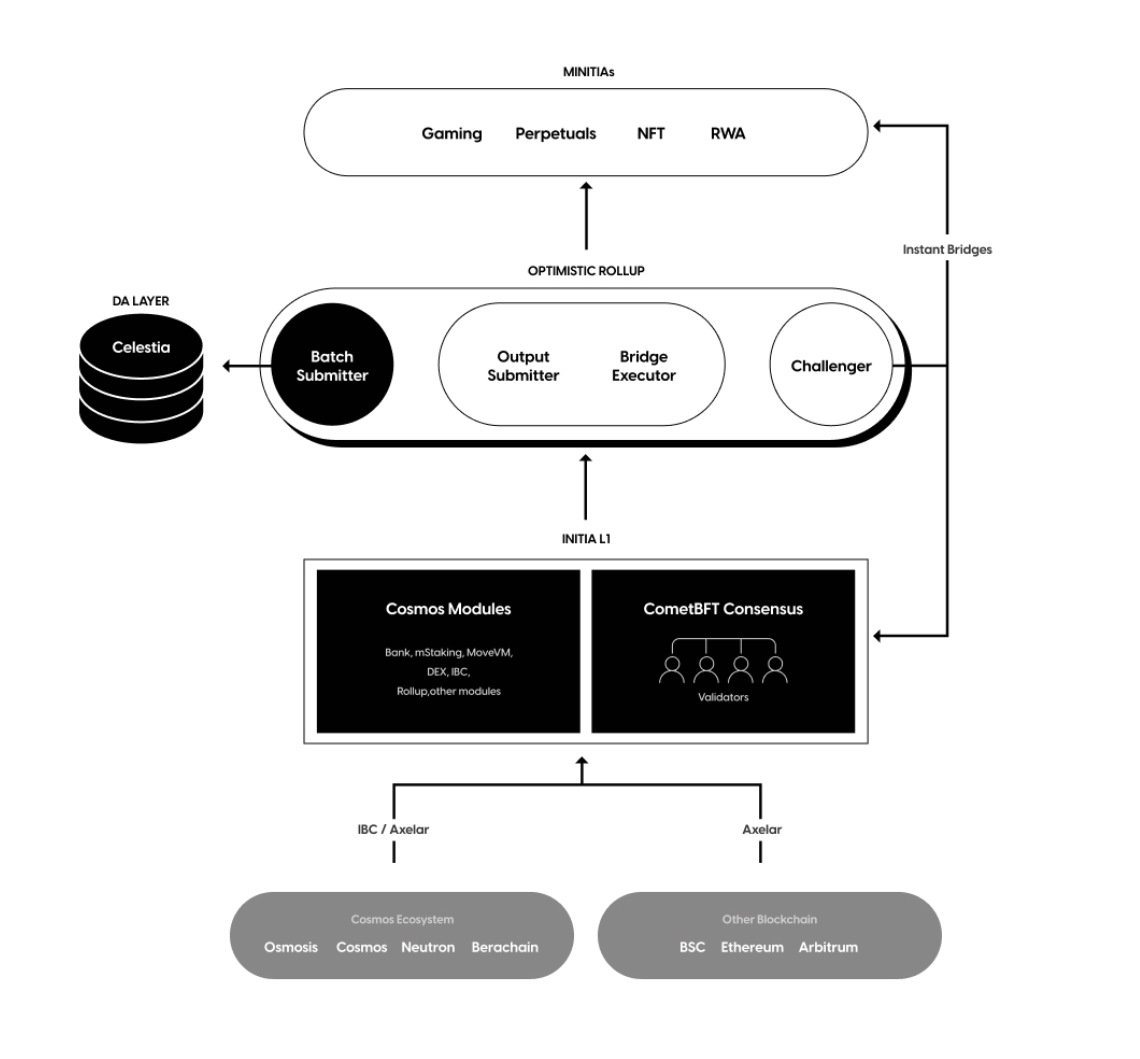

As a network for interwoven rollups, the Initia protocol consists of two main core elements that are integrated into a unified platform:

- Initia Layer 1: Simply known as “Initia,” it functions as an orchestration layer that receives and verifies all the rollup activities while managing security, consensus, governance, interoperability, liquidity, and inter-chain messaging for the whole network.

