Hi Readers👩💻,

A lot has changed since our very first article about decentralized finance (DeFi). The DeFi ecosystem has gone from a buzzword trend to a system with billions of USD locked in it(over 16 billion when I’m writing this, to be exact). And so, we thought it would be a great idea to share some of our favorite DeFi Dapps with you.

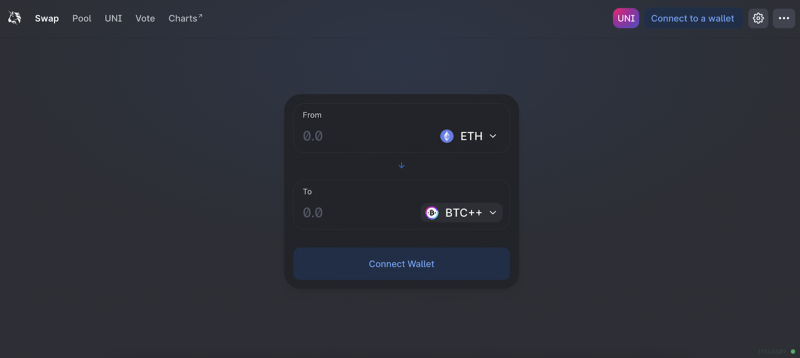

Uniswap

Uniswap is an automated token exchange platform; it can easily swap ERC-20 assets in a non-custodial way. Additionally, the DeFi app can be used to liquidity mine for specific projects — and we can speak from experience that regardless of the impermanent loss, the return isn’t bad. The app launched in 2018 and is based in the United States. The goal of Uniswap is to lower the barrier of entry to financial markets by making it easy to join the decentralized finance (DeFi) movement.

While this is a top-rated DeFi app, it’s also highly experimental, much like the entire DeFi ecosystem, which means it doesn’t come without flaws. Because anyone can list a token on Uniswap, and its decentralized nature means there is no review process. It is easy for scammers to create a token with a name similar to a popular DeFi platform, tricking users into buying useless tokens.

In August 2020, Uniswap took steps to try and mitigate the issue via the introduction of Lists. They aim to establish the legitimacy of tokens based on how many Lists they are included on and how reputable they are. Another downside is the high network fees due to the congestion of the Ethereum chain.

However, compared to other DEX competitors, Uniswap has a high number of advantages for traders: the best liquidity, no listing fees, requires no native tokens, and it has some of the cheapest gas costs of any DEX.

Uniswap is open-source on GitHub and permissionless, meaning that any individual can create any ERC market so long as they have an equal amount of ETH to back it. That allows new projects to create a base price for their token. The app is one of the most used DEX platforms of DeFi at the moment.

Berryclub.io

Berryclub is the first yield farming app on NEAR Protocol; it mixes DeFi with art, human behavior, and community building. The goal is simple: you burn Avocado tokens to draw pixels, and each pixel you “own” yields one Avocado or one Banana token per day. You can then swap these Bananas for NEAR tokens, or for Cucumber, which allow you to earn more NEAR. See the video below for a more in-depth example of how the DeFi app works.

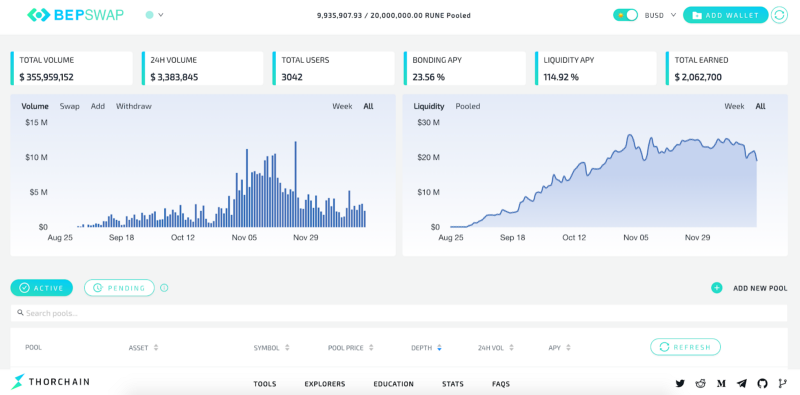

Bepswap

BEPSwap is created with ThorChainand it is Binance Chain’s first decentralized finance application that allows BEP2 token holders to swap their assets or stake them to provide liquidity to the market. THORChain validators maintain the security of pooled assets using threshold signatures. The DApp works with a large set of digital assets, including some blockchains that are usually not compatible with each other. Moreover, the entire app is wholly decentralized.

The way it works is you swap assets by sending them into pools containing RUNE & BEP2 assets. Swaps are then calculated at prices relative to the ratio of assets in the pools. It is possible to swap both ways or swap and send to someone else; when you swap, the balances of the assets in the pool change, which creates a Slip. The deeper the pool, or the smaller your transaction, the less slip.

