This is a quick and easy guide on staking SEI with Stakin, via Leap Wallet.

Sei is the first Layer-1 blockchain network fully optimized and adapted for decentralized trading, DEXs, and DeFi.

Leap Wallet is a Web3 interchain wallet that lets users manage their assets, easily perform in-wallet staking, IBC swaps and transfers, participate in governance, manage their NFT collections, claim airdrops and more. Leap Wallet currently supports 50+ Cosmos SDK chains.

Step 1 - Configure your Leap wallet account

(Note: If you already have a Leap wallet account, you can ignore this and proceed to the next section).

Head to leapwallet.io/download and download your preferred Leap Wallet browser extension.

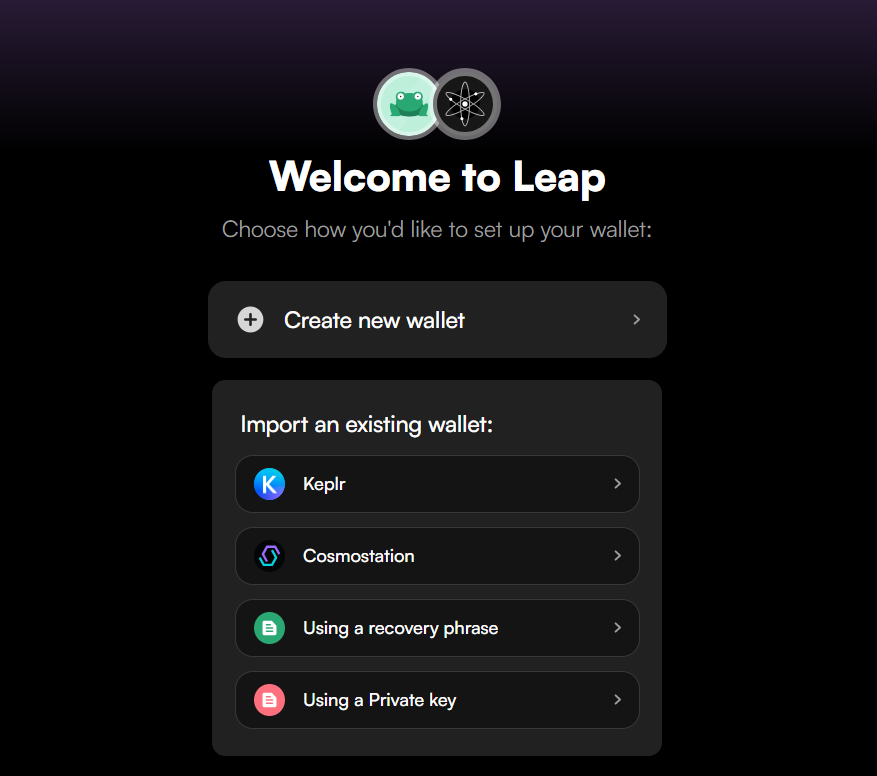

After downloading the extension, you will be presented with the following screen, which invites you to set up your Leap Wallet account. Click “Create new wallet.”

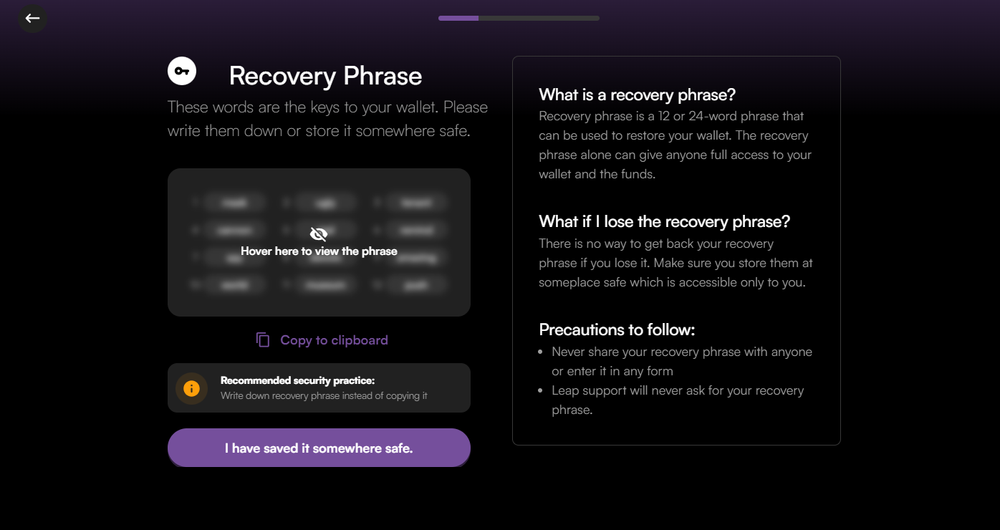

The wallet app will generate a fresh keyphrase for you.

