Hi Readers,

Some of you might already be familiar with the NEAR Protocol. And if so, you’ll probably know that this protocol is famous for its different innovative initiatives. Thus, in today’s article, we’re breaking down three of the NEAR initiatives known as Open Finance, The Creator Economy, and Open Web.

Now, let’s start with a little reminder about NEAR. NEAR Protocol is a decentralized application platform with the prospect to change how systems are designed, how applications are built and even how the web in itself works. NEAR aims to allow developers and entrepreneurs to easily and sustainably build applications that secure high-value assets and identity while making them performant and usable enough for consumers to use.

To accomplish this, NEAR is designed from the ground up to provide end-users with intuitive experiences, scale capacity across millions of devices, and provide developers with new and sustainable business models for their applications. In doing so, NEAR is building the only community-run cloud capable of expanding the reach of Open Finance and powering the Open Web’s future.

Open Finance

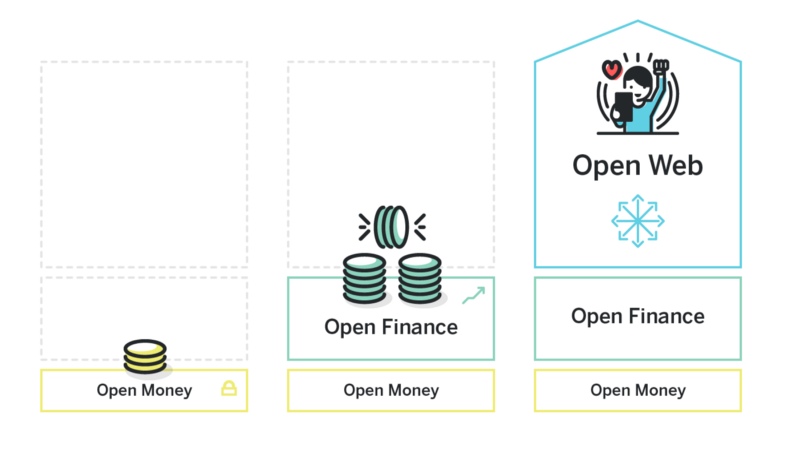

Open Finance is considered the second generation, whereas Open Web is considered the third. The first would be open money, thus making sure that everyone has access to money. Which is the initial goal of blockchain, making assets available for anyone. Now, the second generation is Open Finance as NEAR itself describes it: “Apply programmability to multiply the capabilities of that Open Money”.

So, what does that mean? Well, with Open Finance, money is no longer just a value or transactional asset, it can now be operated on in useful ways which multiply its potential. Things get much more interesting for digital money when the same properties that allow people to initiate Bitcoin transfers without asking permission also allow developers to write programs that do the same thing. Consider this digital currency to have its own independent API that does not require any company to provide you with an API key and Terms of Use contract. Open Finance is also known as Decentralized Finance or DeFi, a critical element of building Open Web or Web 3.0.

The most famous platform for DeFi at this moment is Ethereum, supercharging experimentation with blockchain-based financial services and platforms. However, the same interest and experimentation that has provided so many opportunities for DeFi users, has also made it a lot harder for new potential earners to gain an entry. From network congestion to skyrocketing gas prices to the rising prices of many popular tokens, the barrier to entry for builders and creators just getting started in the crypto space is now significantly higher.

It is NEAR’s goal to make DeFi more accessible, thus they created the Rainbow Bridge, a trustless, permissionless, and generic protocol for connecting blockchains. The bridge protocol removes the need to trust anyone except the security of the connected chains. Together with the Sputnik DAO, DeFi developers now have the tools to enable decentralized governance, issue their own incentives, and create contributor communities with minimal effort.

Open Web

It is important to remember that Open Web isn’t fundamentally different from Open Finance. In fact, the first is more like a superset of the second, however, Open Web’s use cases require a substantial improvement in performance and capability to reach a new tranche of users.

The fundamentals for a platform to run the Open Web are:

- Higher volume, higher speed, lower-cost transactions; the chain must scale to support more nuanced data types and use cases because it is no longer just handling slow-moving asset management decisions.

