Hey Readers👩💻,

At Stakin, we’ve been enthusiastic supporters of the different Proof-of-Stake models (PoS). The entire market has come a long way since its creation in 2012. PoS has moved from being a more sustainable alternative for Bitcoin’s Proof of Work (PoW) to impressive network structures that seem to be the next step in Blockchain’s adaptation into the real world.

But just like all innovations, both offline as in blockchain, there are still a few things that need to be figured out. One of those is how to obtain decentralization in governance; ultimately, another is interoperability between different blockchain networks.

However, 2020 has been the year of networks and protocols working on these issues. That is why, in this article, we decided to give you an overview of the state of staking.

So, let’s have a quick look at what Proof-of-Stake (PoS) is. PoS is a consensus algorithm based on different digital assets that stakeholders can keep, mine, or validate. In a nutshell, various parties respond to the scarcity of the currency itself. When you own 5% of a specific cryptocurrency, you can mine 5%. Like with PoW, PoS aims to approve transactions and store consensus about data.

PoS was first introduced in 2012 by Sunny King. The mechanism elects stakeholders to validate transactions. In PoS, the creator of the next block is chosen through a lottery process. In reward for the creation of new blocks, digital assets are rewarded and added to the network. In PoS, the amount of staked tokens secures the network, unlike in PoW, where the computing power protects the network. At Stakin, we’re very bullish on the future of Proof-of-Stake cryptocurrencies, as we believe that it offers the following pros:

- Less computing power-intensive than PoW: we run a few staking nodes on various PoS protocols, and to do so, we only have a few secured VPS vs. tons of mining rigs for PoW miners.

- Token Holders can earn rewards/interests based on the inflation rate; this can help build up the community and incentivize people to hold on to their token.

- Decentralization: depending on which kind of PoS the protocol has adopted, the network can reach full decentralization, so cryptocurrencies were created.

Read our Proof-of-Stake Guidebook for more information on PoS networks and the different versions of the consensus algorithms.

🧐Decentralization in Governance

As blockchain networks become more and more complex, it can be challenging to obtain decentralization. Decred powered by PoW nodes but with a governance system supported by PoS nodes has tried to find a solution using this double system. Meaning, PoW miners can operate like Bitcoin miners, but they cannot confirm a block until any of the PoS nodes approve. That helps prevent contentious forks; this means miners can’t cause chain splits and build on unapproved blocks.

A familiar name in the PoS blockchain world is Tezos, which has taken the Decred idea further. The network allows random stakeholders to publish blocks and earn rewards. Any individual must put a safety deposit of XTZ (Tezos native asset) up, assuring no lousy behavior will come through. When a stakeholder illustrates malicious behavior, they get slashed and forfeit their stake.

Furthermore, Tezos has the ability to delegate your stake to delegators, such as Stakin. About this, the founder of Tezos, Arthur Breitman, said:

“Since not everyone holding tokens is interested in being a baker, tokens can be ‘delegated’ to another party. The delegate does not own or control the tokens in any way. In particular, it cannot spend them. However, if and when one of these tokens is randomly selected to bake a block, that right will belong to the delegate.”

What begins to happen or what we can see with these two different networks is that slowly, networks’ governance systems become more and more decentralized. Decentralization is the process of making sure that power is distributed away from a central authority. Banks and other financial or governmental institutions are usually centralized, meaning that there is one single highest authority in charge, managing all that is going on.

This centralization approach has a couple of crucial disadvantages since the central authority also plays a single point or the system’s failure. Any malfunction at the top will eventually harm the entire system. As most know, Bitcoin was created to give a decentralized alternative to government money and therefore doesn’t have a single point of failure, making it more resilient, efficient, and democratic.

Its underlying technology, the Blockchain, allows for this decentralization because it will enable every user to become one of the network’s many payment processors. However, true decentralization is tricky and something that has ultimately still a long way to go.

⛓ Blockchain Interoperability

A third important aspect of not just PoS but also PoW will be the interoperability. Interoperability in the blockchain is something that updates such as Stargate of Cosmos are working towards. Firstly, it means the possibility that different independent blockchain systems will communicate with each other, somewhat as Web 1.0 developed towards Web 2.0 as we know it now.

Furthermore, it is possible to share, see, and access data and information across all different blockchain networks without needing any kind of intermediary, such as a centralized exchange. Blockchain projects implement interoperability or work towards its aim to create an ecosystem that will let different blockchains communicate.

Interoperability for blockchain is not only desirable but above all else, critical, enterprises depend on ever-greater levels of collaboration and interaction. Besides, interoperability is crucial in any software system. It only doesn’t work to its full potential if it can’t communicate with other software.

Therefore, it is the only way to truly realize the full promise of blockchain adaptation in enterprises, governments, and everyday life. Interoperability would ensure that information sharing, execution of smart contracts, and user-friendliness of blockchain experiences would be better and more comfortable.

In areas such as supply chain, trade finance, healthcare, and aviation, one blockchain network will simply not provide all the needs for any given transaction. It will ask multiple blockchain networks, each providing their specific value and expertise, to properly communicate data from private networks to other vital systems.

