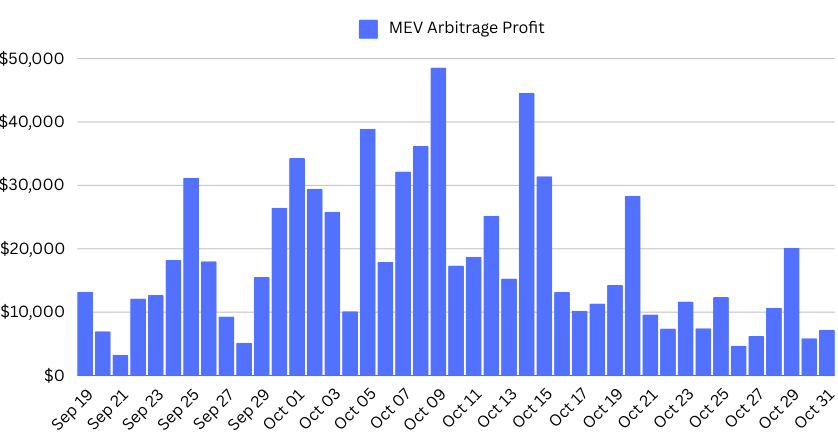

Every day, all across the blockchain world, networks contend with an invisible process that extracts value from user transactions. This process, known as maximum extractable value (or MEV) extracts an average of $18,000 in value per day from transactions taking place in the Sui ecosystem - some of which otherwise could - and should - be retained and distributed to Sui’s vibrant community of users. This value extraction, occurring in the microseconds between transaction submission and execution, adds up to millions in a single calendar year.

While some MEV value extraction is simply the cost of doing business - and can even be beneficial to overall ecosystem health - protecting users from exploitive MEV practices and ensuring that they retain their fair share of the value generated by the network they are participating in is an important priority for this burgeoning DeFi ecosystem.

