A closer look at Chainlink’s Cross-Chain Interoperability Protocol (CCIP) and how it’s a critical component in enabling on-chain capital markets.

For those of us who have been in the crypto space for some time now, the term asset tokenization is likely familiar. We’ve seen many early examples take place on blockchains like Tezos in the form of security token offerings (STOs). While the concept was quite new at the time and experimental by nature, what’s been predominantly shown in some of these efforts is the lack of adoption that follows.

On that very point, it’s clear that there is a fundamental element missing to truly reap the benefits of asset tokenization. As we transition towards digitizing all things on-chain, from currency, commodities, and securities to trading cards, art, real estate, and more, the question becomes not just creating these tokenized assets on the blockchain and letting them out in the wild. Rather, how can they become useful or even generate an in-demand market?

Chainlink’s Cross-Chain Interoperability Protocol (CCIP) introduces a solution for just that. In this article, we’ll dive into what CCIP is and why it’s critical in enabling capital markets on-chain.

What Is CCIP?

In most blockchain ecosystems, we can think of each one as an island. As we can imagine, islands can vary in size. For example's sake, it’s clear within the blockchain space that Bitcoin would represent one of the biggest of these metaphorical islands. There is an inherent problem here amongst all these islands, however.

That problem lies around communicating with different islands. Since each island is isolated in the sense that they all are different blockchains with no means of communication beyond their own ecosystems, facilitating this communication layer is a concept that has been focused on for some time.

That’s where interoperability and Chainlink CCIP come in.

