Hi Readers,

Today, we’re sharing an introduction to the Compound Finance Network and its upcoming blockchain: Gateway. Compound is an algorithmic, autonomous interest rate protocol built for developers, to unlock a universe of open financial applications. Sounds interesting right?! That’s what we thought, so let’s have a look!

Compound, founded by the economist Robert Leshner, is decentralized finance, or DeFi, protocol. It is built on a system of accessible smart contracts built on the Ethereum blockchain. Compound allows lenders to provide loans, and borrowers to take them out, by locking their respective crypto assets in the protocol. Its native token, COMP, enables users to earn interest, transfer, and trade their money.

So, why Gateway? What is it? Gateway is an open, distributed ledger for cross-chain interest rate markets. Let’s break that down a little. It allows users to upload assets from Starport contracts on peer blockchain, which are used as collateral to borrow any asset supported by Gateway. Gateway is built with Substrate and written in the Rust programming language.

- Starports: Starports are interfaces on peer blockchains that facilitate cross-chain transferring of assets. Starports bridge assets to and from Gateway and handles all interactions with other blockchains such as Ethereum.

- Substrate: Substrate is a modular framework that enables you to create purpose-built blockchains by composing custom or pre-built components.

The Ledger utilizes CASH, the native, stable unit of account, which is used to pay interest on collateral and to charge interest on borrowed assets. CASH holders continuously accrue interest on their balance of CASH, regardless of the blockchain where their CASH is held. Currently, CASH can be transferred on Gateway or on Ethereum as an ERC-20 token. Additional blockchains can become supported in the future through Compound Governance.

The Gateway network is made up out of validators, operators and off-chain workers. Validators keep the network secure, and in exchange, receive a portion of the interest paid by borrowers as well as CASH rewards, which are fueled by CASH transaction fees.

About Gateway, Compound Founder Leshner said, in an interview with Coindesk: “Gateway is designed to be a cross-chain tool and not a scaling tool.” “The new chain will someday provide a bridge for assets without demanding token wrapping or other piecemeal shortcuts for getting blockchains to talk to each other.”.

Gateway has a few improvements over its predecessors according to Compound, which they stated in their introduction article as:

- Interest is earned and paid in dollars, using CASH, Gateway’s native unit of account. If you borrow one Ether, you’ll only ever owe one Ether.

- The Gateway risk engine is more robust; risk is based on the volatility of assets you use as collateral, as well as the assets you borrow — leading to capital efficiency improvements for less volatile assets.

- You can quickly and inexpensively transfer any asset in Gateway to other users — even wallets from other blockchains.

Gateway Governance

So, let’s talk governance. Gateway is governed by the Compound Protocol Governance and thus is governed and upgraded by COMP token-holders. COMP is the native ERC-20 token of Compound that allows the owner to delegate voting rights to any address, including their own address. Now, this might be a bit confusing as we were just talking about the CASH token before.

It is important to note that CASH is Gateway’s native asset and is used on the platform to pay interest on collateral and charge interest on borrowed assets. Whereas, COMP is used throughout the Compound DeFi network. You can use COMP on the Gateway platform as collateral, but we will discuss that later.

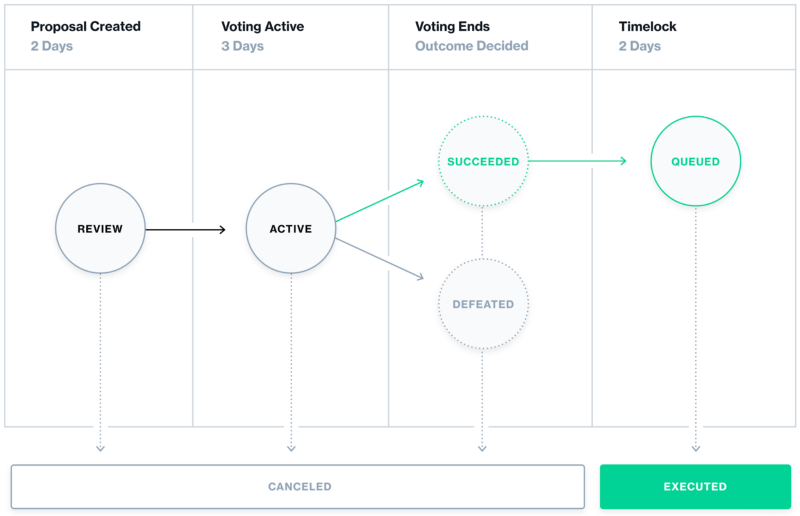

Governance on Compound consists of three components: the COMP token, governance module (Governor Bravo), and Timelock. These allow the community to propose, vote and implement changes through the administrative functions of a cToken or the Comptroller. Proposals can modify system parameters, support new markets, or add entirely new functionality to the protocol.

COMP token holders have the option of delegating their voting rights to themselves or another address of their choice. Any address can lock 100 COMP to create an Autonomous Proposal, which becomes a governance proposal after being delegated 100,000 COMP; any address can lock 100 COMP to create an Autonomous Proposal, which becomes a governance proposal after being delegated 100,000 COMP.

When a governance proposal is created, it goes through a two-day review period before voting weights are recorded and voting begins. Voting lasts three days; if the proposal receives a majority and at least 400,000 votes, it is queued in the Timelock and can be implemented two days later. Any change to the protocol requires at least one week.

Stakin is currently involved on Gateway testnet and plans to support the project towards the developments leading to Mainnet. If you follow our Medium publication, you can expect more articles about Compound Gateway in the future!

DISCLAIMER: This is not financial advice. Staking, delegation, and cryptocurrencies involve a high degree of risk, and there is always the possibility of loss, including the loss of all staked digital assets. Additionally, delegators are at risk of slashing in case of security or liveness faults on some protocols. We advise you to do your due diligence before choosing a validator.