Key Takeaways

- On-chain analytics are a critical metric used to assess the continued usage of a blockchain network over time that are obtained by viewing on-chain statistical data at the protocol level.

- Typically, the higher the rates of on-chain activity, the faster a blockchain protocol is growing, making on-chain analytics a crucial measurement used to analyze the growing network effects of blockchain platforms and their underlying ecosystems.

- On-chain analytics include the analysis of various critical data points such as total value locked (TVL), on-chain stablecoin liquidity, on-chain wallet address and account growth, total on-chain transaction counts, and many others.

Why are On-Chain Blockchain Data Metrics so Important?

For institutions, retail users, governments, enterprises, and other parties to analyze the long-term potential of a blockchain and its adoption trajectory, it is necessary to look at data directly correlated to a blockchain protocol underneath the hood.

While there are other metrics that must be assessed including tokenomics, trading volume, exchange listings, go-to-market strategy and business model, ecosystem size, the project’s team, and more, it is critically important to use on-chain data to assess how the platform is actually performing at a protocol-level.

The following metrics are some of the main data points that are used to calculate and monitor a protocol’s overall growth and usage:

- Total value locked (TVL) - a measurement of the total value deposited and being used within various dApps, protocols, and platforms on a particular blockchain network

- Overall stablecoin liquidity - a metric used to analyze the total stablecoin liquidity on a specific blockchain

- Total network transactions - the total number of transactions being sent on a network over a given period of time

- Active and new accounts/wallets - the total number of active or new wallets being used and created on the protocol

- Tokenomics - the study of the platform’s economic system as it relates to total market cap, total and circulating token supply, token release schedule and vesting periods, and more

- Developer metrics and analytics - an analysis of how much developer activity is regularly recorded by developers building on the network

Total Value Locked and Stablecoin Analytics

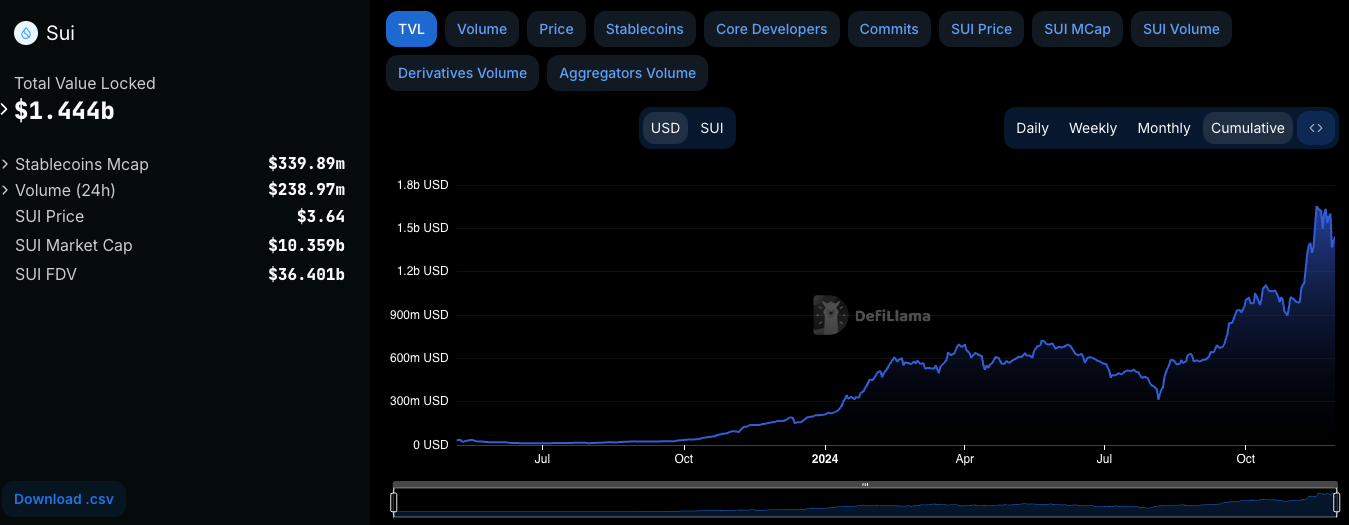

If you consider total value locked (TVL), or the amount of value locked within a blockchain protocol on-chain, Sui has become one of the industry's top performers of late, experiencing a meteoric rise over the last year.