- Initia Rollups (Layer 2s): The specific terminology for these is Minitia, the Layer 2 solutions built on top of Initia. Minitias leverage the Cosmos SDK stack to deploy powerful appchains with limitless use cases/purposes that can operate EVM, MoveVM or WasmVM.

These are the Initia project's most basic architectural components, the starting points for examining its functioning and understanding its true potential.

To combine Layer 1 and Layer 2 capabilities, we must add two other fundamental features explaining how internal and external (cross-chain) interoperability works within the Omnitia ecosystem.

- OPinit Stack: a VM-Agnostic Optimistic Rollup framework designed to develop and deploy highly functional and scalable Minitias. It is a modified version of Optimism’s OP Stack that leverages Cosmos SDK flexibility to secure Minitias via rollbacks and fraud proofs.

- Bridging Middleware: This includes all the Layer 1 features supporting data and asset transfer within Omnitia (between Minitias) and externally to other chains like Ethereum, Cosmos, and others. It is composed primarily of Inter-Blockchain Communication (IBC) and the selected Bridge Provider but also uses Axelar and other related infrastructure solutions.

All these components work together to form Omnitia, a modular platform to support an ecosystem of interwoven rollups.

You may also be interested in:

Let’s now examine Initia and Minitias' technical architecture more closely to discover which features make this project’s components unique and innovative.

Initia (Layer 1), Omnitia’s pillar for liquidity and security

As previously stated, Initia L1 manages all the background work necessary to ensure stability and security for the whole Omnitia ecosystem. Among all its functions, security and liquidity have been specifically designed considering the L2 architecture that will be built on its top.

Omnitia Shared Security (OSS)

To secure the chain activity, the Proof of Stake consensus mechanism CometBFT has been chosen as a direct consequence of adopting the Cosmos SDK technology to build Initia. Adding MoveVM support is a first-time event for non-native Move-based blockchains and implies a curated search for security and versatility as a smart contract platform.

As a network made of rollups, Initia’s top priority is establishing a security framework that simplifies fraud detection and rollbacks in case misbehaviours happen on any Minitias. To do that, its architecture features the following components:

- Unified Data Availability Layer: Put Initia validators in charge of judging upon disputes by provisioning access to state data necessary for fraud proofs and rollbacks.

- Celestia DA: direct transaction posting to Celestia to easily verify the rollup chain state.

- Efficient Data Verification: By using Celestia’s Namespaced Merkle Trees (NMT) and Data Availability Sampling (DAS), transactions of interest can be fetched without wasting resources.

Enshrined Liquidity and Staking

Different from most other L1s where this type of product is left for building to external teams, Initia presents a natively incorporated DEX: InitiaDEX. Due to Omnitia's nature and architecture, its role is clear and straightforward: to be the central hub for the ecosystem’s liquidity.

DEXs have been crucial products for most blockchain ecosystems, often being the first dApp built on any of them or the scale needle between success and failure (vampire attacks at DEX and networks’ levels were a thing until recently).

Liquidity, on the other hand, is fundamental to allowing asset trading on a blockchain network. This attracts and retains users and generates transaction volumes. It also enables the development of financial applications such as money markets, decentralised options platforms, perpetual swaps, etc.

