Solana is an open-source blockchain platform launched in March 2020, boasting fast and affordable blockchain transactions. Solana reportedly can handle 65,000 transactions per second (TPS), with an average cost per transaction of $0.00025, making it one of the most scalable blockchain platforms.

Stakin has been a part of the Solana journey from its earliest days. We have been a Solana testnet participant since the early Solana testnets with TDS Stage 1 in February 2020. Stakin is also a trusted partner of the Solana Foundation as part of the Foundation’s delegation program and partners with leading liquid staking protocols such as Marinade and JITO.

You may also be interested in:

After experiencing a severe downturn during the FTX and Alamada bankruptcy in 2022, Solana again competes as the 3rd largest digital asset in market cap. Solana's high throughput and large block size comes at the expense of a massive blockchain size - the Solana blockchain is over 150 terabytes. As a result, Solana nodes cannot provide full history back to Genesis but are pruned after two epochs (approximately 4 days).

The Solana community has been actively working on addressing the two overarching challenges with the Solana blockchain: network outages and decentralization. The Solana community has recently approved a governance proposal to activate so-called Timely Vote Credits (TVC) — a mechanism that could solve the delays in the validator voting system, which would lead to lesser congestion on the network and faster transaction speed, which matters as the network registered performance issues over the past two years.

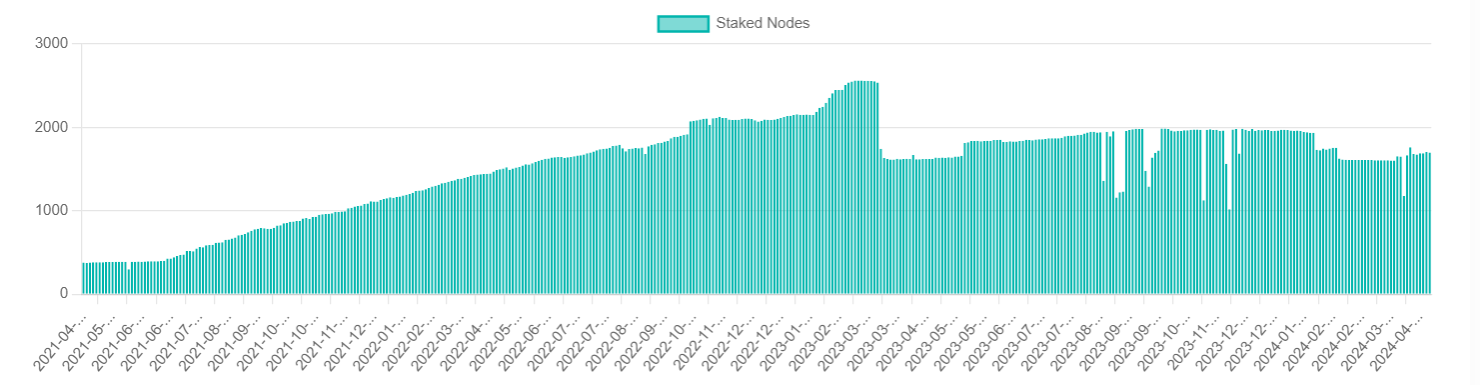

There are notable improvements towards further decentralization of the Solana blockchain. To begin with, the number of Solana validators is increasing (with a notable drop in March 2023 due to a large amount of stake that was redelegated away from nodes that were charging 100% commission, as per a Solana Validator Health Report from October 2023), as the chart below shows:

