The blockchain landscape of 2024 is complex, fragmented, and evolving rapidly. As this game-changing technology continues its relentless progression toward maturity and (eventually) mass adoption, the race to optimize its utility and functionality is heating up.

The needs of the builders, brands, and developers working to realize their creative visions in the blockchain space are shifting by the day. Emerging and evolving applications for blockchain tech have put increased strain on existing ecosystems, and are driving an industry-wide arms race to provide the fastest, smoothest, and most efficient blockchain experience possible. From this hotbed of experimentation, Celestia has emerged as a pioneering force, introducing novel concepts that promise to reshape our understanding of scalability, interoperability, and asset management.

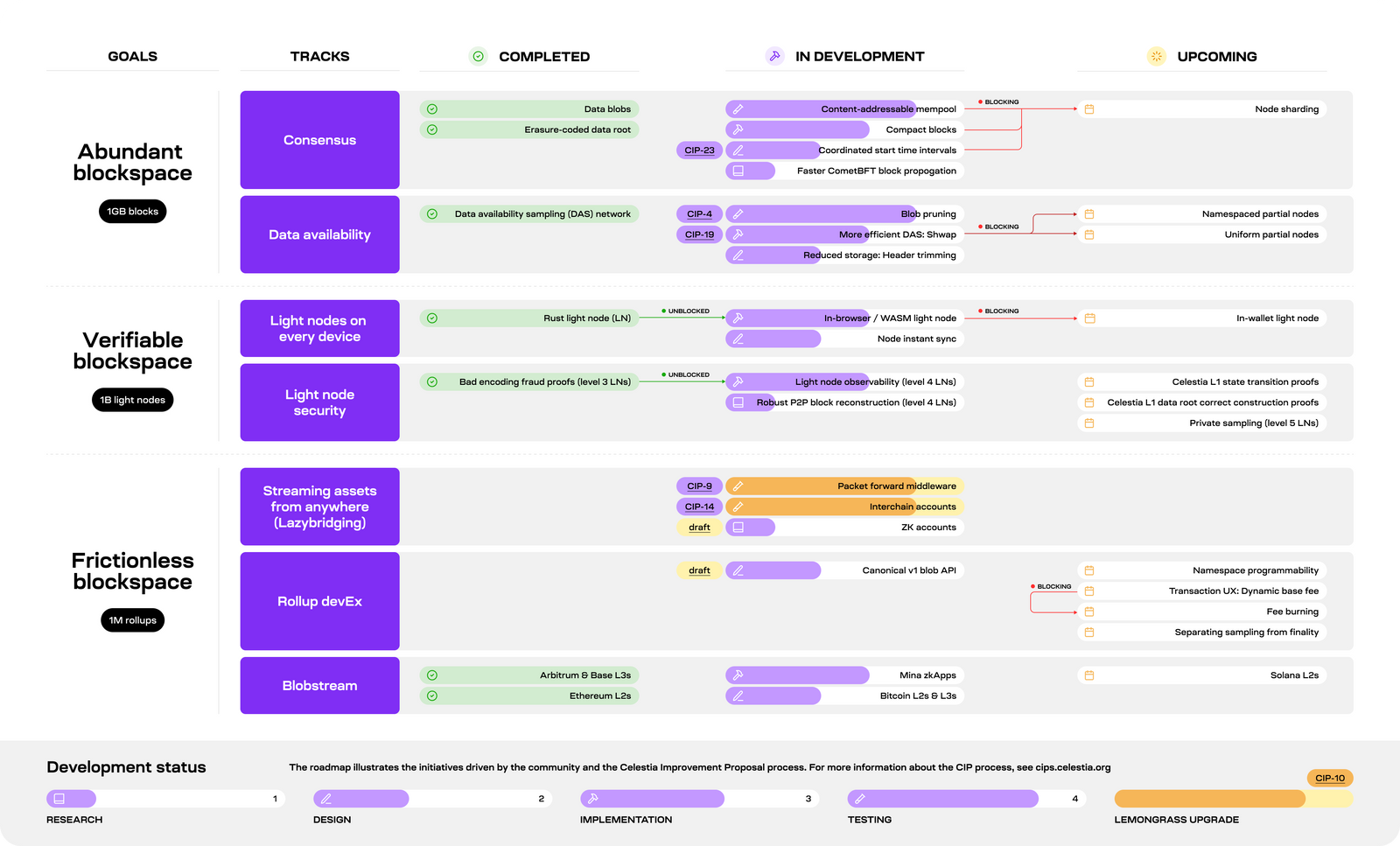

Off the back of Celestia’s first major mainnet upgrade - dubbed “Lemongrass”, which was implemented in September of 2024, the Celestia ecosystem has made great strides toward providing seamless asset streaming across blockchain ecosystems.

