four years according to the following vesting schedule. If you wish to take a closer look under the hood, read over the Polygon’s whitepaper and lightpaper.

With this explosive growth in user adoption, it is worth noting that the staking rewards are still incentivized from the original 12%. When the funds expire, the network hopes the transaction fees will be enough to cover the staking rewards.

FINAL THOUGHTS

Polygon has shown itself as a valuable ally to Ethereum in its quest to scale, becoming the blockchain of the masses. A symbiosis relationship where Polygon leverages on Ethereum so new protocols and dApps can quickly rise to a broader user base who see the congestion and high gas fees as a rigid barrier to entering the ecosystem.

With the easy and seamless integration back and forth between Ethereum, the undisputed champion in smart contracts, Polygon is poised to play a vital role in the years to come.