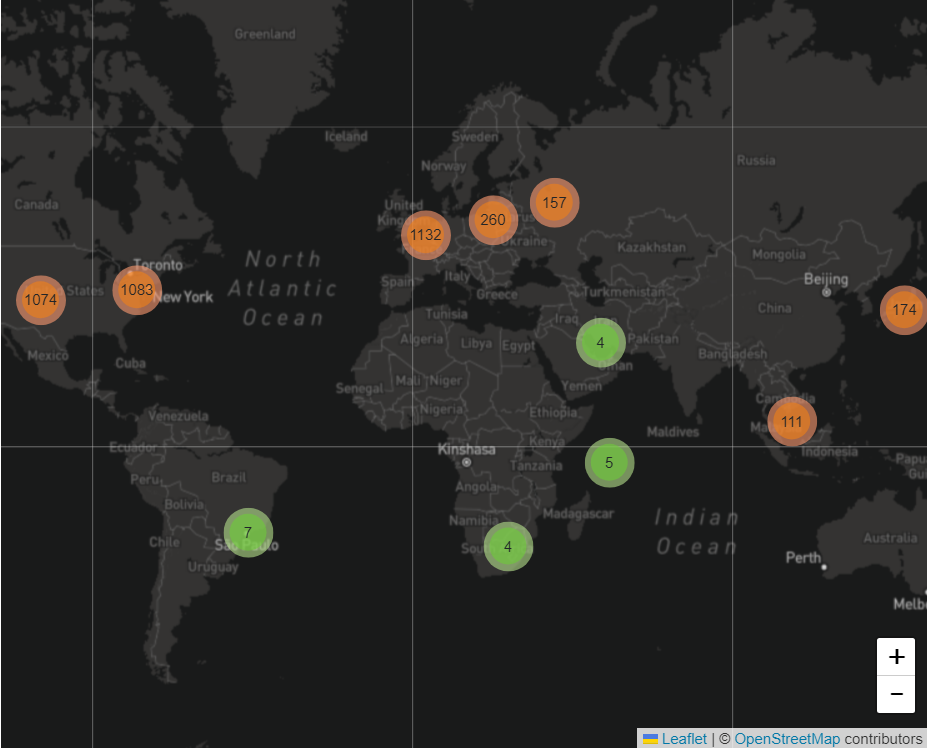

As per Solana Compass, Solana counts over 4,021 nodes spread between 45 countries, 230 cities, and 544 data centers (as of March 11). Solana’s validators are still concentrated in just two regions - The US and Germany; however, this is a fact of the matter with other blockchains as well - For example, Avalanche, another blockchain network with over 1,000 validators, has over 75% of its validators located in the US and Germany. To further decentralize the network, the Foundation’s tokens are staked to smaller validators outside the super minority set.

Despite these challenges, Solana is once again one of the most active blockchain networks, with hundreds of successful blockchain applications and products on top of it.

In the following sections, we will explore some thriving verticals within the Solana ecosystem. More specifically, we will cover the hottest projects and developments on Solana across Web3 gaming, DeFi, payment infrastructure, liquid staking, and DePin (Decentralized Physical Infrastructure).

Web3 Gaming on Solana

Solana is purpose-built for games, with its 400ms block time and lightning-fast confirmations. Game developers can build their games in Javascript and Canvas, Flutter, or use one of the Solana Game SDKs for the two biggest game engines - UnitySDK and UnrealSDK.

Not surprisingly, the Web3 gaming segment on Solana has been emerging with surprising and renewed vigor. For example, Stepn, the leading Play-to-earn dApp on Solana, has recently announced a $30 million airdrop campaign, with FSL (the product development studio behind Stepn) distributing 100 million airdrop points to Stepn players over a weeklong event this April.

Solana’s Hunger Games (modeled after the popular book and movie series The Hunger Games) has been the latest buzz taking over Crypto Twitter, where players take on the role of a "Hunter" and explore cities in search of AR "GBoxes" filled with tokens. The more G a Hunter collects, the higher they rank on the in-game leaderboard displayed on the GG. zip website.

Payments infrastructure on Solana

A recent AllianceBernstein research report revealed that Solana has become the most popular network for stablecoin transfers, especially for cross-border payments.