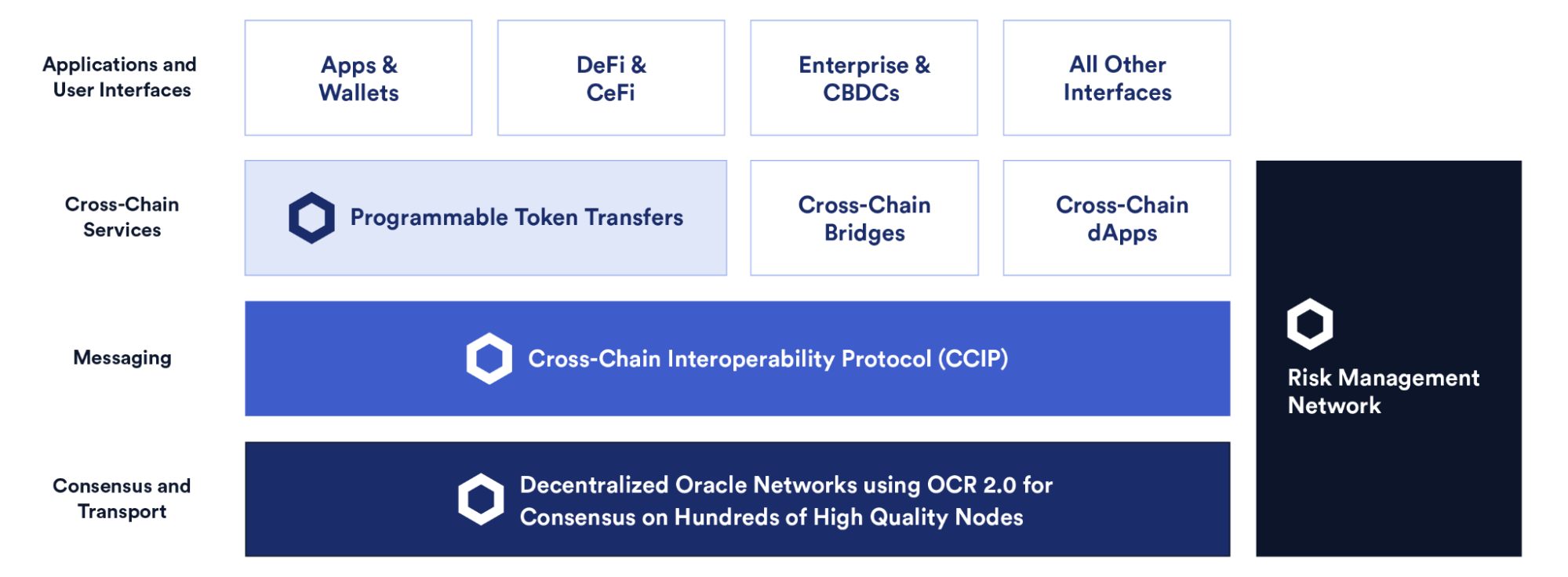

Interoperability refers to the exchange of information between different systems or blockchains, even if they are not compatible. Chainlink CCIP provides an interoperability layer to help developers of blockchain-based applications overcome inherent restraints, specialize their applications, and enable decentralized applications (dApps) to leverage the liquidity and benefits of multiple blockchains.

In essence, CCIP is a global standard for cross-chain communication allowing for arbitrary messaging and token transfers. Through a single and simple interface, users can use CCIP to transfer data, tokens, or both across different blockchains. While mainnet access is currently limited to early sign-ups, CCIP-enabled applications also expand beyond blockchain interoperability.

Beyond enabling cross-chain use cases for blockchains and web3 applications, CCIP can help empower institutions and enterprises to securely access any on-chain environment from a single interface. This is particularly interesting when we consider the work that’s ongoing with entities like Swift and more than a dozen major financial institutions, and DTTC, which has recently begun collaborating with Chainlink on bringing capital markets on-chain.

Why CCIP Is Critical for Enabling Capital Markets On-Chain?