Copy the suggested keyphrase by clicking “Copy to Clipboard” and then Paste it locally on your computer, or ideally, write it down on paper (avoid pasting the keyphrase and saving it in an online document, for security reasons).

Next, click “I have saved it somewhere safe.”

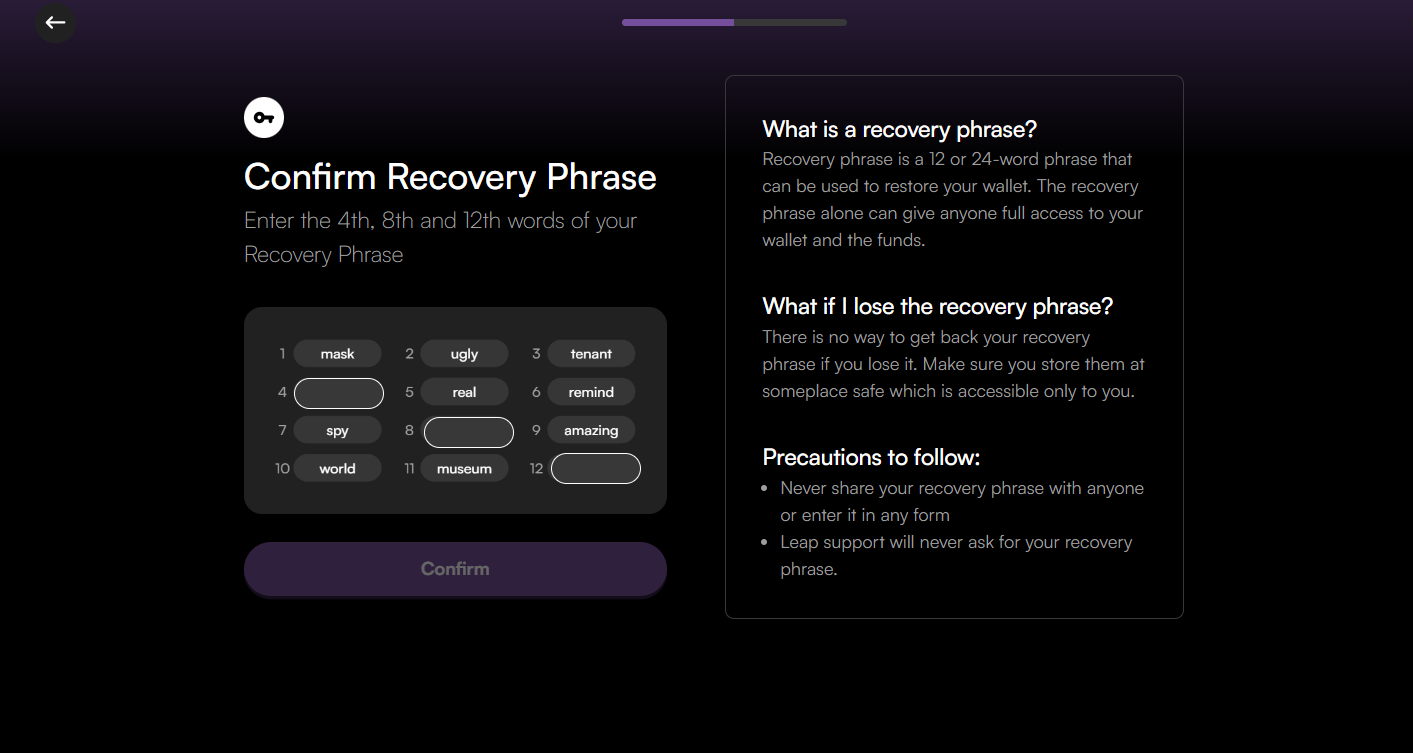

The next window will prompt you to verify that you saved your keyphrase by asking you to type down random words from the keyphrase. After you are done, click “Confirm”.

