Sui developed by Mysten Labs, is designed to address common challenges in the blockchain space, such as transaction speed and network congestion. Sui features a unique consensus mechanism to increase transaction throughput and minimize latency. As a result, Sui is well-suited for a range of applications, particularly in the rapidly expanding area of Decentralized Finance (DeFi).

The Sui blockchain provides significant advancements in scalability, usability, and security, primarily through its innovative object-centric model and parallel execution framework.

The object-centric model at the heart of Sui's design treats each piece of data as an independent object, simplifying interactions and enhancing performance. The object-centric model differs significantly from traditional blockchain architectures, which require operations in a global (account-oriented) state. Sui minimizes bottlenecks that typically slow down blockchain networks by enabling transactions to execute in parallel without conflict.

Moreover, Sui introduces a novel consensus mechanism tailored to its unique data structure, which enhances security without compromising throughput. This mechanism ensures that data integrity and system reliability are maintained despite blockchain's decentralized and autonomous nature.

Finally, Sui delivers improved storage solutions that optimize data handling and retrieval, further speeding up the process and reducing costs associated with data maintenance. This aspect is crucial for maintaining high performance as the network scales and the volume of transactions increases.

Through these properties, Sui positions itself as a highly adaptable and performance-oriented platform capable of supporting next-generation blockchain applications. It promises to deliver a user-friendly experience for developers creating decentralized applications and end-users interacting with the platform.

An overview of DeFi on Sui network

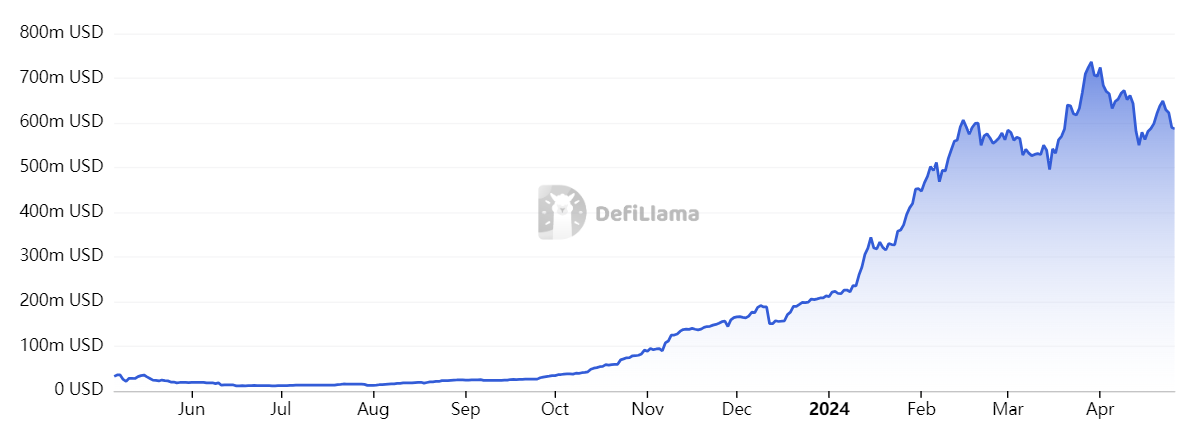

Sui has made significant strides around DeFi, as the network has become one of the Top 13 Layer 1 blockchains, with a TVL of $585 million as of April 26.

Since Sui's mainnet launch in May 2023, TVL on Sui has marked a consistent upward trend, especially in recent months, starting inJanuary 2024.

Sui's recent DeFi growth can be attributed to several factors:

