Note: This article has been updated on 3 of March 2020 as some validators were not in the good category

Hi everyone 😊,

On today’s Research, we are going to have a deeper look at how the Cosmos hub has evolved in ~8 months since our last validator ecosystem research.

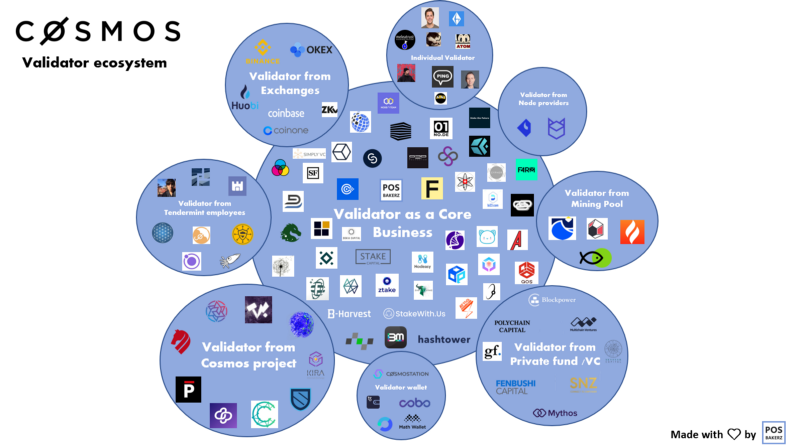

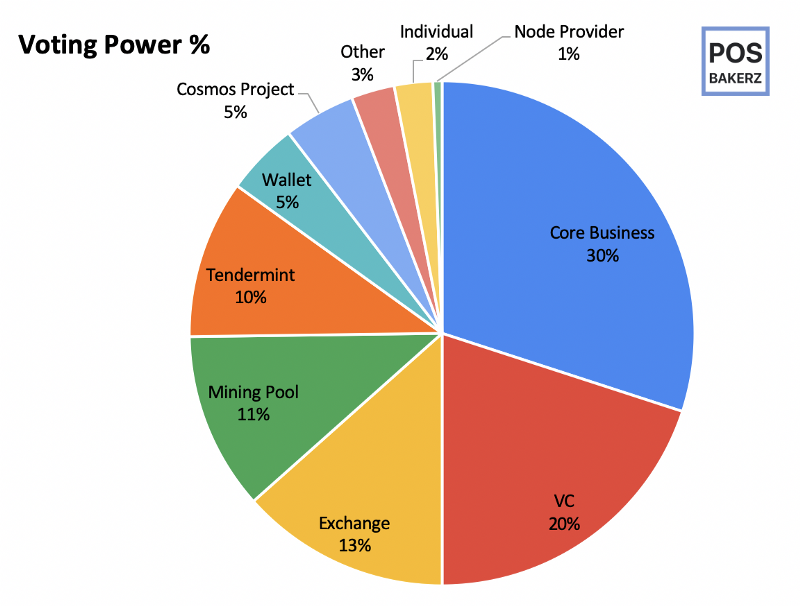

We took into account 10 different categories: Core Business, VC, Exchange, Mining Pool, Tendermint, Wallet, Cosmos Project, Individual, Node Infrastructure providers, and others. We understand that some categories are debatable as some validators could have fit in multiple of these, this categorization nonetheless is a good way to take a look at the evolution of the Cosmos validator ecosystem.

We’ve made our Google sheet public if you’d like to take a deeper look at the data.

From Cosmos-Hub 2 to Cosmos-Hub 3

Since our last analysis in May 2019, Cosmos Hub evolved to Cosmos Hub 3, one of the first major upgrades since the launch in March 2019.

This upgrade has shown the ability of the chain to synchronize between every validator and proved the efficiency of the on-chain governance system, despite certain complications at first.

Check this to see a full list of the improvements & features that the development team has implemented with Cosmos Hub 3.

This upgrade notably allowed the hub to increase the maximum number of validators from 100 to 125, adding further decentralization to the network.

Repartition of Validators in the Cosmos Network

Data is accurate as of 22 February 2020 and may vary in the future.

Great news! By looking at the stats, the hub is starting to become more decentralized compared to our previous research. Of course, a lot of improvement is still possible.

