In a world filled almost to bursting with Layer 1 blockchains, standouts matter. A relative newcomer to the global blockchain space, Sui has emerged from a crowded field as one of the global blockchain industry's most dynamic and fastest-growing networks.

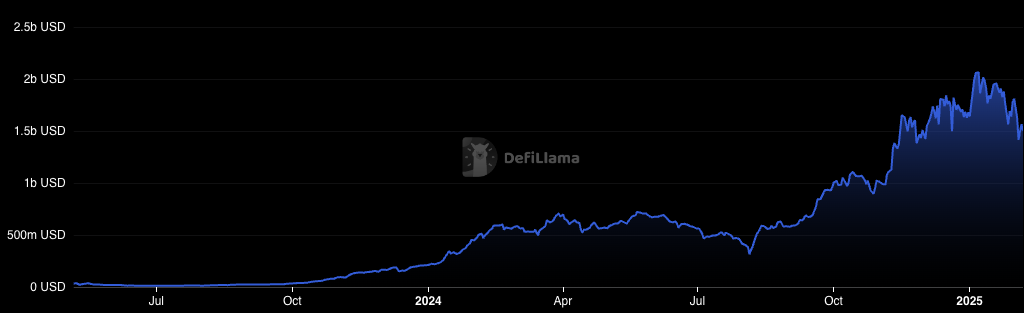

Sui’s decentralized finance (DeFi) ecosystem, in particular, has made impressive progress, reaching a historic milestone, peaking at over $2 billion in Total Value Locked (TVL) in January of 2025. This doubled its previous milestone of $1 billion achieved just three short months earlier. While Sui’s TVL has since corrected somewhat, It remains the world’s 8th biggest DeFi ecosystem by TVL as of this writing, and hitting the $2 billion benchmark puts it in some pretty exclusive company when compared with its competitors.

This remarkable acceleration, backed by innovative technology and growing institutional adoption, signals Sui's emergence as a force to be reckoned with in decentralized finance’s future.

From promising upstart to top-10 industry leader, Sui’s rise to DeFi prominence has been something to behold. And, with decentralized finance maintaining its position as one of blockchain technology’s most promising (and potentially lucrative) use cases, Sui’s moves to position itself at the forefront of the decentralized finance landscape have made it an important decentralized finance ecosystem to watch as 2025 unfolds.

Let’s take a look at why…

The Technical Foundation Driving Growth

Sui's rapid DeFi ascent began with Mysten Labs, founded in 2021 by veteran developers and researchers from Meta. Under the leadership of CEO Evan Cheng, CTO Sam Blackshear, and CPO Adeniyi Abiodun, the Mysten Labs team recognized that true DeFi scalability required rethinking blockchain architecture from the ground up. This vision materialized in two key innovations that have become significant catalysts for Sui’s DeFi growth.

First, the Mysticeti consensus engine, unveiled at Sui's 2024 Basecamp conference, achieved what many thought impossible: 390ms latency while processing over 297,000 transactions per second (TPS) with sub-second finality. To put this in perspective, these speeds represent a 10x improvement over most competing Layer 1 networks, enabling the kind of real-world applications that were previously confined to traditional finance.

Second, the team's development of the Move programming language into Sui Move created a foundation for parallel transaction processing that would prove crucial for DeFi scalability. While other networks struggle with transaction bottlenecks during peak trading periods, Sui's architecture allows multiple complex DeFi operations to execute simultaneously, a capability that has attracted both developers and institutional players to the Sui DeFi ecosystem.

2024: A Tale of Two Quarters

The impact of these technical innovations became increasingly evident through 2024, with each quarter building momentum for the next. It was in the year’s second half, however, where things really got interesting. Q3 2024 quarter saw Sui’s TVL average $611 million, reaching $944 million by quarter’s end. This growth coincided with essential infrastructure deployments, including Sui Bridge and the Mysticeti upgrade, which would prove instrumental in what followed.

2024’s fourth quarter marked a pivotal moment in Sui's overall growth trajectory. Average TVL more than doubled to $1.4 billion, while cumulative trading volume demonstrated even more dramatic growth – soaring to $44.3 billion from Q3's $4.5 billion. This nearly tenfold increase in trading volume outpaced the growth rates seen in the early stages of now-established chains like Solana and Arbitrum, suggesting strong fundamental demand rather than speculative interest.