According to blockchain analytics platform DeFiLlama, Sui’s TVL has skyrocketed from a lackluster 36.46 million on October 1st, 2023 to a staggering ~1.4 billion in one year. This represents a 38x increase, which is remarkable in such a short period of time. After crossing the 1 billion dollar barrier on DeFiLlama, Sui ranks in the top 10 in TVL and will likely hold this spot for the foreseeable future.

Additionally, stablecoin metrics are vitally important to consider because they show the total stablecoin value held within (and being exchanged within) a specific platform. On Sui, this metric is sure to grow exponentially especially because of the recent introduction of Circle’s USDC stablecoin on the network (to learn more, check out our recent article on the topic).

In addition, the total stablecoin value on the network has risen from 5.28 million on January 22nd, 2024 (when stablecoins first went live on the network) to 339 million on November 28th of this year.

Network Transaction Adoption and Active Wallets Analysis

Now that we understand stablecoin liquidity and TVL, let’s have a look at why the number or transactions and the number of accounts/wallets on a given network are important and how they equate to adoption and growth.

Essentially, the more transactions processed over a given period of time, the more the blockchain is being used. That said, it is important to look at the long-term picture to ensure the total number of transactions on the network continue to grow over time.

On the other hand, the total active accounts/wallets metric is a great barometer for how many users are actually transacting on the network, while other metrics such as the number of newly created accounts also shows that the network is continuing to onboard new users.

According to Sui block explorer Sui Vision, the Sui Network had processed 13.81 million transactions on June 3rd, 2023 (a month after its May 3rd 2023 mainnet launch) and by January 1st of this year, the number had risen to 2.37 billion. As of November 28th, 2024, the total transaction count on the Sui Network has surpassed 7.34 billion.

In addition, the platform’s total active accounts (Sui wallets that are regularly used) on June 3rd, 2023 stood at 642 thousand, with an increase to 8.51 million on January 1st, 2024, and 31.23 million as of November 28th, 2024. It seems likely that this number will hit the 40 to 50 million market in the short- to medium-term.

SUI Circulating Supply

Sui Tokenomics

One of the most important aspects of assessing a blockchain platform is its tokenomic and economic structure.