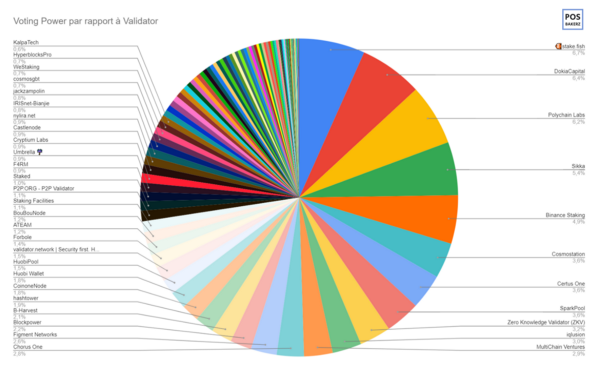

During our previous study, As you can see in this image from May 2019, the top 10 own 56.6% of voting powers. Moreover, the first 50 validators owned 96.2% of voting power while the others 50% only owned 3.8% of the network.

This time, on 22nd February 2020, the top 10 validators own 46.5% so approximately 10% less than 8 months ago, but the Top 50 still owns more than 90% of the voting power, as much as the other 75.

Let’s now have a better look at the different categories!

You can also directly check the full list of Cosmos Network validators and their websites.

Validator as a Core business

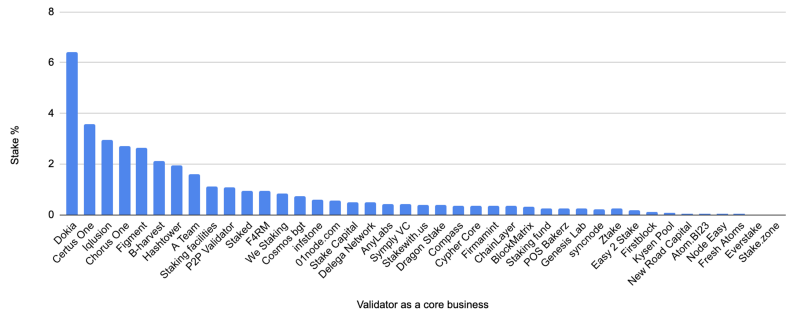

Validators as a Core Business are still the main category in this study. ~1/3 of the Cosmos Hub-3 is still validated by companies considering validation as their main activity.

This category is where most of the Cosmos hub staking providers operate for now, but more & more are starting to differentiate. Indeed through branding, marketing, staking derivatives products and/or fees, most Validators as a Core Business are in the process of building a different value proposition for their end-user.

An interesting point to look at in the future will be to compare inside this category how are doing validators who raised funds (Staked.us, Infstones, Figment, Stakewith.us…) vs those who are trying to bootstrap such as ourselves and/or others like Chorus One, Certus, Node.one, Ztake, Cypher Core…

With many operating as multi-protocol nodes operators, it will also be interesting to see how everyone will be doing on other upcoming protocols such as Ethereum 2.0 or Polkadot and the eventual influence this could have on the validator ranking!

Compared to our previous research of Cosmos-Hub 2, we can see that newcomers have joined the validation activity in Comos such as Bit Cat, Everstake, Node easy…

We also added Iqlusion to this category and removed them from the Tendermint validator set as Zaki recently left the Tendermint team.

Good point is that the disparity between all actors diminished even if Top 5 in this category own almost as much voting power as the rest of the other validators, we can see some small validator started to increase their voting power while some leading actor lost some in this 8 month period of time. This demonstrates a good hope for the future of the Cosmos Network decentralization.