Step 2 - Fund your wallet

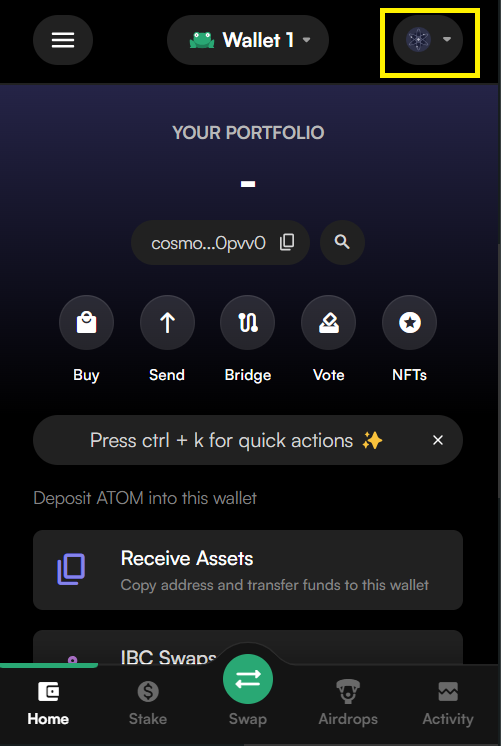

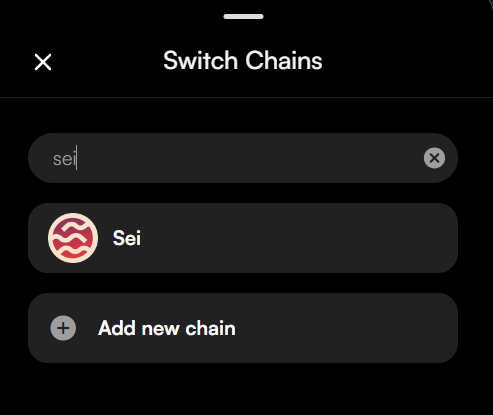

First, ensure you are connected to the right network, in this case, Sei. Click on the button on the top right, as shown below:

The next window will offer you several available options. Type ‘sei’ in the search box and then select Sei.

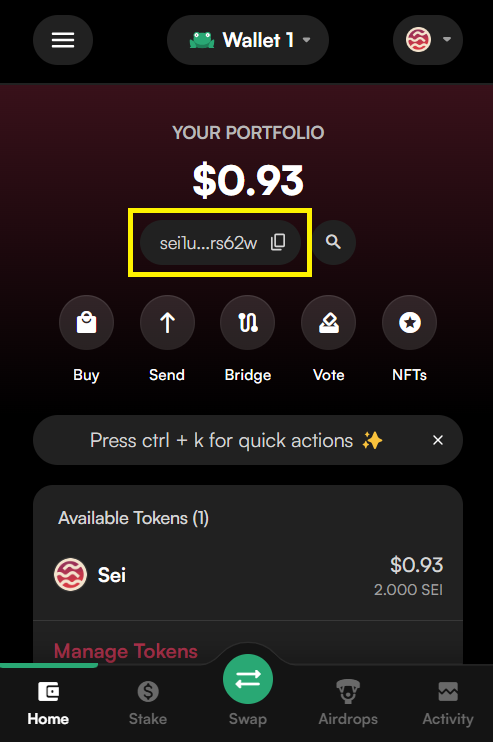

That’s it - Your Leap wallet is now connected to Sei blockchain.

Next, copy your Sei wallet address and paste it into the appropriate centralized or decentralized exchange account from which you intend to purchase and transfer your Sei tokens.

Step 3 - Stake your SEI tokens

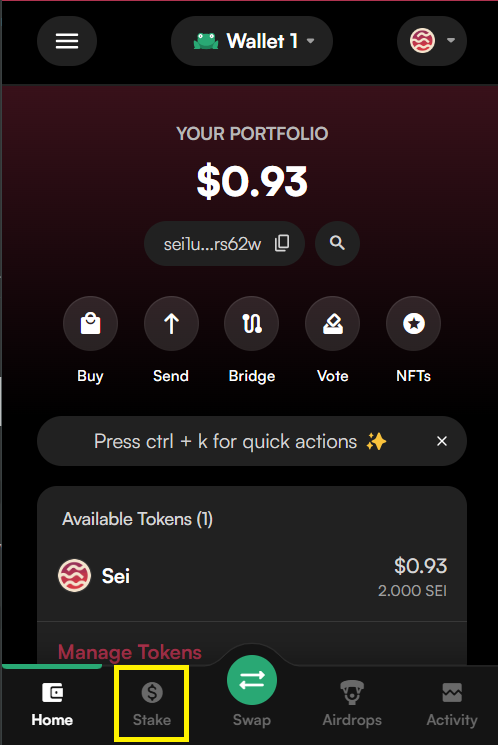

Make sure you are still located on Leap Wallet's dashboard page. Then click on the “Stake” button as shown below:

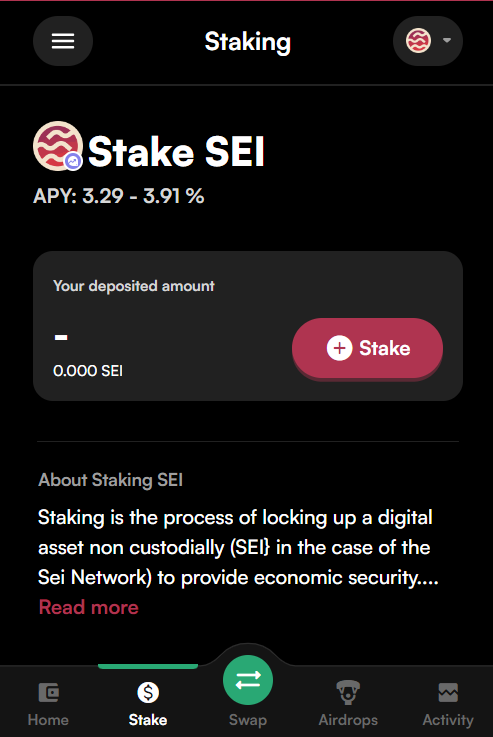

Next, click on the “Stake” tab:

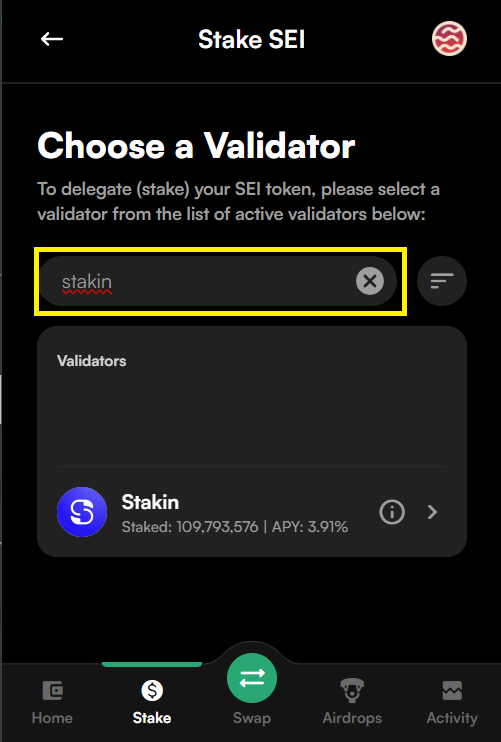

Select Stakin as a validator, by typing in “stakin” in the search validator textbox, as shown below:

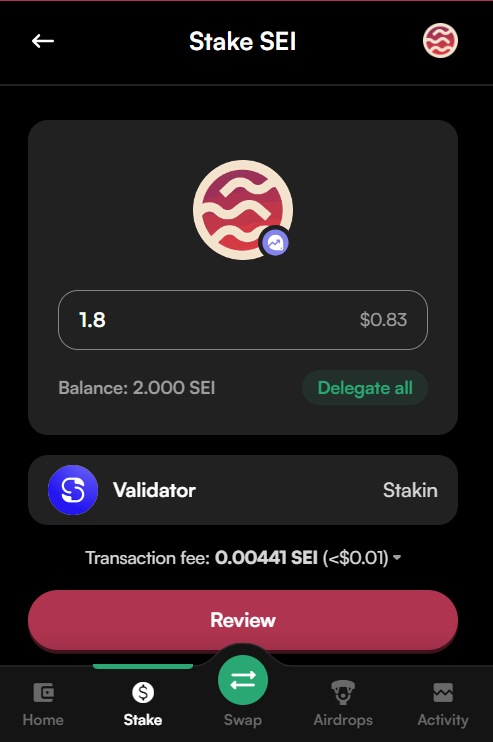

Specify the amount of SEI you wish to stake, then click the “Review” button:

Make sure that details such as the desired staking amount are correct.