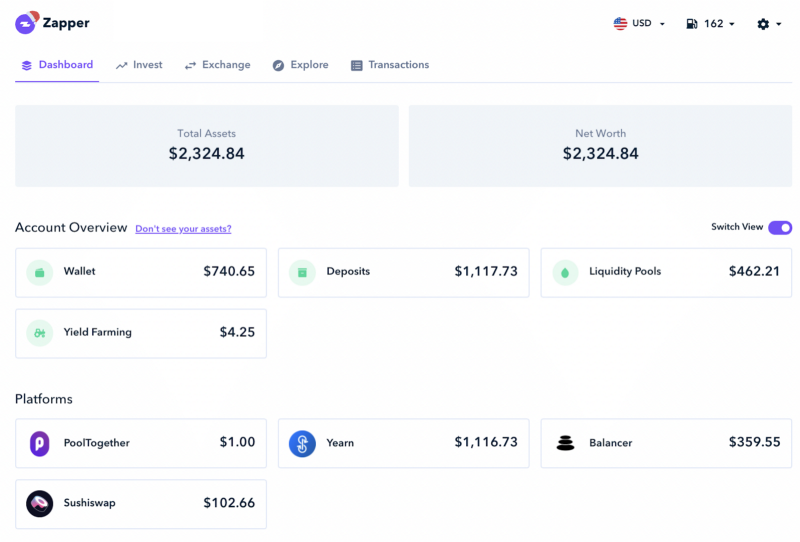

Zapper

Zapper is a DeFi platform that lets you manage your DeFi assets and liabilities in a straightforward interface. The DApp provides an excellent dashboard to keep an eye on your digital assets stored in wallets or used in other DApps. Zapper offers three different main features: monitoring, investing (Zap), and managing. With the monitor, you get a snapshot of all your DeFi assets, as mentioned before. Invest or Zap lets you invest in unique opportunities available across an expanding list of DeFi platforms, saving time and gas. Thirdly, you can easily re-balance between the DeFi platform or create your chances with “manage”.

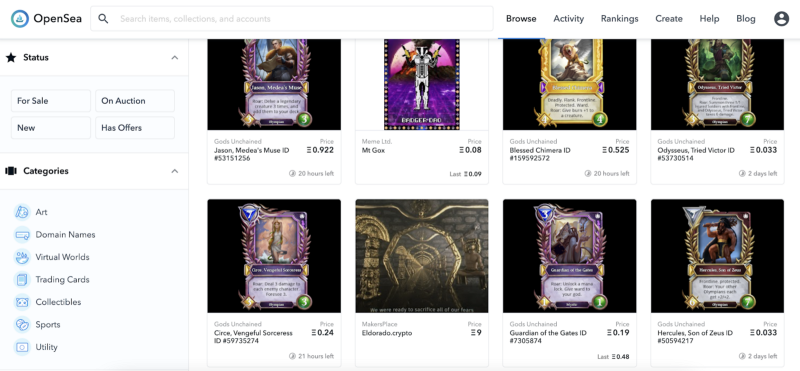

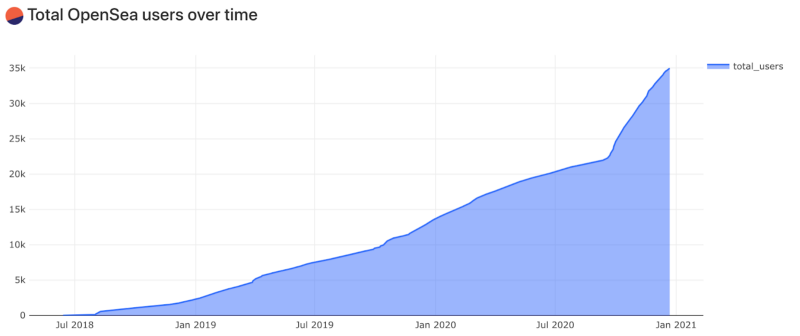

OpenSea

While OpenSea is not the largest DeFi app out there, it is the largest marketplace for crypto collectibles with more than 30,000 users to date. On OpenSea, you can buy, sell, and trade items with anyone in the world, and it is, therefore, a decentralized marketplace. Trading on OpenSea happens through a smart contract, which means that no central authority ever holds custody of your items. Instead, users store items in their wallet of choice.