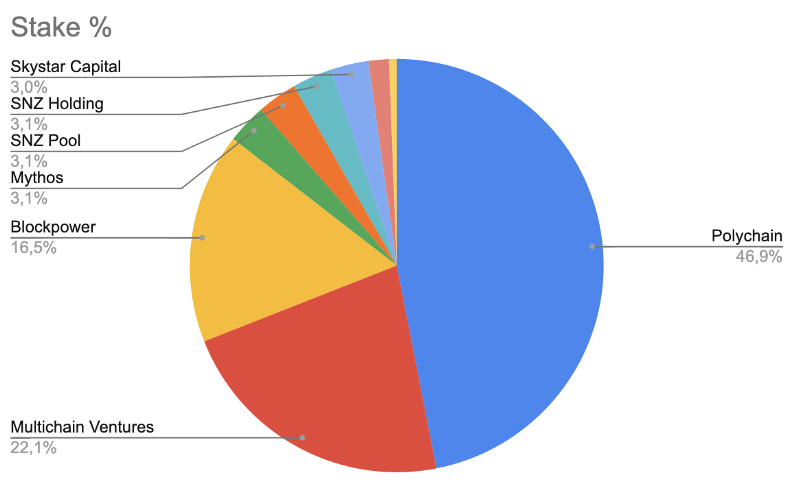

Validator from VC / Private funds

After Validator operating nodes as a core business, the 2nd biggest category in this study is Private Funds / VC that represents ~13% of the voting power in Cosmos.

The biggest difference between the other category is the number of actors. While there are 40 validators operating as node providers in this research, 9 operate a node, in addition, to have a VC or Private funds.

Polychain Capital isleading this category and is even in the Top 3 of the Cosmos validator hub.

Polychain represents almost 50% of the voting power from this category.

However, during this 8 month period, we have seen this category joined by some important & famous VC such as Multichain Ventures, Gf.network or Fenbushi.

Validator from Exchanges

Our 3rd category is not Tendermint employees but exchanges, which is a great sign of Atom adoption! Indeed in this 8 past month, exchanges are the category which has grown the most in size in the validator set from 4.2% to 13.4%. This is due to the recent interest of exchanges such as Binance or Coinbase who have announced & launched their staking services.

While this is a threat to the network centralization, it is also an opportunity for the staking industry to get more people earing and getting interested in this new method of earning fixed income in cryptocurrencies.

Many exchanges have joined the Staking industry by offering soft/liquid staking, forcing the industry to find ideas to compete with this.

As you can see from the chart above, Binance made a remarkable entry in the set of validators and is currently leading this category with more than 9 million ATOM at stake! Then it is followed by Huobi operating 2 nodes Huobi Pool & Huobi Wallet with respectively 1.44% and 1.85%.

Then you can find ZKV that we added in this category because the CEO is also the founder of DeversiFi (previously ETHfinex).

For now, Coinbase Custody is the last one of this category with only 10,000 at stake, but it would be interesting to check how Coinbase will grow in the next few months…

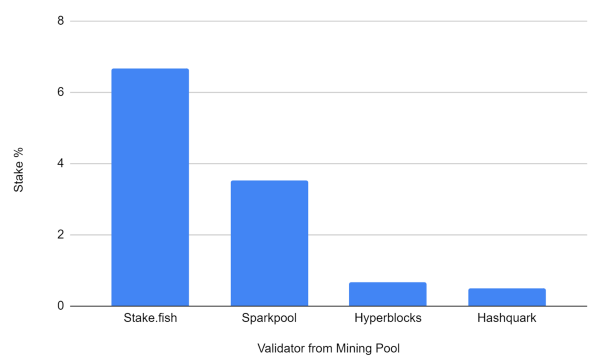

Validator from Mining Pool

This is one of the categories that hasn’t moved so much. While 8 months ago this category represented 13% of the voting power, it’s at 11.4% on the 22nd of February 2020.

With only 4 validators from mining pools, we can see that two (Stake.fish & Sparkpool) are clearly leading this category.