This growth manifested across the ecosystem's key protocols, each contributing to and benefiting from the network's expanding liquidity:

- Cetus: Evolved from a $170 million TVL in Q3 to $213 million in Q4, with quarterly volume reaching $17.3 billion – growth rates that surpass the early development stages of leading DEXes on other chains.

- Suilend: More than doubled its TVL from $222 million to $519 million, establishing itself as one of the fastest-growing lending protocols across all networks at a similar stage.

- NAVI: Leveraged its early success to grow from $324 million to $457 million TVL, while expanding its services to meet increasing institutional demand.

- Bluefin: Achieved a remarkable 429.44% quarterly TVL increase, demonstrating how Sui's architecture enables sophisticated trading products that attract serious capital.

Infrastructure Maturation Fueling Sui’s DeFi Future

The Sui DeFi ecosystem's growth has been perpetuated by an impressive cycle of infrastructure development. DeepBook's launch of the DEEP token introduced innovative liquidity mechanisms that address the challenges that have historically limited DEX growth on other chains. Meanwhile, the stablecoin landscape's development, led by USDC's $271 million market cap, has created the stable foundation necessary for sustainable DeFi growth – a lesson learned from the challenges faced by earlier Layer 1 networks.

Perhaps most significantly, the SatLayer collaboration with Babylon, enabling Bitcoin liquid staking through Lombard's LBTC, has positioned Sui to tap into Bitcoin's $1.8 trillion market cap. This integration represents a potential growth catalyst that wasn't available to earlier Layer 1 networks at similar stages of development.

Security Scaling with Growth: The SHIO Innovation

As the Sui DeFi ecosystem has expanded, SHIO has emerged as a crucial component in sustainable growth. SHIO's Maximal extractable Value (MEV) protection protocol demonstrates Sui's proactive approach to challenges that have historically plagued maturing DeFi ecosystems. This focus on security alongside growth has helped attract institutional capital that might otherwise have remained sidelined.

Strategic Partnerships

The Sui DeFi ecosystem's expansion has been accelerated by partnerships that address specific growth barriers:

- Phantom Wallet: The integration of this leading crypto wallet, serving over seven million active users, brought essential features like in-app swaps and NFT support to Sui. Phantom's reputation for user-friendly design has significantly lowered entry barriers for new users.

- Franklin Templeton: The traditional finance giant's incorporation of SUI tokens into investment products marked a significant milestone in institutional adoption, bringing traditional finance credibility to the Sui DeFi ecosystem.

- Grayscale: Their inclusion of SUI in investment vehicles has opened new channels for institutional exposure to the network's growth.

- VanEck: The investment firm's development of SUI-based products has further expanded institutional access to the ecosystem.

- Stakin: Stakin’s validator services and institutional staking solutions have strengthened network security and enabled broader institutional participation in the Sui ecosystem.

The Path Forward: Sustainable Growth Through Innovation

As Sui enters 2025, its growth trajectory suggests we're witnessing the emergence of a significant and influential force in decentralized finance. Sui’s combination of technical innovation, strategic partnerships, and robust security measures has created an ecosystem that's not just growing quickly, but growing sustainably.

Sui's ability to handle complex parallel transactions opens possibilities for sophisticated financial products that could attract the next wave of institutional capital. With cross-chain functionality expanding and liquidity deepening, Sui appears positioned to maintain its growth momentum in ways that some earlier Layer 1 networks couldn't at similar stages in their development.

Final Thoughts

Sui's achievement of $2 billion TVL represents more than just a milestone – it’s validated a comprehensive approach to ecosystem building that learns from and improves upon the growth patterns of earlier networks. As Christian Thompson, Managing Director of the Sui Foundation, noted, "Sui is the most exciting ecosystem in crypto right now because it's the first base layer that can compete with – and eventually replace – the legacy systems that billions of people depend on today."

Sui's unique combination of technical excellence, growing institutional support, and vibrant developer community suggests that its current growth trajectory is just the beginning. With its proven scalability and rapidly maturing DeFi ecosystem, Sui demonstrates how blockchain technology can deliver on its promise of transforming traditional financial systems – not through speculation, but through sustainable, innovation-driven growth.

DISCLAIMER: This is not financial advice. Staking and cryptocurrency investment involve a certain degree of risk, and there is always the possibility of loss, including the loss of all staked digital assets. Additionally, delegators are at risk of slashing in case of security or liveness faults on some PoS protocols. We advise you to DYOR before choosing a validator.