NEAR Protocol, also referred to as NEAR, is a decentralized application platform designed to facilitate the open web of the future and power its economy. The NEAR Protocol, launched in 2020, stands as a third-generation blockchain based on PoS that processes 1,000 transactions per second while running much more efficiently than PoW chains. The envisioned web of the future for NEAR has everything from new currencies to new applications and even wholly new industries. On the NEAR platform, developers can host serverless applications and smart contracts with easy access to open finance networks and benefit from an entire ecosystem of open web components.

On NEAR, we have some characteristics that determine the inevitable success of the whole protocol:

- A Carbon-Neutral Blockchain - Did you know that NEAR consumes in a year the same energy bitcoin consumes in 3 minutes? The network is certified carbon-neutral. In February 2021, NEAR Protocol engaged South Pole to assess NEAR’s carbon footprint, reduce it where possible and fully compensate the remaining exhaust with CO2 offsetting projects going forward. South pole considered the NEAR Foundation’s carbon footprint, the Core Collective (all employees and contractors working on the NEAR Protocol), and all validators in the assessment. The NEAR Protocol currently generates a carbon footprint of 174 tons of CO2 per year. Therefore, NEAR Protocol is more than 200,000 times more carbon efficient than Bitcoin, mainly by applying PoS instead of PoW.

- Human-Readable Accounts, Fast & Simple - On NEAR transactions are incredibly fast (~1s transactions). To be more user-friendly and approachable, NEAR account IDs are human-readable instead of public key hashes. In NEAR, users can register named accounts (e.g., stakin.near), which are simpler to use and remember. Moreover, named accounts can create sub-accounts of themselves, helping to organize related accounts better.

- Exclusive Grants Program - NEAR offers project funding through Grants Program. Using this unique opportunity, 800+ projects are already funded and $45M+ awarded. The Grants Committee goes through 4 internal rounds of approvals. Applicants move through the evaluation stages: Initial Screen; Technical Review; Interview; Committee Review, and Decision. Projects are selected openly and transparently. Such an approach helps the NEAR Protocol to grow its community, attract young developers, and contribute to Web3 development.

- Stake & Earn - Due to the reason that the NEAR protocol is a decentralized and community-operated ecosystem, this means that multiple actors collaborate to keep it safe. Such actors are called Validators and Delegators. Validators are the leading participants who ensure the production of blocks and the security of the network. Delegators are those who stake their tokens and contribute to the advancement of the network with validators. Through staking both parties are rewarded. Validators get rewards for their service at the end of every epoch. Delegators also receive rewards at the end of every epoch minus the fees paid to the Validator. Rewards are compounded at the end of each epoch (~12h), so there is no need to claim. On top of that, unlike many other tokens, Delegators can stake any amount of NEAR tokens because there is no minimum amount to stake.

The NEAR Protocol is based on the same underlying technology as Bitcoin and combines it with advances in community consensus, database sharding, and usability. NEAR Protocol prides itself on being built from the ground up to be the most accessible network in the world for developers and end-users while ensuring scalability and security to serve those same users. Three concepts make this possible: building decentralized applications, onboarding users with excellent experience, and scaling applications. By doing so, NEAR is the first-ever community-based network to extend the reach of Open Finance and power the future of the Open Web.

Overview of The Computing Platform for the Open Web

So, what is this Open Web that NEAR keeps referring to? Technological advances and specific system design decisions have taken blockchain’s functionality through three generations of development. These are Open Money (everyone has access to digital money), Open Finance (apply programmability to the multiple capabilities of Open Money), and Open Web. The Open Web isn’t so different from Open Finance; instead, it is more of an addition.

Open Web use cases need additional performance improvements and the capability to reach a new group of potential users. There are vital requirements for a platform to drive the Open Web, which are:

- Improved volume, speed, and lower-cost transactions - Since the blockchain is no longer just handling slow-moving asset management decisions, it needs to be able to scale to support other data types and use cases.

- Usability - Open Web use cases will cross into consumer applications; the different components and apps must allow for an end-user experience that consumers are used to while preserving user-ownership of their data.

These two requirements are highly complicated, so no platform has been able to achieve them until NEAR.

Thresholded Proof-of-Stake

Currently, there are a few well-known consensus mechanisms to keep a blockchain working correctly and resistant to attacks. The NEAR Protocol functions on a Proof-of-Stake election mechanism called Thresholded Proof-of-Stake (TPoS). In this system, the idea is that a predetermined way to create a large number of participants maintaining the network will increase decentralization and security and create a fair reward distribution system. The NEAR Protocol wants to have a large pool of participants (called witnesses) to make decisions during a specific time (set to 1 day). Every interval splits into block slots, which are 1440 slots per minute. The number of witnesses is set at 1024 per block. According to these default settings, there will be 1,474,560 witness seats. Each of these seats is defined by the stake of all participants, indicating their interest in signing blocks.

