The blockchain world of 2025 is a paradox: a sprawling, theoretically interconnected system of decentralization that - in practice - remains significantly fractured, segmented, and disconcertingly disparate. As of this writing, some $68+ billion in cryptocurrency assets, known as Total Value Locked (TVL), have been deposited in decentralized finance (DeFi) protocols across numerous blockchains. Yet, these assets remain siloed across countless chains - Layer 1s, Layer 2s, appchains - each a somewhat isolated island in a sea of fragmented liquidity. Users face clunky bridges, developers wrestle with isolated ecosystems, and the promise of a seamless Web3 feels, at times, like a distant dream.

Enter Saga Protocol’s Liquidity Integration Layer (LIL). Launched February 27, 2025, Saga’s LIL represents a bold and intriguing effort to unify the larger blockchain ecosystem and stitch together the chains, tokens, and ecosystems within it into a seamless network capable of delivering on this technology’s true interconnected promise.

Let’s take a look at how…

What is Saga?

Saga Protocol, born in 2024, is a Layer 1 blockchain designed to streamline the creation of application-specific blockchains, known as "chainlets." Unlike general-purpose chains like Ethereum, it enables developers to launch tailored blockchains in minutes, secured by the Saga Mainnet’s validators through Cosmos’ Interchain Security (ICS) and an approach called Optimistic Coordination. From gaming and DeFi applications to AI marketplaces, Saga provides the infrastructure, leveraging modular technologies like Cosmos SDK, Tendermint, and Polygon Edge. Targeting the Web3 gaming, entertainment, and decentralized finance sectors, Saga’s rise to prominence has been marked by meaningful moves like launching its Saga Origins publishing arm, which have spurred a thriving ecosystem comprising numerous projects.

Saga’s Evolution and the Case for LIL

Saga’s early pitch was compelling: democratize blockchain creation, lean on shared security, and target high-growth niches like gaming and DeFi. Chainlets launch fast - one transaction, one minute - and come fortified by the Mainnet’s validator muscle, slashing the need for each chain to bootstrap its own security. It worked. Projects flocked, from Web3 multiverse games demanding near-perfect uptime to DeFi platforms craving high-volume, low-value transactions. But this success exposed a crucial bump in the road: liquidity.

As chainlets multiplied, so did silos. Assets minted on one chainlet couldn’t easily flow to another, or beyond Saga, without slow, costly bridges. Developers built vibrant apps, but users struggled to move funds seamlessly, echoing a broader multichain problem: fragmented liquidity impacting efficiency. Saga’s Mainnet 1.0 handled security, but scaling an ecosystem of hundreds of chainlets demanded more - a way to unify liquidity without breaking the bank or the user experience. Saga’s Liquidity Integration Layer was designed to provide exactly this. Its goal: to shift Saga from a chainlet factory to a liquidity powerhouse.

What is the Liquidity Integration Layer?

The Liquidity Integration Layer, or LIL, is Saga’s answer to the multichain liquidity problem. Launched with Mainnet 2.0 on February 27, 2025, it’s a system built to weave Saga’s chainlets—and external networks - into a single, fluid liquidity network. LIL automates asset flow, embedding bridges into every chainlet and routing value through a dedicated hub. It’s a pivot from Saga’s original gas-based economics to one tied to liquidity movement: validators profit from the flow of value, not per-transaction tolls. Backed by Uniswap V3 as its gasless DEX (a first for an appchain), LIL aims to make DeFi, gaming, and other applications as smooth as single-chain systems - without losing the multichain edge.

How Does It Work?

LIL isn’t magic; it’s a stack of technical pieces working in sync. Here’s the deep dive:

- Automatic Bridge Relayers: When a chainlet launches (still just one transaction), LIL embeds bridge logic into its validator set. Relayers - nodes facilitating cross-chain transfers - run natively, connecting chainlets to each other and external chains (e.g., Ethereum, Cosmos Hub) instantly. No third-party middleware, no delays.