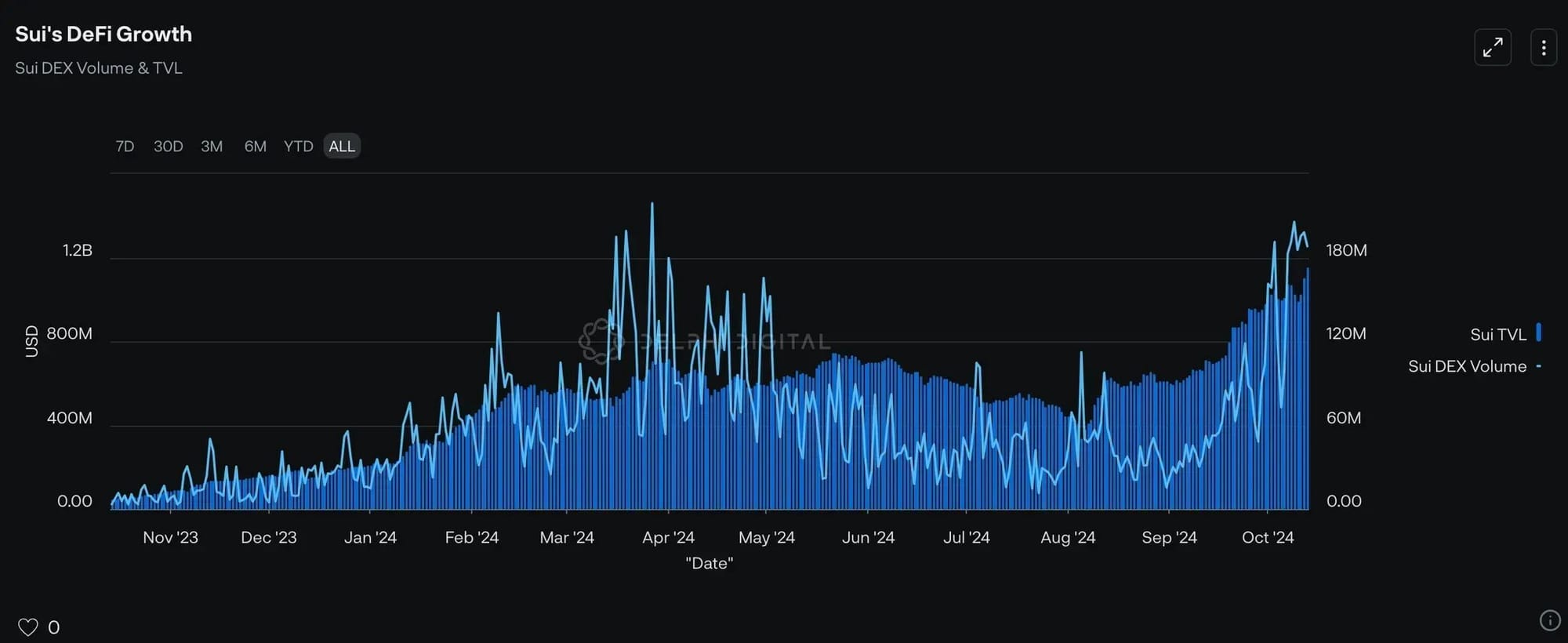

As Sui's network activity surges past $21 billion in trading volume and its DeFi ecosystem crosses the $1 billion milestone in total value locked, protecting users and their transactions from exploitive MEV strategies is becoming increasingly critical. The challenge grows more pressing as network activity increases, with sophisticated extraction methods evolving right alongside the Sui ecosystem's impressive growth.

Understanding the Broader MEV Challenge

When discussing Maximum Extractable Value, it’s important to remember that for participants in any financial system, extracting value is - and always will be - a central part of the entire exercise. The ability to extract value incentivizes network participation/activity and can help improve overall efficiency within a blockchain/DeFi network.

Maximal Extractable Value (MEV) represents the value that can be (and is!) extracted from blockchain networks by those who have the ability to influence how and when transactions are processed. It occurs in the critical moments between when a user submits a transaction and when that transaction is permanently recorded on the blockchain. During this window, sophisticated actors can manipulate transaction ordering, insert their own transactions, or strategically place trades to capture value that would otherwise belong to regular users. As the larger blockchain ecosystem has expanded and diversified over time, this value extraction has become increasingly sophisticated, evolving from simple reordering strategies to complex algorithmic systems that capitalize on every possible advantage.

Sandwich attacks squeeze value from large trades by placing strategic orders before and after them. Arbitrage bots exploit price differences across platforms, while liquidation mechanisms target vulnerable positions in lending protocols. On established networks like Ethereum, MEV extraction has already surpassed half a billion dollars, highlighting the scale of this challenge.

However, the implications of MEV extend beyond immediate financial implications. While productive MEV strategies like arbitrage can help ensure the alignment of prices across multiple exchanges, for example, more malicious types of MEV extraction can destabilize protocols, erode user trust, and create unfair advantages for technically sophisticated participants. All of this is, of course, antithetical to the founding principles of blockchain technology and decentralized finance. As the decentralized finance landscape grows more complex, the potential for value extraction increases, making protection mechanisms increasingly crucial for overall ecosystem health.

MEV in the SUI Ecosystem

Sui's blockchain architecture fundamentally differs from traditional networks through its implementation of parallel processing and directed acyclic graph (DAG) structure. These unique characteristics create distinct patterns of both vulnerability and resistance to MEV extraction. The Sui network's recent transition to Mysticeti consensus has reshaped how transactions flow through the system, introducing new considerations for MEV protection.

In SUI's architecture, transaction processing involves multiple participants with varying levels of access and influence. Network validators, serving as primary transaction processors, must achieve quorum consensus before finalizing transactions. This requirement creates natural friction against certain types of MEV extraction, as frontrunning attempts need coordinated action across multiple validators. Full nodes maintain network records and validate transactions but lack direct ordering influence, while users initiate the economic activities that drive the ecosystem.

The transition to Mysticeti consensus particularly impacts MEV dynamics by changing how transactions are ordered and finalized. Unlike traditional blockchain architectures where miners or validators have complete control over transaction ordering, SUI's consensus mechanism requires broader agreement, creating both unique challenges and opportunities for MEV security.

Introducing SHIO: A Solution for SUI

SHIO is the SUI ecosystem’s first comprehensive MEV protection protocol, developing infrastructure specifically tailored to SUI's unique architectural requirements. At its core lies SIP-19, a groundbreaking enhancement to transaction bundling capabilities. This innovation addresses fundamental limitations in traditional programmable transaction blocks, which previously restricted multiple-party interactions and created efficiency bottlenecks.