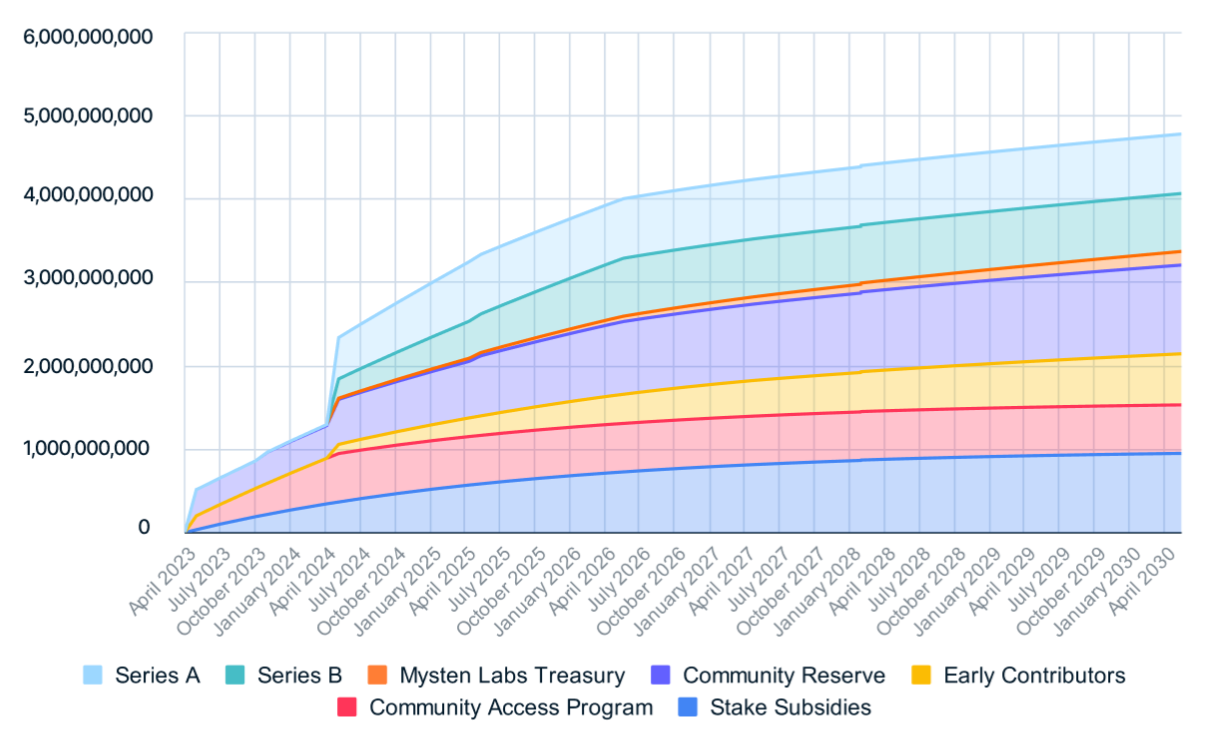

As of November 28th, 2024 the Sui token has a circulating supply of 2.85 billion, or nearly 29% of its 10 billion total supply. This means that for the price to move, less buying power is needed than if all tokens were circulating.

However, this means that there could be sell pressure over the coming years and months that could suppress the price. Nonetheless, this seems quite unlikely considering that of the platform’s 10 billion-strong total supply, only 4.8 billion will be in circulation by 2030.

Therefore, in some respects, it could be argued that the total token supply is only 4.8 billion because the remaining 52% of tokens will not start to be released into circulation until after 2030. This means for all intents and purposes that over the next 5 years, the total market cap is less than half what it is actually noted on platform’s such as CoinMarketCap.com that note the full 10 billion as its total supply.

The Sui token release schedule up until 2030 is also quite gradual if you compare it to its largest Move L1 competitor Aptos, which has an extremely aggressive release schedule. This means the possibility exists that more early investors will sell APT after initially buying the token for very low prices several years ago, arguably negatively affecting the economic system of the platform.

Sui Developer Growth Metrics

The analysis of developer growth metrics is critically important during blockchain project assessment. This is because the number of active developers and the total number of developers building on a distinct network shows that new development activity is regularly taking place on the blockchain in question.

In many respects, the more activity and the more developers building on a specific chain or ecosystem, the more the chain will grow and gain adoption. While this is not always 100% accurate, it is a good indicator that the network is continuously improving its technology and undergirding platform.

According to Electric Capital’s developerreport.com website, on July 1st, 2024 Sui had 202 full time developers, representing a 135% increase over the past 2 years. Further, in July of this year it was noted that the platform had 1108 total developers (likely including those building all dApps on the network), a figure that at the time had increased by 62% over the previous year, and 257% over the last 2 years.

Although this information only includes data up until July, it shows clear continued upward growth. On the other hand, data from DeFi Llama shows that the number of Sui core developers decreased from 86 on January 1st of this year to 53 on November 1st. Although these numbers are quite different from those supplied by Electric Capital, it is clear that they both used varied classifications as to what constitutes a full time developer. Regardless, Sui development activity is strong and it's likely it will continue to be moving forward for the next several years.

Concluding Thoughts

After analyzing the Sui Network and its on-chain data, it is clear the platform is experiencing extremely strong growth, highlighting its strong long-term potential. This remarkable growth is demonstrated by exponential increases in on-chain analytical data such as total value locked, stablecoin liquidity, network transactions, wallet and account growth, and developer activity.

The SUI token’s recent bullish price action is also a massive factor contributing to the network's overall growth. As a result, it seems likely that investors, builders, and users the world over will continue to buy the SUI token with hopes of it appreciating in value at the breakneck pace it has over the last several weeks.

Because of these considerations and others, Sui has positioned itself as one of the fast growing blockchain networks in the industry over the past year. As the Sui platform continuously grows its developer and user base, the network will continue its rise in the coming months and years. Although Sui may ultimately not be able to compete with the likes of Solana and Ethereum, it has a chance to become one of the industry's largest players over the next several years.

DISCLAIMER: This is not financial advice. Staking, delegation, and cryptocurrencies involve a high degree of risk, and there is always the possibility of loss, including the failure of all staked digital assets. Additionally, delegators are at risk of slashing in case of security or liveness faults on some protocols. We advise you to do your due diligence before choosing a validator.