Cronos Chain has exceeded 50 million transactions 🔥 The perfect time to have a better look at the Cronos Chain, and to better understand what this chain is all about. Introduced on 8 Nov 2021, Cronos Chain is an Ethereum-compatible blockchain, built on the Cosmos SDK. Cronos aims to massively scale the DeFi, GameFi, and overall Web3. Cronos’s base settlement currency is $CRO, the native token of its parallel blockchain, the Crypto.org Chain.

The Crypto.org Chain is the backbone behind all Crypto.com applications, Cronos Chain is EVM compatible, for devs that want to build DApps using Solidity whereas Crypto.org Chain uses CosmWasm and targets Go and Rust developers. Both chains use the same native token, the $CRO coin. Both chains were built using the Cosmos SDK and support IBC, meaning that digital assets can be transferred between chains without a need to wrap them, like the two BEP2 and BEP20 BNB.

- Cosmos SDK = Framework to build PoS blockchains

- EVM compatible = Compatible with the Ethereum Virtual Machine, dApps running on Ethereum can be ported to Cosmos

- IBC = Protocol that makes Cosmos SDK based blockchains to communicate with each other

At the time of writing Crypto.org chain and Cronos Chain hold 6th and 7th place for the biggest network by IBC volume respectively, according to Map of Zones.

Cronos is supported by Cronos Labs, the ecosystem grant fund, Web3 start-up accelerator, and incubator of the Cronos chain. Cronos Ecosystem Grants program aims to support early-stage projects on Cronos by bootstrapping initial product development and providing technical support. By aligning incentives together with new builders and teams helping their projects grow with the broader ecosystem. Cronos is focused on bringing talented individuals & teams who are passionate and committed to building incredible products within the Cronos ecosystem.

Cronos Tokenomics

The token’s original deployment was as an ERC-20 token on the Ethereum blockchain. Then migrated as an app-chain in the Cosmos Ecosystem.

Cronos $CRO circulating supply is 25,263,013,692 $CRO, and a total supply of 30,263,013,692 $CRO. Almost all supply is out in the market, with the remaining being released which is good.

A little history lesson, there was a max. supply of 100 billion $CRO. However, before the Crypto.com Chain mainnet went live, Crypto.com announced one of the largest token burning in blockchain history. Burning 70,000,000,000 $CRO. As for now, 5.9 billion are held by the Crypto.com team.

Cronos Ecosystem

Decentralized exchanges (DEXs), bridges, gaming, wallets, tools, non-fungible tokens (NFTs), you name it. Cronos ecosystem is filled with dApps! Let’s have a look at a few of them.