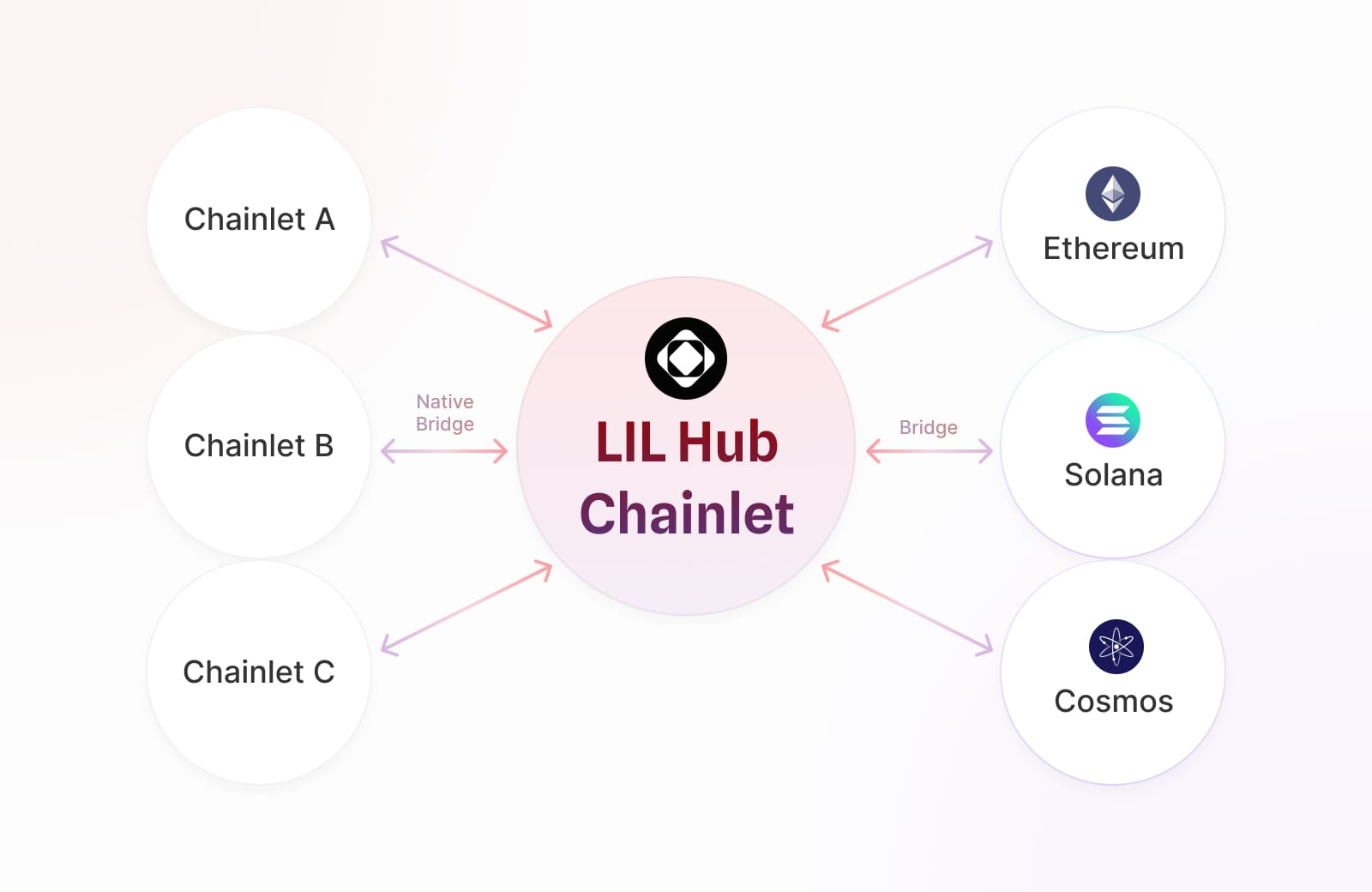

- LIL Hub Chainlet: A specialized chainlet acts as the network’s brain, using routing algorithms to optimize asset paths. Built on IBC (Inter-Blockchain Communication), it calculates real-time costs and latency, ensuring transfers take the least painful route—whether between two Saga chainlets or out to an EVM chain.

- Packet-Forwarding Middleware: Borrowing from IBC’s playbook, this automates multi-hop transactions. Swap a token on Chainlet A, send it to Chainlet B, then bridge it to Ethereum. LIL bundles it into one user action. It’s powered by “packet-forwarding” - a relay system that passes data and values securely across chains.