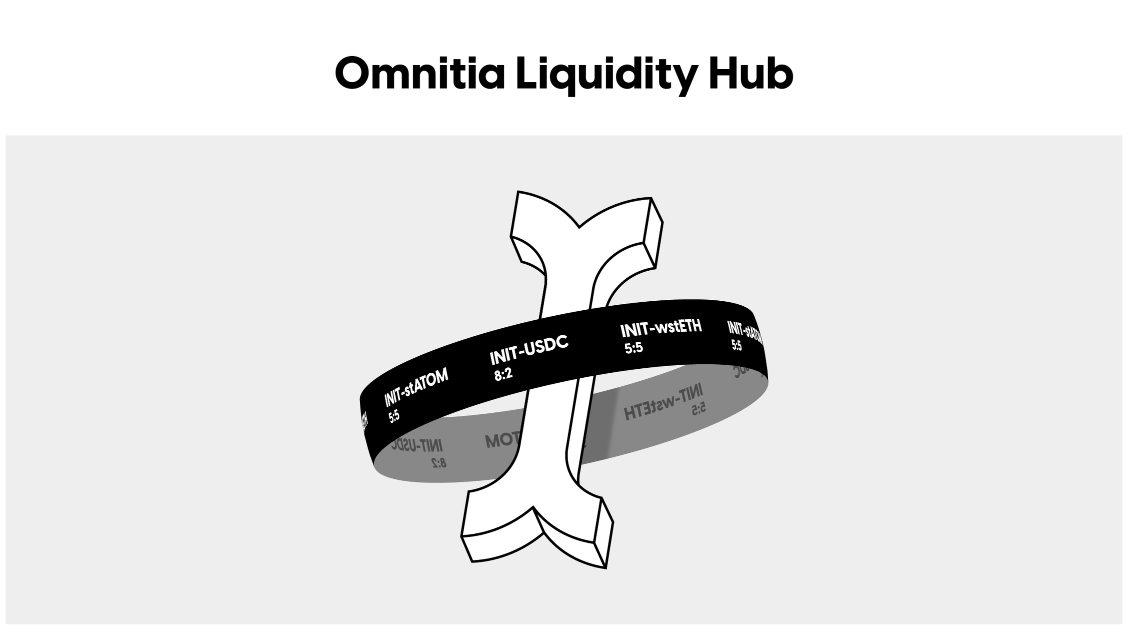

Omnitia’s architecture emphasises these needs to the highest degree by aiming to interconnect potentially millions of Minitias. Thus, the InitiaDEX must be integrated into the platform's multi-layer architecture to provide seamless interaction between its components (L1 and L2s) while delivering the most innovative liquidity pool solutions, such as:

- Weighted Pools: Unlike classical AMM pools popularised by Uniswap, where the two compose a pool 50:50, this solution allows you to build a pool with more than two tokens and different weightings (such as 80/20 or 60/20/20). The benefits of weighted pools are better control over the level of exposure to certain assets and a far lower impermanent loss. However, asymmetric pools have a higher slippage due to the higher reliance on a single asset.

- Stableswaps: This liquidity pool type was first introduced by Curve Finance and is designed to swap specific closely priced assets, like stablecoins. Due to the invariant curve slippage function used, these pools work only with a restricted category of assets but reduce slippage and impermanent loss to almost zero.

- MinitSwap Pools: designed explicitly for IBC-bridged tokens and their native L1 counterparts to facilitate interoperability within the Omnitia ecosystem.

However, a well-equipped DEX cannot be the only solution to solve all liquidity concerns in such a complex ecosystem as Omnitia. That’s why the Initia team came up with the so-called Enshrined Liquidity.

Enshrined Liquidity is a tweak to the standard DPoS consensus mechanism that implements the x/mstaking module. This addition allows multiple tokens to be staked directly with validators to gain voting power upon the governance proposal and its acceptance.

Together with native INIT tokens, InitiaDEX LP tokens that have been whitelisted and approved by a governance proposal can also take part in the consensus mechanism via staking. The prerequisite for that are:

- The LP tokens must include INIT in their pair.

- The INIT weight of that pool must be at least 50%.

- For an LP token to be allowed as a staking asset, a whitelist proposal, including the token's

reward_weight, must be submitted and voted on.

Adding new tokens to participate in the consensus mechanism and gain governance power might seem like a potential threat to overall network security. But that’s not the case with Initia.

Indeed, despite encompassing both INIT and LP tokens, Initia’s governance power is denominated solely in INIT units. It aggregates only solo INIT staked and the amount of INIT being part of the LP staked tokens at the time of the snapshot for a given proposal. As a result, non-INIT assets belonging to the LP staked tokens cannot affect or threaten Initia governance (different reward weights of LP tokens don’t interfere with how governance power is assigned).

The combination of InitiaDEX modules and capabilities with the innovation brought by Enshrined Liquidity form together the Omnitia Liquidity Hub. This new system, made to strengthen ecosystem liquidity at its core level, provides several advantages. Some of these are:

- Unified Liquidity Layer: Improve user experience by creating a unique and shared liquidity moat usable by all Minitias and assets coming from outside Ominitia

- Boosted Staking Yields: Unlock the liquidity potential of staked assets, including INIT-X and INIT-LSD (Liquid Staking Derivatives), by simultaneously earning staking yields, LSD yields and trading fees.

- Improved asset allocation: Expand the range of asset exposure capable of earning a yield while also diversifying the available methodologies to increase network security via staking.

- Inter Minitia Router: Simplify asset movements between Initia and Minitias across the ecosystem.

