Hi Readers,

Solana is a fast, secure, and censorship-resistant blockchain providing the open infrastructure required for global adoption. It is by far one of the fastest blockchains out there, with 400ms block time and currently 60,000+ TPS. If you’re not yet familiar with Solana, have a look at our article “A Quick Introduction and Overview of Solana”. For this article, we’ve taken a look around the Solana ecosystem and have selected the top 10 projects that we find most interesting right now. So, let’s dive right into it.

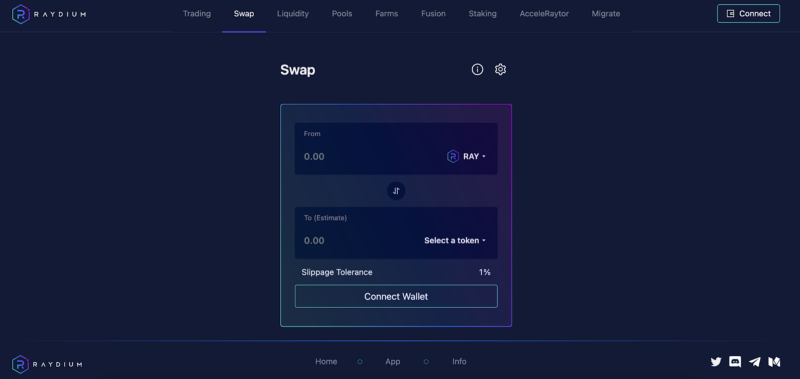

Raydium

Raydium is a DeFi (Decentralized Finance) application and works as an on-chain order book AMM (automated market maker) to power the evolution of DeFi. Unlike many other AMM platforms, Raydium provides on-chain liquidity to a central limit order book. That means that the users and liquidity pools of Raydium can access the order flow and liquidity of the entire Serum ecosystem and the other way around.

On Raydium, it is also possible for liquidity providers to generate rewards from trading fees for contributing. Key pools are incentivized with $RAY assets as farming rewards. Projects that like to reward users for providing liquidity can also add extra reward tokens.

Interestingly, as the platform progresses, it aims to partner with other DeFi and AMM communities and provide support to build out their products on Solana. That will make sure that more liquidity is added, and more and more DeFi protocols will be brought to the Solana ecosystem. Through these additions, Raydium can incorporate additional flexibility and function for future versions and new features.

Serum

In the paragraph above, we already quickly mentioned the Serum Project. To dive further into it, the Serum Project is a decentralized exchange (DEX) and ecosystem that brings unprecedented speed and low transaction costs to decentralized finance. It is built on Solana and is completely permissionless. Because it is built on Solana, Serum offers sub-second trading and settlement, with an on-chain order book and extremely low gas fees.

There are many different DEX’s built on the Serum ecosystem, as well as swaps and wallets. For an extensive list, please visit here.

Bonfida

Bonfida is another network building on top of the Serum and Solana ecosystem. The platform offers a complete product suite that helps bridge the gap between Solana, Serum and its users. Additionally, Bonfida brings data analytics to Solana with their API, which is used by some of the largest market makers in the space and has seen a significant growth rate during its existence.

Apart from an API and DEX, Bonfida is also a Serum GUI. The GUI provides the features Serum users ask for and has a great UX/UI. To grow its base, the GUI aims to achieve the following:

- Exclusive markets and listing.

- On-chain Advanced order types.

- Order Placement Through TradingView Charts.

- Advanced and Basic User Interface Options.

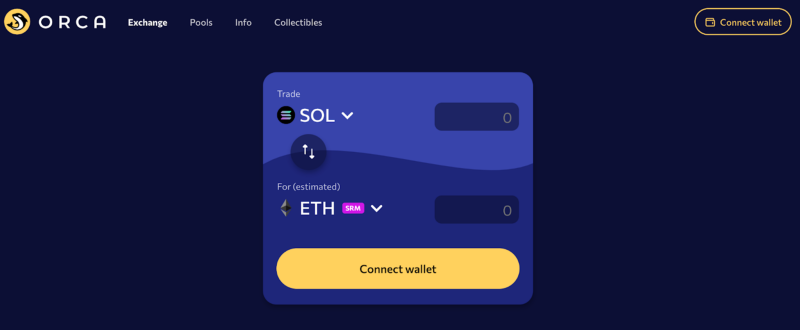

Orca

Orca is a cryptocurrency exchange or DEX built on Solana and focussed on user-friendliness. Orca seeks to provide a more straightforward, more human-centred experience for the traders on Solana, which is made possible by utilizing a Fair Price Indicator, Aggregator and Token Balances.

First, the Fair Price Indicator is created to solve one of the most significant pain points among DeFi users: determining whether a given pool currently offers a fair price. Through the Fair Price Indicator, users no longer need to blindly trust DEX proposed market rates or search through time-consuming trackers and exchanges to compare rates.

Second, Orca is not just an AMM but also an aggregator. Each time you input a trade, it offers the best available rate from Orca's liquidity pools. Finally, Orca has built a Tokens panel directly into its interface. So that users can see their balance or all tokens listed on Orca, including live updates whenever a trade is made or liquidity provided.