Now, with the advent of a new approach to handling cross-chain interactions called “Lazybridging”, the Celestia team is hopeful that the friction historically caused by cross-chain interactions can be eliminated completely.

Let’s take a look at how…

Celestia: Blockchain Goes Modular

Unlike traditional monolithic blockchains that handle all aspects of decentralized applications (dApps) - from consensus to execution to data availability - Celestia introduces a “modular” approach. At its core, Celestia is a minimal blockchain that focuses solely on ordering transactions and ensuring data availability.

This modular design separates concerns, allowing for increased scalability and flexibility. By offloading execution to layer-2 solutions or rollups, Celestia can achieve high throughput without sacrificing decentralization or security. This approach addresses the infamous blockchain trilemma - the challenge of achieving scalability, security, and decentralization simultaneously.

Celestia's primary innovation lies in its data availability sampling mechanism. This allows light clients to verify that all transaction data is available without downloading the entire blockchain, significantly reducing the resources required to participate in the network. This approach makes Celestia an ideal base layer for various scaling solutions, including optimistic rollups, ZK-rollups, and validiums.

Asset Streaming, and Why It Matters

Asset streaming represents a paradigm shift in how we think about transferring value in the digital realm. Unlike traditional transactions that occur in discrete amounts at specific times, asset streaming allows for the continuous, real-time transfer of digital assets or tokens from one party to another.

In an asset streaming model, value flows in a fluid, ongoing manner, often on a per-second basis. This granular approach to value transfer opens up a world of possibilities, including real-time payments, dynamic pricing models, programmable money flows, and micro-transactions at scale.

The importance of asset streaming lies in its potential to revolutionize how we interact with money and value. It could lead to more equitable compensation models, more efficient use of resources, and entirely new business models that weren't possible with traditional, discrete transactions.

The Lemongrass Upgrade: Enhancing Interoperability and Efficiency

Celestia’s Lemongrass upgrade, implemented in September 2024, marked a significant milestone in Celestia's evolution. It introduced several critical improvements to the network's functionality and interoperability.

Key features of the Lemongrass upgrade include:

- Interchain Accounts (ICA): This feature allows accounts on Celestia to be controlled by other blockchain networks via the Inter-Blockchain Communication (IBC) protocol. ICA enhances interoperability within the Celestia ecosystem and beyond, enabling more complex cross-chain interactions.

- Packet Forward Middleware (PFM): PFM optimizes IBC transfers by enabling multi-hop routing of data packets. This reduces latency and overhead in cross-chain communications, making interoperability more efficient and user-friendly.

- Coordinated Upgrades: A new signaling mechanism for network upgrades was introduced, allowing validators to signal readiness for hard forks. This streamlines the upgrade process, ensuring smoother transitions for future network improvements.

- Price Enforcement: The upgrade implemented a minimum gas price mechanism to mitigate spam transactions and ensure network efficiency.

- Blobstream Module Deprecation: The Blobstream module was disabled in favor of more advanced zk-light client solutions, simplifying the network architecture and improving performance.

These enhancements collectively position Celestia as a more robust and interoperable blockchain infrastructure, setting the stage for advanced cross-chain applications and asset management strategies.

Lazybridging: A Novel Approach to Cross-Chain Asset Transfers

Building on the foundation laid by the Lemongrass upgrade, Celestia has developed “Lazybridging” - a novel approach to cross-chain asset transfers that leverages the power of Zero-Knowledge (ZK) proofs and Celestia's unique architecture.

While the Lemongrass upgrade didn't directly implement Lazybridging, it provided crucial enhancements that set the stage for this innovative technology. The introduction of Interchain Accounts improved Celestia's overall interoperability, creating a more conducive environment for cross-chain operations. The Packet Forward Middleware optimized IBC transfers, essential for efficient cross-chain communication in Lazybridging. Additionally, the price enforcement mechanism and the move towards more advanced zk-light client solutions align well with Lazybridging's approach to efficient, ZK-proof based cross-chain transfers.

Lazybridging is fundamentally a ZK account application designed to work within Celestia's data availability-focused framework. Unlike traditional smart contract platforms, Celestia doesn't execute transactions, but instead verifies proofs. This approach offers several advantages:

- Efficiency: By focusing on verification rather than execution, Celestia can process cross-chain transfers more efficiently, reducing computational overhead.

- Flexibility: Lazybridging allows for complex off-chain logic to be implemented without requiring changes to Celestia's base layer.

