Hi Readers👩💻,

You might be aware of the Celo Testnet deliciously named after the Turkish baking good, baklava. The Celo Mainnet is launched on May 18th, 2020. And therefore, we thought now would be a good time for a quick guide about the Celo Platform.

🧐 Part 1 — What is Celo?

The Celo Platform is developed based on the idea to build a monetary system that creates the conditions of prosperity, for everyone. This kind of blockchain ideology has been around since the introduction of Bitcoin, so why is Celo different?

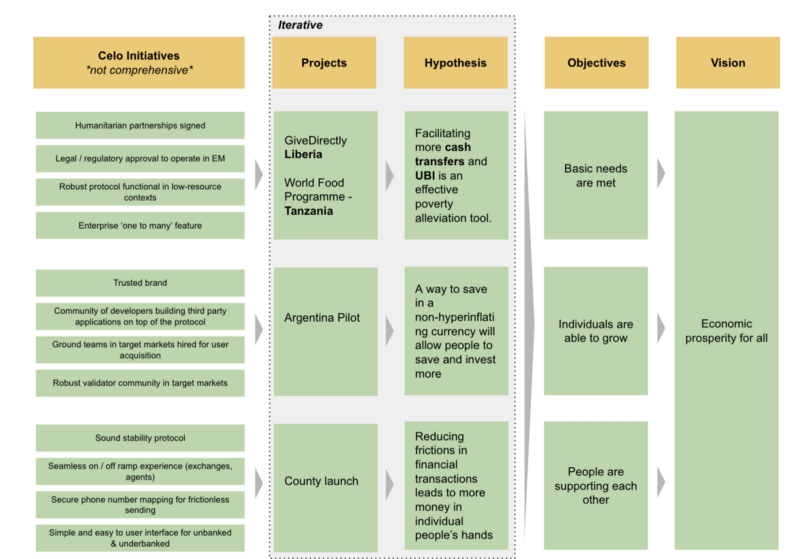

To stand out from the crowd and to make their high-stakes goal achievable the team behind Celo (CLabs) created the theory of change. Generally speaking, a theory of change is a framework that describes how short-term actions will lead to long-term social impact. CLabs aims to promote prosperity, by making sure human basic needs are met around the world. And by enabling financial growth potential for everyone. Furthermore, they want to increase social support for people worldwide, through the Celo Platform.

So, in order to have a solid theory of change, the Celo team has adopted metrics within each objective that will track the evolution of the network. By monitoring and reporting impact metrics, they hope to create accountability on their progress toward economic prosperity. Their initial goals are:

- Increase the number of people whose basic needs are met.

- Enable individuals to grow along their own path.

- Support among the users of the Celo Platform is actively happening.

Below is a visual representation of Celo’s Theory of Change as shown first by the Celo Platform.

So, now that you know about the philosophy behind the Celo Platform, let’s take a look at what it is. The Celo Platform blockchain reference implementation is based on go-ethereum, the Go implementation of the Ethereum protocol. The platform is open and open-sourced, to allow an ecosystem of powerful applications to be built on top, including cash transfers, peer-to-peer lending, collaborative small-scale insurances, and other digital assets.

To some, this might seems a bit vague. However, by running some incredibly successful pilots and implementations in Argentina, the Celo Team has shown their dream is achievable. Celo has been running tests of the easy-to-use wallet app in Argentina. The reason for the decision to conduct the trial in Argentina was the country’s proneness to inflation and distrust of the off-chain financial system. Co-Founder of Celo, Rene Reinsberg said the following about this test: “We see big potential in letting people, directly on their smartphone, access basic financial services”. He went on to say that whilst Celo is based on blockchain technology, for the end-users off-chain, they try to keep that abstract away from the app. Making the experience as easy as “just another mobile app”.

Celo’s philosophy and hands-on approach to tackling problems has obtained them an impressive number of top backers. Celo is supported by more than 80 different companies and individuals, that include prominent venture funds, C-Level operators, academics and experts. Think about entities such as a16z, Polychain, and Coinbase for example.

💻 Consensus and Proof-of-Stake

Celo’s consensus protocol is based on an implementation called Istanbul Byzantine Fault Tolerance (IBFT). IBFT was developed by AMIS Technologies and suggested as an additional extension to go-ethereum, however, this never happened. IBFT deviates from the Byzantine Fault Tolerant (BFT) consensus algorithm. In this algorithm, a defined set of validators broadcast signed messages between themselves in a sequence of steps, to reach an agreement even when up to a third of the total nodes are offline or faulty. Celo has modified IBFT to bring it up to date with the latest go-ethereum releases and fixed its correctness and liveness issues, as well as, improving the scalability and security.

- Go-ethereum is one of the three original implementations of the Ethereum protocol. It is written, as the name suggests, in Go.

There is a maximum number of active validators that can be changed by governance proposals, which is initially set at 100. The validator set is determined by the Proof-of-Stake process and is updated at a fixed period of approximately twenty-four hours. There are active validators, elected validators and registered validators (which are configured but not actively selected).

Holders of Celo Gold, the native asset, can participate in the validator elections. Just like any other PoS consensus, they earn rewards for their contributions. Accounts can’t make votes for one validator but instead vote for validator groups.

- Validator elections — a validator set is updated by running an election in the final block of each epoch (set period of time).

- Validator groups — a group of members, and an ordered list of candidate validators. There is a limit as to the number of members any group can have. Validator groups help mitigate the information disparity between voters and validators.