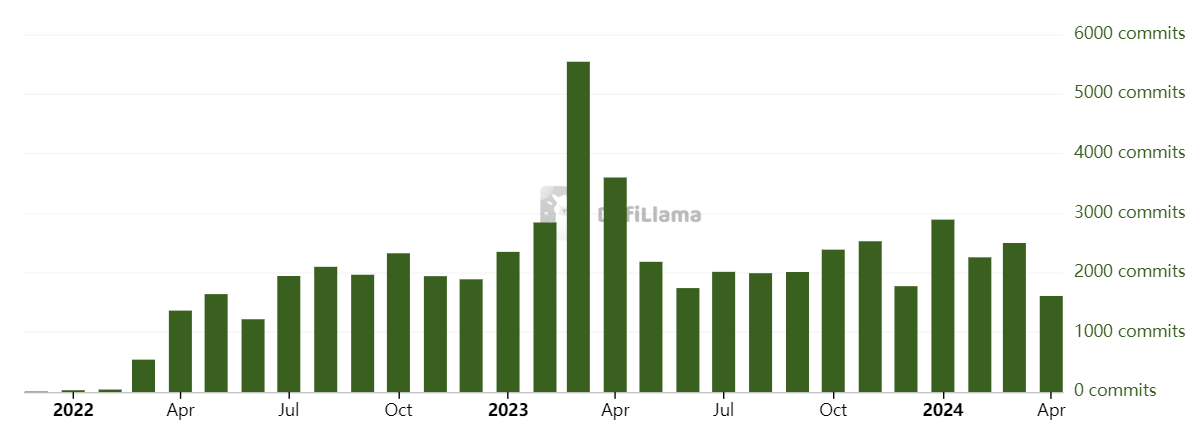

- Developer Engagement: Increased interest from developers, drawn by Sui's efficient design and user-friendly features, has led to a broader range of DeFi applications.

- Community Support: The expanding Sui community, encompassing developers and users, has created an environment that encourages the rapid development and improvement of DeFi projects. SUI features a thriving support of developers and a commendable number of total network commits.

OtterSec and Movebit, Navi Protocol, have audited NAVI protocol, the top DeFi protocol on Sui. Scallop Lend, the second most popular TVL DeFi protocol has also been audited by the same entities, as well as by Cetus.

Key DeFi protocols on Sui

Bellow we will highlight the most notable DeFi protocols on Sui, including:

- NAVI Protocol

- Scallop Lend

- Cetus

- Aftermath Finance

- Kriya

- Suilend

Navi Protocol

NAVI Protocol is a decentralized liquidity protocol on the Sui blockchain that facilitates lending, borrowing, and liquid staking. The NAVI X Ecosystem Fund, has committed 10 million NAVX tokens, aiming to support the development of DeFi applications on the Sui blockchain. This initiative provides financial support, advisory services, and networking opportunities to foster innovation and growth within the ecosystem.

Scallop Lend

Scallop Lend is a premier DeFi lending protocol within the Sui blockchain ecosystem. It offers a user-friendly platform for lending and borrowing digital assets, addressing the needs of various users through its robust security measures and integration into the broader DeFi landscape. Leveraging Sui's unique architecture and the Move intelligent contract language, Scallop enables seamless connections with other applications, which enhances its functionality and accessibility.