The protocol's design specifically considers SUI's parallel execution capabilities, ensuring protection mechanisms work in harmony with the network's natural advantages. By enabling atomic execution of multi-party transactions while preserving consensus properties, SHIO creates new possibilities for protecting against MEV strategies without sacrificing performance.

Core Protection Mechanisms

SHIO implements four essential layers of defense against MEV:

- Advanced bundle propagation ensuring rapid network coverage

- Sophisticated threat detection using real-time analysis

- Comprehensive monitoring infrastructure

- Automated protection protocols with fallback systems

Each layer works in concert to create a robust defense against value extraction. The bundle propagation system ensures transactions receive immediate protection across the network, while threat detection mechanisms identify and counter potential extraction attempts before they impact users. The monitoring infrastructure provides continuous oversight, enabling rapid response to emerging threats and evolving extraction strategies.

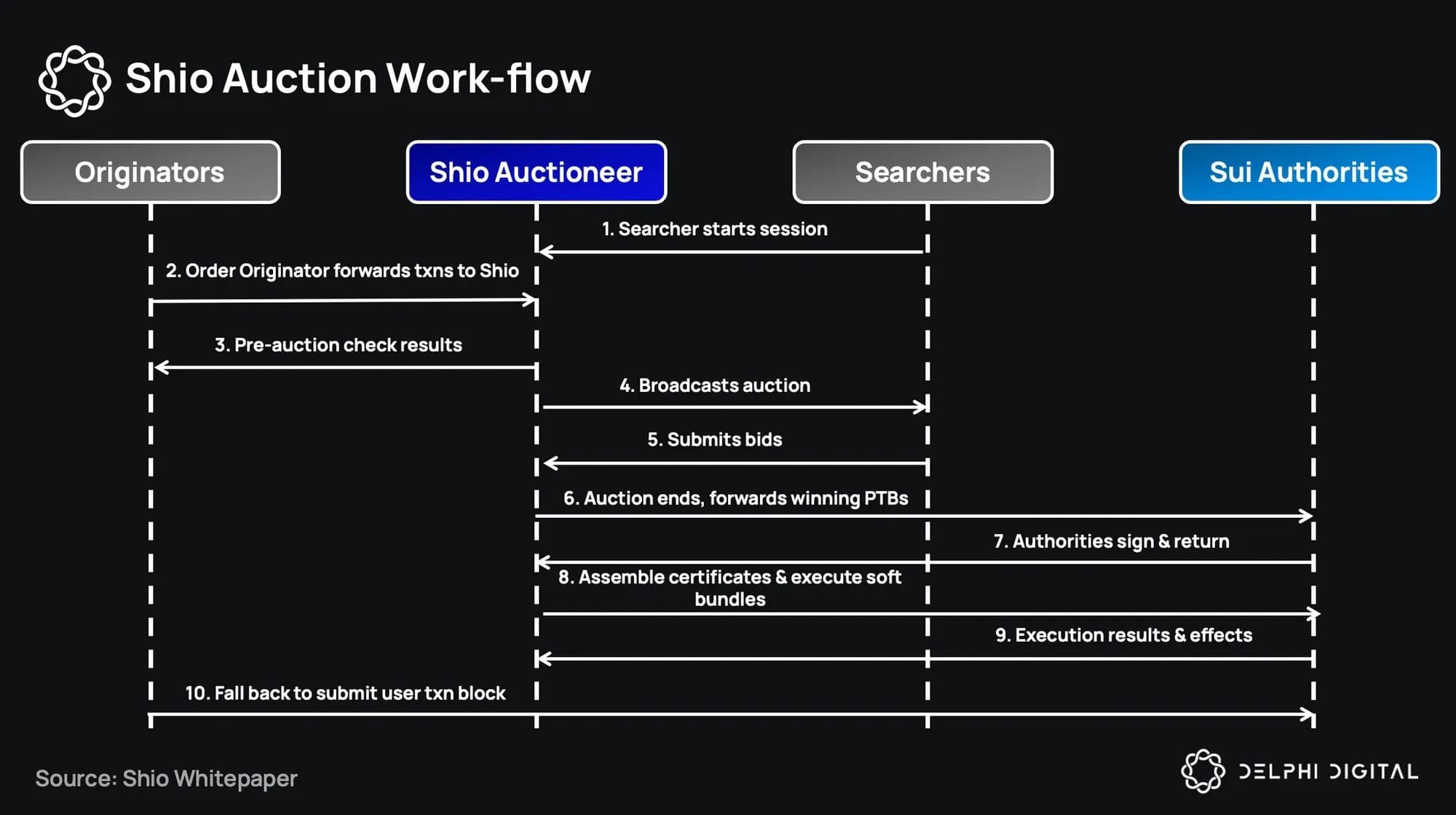

Advanced Auction Process

SHIO's auction mechanism is specifically designed to ensure fair value distribution. It processes transactions through four key phases:

- Initial evaluation and opportunity detection

- Secure searcher connectivity verification

- Competitive bidding windows with fair access

- Guaranteed execution paths with protection

This structured approach ensures that value previously lost to extraction now flows back to the community. The system's design prioritizes both efficiency and fairness, creating an environment where all participants can compete on equal terms while maintaining transaction security.

Strategic Ecosystem Integrations/Partnerships

SHIO's network of partnerships creates comprehensive protection across DeFi activities. Through integration with Turbos Finance, the system enhances general transaction security and efficiency. Its partnership with Navi Protocol extends protection to swap executions, ensuring every trade benefits from SHIO's security mechanisms. Collaboration with FlowX Finance brings these protections to decentralized exchange operations, creating a robust network of protected trading venues.

These strategic relationships (to name just a few) demonstrate SHIO's commitment to ecosystem-wide protection. Each partnership strengthens the network's resilience to MEV extraction while expanding the scope of protected activities. Through careful integration with leading platforms, SHIO ensures users can trade confidently across multiple venues while maintaining consistent protection standards.

Technical Architecture

SHIO's technical foundation combines sophisticated infrastructure with practical security measures. Working closely with Mysten Labs, the SHIO team has implemented advanced monitoring tools that track transaction patterns and identify potential threats. This collaboration enables rapid response to emerging challenges while maintaining overall system efficiency.

