Unmatched Scalability and EVM Compatibility Realized

In 2015 the Ethereum blockchain launched for the first time as the pioneer of programmable smart contracts. Over many years it became the most decentralized and secure network in existence outside of Bitcoin.

That said, because the network has exhibited scalability and speed limitations at times throughout its history, it has been unable to solve the blockchain trilemma, a notion that states it is impossible to build a blockchain that is simultaneously scalable, secure, and decentralized.

For those unfamiliar, Ethereum typically supports 10 to 20 transactions per second (TPS) and is often susceptible to exorbitantly high gas fees, especially during times of increased network activity. Despite these limitations, the vast majority of DeFi applications in blockchain and crypto run on Ethereum Virtual Machine (EVM) compatible software.

These challenges have led to the development of various EVM-compatible Layer 1s built to solve many of the issues we touched on above. For the most part, however, these alternative Ethereum-compatible L1s have fallen short of their aspirations.

While there are several contenders focused on solving the blockchain trilemma such as Solana, Sui, Aptos, and others, none so far have solved the trilemma while combining full EVM compatibility out-of-box. Thankfully, Monad’s combination of next-level performance along with EVM compatibility stands out because it is one of the very few chains that mix the best of both worlds.

Remember, the likes of Solana (Rust-based), Sui, and Aptos (Move-focused), and the like exhibit some Ethereum compatible features, but not nearly in the same vein as Monad, which is built to be fully interoperable with Ethereum dApps and EVM development implementations.

In particular, Monad is one the industry’s most advanced newly developed Proof-of-Stake (PoS) EVM networks designed to address Ethereum’s performance bottlenecks and inefficiencies. In many respects, this is achieved via parallelized transaction processing and other related constructs, meaning Monad is capable of processing 10,000 TPS with 1-second finality and gas fees that are barely negligible.

These characteristics and the platform's compatibility with existing EVM software and low hardware requirements (which don’t limit a smaller actor from deploying nodes on a network) cater to massive scalability and support a wide range of utilities in Web2, Web3, and beyond.

The Monad network is designed with scalability, cost, and transaction speed in mind, opening up the Monad ecosystem to Ethereum developers with little additional effort to ensure cross-chain, cross-application, and cross-ecosystem portability and compatibility.

Monad's high-performance parallelized architecture coupled with the ubiquity of Ethereum-based dApps lends itself exceptionally well to applications such as DeFi, especially DEX implementations.

To help realize the above capabilities and others, Monad offers a bespoke suite of features available for developers and users. These include:

- MonadBFT: MonadBFT is a byzantine fault tolerant (BFT) consensus mechanism for arbitrary payloads under asynchronous execution, representing a critically important characteristic that simplifies parallelized workloads.

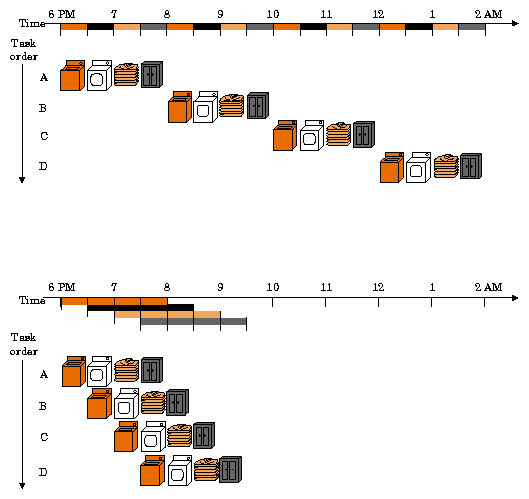

- Parallel Execution: Monad parallelizes transaction processing using a technique called optimistic execution that allows several transactions to be processed simultaneously. In the event a conflict arises via the tracking of inputs and outputs, affected transactions are rescheduled and reevaluated as needed.

- Deferred Execution: By decoupling transaction consensus from execution, Monad can finalize its transaction order prior to transaction execution. This model is unlike Ethereum which makes use of a strict sequential execution-consensus order.