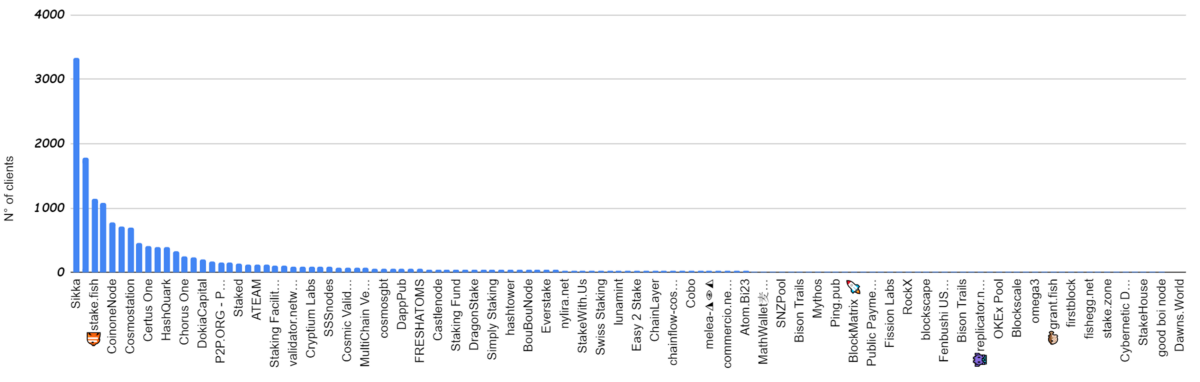

Once again this category is the one attracting the more delegates because excepted Sikka with 3,334 delegates, then validators with most clients are Sparkpool (1,780) & Stake fish (1,148).

By looking at the number of clients, we can clearly see a concentration of the voting power in validators charging low fees or 0 commission.

For example at POS Bakerz, while being ranked 66, we have 452 addresses that delegate their tokens to us thanks to our 0% fees and easy accessibility through the Trust Wallet interface.

⚠️ By looking at the number of delegated addresses in the hub, we can see a high concentration in a few numbers of nodes. Only 25 validators have more than 100 addresses delegated to them. Some validators have voting power and are part of the active set only thanks to a few customers or the Foundation.

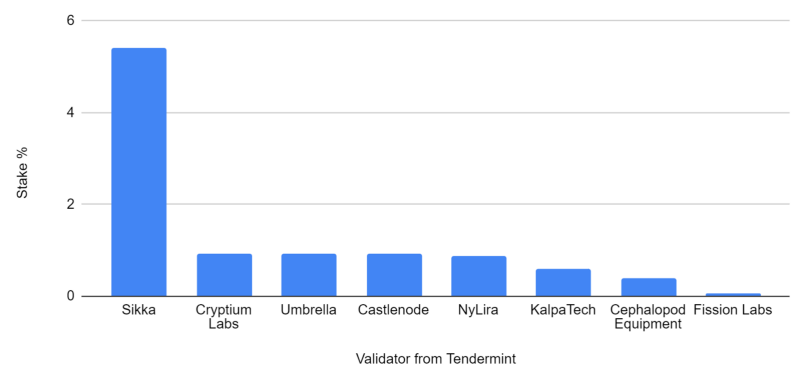

Validator from Tendermint team

In this category, Sikka is the validator who has the most voting power delegated to him.

By itself, Sikka has more than 3,000 delegates and represents more than 50% of the voting power delegated to Tendermint employees.

This is mostly the case due to the change of Iqlusion moving from the Validator as a core business category.

Another interesting point we can see in this category is that the Cryptium Labs, Umbrella, Castlenode & NyLira have almost the same voting power ~0,9%.

In this category, we have also seen Adriana KalpaTech | Tendermint join the Tendermint team.

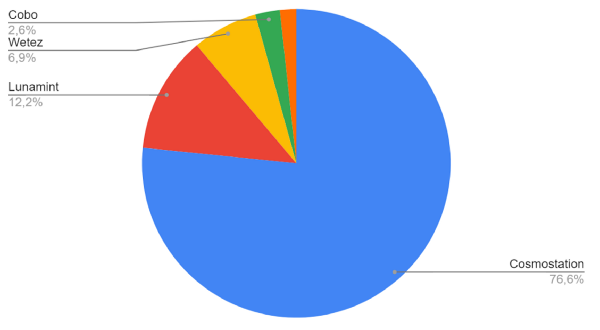

Validator from Wallet

Then the 6th category with 4.7% is validator from wallet. This category is still lead by Cosmostation that represents 75%+ of this category.

Cosmostation is a great Cosmos chain wallet & they’re also operating Mintscan.io block explorer!

Then it is followed by Lunamint as we decided to count Huobi Wallet as the same that Huobi Pool and added their data in the validator from exchanges category.

