Hey Readers👩💻,

Once again, it’s been a couple of busy weeks in the blockchain world. In today’s newsletter, we’re discussing:

- SKALE Fuji Testnet

- Solana Mainnet Beta v1.2 Upgrade and Serum Project

- Ethereum 2.0 Final Testnet

- ICON SCORE audit system

- Ongoing and launched ICON DeFi Projects

- Cardano Shelley Mainnet

- Pocket Mainnet

- StaFi Staking Drop

🌋 SKALE Fuji Testnet

The final testnet of the SKALE network was supposed to be finished before the 30th of June, the estimated launch date of the Mainnet. However, in these crazy times, the network experienced some delays, which means stakeholders are currently finishing up the last testnet tasks.

The goal for the incentivized testnet is to have actual SKALE network validators test and verify the setup of validator nodes and confirm the proper performance of validator and delegator operations.

There are a couple more phases left to test: SKALE Chains will be created, and subnodes will be assigned to them on a random basis, stress testing and unexpected conditions will also be introduced to test the chain. Furthermore, node replacement in the event of node failure will be tested. For those of you interested in buying digital assets from SKALE, the Mainnet sale is planned for August 2020.

🏎 Solana Mainnet Beta v1.2 Upgrade and Serum Project

Recently, Solana announced the Mainnet Beta v1.2 upgrade that will take place during a 2-day window, called the Upgrade Epoch estimated to occur between August 1st and 3rd 2020. Once the Upgrade Epoch starts, all user transactions will be rejected. Each staked validator should then upgrade to the v1.2.15 release during their time window.

But that’s not the only news coming from Solana these past two weeks. The network also announced its collaboration with the Serum Foundation to build a high-speed, non-custodial decentralized derivatives exchange. FTX, a leading exchange, and derivatives platform will collaborate on this project as well.

The Serum Project is a complete non-custodial spot and derivatives exchange that will run on an on-chain central limit order book (CLOB) on Solana’s mainnet. Serum will support cross-chain asset swaps, decentralized stable coins, oracles, and more. The collaboration with Solana enables the best of both centralized and decentralized worlds by creating an exchange that is censorship-resistant and non-custodial, fast, inexpensive, and highly liquid.

💰 Ethereum 2.0 Final Testnet

On the 21st of July, Vitalik Buterin, Co-Founder of Ethereum, announced that the final Testnet would launch in just two weeks. Meaning the launch can be as early as the 4th of August, assuming all necessary conditions are met.

The last Testnet will support the networks many different clients’ ways of running a blockchain, enabling them to scale Ethereum and grow to accommodate the decentralized finance (DeFi) ecosystem. This long-awaited upgrade could come at the perfect timing as the DeFi ecosystem is booming right now. However, while the founders and builders are positive, it can not be for sure that the Testnet will launch this soon as technical issues have delayed the project before.

🧐 ICON SCORE audit system

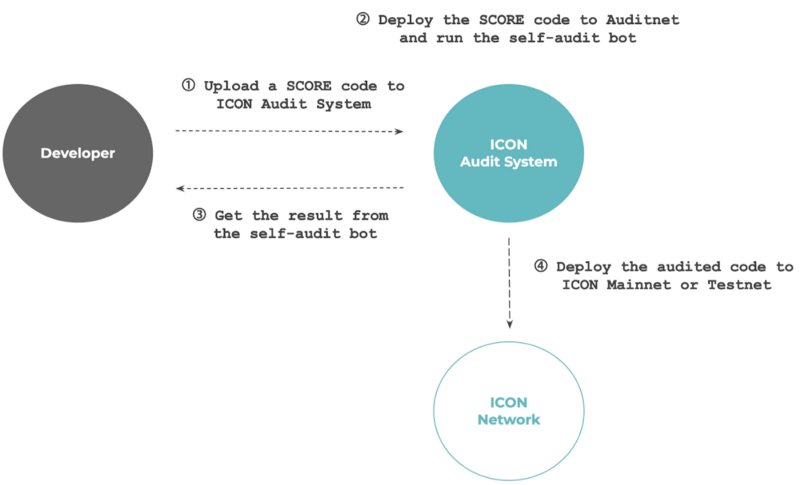

The ICON Foundation announced the SCORE audit system on the 22nd of July. The SCORE audit system is a smart contract audit system that will make it easier for SCORE developers to verify and deploy smart contracts to the ICON Network. A great development! The system will also allow developers to review and confirm their smart contracts and pre-audit them before submitting to the auditors of ICON.

If you’d like to verify your smart contracts or are interested in developing one, click here.