- Shared mempool: Monad uses a framework where pending transactions are maintained in independent mempools distributed across a set of validators which are then distributed through an optimized broadcasting mechanism. This allows individual transactions to be referenced by their hash rather than the full data set, greatly reducing the bandwidth needed for transmission.

- MonadDb: Monad leverages a bespoke database using native Patricia tree structures to store data in RAM and fixed storage. When combined with asynchronous I/O, this allows for highly efficient parallel execution. MonadDB’s design maintains consistency during concurrent operations and does not rely on secondary data structures (e.g., external databases) for storage, contributing to speed and efficiency.

Diving Deeper into Monad’s History and Background

Founded in early 2022, Monad is a fairly new addition to the blockchain sphere. Nevertheless, a year after the network's development began, the platform raised a 19-million seed round led by Dragonfly Capital and other participants including Placeholder, Shima Capital, Lemniscap, Finality Capital Partners, and various crypto angel investors such as Naval Ravikant (the co-founder of AngelList), and 0xMaki (the founder of SushiSwap).

Monad was co-founded by Keone Hon (CEO), James Hunsaker (CTO), and Eunice Giarta (COO), all computer science engineers with backgrounds in high-frequency trading (HFT), trading algorithm development, and related disciplines.

Keone Hon attended MIT from 2007 to 2011, earning a Bachelor of Science in Computer Science and Mathematics, and later completing his Masters in Finance, Engineering, and Computer Science.

After completing college, Hon spent 9 years with Jump Trading, Jump Crypto, and other related enterprises. His work as a software engineer mainly focused on the development of quantitative trading strategies, until finally turning to management where he oversaw a team of computer engineers focused on the same niche.

Eunice Giarta attended MIT between 2009 and 2013, graduating with a Bachelor of Science in Computer Science and Engineering and a minor in Management Science and Finance. Giarta then went on to work at several firms in product development, product management, business development, payments, rates derivatives trading, and more before co-founding Monad.

James Hunsaker spent 8 years at Jump Trading between 2014 and 2021 where most of his time as a senior software engineer was spent on the development of high frequency trading (HFT) algorithms and similar technologies. Hunsaker also spent time at Goldman Sachs and JPMorgan working on advanced trading algorithms, electronic market making, EQ volume automation, and other related areas.

After being relatively unknown during its first two years, Monad became lauded for its development of a parallelized EVM-compatible Layer 1 meant to compete with the likes of Solana, Ethereum, Sei, and others; so much so that in April of 2024, the project raised $225M.

This round was supported by crypto VC heavyweight Paradigm with participation from the likes of Coinbase Ventures, Electric Capital, Castle Island Ventures, Greenoaks, EGirl Capital, and angels such as Rune Christensen (the founder of MakerDAO), Bryan Pellegrino (the founder of LayerZero), and Robinson Burkey (the co-founder of the Wormhole Foundation), and many others.

Exploring Monad’s Real-World Uses

Monad is suited for numerous use-specific applications and is designed with decentralized finance (DeFi) at the top of its mind. Its low-cost high-performance nature makes the blockchain a far more attractive alternative for Ethereum-compatible application development than many existing solutions.

Many DeFi applications rely on high scalability, rapid finality, increased throughput, and fast transaction speeds. This design allows DeFi protocols to mitigate challenges such as high slippage and others which can potentially lead to loss of funds for traders.

Slippage is an issue that affects not only high-volume traders and DEX users and operators but also anyone wanting to conduct simple asset swaps in their wallet of choice because 1-5% can be lost during execution.

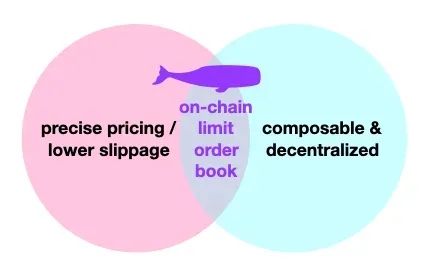

One specific set of applications that are particularly well suited for Monad’s environment are decentralized limit order book (LOB) exchanges. Specifically, LOBs are DeFi applications that mimic the order-matching mechanics of traditional exchanges whereby a user can place limit orders executed using a price-time priority mechanism.