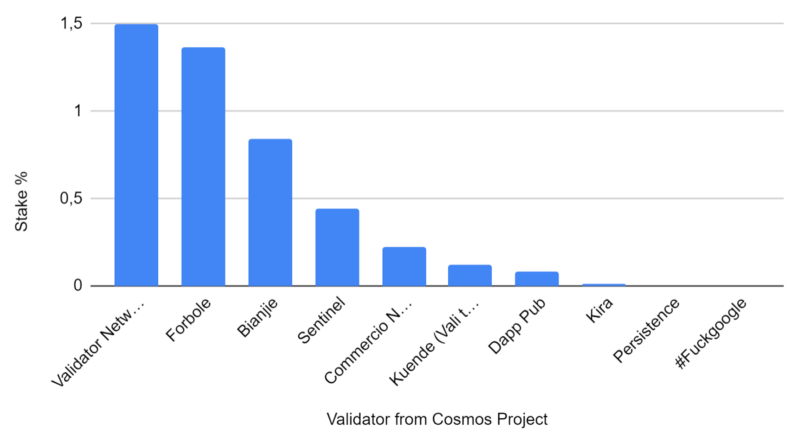

Validator from Cosmos Project

Then, we have validators from Cosmos Project such as Forbole, Validator Network (e-money), Bianjie (IRISnet), Commercio Network and/or Kira…

We can also notice the addition of new projects like Persistent an Enterprise Cosmos Hub or #Fuckgoogle (Cybercongress) a decentralized search engine built on top of the Cosmos SDK. For now, they don’t represent voting power but the Hub opening to 125 has been a great opportunity for more projects to launch their own validator.

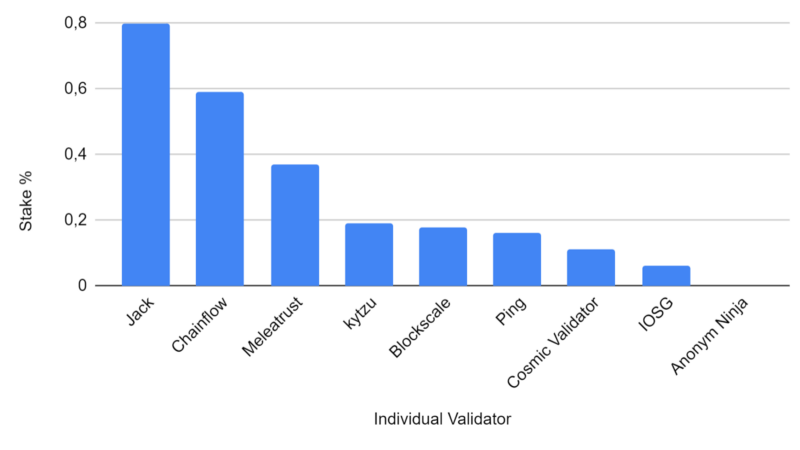

Individual validator

The opening of the validator set also allowed to attract more individuals to launch their validator and tried to join the active set.

In this category, you can also notice the addition of Jack Zampolin as he recently left Tendermint team.

In this category, none individual validator represents more than 1%, and you can also see a high concentration of their stake from All in Bit delegation that can be problematic for some in case of massive redelegation!

Other + Node providers

Finally, the two last categories are the validator we couldn’t include in a previous one such as Boubounode.

We also wanted to separate node providers such as Bison Trails & Blockdaemon. For now, as the time of writing Node providers only represent 0.59% compared to the entire set, but we believe it will become a leading node provider in Proof of Stake protocols.

To conclude, what we can remember of this comparison between the one 8 months ago, is the improvement of the hub decentralization even if not everything is perfect yet. The Top 10 validators represent now less than 50% voting power than 8 months ago, even if the 50 main validators still own more than 90%. Another concerning point is the rise of exchanges among top staking players, the centralization of clients to low fee validators and the high concentration of Foundation delegation to some clients.

If you have any questions about staking or Cosmos Network, feel free to ask us directly in our Telegram.

Links & Materials

- Whitepaper

- Previous Cosmos Validator study

- Official Intro to Cosmos

- Intro to the Cosmos Network by Sunny Aggarwal

- Understanding the value proposition of Cosmos by Gautier MARIN

- Tendermint BFT in a nutshell

- Tendermint.com / Tendermint

- Cosmos Wallet

DISCLAIMER: This is not financial advice. Staking and cryptocurrencies investment involves a high degree of risk and there is always the possibility of loss, including the loss of all staked digital assets. Additionally, delegators are at risk of slashing in case of security or liveness faults on BPoS protocols. We advise you to DYOR before choosing a validator.

Made with ❤️ by POS Bakerz