SHIOs architecture particularly excels at handling complex DeFi operations. When processing multi-step transactions involving lending, trading, or arbitrage, SHIO's protection mechanisms ensure value retention throughout the execution chain. This capability becomes increasingly important as trading strategies grow more sophisticated and interconnected.

Impact on SUI Stakeholders

For users, SHIO's protection translates into tangible benefits: more value retained from each transaction, reduced risk of exploitation, and fairer access to trading opportunities. Developers gain powerful tools to protect their applications and users, while potentially capturing value that would otherwise be lost to extraction.

Validators benefit from participating in fair value capture mechanisms, while the broader ecosystem becomes more attractive to participants seeking secure, efficient trading environments. This comprehensive approach to stakeholder benefits ensures sustainable growth and adoption of protected trading practices.

Final Thoughts

SHIO's development of secure MEV infrastructure for Sui represents more than technical innovation – it establishes new standards for fair and efficient blockchain operations. As Sui's ecosystem grows, particularly with upcoming protocol enhancements, SHIO's role in protecting and optimizing transaction value from malicious MEV actors - while leaving space for beneficial MEV value extraction strategies - becomes increasingly vital.

The successful deployment of SIP-19 marks an important milestone, but it's just the beginning. Through continued innovation and strategic collaboration, SHIO builds infrastructure that not only addresses current challenges but anticipates future ecosystem needs. This forward-looking approach ensures that as Sui's ecosystem evolves, its participants can operate with confidence, knowing their transactions are protected by sophisticated, adaptive security mechanisms.

Looking ahead, SHIO's comprehensive approach to MEV protection positions SUI for sustainable growth in the burgeoning decentralized finance space. By combining technical excellence with strategic partnership development, SHIO helps create an ecosystem where value generated by the network benefits its participants rather than extractors – a crucial foundation for SUI's continued expansion in the blockchain landscape.

DISCLAIMER: This is not financial advice. Staking, delegation, and cryptocurrencies involve a high degree of risk, and there is always the possibility of loss, including the failure of all staked digital assets. Additionally, delegators are at risk of slashing in case of security or liveness faults on some protocols. We advise you to do your due diligence before choosing a validator.