🧑🚀 Ongoing and launched ICON DeFi Projects

As we mentioned earlier in this newsletter, the decentralized finance (DeFi) is booming. On the ICON Network, the first-ever DeFi Platform on ICON, Balanced is paving the way for all new projects and implementations. Together with Band Protocol’s Scalable Oracles, they have created a custom oracle for ICX/USD price feed from five trusted data sources.

But Balanced isn’t the only DeFi project on the ICON Network. The Liquid ICX (LICX) project built by Block42is a new form of ICX aimed towards the implementation of DeFi solutions. Additionally, we at Stakin are working hard on launching our first-ever lossless lottery on the ICON Network.

- For a complete overview of all DeFi projects on the ICON Network, click here.

🔥 Cardano Shelley Mainnet

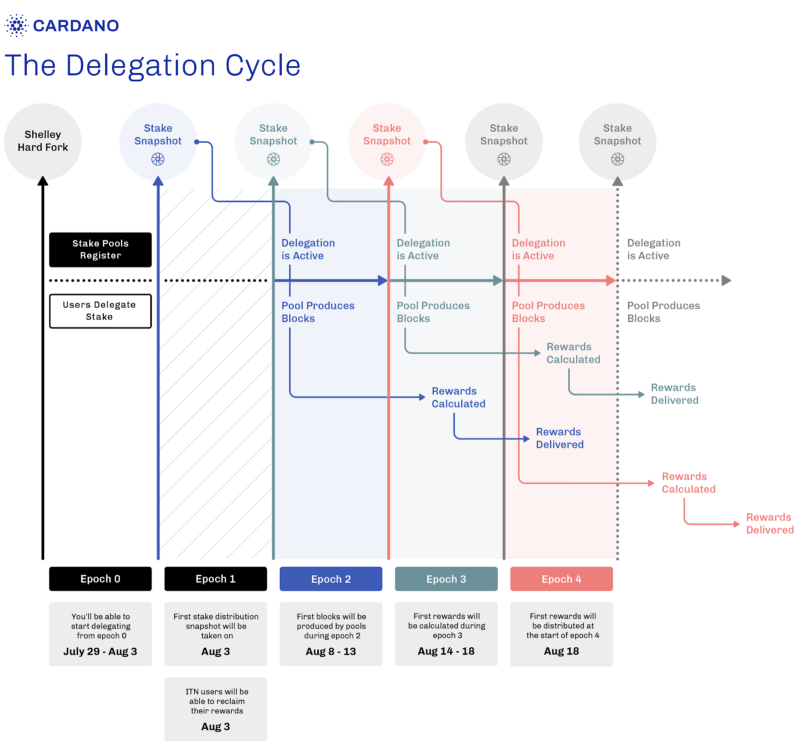

On July 29th, the Cardano Shelley Mainnet went live. The upgrade to Mainnet introduces staking possibilities and the network’s digital currency, called ADA. On the Cardano Network, two types of staking are possible. More experienced users can run their staking pools, needing technical management, and reliable uptime. Furthermore, everyday users can delegate their assets to a selected pool and earn rewards.

The estimated amount of interest users will earn per year is set around 4.63%; however, this rate may change depending on the participation within the network. Rewards are calculated cyclically, as seen in the image below.

🎉 Pocket Mainnet Release

The Cardano Mainnet isn’t the only Mainnet release that caught the attention of blockchain enthusiasts during the last two weeks. Pocket Network also released its Mainnet and the Pocket Core RC-0.5.0 on July 28th. Over the next few weeks, the focus of the network will be on the quality of their nodes, onboarding bootstrap nodes, and onboarding the first set of Pocket DAO and working to ratify the DAO constitution.

After the first phase, the second phase that will start on August 3rd will expand the voting set through a champion system. The third phase of the Pocket Mainnet will focus on the release of Pocket Dashboard and Gateway. Finally, gaming options and growing the DAO set will be the last phase of the Pocket Mainnet.

🪐 StaFi Staking Drop

The StaFi Protocol built intending to empower the liquidity of staking assets — such as Cosmos, Polkadot, and more — while also enhancing staking rates and making Proof-of-Stake (PoS) networks safer has launched a new campaign. The campaign named StakingDrop is created to promote the use of StaFi.

StakingDrop is focussed on airdropping to targeted users — stakers — because they are the base for the future. In StakingDrop, staking is used as locking. Digital assets should be locked on their original chain, and thus losing their liquidity. Therefore, despite StakingDrop requiring a more extended locking period when users are not allowed to unstake, extra FIS rewards to those users.

- The StakingDrop page is live and can be visited here.

DISCLAIMER: This is not financial advice. Staking, delegation, and cryptocurrencies involve a high degree of risk, and there is always the possibility of loss, including the loss of all staked digital assets. Additionally, delegators are at risk of slashing in case of security or liveness faults on some protocols. We advise you to do your due diligence before choosing a validator.