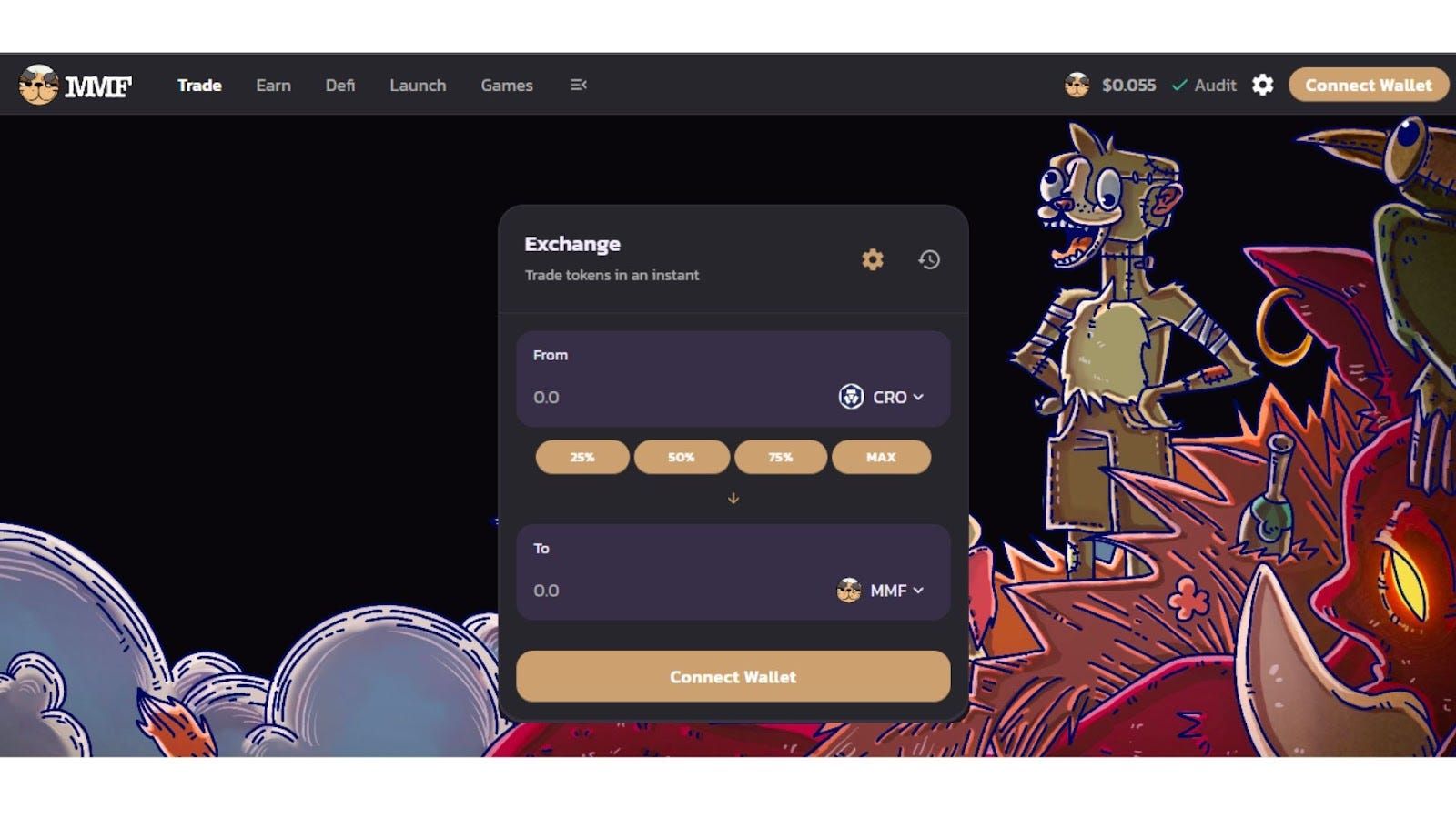

Here’s a brief look at the two biggest DEX’s on Cronos by trading volume. The first is MM Finance, which has the largest ecosystem on Cronos with its DEX, Yield Optimizer, NFT, Algo Stablecoin & DTF. At the time of writing, MMF Total Value Locked is at $96.6 million and 17.5 billion in Total Volume Traded. Yield Farms allow you to stake Liquidity Pool (LP) tokens to earn MMF on MM Finance. Have a look at their road map here.

The second, VVS Finance is designed to be the simplest DeFi platform for users to swap tokens, usars can provide liquidity, or stake $VVS to earn more $VVS. Making DeFi simple and within reach of billions. Low fees and fast transactions. Prides itself to be a yield farming opportunity, with clear incentives for all, a secure platform and governance driven. See their stats here.

Validators

Cronos Chain is PoA (Proof of Authority), “confirm current validators number” with plans to expand the set in the future. Proof-of-Authority (PoA) is a derivative of Proof-of-Stake (PoS) where instead of stake with the monetary value, a validator’s identity performs the role of stake. For more information about the different versions of Proof-of-Stake, have a look at our guide.

Currently, there are 26 live Cronos validators. Cronos validators hold two types of tokens: $CRO collected from users in transaction fees, and the Cronos Staking Token, which is allocated to validators as part of the Proof of Authority governance of the Cronos chain and represents their voting power in the consensus and other on-chain decisions. Learn more about validators in Cronos via https://cronos.org/validators.

Stakin’s public address for Cronos here is crcvaloper1pqqw8snkduy3m46xchpmzxjgvz58h3ypjpkapv.

Cronos Play

Cronos Play was launched on April 6th, 2022, builders can create games on Cronos using Gaming SDKs, with full support for Unity and Unreal Engine. Cronos Play was created to let its users easily integrate their game on Cronos with a few lines of code, Cronos Play is backed by Cronos Labs, the startup accelerator.

One of the Stakin team’s current favorite games is Decentral Games; which is a play-to-earn, free-play poker game located in the metaverse. Its beta version went live a short while ago.

A Look Towards The Future

With these facts laid out in this article, we think Cronos is a chain worth having a lock at, its community is very engaged, its user base is huge compared to other networks and the development simply doesn't stop.

Recently, Cronos Chain block size was doubled (from 20 million to 40 million gas) meaning that Cronos chain can process twice transactions per day now!

Also important, Cronos Gravity Bridge Testnet “Pioneer 11” launched on 28 June 2022. It came to be to start testing out the Cronos Gravity Bridge, Gravity Bridge allows the secure transfer of any ERC20 crypto asset from and to Ethereum Mainnet. This will enable Ethereum users to transfer their crypto assets to Cronos. GB is set to be positioned as the canonical decentralized bridge between Cronos and Ethereum Mainnet. Stay on the lookout for that.

DISCLAIMER: This is not financial advice. Staking, delegation, and cryptocurrencies involve a high degree of risk, and there is always the possibility of loss, including the failure of all staked digital assets. Additionally, delegators are at risk of slashing in case of security or liveness faults on some protocols. We advise you to do your due diligence before choosing a validator.