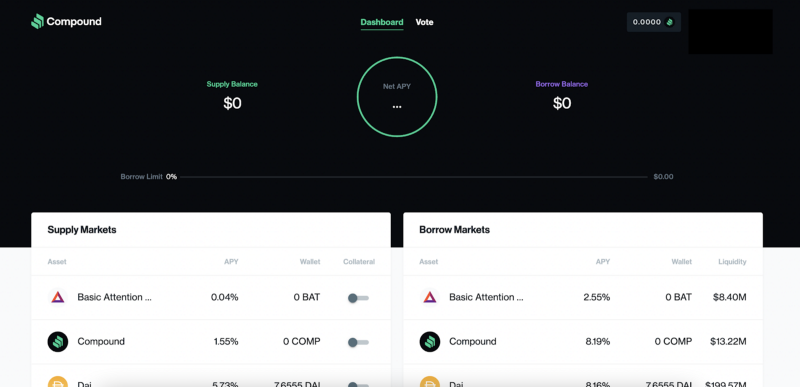

Compound

You might have heard about Compound before, one of the most well-known DeFi players out there. This platform is an algorithmic, autonomous interest rate protocol built for developers to unlock a universe of open financial applications. And according to Dappradar.com, the app has the highest number of users over the last 30 days, 65.25k to be exact.

The decentralized lending platform was created by Compound Labs Inc. in September 2018 and is built on the Ethereum blockchain. At launch, the protocol was centralized; however, the recent release of its governance asset COMP marks the first step in turning Compound into a community-driven decentralized autonomous organization (DAO). The underlying idea of Compound is to put your crypto assets to use by letting users lend and borrow 9 Ethereum-based assets.

Recently, Compound Labs released a white paper outlining Compound Chain, a stand-alone distributed ledger that connects assets and value across different blockchains, including Ethereum, Polkadot, Tezos, and more.

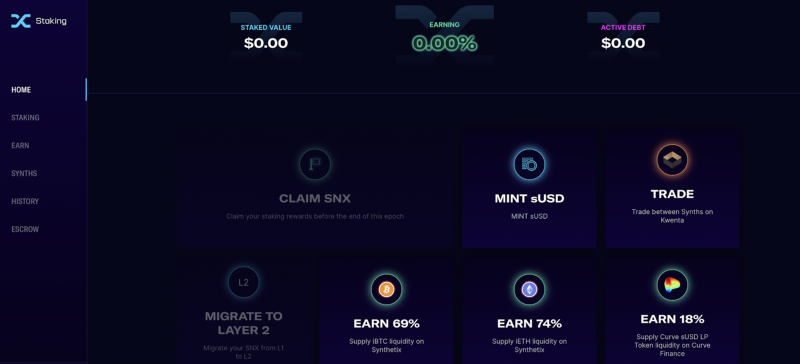

Synthetix

Synthetix is a decentralized platform on Ethereum, which creates Synths: on-chain synthetic assets that track real-world assets’ value. Born as stable coin project Havven, Synthetix rebranded and expanded its scope before launching on Mainnet in February 2019. As of May 2019, the Synthetix platform supports over 20 Synths representing fiat currencies, commodities (e.g., gold), and crypto-assets. Stocks, indices, and other derivatives are expected to be added soon.

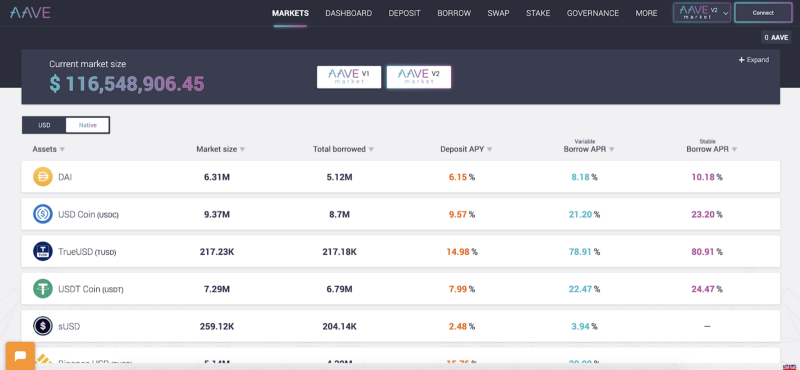

Aave

Recently listed by Coinbase, Aave is an open-source and non-custodial liquidity protocol for earning interest on deposits and borrowing assets. You can deposit and earn interest in providing liquidity to the lending pools, while borrowers can obtain loans by tapping into these pools in both an overcollateralized or undercollateralized fashion. Aave protocol is unique in that it tokenizes deposits as aTokens, which accrue interest in real-time. It also features access to highly innovative flash loans, allowing developers to borrow instantly and easily; no collateral is needed.