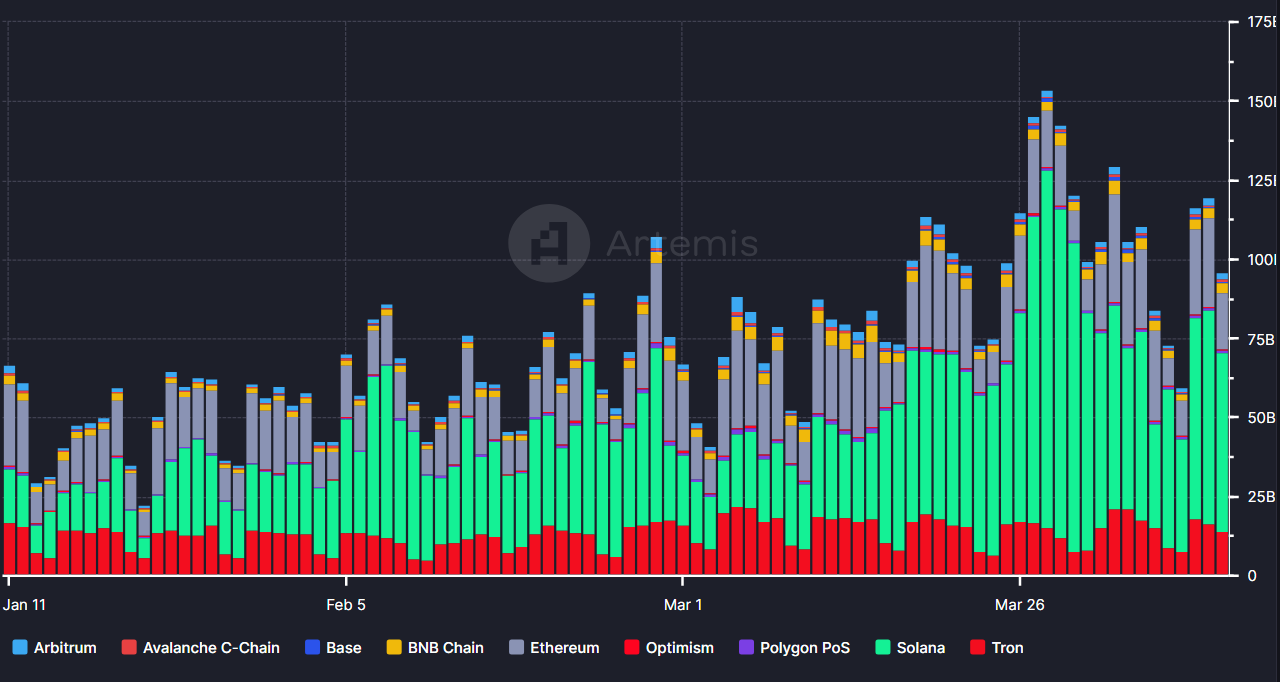

Solana processed roughly $1.4 trillion in stablecoin transfers in March. As per an Artemis report, Solana has captured a dominant 43% market share in the value of stablecoins transferred, significantly outpacing Ethereum.

Last September, Visa announced it was expanding its stablecoin settlement capabilities to Solana and working with merchant acquirers Worldpay and Nuvei.

This has triggered a flurry of Solana-based infrastructure companies and applications. For example, in January, Espresso Cash launched its global money transfer app for users in the USA, Europe, and Nigeria. In February 2024, Sphere Labs, which now lets users send payments via a link, announced a $2.8 million fundraising event.

DeFi on Solana

Solana is currently the 4th largest DeFi ecosystem, with around $4.9 billion TVL. Lending and yield protocol Kamino emerged as the largest DeFi protocol on Solana, with over 1.05 billion in TVL as of today. Since its launch on Solana in January 2021, USDC has been the ecosystem’s most dominant stablecoin, with a current supply of $2.5 billion.

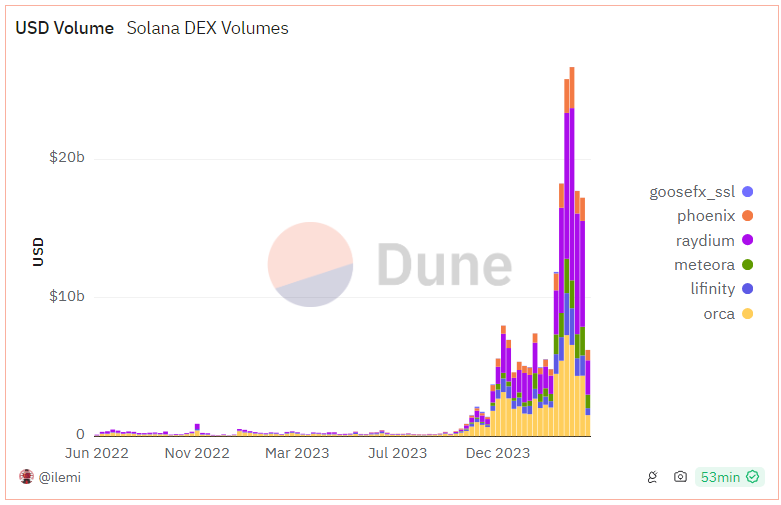

Dex volume on Solana continues to grow, with memecoin trading largely accountable for the recent boom. On March 18, DEX volume on Solana marked $26.7 billion. The top DEXs on Solana are Orca, Phoenix, Radium, Lifinity and Saber. In addition, Jupiter stands out as the key liquidity aggregator for Solana, offering the widest range of tokens and the best route discovery between any token pair.

Liquid Staking on Solana

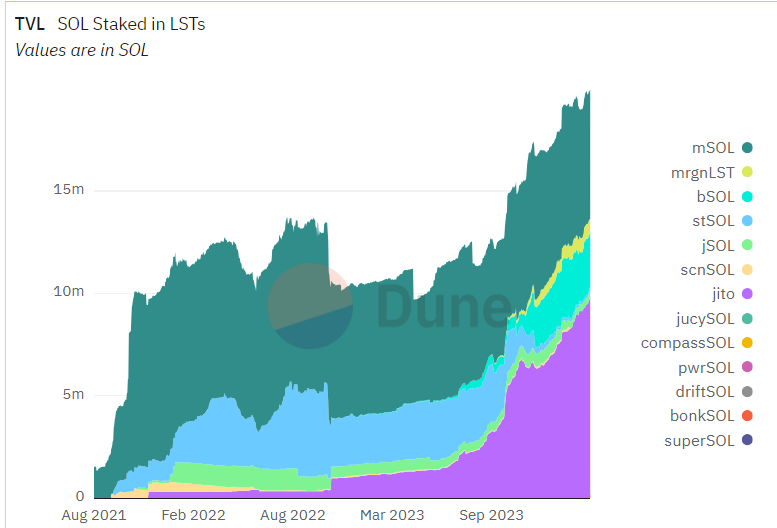

Traditional staking requires stakers to lock up their SOL directly with a validator. Their staked tokens are not readily available for trading, spending, or transferring.