- Cross-Chain Execution Engine: Developers get a clear edge: smart contracts that span chainlets or EVM-compatible networks. Mint an NFT on one chainlet, list it on a marketplace on another, and settle payment on a third - all triggered by one call. It’s composability on steroids, leveraging Axelar’s secure messaging under the hood.

- Gasless Economics: Saga ditches gas fees by tying rewards to liquidity flow. Validators stake SAGA tokens and earn based on the volume they facilitate—think tolls on a value highway, not a per-car ticket. Uniswap V3’s integration as a gasless DEX seals the deal, using concentrated liquidity pools to cut user costs.

It’s a tight system: validators secure and relay, the hub routes, middleware simplifies, and economics incentivize flow over friction.

Key Features

LIL’s tech translates into tangible perks:

- Unified Liquidity Pools: Chainlets share a multichain liquidity backbone, amplified by integrations like Squid for cross-chain swaps. Pools span Saga and beyond, reducing fragmentation.

- Gasless Trading: Uniswap V3’s gasless debut on Saga leverages LIL’s fee-free model, letting users swap tokens without wallet-draining costs. Just days after launch, trading pairs like SAGA/USDC, ETH/USDC, and SAGA/ETH are live, with incentives for liquidity providers boosting participation. It’s concentrated liquidity meets zero-gas execution.

- Pre-Installed Interoperability: Every chainlet launches with LIL baked in—bridges, routing, execution, all ready. Developers focus on apps, not infrastructure plumbing.

- Ecosystem Synergy: Partners amplify LIL’s reach. Axelar ensures secure cross-chain messaging, Evmos adds EVM compatibility, Oku powers DeFi tooling, and Squid handles swaps. It’s a coalition play.

- Scalable Composability: Cross-chain contracts allow applications to operate seamlessly across multiple chains while harnessing the scale of a vast multichain network. This powers DeFi protocols and game economies that span dozens of chainlets with ease.

Potential Impact (Why LIL Matters)

LIL’s launch represents what could be a significant turning point for Saga, transforming it from a platform for spinning up chainlets into a solution for one of Web3’s most important challenges: fragmented liquidity. While only recently launched, LIL shows tremendous promise. Take DeFi - gasless Uniswap V3 and unified pools could ignite a surge in activity. Early adopters, including 20 beta projects like Metropolis (AI-driven trading) and Crazy Meme, are testing its limits. Small traders, fed up with Ethereum’s fees, might find Saga’s cost-free swaps irresistible, potentially driving volumes that rival more established chains.

Developers stand to gain just as much. Chainlets were always quick to launch, but LIL’s built-in liquidity could lure hundreds more builders from overcrowded Layer 1s or the tangled Cosmos ecosystem. With 300+ projects already in Saga’s orbit, this could be the spark that turns a steady hum into a roar. Gaming, too, benefits - Saga Origins envisions interoperable economies where assets flow effortlessly between chainlets, powering everything from multiverse games to virtual marketplaces. Even AI-driven projects like Metropolis suggest broader horizons, with chainlets as hubs for data markets or compute networks, all tied together by LIL’s liquidity backbone.

Web3’s multichain reality is a double-edged sword. Fragmentation - those billions in siloed assets - stifles adoption. Users balk at clunky UX, and developers hit walls scaling on isolated chains. LIL, backed by Uniswap V3 and a coalition of partners like Axelar and Squid, positions Saga to break that deadlock. It’s no longer just about easy chainlet creation; it’s about a fluid, interconnected Web3. Challenges remain, but with billions staked in its ecosystem, Saga has the momentum to turn vision into reality.

Final Thoughts

Saga’s journey - from a 2024 chainlet factory to a 2025 liquidity pioneer - mirrors Web3’s own evolution: bold ideas meeting inconvenient realities. LIL is a swing at a big and important problem, blending technical grit with a vision of frictionless value flow. Whether it’s DeFi’s next wave, gaming’s backbone, or an unexpected killer app, its potential to help unify Web3’s fragmented landscape is real - built on execution, scale, and a growing ecosystem. For now, it’s an intriguing step forward, and one we’re excited to watch unfold.

DISCLAIMER: This is not financial advice. Staking and cryptocurrency investment involve a certain degree of risk, and there is always the possibility of loss, including the loss of all staked digital assets. Additionally, delegators are at risk of slashing in case of security or liveness faults on some PoS protocols. We advise you to DYOR before choosing a validator.