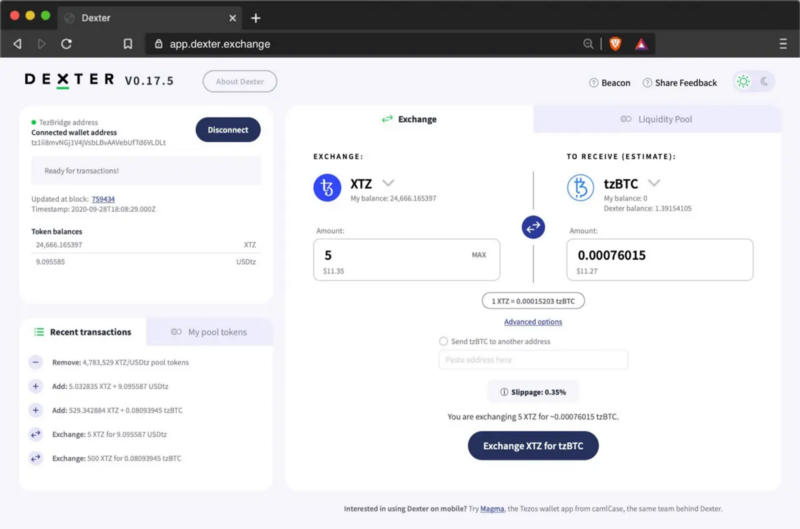

Dexter Exchange

You might have heard about the recent news that StableTech has brought wrapped ETH tokens to the Tezos blockchain in a bid to win over DeFi users sick of the high fees on Ethereum. Wrapped tokens have already brought millions worth of value to the Ethereum blockchain. Tezos is trying a similar strategy, debuting wrapped Ethereum on the Tezos blockchain to get in on the DeFi action.

But one DEX that doesn’t need any convincing and has already built their DeFi application on Tezos is Dexter Exchange; it promises lower fees and ultra-fast transactions for all upcoming tokens built on the blockchain. The DEX is an open-source, non-custodial exchange built for XTZ holders and other Tezos FA1.2 assets (such as ERC20-like fungible token standard for Tezos).

- Dexter’s smart contract was formally verified by Nomadic Labs, with an official report on the audit.

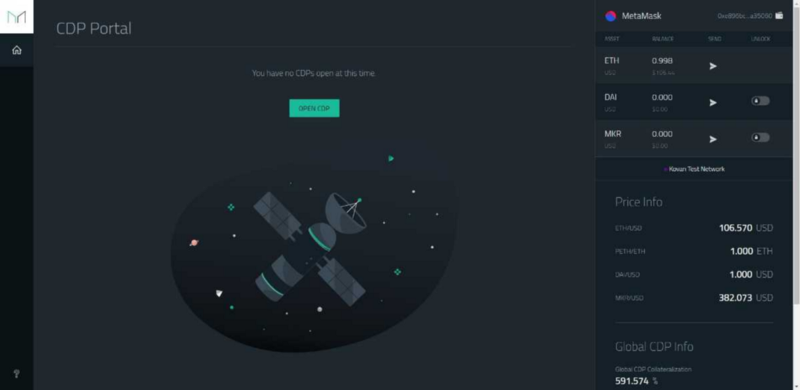

MakerDAO

This list wouldn’t be complete without MakerDAO, the permissionless lending platform responsible for creating DAI, the first decentralized stable coin built on the Ethereum ecosystem. Until now, the DApp is still one of the most used 4,600 monthly users.

Many will call Maker the very first DeFi project, and it has long since hold the number one position for ranking on virtually all DeFi platforms when it comes to the total amount of ether (ETH) locked within the system.

The platform allows any user to autonomously take out a loan by staking digital assets such as ether (ETH) as collateral. The system is inherently permissionless, meaning that there are no KYC requirements necessary to get started. Furthermore, all lending actions are performed by smart contracts, meaning that no human is involved in the facilitation of any specific loan.

Final Words

From the beginning of 2020, when we started writing about DeFi, until now, the USD locked in the DeFi ecosystem has grown from $1 billion to over $16 billion. New network integrations and new apps arise in the ecosystem every week, and it is growing so fast that it’s almost impossible to keep track of all projects. And it is essential to note that DeFi didn’t even exist two years ago.

And so, the main question arises: “is DeFi ready for mainstream adaptation?”. We’d say, right now, no, it is not. There are still many flaws, such as the dForce ecosystem losing 99% of its resources due to a hacker attack. And as ourcrypto.net stated recently: “DeFi is not ready to receive the money of a customer who would be in serious pain and disadvantage of losing their resources”.

But this doesn’t undermine the authority, innovation, and success of the DeFi ecosystem. All innovations need to go through a growth process, and that’s also true for DeFi. In any case, DeFi and blockchain are ready to develop further and exploit potential opportunities to deliver technology that will be used for years to come. 2021 is looking to be a good year for DeFi, and we’re excited to see what will happen.

DISCLAIMER: This is not financial advice. Staking, delegation, and cryptocurrencies involve a high degree of risk, and there is always the possibility of loss, including the failure of all staked digital assets. Additionally, delegators are at risk of slashing in case of security or liveness faults on some protocols. We advise you to do your due diligence before choosing a validator.