In comparison, liquid staking addresses this liquidity issue by allowing staked assets to be reused in various ways while still participating in the staking process.

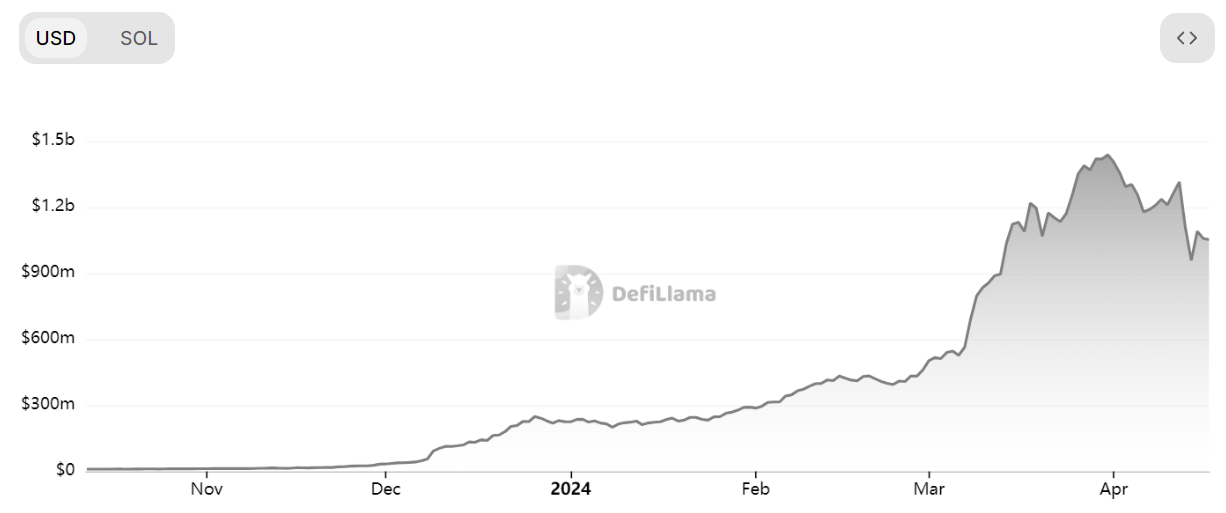

Around 63% of the current SOL supply is currently staked with liquid staking protocol Jito leading the pack. Jito’s TVL has grown to 9.4 million SOL, surpassing Marinade Finance as the top liquid staking protocol by TVL. Marinade was Solana’s first-ever native liquid staking solution, offering both liquid staking and native staking.

Other notable liquid staking protocols on Solana are Blaze and MarginFi. Another worthwhile liquid staking protocol that has recently been launched is Sanctum Infinity. The Sanctum Infinity Pool is a multi-LST liquidity pool with twenty-two liquid staking tokens, and it prices LSTs based on their “floor price” relative to SOL.

DePin on Solana

Solana is becoming a hub for DePIN applications, hosting Helium, Hivemapper, Render, Teleport, and GenesysGo, to name a few.

Solana works well for DePIN (Decentralized Physical Infrastructure Network) projects due to its low transaction cost, high throughput speed, and scalability.

The Helium Network is the leading DePin project on Solana which allows for the creation and maintenance of a distributed wireless network by incentivizing participants to contribute resources and share the benefits.

In January, Nova Labs announced a partnership with telecommunications company Telefonica to launch Helium Mobile Hotspots in Mexico and integrate them into Telefonica’s network.

Other noteworthy DePin projects on Solana include:

- Hivemapper, a decentralized physical infrastructure network that uses dashcams and AI to collect the world’s freshest map data for developers and enterprise customers

- APhone, the first decentralized cloud-based smartphone, which provides heightened security, privacy, and user protection.

Conclusion

Solana has had a thriving 2023, which has continued into 2024.

Projects building primarily on Solana raised almost $90 million in Q1 of 2024, more than the total amount raised throughout 2023. Most of these projects originate from the Solana Foundation hackathons, which recently announced the formation of Colosseum - An accelerator with a venture capital arm similar to Y Combinator.

Colosseum, alongside Anza (a developer shop kickstarted by former executives and core engineers from Solana Labs), marks a shift towards further decentralizing Solana’s social layer. This, combined with the wider geographical distribution of Solana validators nodes, signifies that Solana remains committed to further decentralization.