If you want to participate in network maintenance, you can submit a particular transaction that indicates how much money you’d like to stake. When the transaction is accepted, the specified amount of assets are locked for a minimum of three days. Every 24 hours, witness proposals are gathered with all the participants who signed blocks during that day. The cost for an individual seat gets identified, and several seats for everybody who has staked at least the cost amount are allocated.

NEAR Protocol uses inflationary block rewards and transaction fees to incentivize witnesses to participate in signing blocks. The inflation rate is defined as the percentage of the total number of digital assets. A portion of their assets is locked up whenever someone signs up to be a witness. The stake of each witness is unlocked a day after the witness stops participating in the block signature. What are the advantages of TPoS?

First, in a TPoS network with witnesses, as NEAR has created, there will be less forking. Forks are possible when there is a severe network split with less than one-third of adversaries. However, in NEAR, the minority of the network participants will see blocks with less than half of the signatures and will have quick and unmistakable evidence that the network might be split. Secondly, there is no need to pool stake or computational resources because the reward is directly proportional to the stake. And lastly, the security is higher. This is because an attack is hard to conduct because you would need the private keys from witnesses that hold two-thirds of the total stake amount over the two days in the past.

Nightshade

NEAR Protocol has implemented something called Nightshade Sharding for their Proof-of-Stake consensus mechanism. If you’re unfamiliar with sharding, check the video below to get a basic understanding.

While the original sharding model with shard chains and a beacon chain has proven to be very useful, it does have inevitable hiccups. For example, the fork choice rule needs to be executed separately in each chain, and the fork choice rule in the shard and the beacon chains must be built differently and tested independently.

With Nightshade, the system is modeled as a single blockchain in which each block contains all the transactions for all shards and changes the whole state. It is, however, not necessary for participants to download the full state or logical block. Instead, each network participant only maintains the state corresponding to the shards they validate transactions for. The list of all the transactions in the block is separated into solid chunks, one chunk per shard. Ideally, each block contains one chunk per shard per block; however, in practice, each block contains around zero or one chunk per shard.

The Native NEAR Asset

The NEAR platform is designed to efficiently store different digital assets, like tokens bridged from other chains or created on top of the NEAR Platform. Stablecoins are found to be particularly useful for transacting on the network. Thirdly, unique digital assets, also referred to as Non Fungible Tokens (NFTs), ranging from in-game collectibles to representations of real-world asset ownership, can be stored and moved using the platform.

Besides all these different options, the platform also has a fundamental native asset for the NEAR ecosystem. The NEAR token, as it is called, is similar to Ether and can be used to pay, run validation nodes, to stake, and for governance processes.

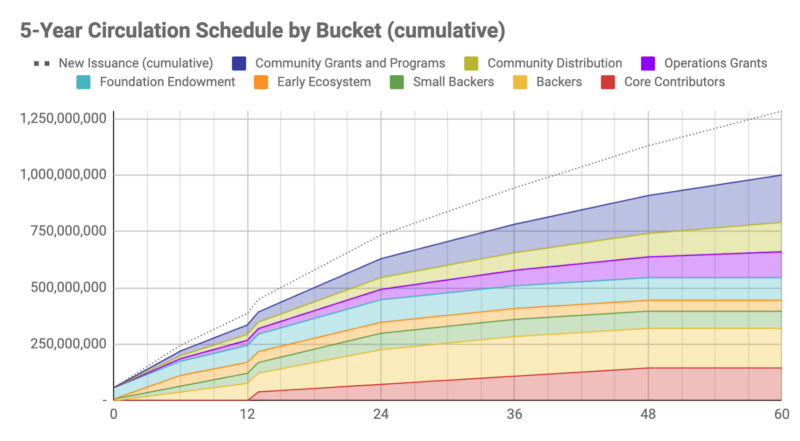

NEAR announced that 1,000,000,000 NEAR tokens were created at Genesis on April 22, 2020. However, as shown in the image below, the NEAR token supply is expected to grow over the next five years. For an in-depth explanation of the supply circulation, check here.

Thanks to excellent developer experience, technical improvements, and one of the most significant community connections, NEAR Protocol has become a blockchain for everyone.

More Information & Sources

- NEAR Protocol Official Whitepaper

- Stakin Twitter

- Stakin Reddit

- NEAR Github

- NEAR Twitter

- NEAR Protocol Official Website

- Stakin Official Website

DISCLAIMER: This is not financial advice. Staking, delegation, and cryptocurrencies involve a high degree of risk, and there is always the possibility of loss, including the loss of all staked digital assets. Additionally, delegators are at risk of slashing in case of security or liveness faults on some protocols. We advise you to do your due diligence before choosing a validator.