However, before voting, holders of Celo Gold have to move tokens into the Locked Gold smart contract. This Locked Gold can be used to place votes, maintain stake or register as a validator, and voting in on-chain governance proposals. Unlike in other Proof of Stake systems, holding Locked Gold or voting for a group does not put that amount ‘at risk’ from slashing. Only the stake put up by a validator or group can be slashed.

⚖️ Governance

In the Celo network, changes are managed via governance smart contracts. These contracts act like “owners” in order to make modifications to the protocol’s smart contracts. At the beginning of the mainnet, the governance contract will be owned by a multi-signature wallet. Once the community’s experience of DAOs has matured, it can be owned by Celo Gold holders.

Any user of the Celo network can submit a proposal, which is accompanied by a small deposit of Celo Gold (which is required to avoid spam). The deposit is refunded when the community decides the proposal is interesting enough to vote on. Submitted proposals are added to the queue of proposals and expire from this list after one week.

On a daily basis, the top three proposals at the head of the line, are moved to the approval phase. In this phase, graduated proposals need to be approved by the approver, which is at first a multi-signature address and overtime a DAO. Once a proposal is approved, it shifts to the referendum phase. In this phase, users can vote: “yes”, “no” or “abstain” on the proposals. The weight of their vote is determined by the weight of their staked assets. The referendum stage lasts two days, after which the proposal is marked as “passed” or “failed”.

🌏 Celo Alliance

The Celo Alliance was introduced in March this year. The goal is to take action in solving real-world problems by collaborating with different types of organizations. The alliance is already supported by over 50 different organizations, such as the Mercy Corps. By building financial tools for over 5.6 billion smartphone owners, including the world’s poorest citizens, the Celo Foundation aims to bring stability to those who need it most.

CLabs team member and head of the Alliance for Prosperity, Chuck Kimble, said: “the Celo Dollar cryptocurrency, backed by an open blockchain platform, can be the answer to eliminating delays in payments of loans for people in need, among other uses”.

👉 Celo vs. Libra

Many speculate that the Celo Dollar might be a more open alternative to Facebook’s Libra. Libra has been criticized for being controlled by the social media giant, who has been in the press for many wrongdoings when it comes to the privacy of individuals. Celo Alliance founder, Kimble said that while the two share a similar mission, other than that, they are very different.

One of their main differences being that Celo Alliance is a completely decentralized collective of organizations with an aligned mission. There is no such thing as a central governing body to oversee the evolution of the platform. Instead, individuals will be able to vote on how Celo should evolve (see consensus and governance).

What’s interesting about the Celo Alliance and Libra is that they share many of the same backers such as Andreessen Horowitz, Coinbase, and Mercy Corps. One could argue that this will eventually lead to a conflict of interest regarding the development and promotion of the cryptocurrencies. However, Kimble argues that this is the true meaning of decentralization, anyone can join and contribute.

Part 2 — Token and Grant Program

In this part, we’ll discuss all that we know so far about the platforms token and their grant program.

💰 Token

The native token of the Celo Platform is called Celo Gold. It is established a fixed supply or reserve tokens will be created, of which a portion is distributed over time. Another portion will be placed in reserve and diversified. The Celo Platform has its own wallet, which is described as the easiest way to distribute digital assets. You can find more information about the wallet here.

Next, the protocol also established a means-of-payment currency called the Celo Dollar. This dollar will be pegged to the USD, adhering to the following elastic coin supply rule: “when the coin supply needs to expand, the protocol creates new coins”. However, instead of distributing these tokens, the protocol will use them to purchase a basket of cryptocurrencies at market rates. The purchases get added to the reserves. This works analogously to a central bank expanding its money supply by buying assets on the open market.

So far, there’s not much known on how Celo Gold will be distributed. However, the platform has created a website, which you can check here. We expect that they will hold their first token sale there.

👨💼Celo Grant Program

On March 31st, 2020 the Celo Platform has announced that they will be distributing $700,000 in developer grant funding to 16 startups that will be building on the Celo Network. To be able to receive a grant from Celo, one of the most important things was to see if the start-ups align with the mission. Meaning, “building an open financial system that creates conditions of prosperity for all”. Other aspects for review were the innovation, the market opportunity that the start-ups are aiming to work upon and the team’s background. Once the mainnet has launched, Celo grants will be disbursed using cGLD (Celo is issuing cGLD tokens via auction with a reserve price of 1 USD).

But that’s not all. Over 2020, the Celo Network plans to distribute over 15 million USD in grants. The next wave of grants, as the network itself likes to call it, will be focussed on how the Celo community can work together to protect vulnerable populations. The reason behind this being that the COVID-19 pandemic will have a lasting effect on the world. The Celo Foundation will focus on supporting projects that work on open financial systems, with a priority to those that help communities impacted by the pandemic. For more info, check here.

📈Part 3 — Roadmap

The first release of the Mainnet, called RC1 will go live on April 22nd, 2020. Which is also Earth Day. Here’s the roadmap of what will happen afterward:

- ✅ 16:00 UTC — Genesis Block Creation — April 22nd, 2020. At the same time, core contracts will be developed, and if the quorum is achieved, block production will begin.

- ✅ At the end of April 2020, the governance proposals for the unfreezing of validation elections and epoch awards should be submitted. When they pass, they will be implemented at the beginning of May 2020. Halfway through May, it is expected to have another two governance proposals submitted.

- ✅ If all goes well, on the 13th of May, 2020. The migration to the mainnet will be completed🎉

More Information

DISCLAIMER — This is not financial advice. Staking, delegation, and cryptocurrencies involve a high degree of risk, and there is always the possibility of loss, including the loss of all staked digital assets. Additionally, delegators are at risk of slashing in case of security or liveness faults on some protocols. We advise you to do your due diligence before choosing a validator.