- Security: The use of ZK proofs ensures that only valid state transitions are accepted, enhancing the security of cross-chain transfers.

- Scalability: By offloading execution to layer-2 solutions, Lazybridging can handle a high volume of cross-chain transfers without congesting the base layer.

Here’s a step-by-step guide to how Lazybridging works:

- A user initiates a cross-chain transfer (e.g., moving tokens from Solana to Celestia).

- The transaction is processed off-chain, generating a ZK proof that verifies the validity of the transfer.

- This proof is submitted to Celestia, where it is verified without executing the underlying logic.

- Upon successful verification, the corresponding ZK account on Celestia updates its state and completes the transfer.

This mechanism allows for seamless asset streaming across different blockchain ecosystems without requiring complex smart contract executions on the base layer.

Implications for Asset Streaming

The combination of Celestia's modular architecture, the Lemongrass upgrade, and Lazybridging technology opens up new possibilities for asset streaming in the blockchain space:

- Continuous Cross-Chain Liquidity: Lazybridging enables the creation of continuous liquidity streams across different blockchains. This could revolutionize cross-chain DeFi applications, allowing for more efficient market-making and yield farming strategies.

- Micropayments and Subscriptions: The efficiency of Lazybridging makes it feasible to stream tiny amounts of assets continuously. This could enable new business models based on real-time, cross-chain micropayments or subscription services.

- Interoperable NFTs: With Lazybridging, non-fungible tokens (NFTs) could be seamlessly transferred across different blockchain ecosystems, opening up new possibilities for cross-chain gaming and digital asset marketplaces.

- Cross-Chain Governance: The ability to stream governance tokens across chains could enable more inclusive and diverse DAO structures, allowing for truly cross-chain governance mechanisms.

- Efficient Cross-Chain Oracles: Lazybridging could facilitate the creation of more efficient cross-chain oracle systems, enabling real-time data streaming across different blockchain networks.

Challenges and Future Developments

While Celestia's Lazybridging presents exciting possibilities for asset streaming, several challenges remain:

- Adoption: The success of Lazybridging depends on widespread adoption by other blockchain networks and DeFi protocols.

- Regulatory Compliance: As cross-chain asset streaming becomes more seamless, ensuring compliance with varying regulatory frameworks across different jurisdictions may become more complex.

- User Experience: Simplifying the user experience for cross-chain interactions remains a crucial challenge for mainstream adoption.

- Scalability: As the volume of cross-chain transfers increases, ensuring that Celestia can handle the load efficiently will be crucial.

Looking ahead, we can expect further developments in Celestia's ecosystem. The development of more sophisticated ZK-rollup solutions built on Celestia could further enhance the efficiency and capabilities of Lazybridging, pushing the boundaries of what's possible in cross-chain interactions. We may also witness the emergence of truly cross-chain decentralized applications that leverage Celestia's infrastructure for seamless asset transfers across multiple blockchains, opening up new possibilities for decentralized finance and digital asset management. As the technology matures, increased integration between blockchain-based systems and traditional financial infrastructure seems likely, potentially bridging the gap between these two worlds and bringing blockchain technology closer to mainstream adoption.

Final Thoughts

Celestia's innovative approach to blockchain architecture, coupled with the Lemongrass upgrade and Lazybridging technology, represents a significant leap forward in the quest for truly interoperable and efficient blockchain ecosystems. By enabling seamless asset streaming across different networks, Celestia is paving the way for a new era of decentralized finance and digital asset management.

As Celestia’s technology continues to evolve and mature, we can expect to see increasingly sophisticated applications that leverage its infrastructure to create novel financial instruments, business models, and applications. The future of blockchain interoperability is bright, and Celestia is at the forefront of this exciting revolution.

About Stakin

Stakin is an infrastructure operator for Proof-of-Stake (PoS) blockchains offering secure, reliable, and non-custodial staking services. The company enables cryptocurrency holders to earn interest on their assets and take part in decentralized governance while remaining in possession of their own cryptocurrencies.

Stakin serves institutional crypto players, foundations, custodians, exchanges as well as a large community of individual token holders. Driven by demand from institutional customers and the community, Stakin provides services for a wide range of networks including leading ecosystems such as Ethereum, Cosmos, Solana, Near, Polygon, Polkadot, Aptos, Sui, and more.

For more information about Stakin, visit the Website, Twitter, Blog, or join the Telegram community.

DISCLAIMER: This is not financial advice. Staking, delegation, and cryptocurrencies involve a high degree of risk, and there is always the possibility of loss, including the failure of all staked digital assets. Additionally, delegators are at risk of slashing in case of security or liveness faults on some protocols. We advise you to do your due diligence before choosing a validator.