- Usability, since the use cases will cross into consumer-facing applications, it is vital that the components developers build or the apps built on top of them provide for smooth end-user experiences, such as when provisioning or linking accounts to various assets or platforms while retaining user ownership of their data.

NEAR has purposefully advanced its technology and tuned its performance characteristics to meet the Open Web’s full requirements.

NEAR combines scalability approaches from the world of high-performance databases with advances in runtime performance and years of usability progress. It has a full virtual machine built on top of a blockchain, similar to Ethereum, but the underlying chain adjusts its capacity to meet demand by dynamically splitting computation into parallel processes (sharding), while still maintaining the necessary security. Thus, the full set of possible use cases can be built on NEAR, and Open Finance tools can scale up to complex financial instruments.

The Creator Economy

The creator economy refers to the numerous businesses built by independent creators, from vloggers to influencers to writers, to monetize themselves, their skills, or their creations. It also encompasses the companies serving these creators, from content creation tools to analytics platforms.

According to NEAR’s Erik Trautman, the relationship between creators and their communities drives the so-called Creator Economy, which has 3 factors:

- Creators who produce something valuable

- Communities that support the creation

- And finally, financial tools and platforms to help make creators and their communities sustainable.

The line between creators and communities can be blurry, for example when users generate content, but ultimately someone has to pay for something in order to create a sustainable economy.

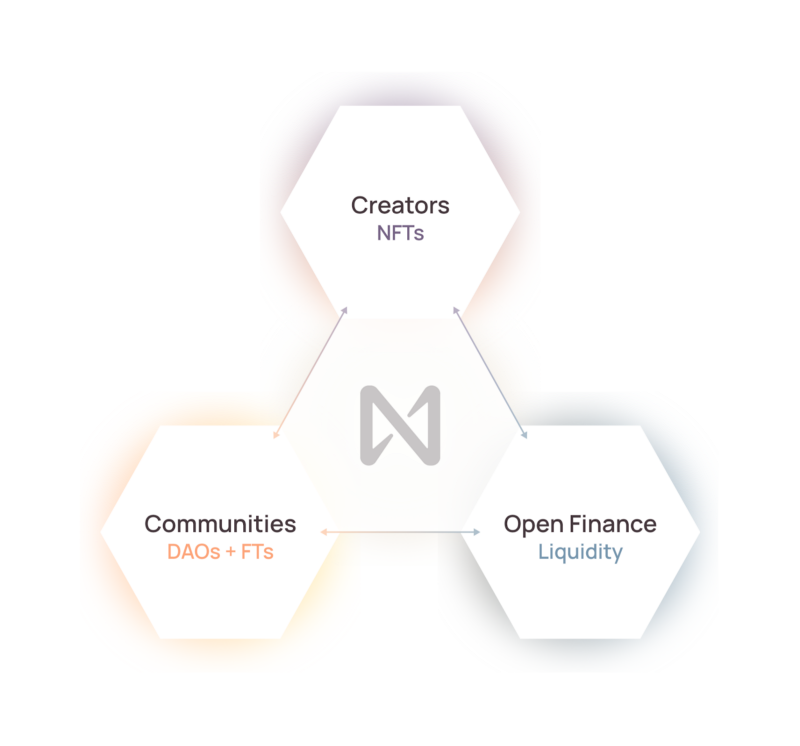

Now, in 2021, blockchain technology is finally advanced enough, to the point where it can unblock the Creator Economy. This is due to the fact that each of the key aspects of the Creator Economy is served by a specific set of tools that could not be combined in this manner prior to the availability of a platform like NEAR. This results in a new Creator Economy Triangle that illustrates how these tools — NFTs, DAOs, Fungible Tokens, and Open Finance (“DeFi”) — interact. See the image below.

Final Thoughts

The blockchain is ever-changing, and with protocols such as NEAR coming up with great innovations and making everyday solutions for huge problems, we are one step closer to blockchain being a solution that is adopted everywhere.

DISCLAIMER: This is not financial advice. Staking, delegation, and cryptocurrencies involve a high degree of risk, and there is always the possibility of loss, including the loss of all staked digital assets. Additionally, delegators are at risk of slashing in case of security or liveness faults on some protocols. We advise you to do your due diligence before choosing a validator.