The high speed of LOBs reduces slippage to a point where it completely finalizes trades without the use of liquidity pools which are traditionally used by automated market makers (AMMs). Consequently, Monad represents a framework built for high-speed, non-custodial, and decentralized trading with minimal slippage.

Monad allows for the ability to deploy DeFi applications that offer a DEX experience that is much closer to that of a centralized exchange (CEX), which had previously been impossible in many respects. One of many key benefits of this model is that DEXs built atop Monad will also allow for the use of non-custodial wallets, allowing holders to retain full control of their assets while utilizing a CEX-like trading experience.

The above design considerations are made possible through many technological innovations. Some of the most critical of these include Monad’s ability to reach finality within one second and the fact that all transactions are present on-chain after a single block, while also leveraging an extremely robust secure environment. This is in contrast to Ethereum, which reaches finality after approximately 13 minutes (or 2 Ethereum-specific epochs).

Monad’s additional uses encompass the broader fintech landscape, including bridges to traditional financial frameworks such as Swift and those for increasing the utility and usability of insurance, traditional financial instruments and derivatives, and more.

However, outside the financial sphere, a plethora of applications exist that are suitable for Monad including those related to big data, cybersecurity, healthcare, genomics, artificial intelligence (AI), supply chain, logistics, and others.

As blockchain becomes ever more mature as a viable large-scale database model, it is only a matter of time before applications such as e-governance, automobile, agriculture, Internet of Things (IoT), and decentralized identity (DID) will fully embrace the technology.

With its high speed, security robustness, and low cost, Monad could have the potential to gain a sizable market share moving forward, especially considering its scalability and out-of-the-box compatibility with Ethereum and EVM-compatible chains.

Monad Moving Forward

Monad represents a new and innovative EVM-compatible Layer 1 blockchain ecosystem exhibiting full bytecode-level compatibility with existing Ethereum infrastructure and EVM dApps. By implementing extensive parallelization, superscalar pipelining, and a new consensus mechanism, Monad solves several of the drawbacks present within Ethereum and other EVM-compatible blockchain systems.

Monad’s high speed and reliability, combined with unsurpassed compatibility with existing EVM infrastructure, makes it a viable alternative to many existing platforms, especially for the development of DeFi at scale. A large majority of DeFi applications currently run on EVM infrastructure, meaning Monad’s high degree of compatibility allows for effortless migration and portability within the larger Ethereum development ecosystem.

Key innovations such as parallel execution and superscalar pipelining, along with other advanced technological features, give Monad a strong foundation for future growth and utility capable of supporting a vast number of real-world applications. With its impressive ability to handle 10,000 transactions per second, Monad sets a high benchmark compared to many existing chains and could one day scale to hundreds of thousands of TPS in the coming years.

Because of the above considerations and others, Monad shows tremendous overall long-term potential. The protocol’s unique combination of decentralization, scalability, and Ethereum compatibility has the potential to position the platform as a strong competitor to other major Layer 1 ecosystems in the space.

In particular, Monad’s advanced scalability and Ethereum compatibility position it well for the development of high-performance decentralized exchange platforms, trading systems, and other cutting-edge utilities.

That said, Monad faces significant adoption challenges because of the fact it is so new and not yet established like Ethereum, Avalanche, Solana, Sui, and many others. This signifies that gaining increased market share in a space dominated by more established competitors won’t be easy.

DISCLAIMER: This is not financial advice. Staking, delegation, and cryptocurrencies involve a high degree of risk, and there is always the possibility of loss, including the failure of all staked digital assets. Additionally, delegators are at risk of slashing in case of security or liveness faults on some protocols. We advise you to do your due diligence before choosing a validator.