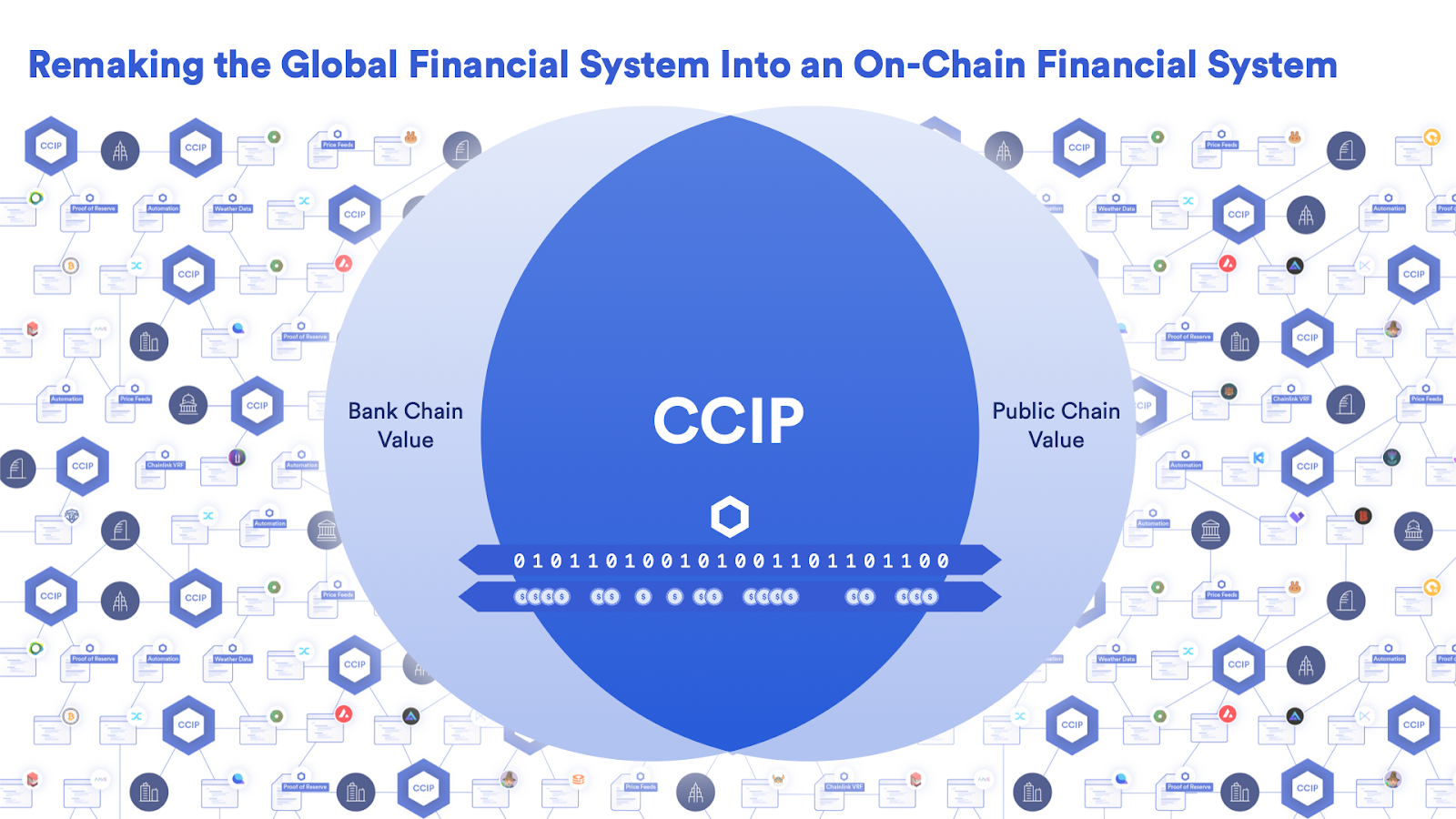

A common misconception amongst many is the idea for a singular network to rule supreme over others in terms of usage and value. The neat part about Chainlink CCIP is it does not exist on a chain or act as a settlement layer. It merely serves as a gateway for moving data and tokens across different blockchains.

When we consider appealing to enterprises and institutions, it’s clear an approach like this that makes the most sense for them.

In Sergey Nazarov’s (Chainlink Co-founder) interview at Sibos 2023, he outlined this very point and went on to expand on why CCIP is a crucial component towards enabling on-chain capital markets.

“CCIP I think is a critical component in providing liquidity and creating viable real markets for those assets made by banks. I think banks are really starting to realize that if you make your own chain and you put an asset on your chain, you might end up in a situation where you don’t have a market, you don’t have liquidity, and you don’t have people wanting to buy your assets. If you don’t have liquidity, you don’t have a market, and you don’t have people wanting to buy your assets then why did you make the asset? More importantly, why did you even make the chain?

“So, it’s not just about making an asset of your own as a bank. As a bank, it’s about getting that asset sold. It’s about getting that asset into the hands of users and those users are in other chains and those clients are in other banks’ chains. This is really the realization that’s driving a lot of CCIP adoption.”

The overwhelming dilemma we see here from the enterprise/institutional perspective is having a clear-cut means to be able to tap into existing users. By not having a chain or settlement layer in place for CCIP, we’re essentially seeing a mass gateway for enterprises, institutions, and more to come in and connect with their counterparties efficiently.

Through CCIP, a tokenized asset can become available on any blockchain, transforming it from just a single asset on one blockchain to an any-chain asset. In a recent case study, Chainlink Labs, alongside Australia and New Zealand Banking Group (ANZ), demonstrated exactly how this use case can be leveraged in practice for tokenized assets across public and private blockchains.

Final Thoughts

Chainlink CCIP is a critical component in enabling the creation of capital markets on-chain. With key relationships and ongoing collaborations with entities like Swift, DTTC, and ANZ, it’s clear that the necessary pillars are in place to make this technology available to enterprises, institutions, and other large players in the traditional financial sector. As we continue to witness these collaborations unfold, it is worth watching how the tokenized asset space grows and Chainlink’s role in shaping its future.

About Stakin

Stakin is an infrastructure operator for Proof-of-Stake (PoS) blockchains offering secure, reliable, and non-custodial staking services. The company enables cryptocurrency holders to earn interest on their assets and take part in decentralized governance while remaining in possession of their own cryptocurrencies.

Stakin serves institutional crypto players, foundations, custodians, exchanges as well as a large community of individual token holders. Driven by demand from institutional customers and the community, Stakin provides services for a wide range of networks including leading ecosystems such as Ethereum, Cosmos, Solana, Near, Polygon, Polkadot, Aptos, Sui, and more.

For more information about Stakin, visit the Website, Twitter, Blog, or join the Telegram community.