- Just-in-Time Gas: Easy conversion of assets into gas for operations on Minitias within a single transaction, improving accessibility and user experience.

Minitia (Layer 2), the new architecture for a universe of rollups

Minitias' goal is to offer a flexible blockchain platform with powerful tools to build purpose-specific appchains that are integrated into a robustly interconnected ecosystem (Omnitia).

To simplify the developers’ job, they offer a comprehensive suite of built-in features natively at the Layer 1 level so that builders can focus primarily on creating innovative applications. Some of the features offered are the following:

- Instant bridging and access to native USDC and CCTP

- Token fungibility across different virtual machines

- Oracle interfaces, fiat gateways, and extensive developer tools

- Frontend widgets to lower the entry barrier for end-users

As anticipated, we can consider Minitias as Layer 2 fully functional Cosmos SDK appchains using optimistic rollups for settlement on Initia Layer 1. Their mixed nature (built as sovereign chains but relying on Layer 1 for security and data settlement) allows them to run without the need for a consensus mechanism and/or validator set while still being able to integrate advanced functionality CometBFT modules such as AuthZ and Feegrant.

OPinit Stack: the first of its kind

Inspired by Optimism’s Bedrock specification, the OPinit Stack is the first optimistic rollup framework ideated specifically for the Cosmos ecosystem.

This optimisation comes from the need to solve one of the major issues affecting the OP Stack: reliance on third-party service providers. Thanks to a relayer connecting the OPinit optimistic rollup tech with the Cosmos IBC protocol, it allows for total interconnectivity between Initia Layer 1 and Minitias. In addition, it provides support for multiple virtual machines, including MoveVM, EVM, and WasmVM.

The OPinit Stack is the actual founding pillar of Initia’s innovative approach. Indeed, it has been designed to free developers from being siloed into only a few options for smart contract programming.

For all optimistic rollups, transactions on L2s are batched together and sent to Layer 1 for verification and confirmation. Thus, by supporting fraud proofs and rollback capabilities, OPinit’s rollups are simultaneously extremely powerful but lightweight.

The addition of MoveVM, despite its quite recent arrival, signals the attention to new and more precise and secure environments and the willingness to include them to build more robust blockchain products.

Minitia technical specifications and features

Thanks to their wide range of features and technical specifications, Minitias seem to be one of the most scalable solutions ever seen for purpose-built appchains. To sum them up:

- High throughput of over 10,000 TPS and 500ms block times

- IBC for Cosmos interoperability and Omnitia Shared Security

- Support for Celestia Data Availability, MoveVM, WasmVM, and EVM

- Native features such as vested interest programs, token kickbacks, and an Omnitia Messaging Module

- All-inclusive tooling package, including the InitiaSDK, WalletSDK, and 1-Click Deposit Widget

- Integration with third-party services and oracles to enhance functionality and user experience

- OPinit Stack: an environment-agnostic optimistic rollup framework specifically built for the Cosmos SDK tech stack.

The Omnitia ecosystem core: Initia Applications

As a network built to support developers in their mission to create new and disruptive dApps on the blockchain, the Initia protocol presents itself with plenty of core applications for users of all kinds to start interacting with and building on top of its network. These core applications include:

- InitiaApp: a platform connected with all the other Initia applications to dive deeper into the ecosystem. Through InitiaApp, you can swap, stake, and participate in the public testnet while trying all the products that have been released.

- InitiaScan: the multichain ecosystem explorer with VM-specific tools and data for users of all levels who want to track activities at the blockchain level.

- InitiaWallet: Initia’s in-house built wallet designed for the Omnitia ecosystem.

- Initia Usernames: On-chain identity system built on top of Initia.

- Wallet Widget: designed to support both Cosmos and EVM wallet signing, it also supports social login features.

Final thoughts

Omnitia stands out as a pioneering infrastructure within the blockchain ecosystem. It seamlessly merges Layer 1 (Initia) and Layer 2 (Minitia) functionalities to offer a cohesive and scalable blockchain ecosystem.

By leveraging advanced technologies like the OPinit Stack and innovative liquidity solutions, Omnitia ensures robust security and interoperability and offers developers many opportunities to build scalable purpose-specific applications.

At Stakin, as a web3 infrastructure provider and Initia validator, we are proud to support this network and look forward to the continued growth and success of the Minitia ecosystem.