Rasmus Winther Mølbjerg, Director of Deloitte in Denmark said:

“Everyone is dependent on physical goods’ ability to move across all participants in the global supply chain with minimal friction. We need the same ability to move a digital asset from one blockchain to another without creating redundant data or a new market for intermediaries. This is why blockchain interoperability is critical.”

Blockchain characteristics will allow disconnected supply chain management systems to interoperate securely, with low investment costs; this is just one example of how blockchain can be useful and effective in the offline world.

- Read more about interoperability in blockchain here.

🌏 Global Proof-of-Stake Market

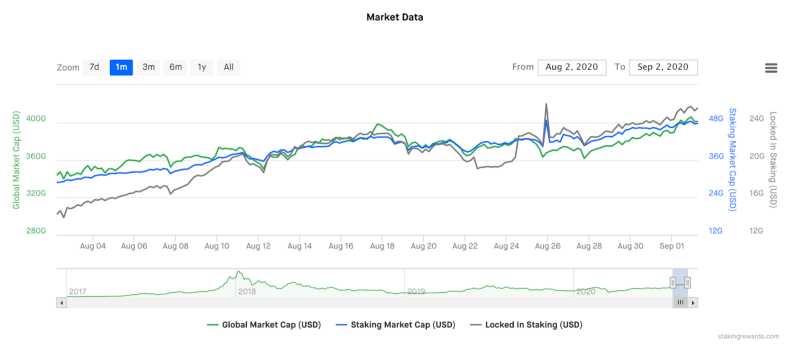

As illustrated in the table above, sourced from stakingrewards.com, between August the 2nd and September 2nd, 2020, the Global Market Cap in USD for PoS has been gradually increasing. This is not surprising as the Decentralized Finance market is also increasing, and most DeFi applications, etc. are either built on Ethereum, Cosmos, or ICON.

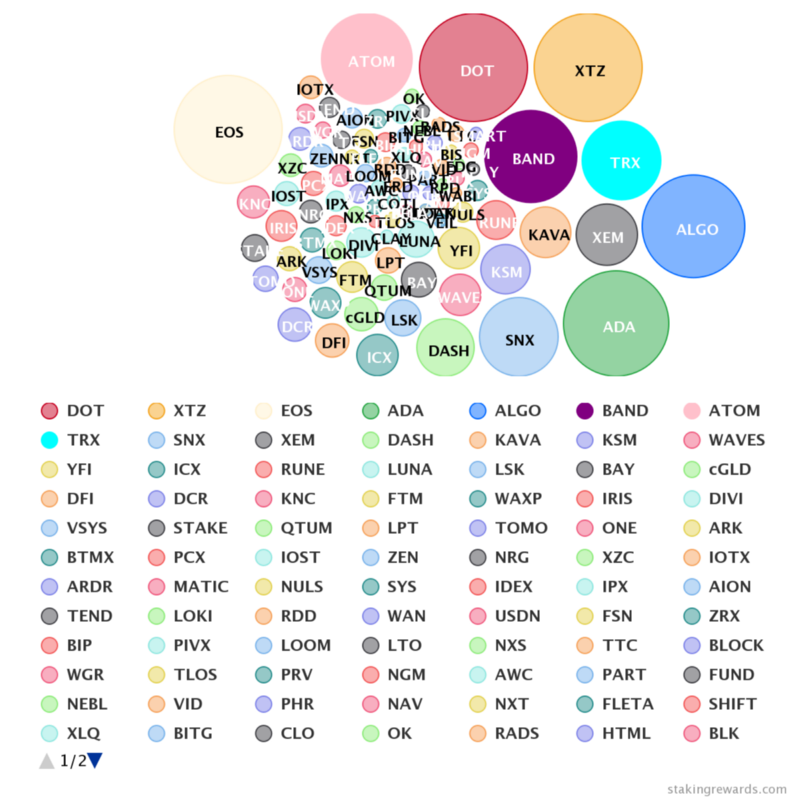

Interestingly, where stakingrewards.com reported a complete dominance of $XTZ (Tezos) and EOS in June 2020. At the time of writing this article, we’re noticing a different trend. Relatively new coming Mainnet Polkadot, and their $DOT’s have a considerable portion of the total amount locked in staking (see image below). Additionally, $BAND, $ATOM, and $ADA have also climbed from June to September 2020. These changes directly illustrate the rapidly changing nature of the PoS blockchain market, where each month can look completely different.

🕵️♂️ Conclusion

With much-anticipated networks such as Ethereum 2.0 still waiting to be launched and many other exciting developments coming. The rapidly changing and improving the Proof-of-Stake market is an always exciting and interesting market to be a part of. We’re excited to see what else is coming in 2020 and 2021.

Check out our bi-weekly newsletter to read the latest developments of PoS.

DISCLAIMER: This is not financial advice. Staking, delegation, and cryptocurrencies involve a high degree of risk, and there is always the possibility of loss, including the loss of all staked digital assets. Additionally, delegators are at risk of slashing in case of security or liveness faults on some protocols. We advise you to do your due diligence before choosing a validator.