Cetus

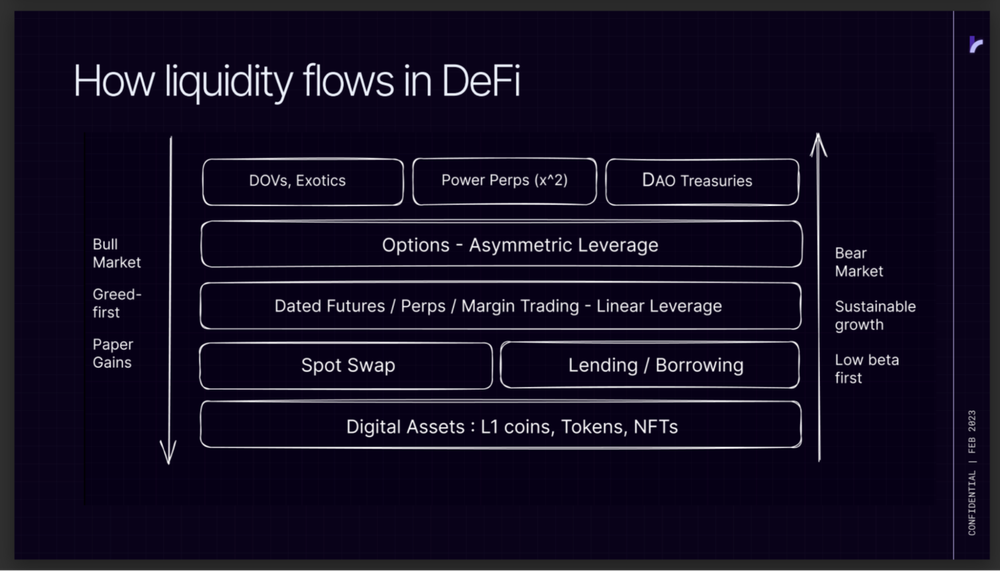

Cetus is a decentralized exchange (DEX) and concentrated liquidity protocol built on the Sui and Aptos blockchains. It aims to enhance the trading experience and improve liquidity efficiency for DeFi users. Cetus allows liquidity providers to focus their liquidity within specific price ranges, which can increase transaction fee earnings when those ranges are active.

This model also benefits traders by potentially offering lower slippage during trades. The protocol includes various innovative features, such as range orders and a native oracle for liquidity data, making it a versatile tool for developers and traders.

Aftermath Finance

Aftermath Finance is also part of the Sui blockchain ecosystem, focusing on creating a comprehensive platform for trading, investing, and yield earning. This platform features a Constant Function Market Maker for multi-asset pools, facilitating low-slippage trades and efficient liquidity management.

Additionally, Aftermath Finance incorporates liquid staking derivatives, perpetual markets, and isolated lending pools designed to cater to a broad range of DeFi activities. The platform emphasizes speed, cost-efficiency, and transparency to enhance the user experience across its markets.

You may also be interested in:

Kriya

Kriya is a dynamic suite of DeFi products on the Sui blockchain. It emphasizes a user-centric approach to decentralized perp-dex trading. It integrates various features such as perpetual, leveraged positions, and an on-chain order book to provide an institutional-grade trading environment.

Kriya focuses on liquidity aggregation and capital efficiency, employing automated strategies like CLMM (Concentrated Liquidity Market Maker) yield optimizer vaults. These vaults facilitate liquidity provision with auto-rebalancing and auto-compounding, enhancing user engagement and profitability.

Suilend

Suilend is a versatile lending and borrowing platform designed for the Sui blockchain, which builds on the experience gained from the well-established Solend platform. This platform is particularly tailored for developers, providing an optimized environment to meet their specific needs within the Sui ecosystem. Suilend features an attractive incentive program to engage users and promotes itself as this innovative blockchain's most suitable financial ecosystem.

Future outlook

As announced at Sui Basecamp recently, Axelar and Sui are collaborating to enhance cross-chain interactions. Axelar, known for facilitating secure cross-chain communication, integrates with Sui through the Squid Router, a cross-chain DEX.

This integration allows for the seamless transfer of digital assets across different blockchains. Additionally, Sui, which is otherwise praised for its high performance and strong liquidity, will be utilized by the Squid Router to settle trades using the DeepBook Protocol as its backend. This collaboration signifies a step forward in creating a more interconnected and efficient blockchain ecosystem.

Sui’s burgeoning DeFi ecosystem is already making further inroads to bring more liquidity to Sui. This development with Axelar signals further strength and taps into an underexplored region: the Cosmos ecosystem.

Sui's unique attributes, such as its high performance and strong liquidity, position it well for a promising future in DeFi. These capabilities can lead to more robust and efficient financial applications. The ability to process transactions quickly and handle high throughput makes Sui an attractive platform for developers looking to build scalable DeFi applications.

Moreover, its integration with technologies like Axelar for cross-chain interoperability enhances its potential to become a hub for a more interconnected blockchain ecosystem, expanding its role in the broader DeFi landscape.

Final thoughts

The future outlook for DeFi on the Sui blockchain appears quite promising, especially considering the rapid growth and strategic partnerships it has established since its main net launch in May 2023.

As one of the Top 13 Layer 1 blockchains by TVL, Sui has demonstrated significant potential within the DeFi space, reflecting investor confidence and operational success. It will be exciting to witness how collaborations with ecosystems such as Axelar begin to unravel, further positioning Sui as a DeFi leader.