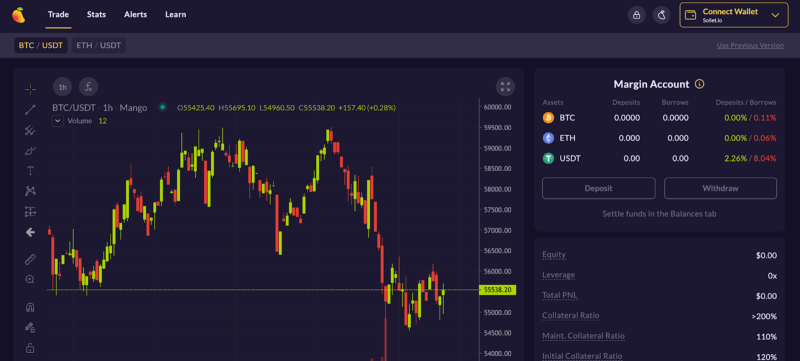

Mango Markets

Mango Markets offers decentralized cross-margin trading with up to 5x leverage. Mango Markets aims to create a trader and maker-friendly decentralized platform. Initial core features of the platform are on-chain margin trading on limit order books and perpetual futures, which are the main drivers of centralized exchange revenue. Thus, moving those to DeFi is a vital step to overcome CeFi (Centralized Finance) platforms.

Mango Markets can also be used to lend digital assets or to play the liquidator role when positions don’t meet their collateral requirements.

Oxygen

Oxygen.org is a DeFi Prime Brokerage Protocol built to support hundreds to millions of people in the future. The platform helps its users as holder of digital assets, generate liquidity, earn yield, borrow assets to go short, get trading leverage against portfolio assets and allows for more efficient use of your assets in three ways:

First, through multiple uses of the same collateral, Oxygen enables you to generate yield on your portfolio through lending out your assets and borrowing other assets at the same time. Second, cross-collateralization, lets you utilize all your portfolio as collateral when you’d like to borrow other assets. This means, a lower margin call or liquidation risk for your portfolio. Finally, Oxygen Protocol is order-book based, and thus gives a fair price for borrowing and lending at all times.

Phantom Wallet

Phantom Wallet is a digital wallet created for DeFi and NFTs. The wallet offers a browser extension that can be used to manage digital assets and access decentralized applications on the Solana blockchain. It works by creating and managing private keys on behalf of its users, allowing them to store funds and sign transactions.

Furthermore, the extension injects a Solana object into the Javascript context of every web application the user visits. Next, the application can interact with the wallet, such as asking for permission to perform a transaction, through this injected object.

The UI is very friendly, and it’s most likely the best Solana wallet if not one of the best blockchain wallets out there!

Star Atlas

Star Atlas is developing a unique gaming experience by combining blockchain mechanics with traditional game mechanics. When Solana launched the first-ever “web-scale blockchain” in 2019, it became the only blockchain solution capable of hosting applications with the computational bandwidth akin to the modern internet, presenting the capability to power decentralized versions of Twitter, Nasdaq and a myriad of other blockchain applications. Star Atlas embraces the potential of decentralized self-sovereign ownership of assets permitted through the implementation of blockchain into asset ownership and NFT marketplaces.

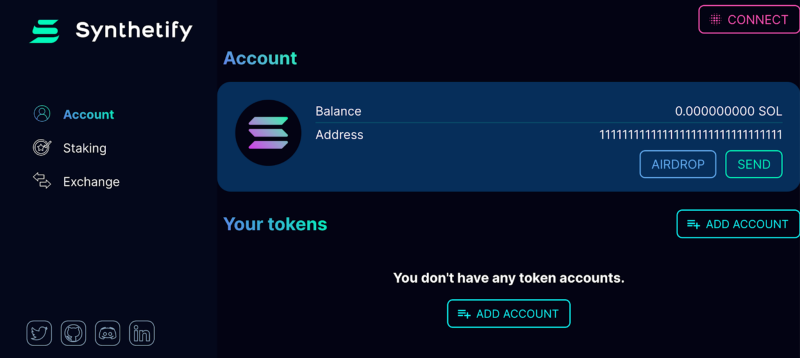

Synthetify

Synthetify is a decentralized protocol focussed on the creation and exchange of synthetic assets without the need for a counterparty. Synthetic assets are backed by $SNY assets. Thus, staking of $SNY gives users participation in a global debt pool, which acts as a counterparty for other users to trade against. Participants of the debt pool earn a share of fees created by an exchange of synthetic assets. Users can free up their staked assets by burning synthetic tokens of the value of users’ current debt.

The price of assets is determined by oracles that gather the price of specific assets and post it to the Solana blockchain. Synthetic assets can be used in all other applications (Serum, Raydium) or even migrated into other chains via a bridge. Users of Synthetify exchange can expect fees near-zero (0.001$) and close to instant confirmation time.

DISCLAIMER: This is not financial advice. Staking, delegation, and cryptocurrencies involve a high degree of risk, and there is always the possibility of loss, including the failure of all staked digital assets. Additionally, delegators are at risk of slashing in case of security or liveness faults on some protocols. We advise you to do your due diligence before choosing a validator.