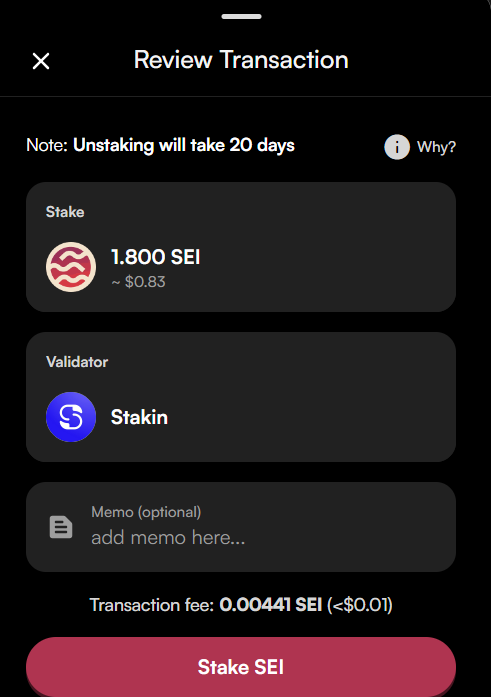

Finally, complete the staking process by clicking on the “Stake SEI” button:

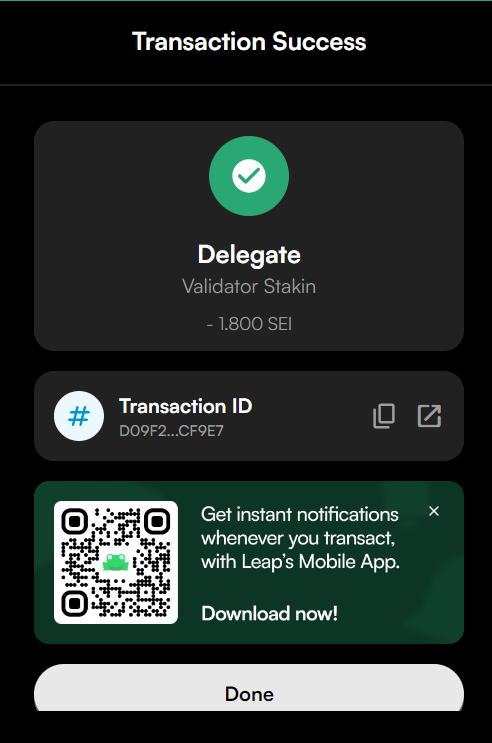

Congratulations - You’ve staked your SEI tokens with Stakin, via Leap Wallet.

If you wish to unstake your SEI tokens, ensure you are located on the main dashboard screen. Then click on the “Stake” button as in the preview above, select your stake, and click the “Unstake” button.

Please remember that on Sei blockchain unstaking takes 20 days, which means your tokens will be liquid after 20 days.

Why stake your SEI with Stakin

- Network expertise. Stakin currently supports 20+ Cosmos networks and has been a participant in early Sei Testnet phases, as well as Mainnet genesis participant. As a community contribution, Stakin further provides public RPC nodes and IBC Relayers connecting the IBC ecosystem of networks together and is an active governance participant and voter on all key proposals.

- Enterprise-grade staking services. We distribute our servers across various locations and partner with premier bare metal and cloud providers. We also provide Institutional-grade SLAs with uptime and slashing guarantees.

- You contribute to decentralization. By delegating to Stakin, you contribute to network decentralization by choosing a smaller validator.

Sei staking for institutional investors

As an institutional-grade SEI node operator, Stakin has a full range of staking services and advantages to cater to the needs of enterprises and investors, such as asset managers, company treasuries, exchanges, VCs and hedge funds, wallets, custodians, and liquid staking services:

- Institutional grade SLAs with 99%+ uptime guarantees and slashing guarantees for both the validator and oracle operations

- Integration with custodians, such as Anchorage, Bitgo and also Fireblocks (via raw signing)

- Dedicated Account Manager to answer all your technical and commercial questions

- Information about potential airdrops that you may be eligible for by staking with us so that stakers can maximize your staking yield

- Whitelabel and dedicated nodes with dedicated infrastructure that can be deployed in your preferred region to fit decentralization or compliance need

- 24/7 monitoring and alerting with a private dashboard for dedicated and Whitelabel nodes

DISCLAIMER: This is not financial advice. Staking and cryptocurrency investment involve a certain degree of risk, and there is always the possibility of loss, including the loss of all staked digital assets. Additionally, delegators are at risk of slashing in case of security or liveness faults on some PoS protocols. We advise you to DYOR before choosing a validator.