- Infrastructure regulation matters: MiCA (EU) and GENIUS Act (US) target node operators, validators, sequencers, and rollup operators.

- Enterprises launching stablecoins or L2s must meet high standards for uptime, resilience, and jurisdictional compliance.

- ChainOps-as-a-Service delivers enterprise-grade infrastructure that's secure, compliant, and audit-ready.

- Stakin brings 40+ network experience, ISO 27001 alignment, and dedicated support to regulated blockchain deployments.

As the blockchain industry matures, compliance is no longer just a concern for exchanges and custodians. With new regulations emerging in both the EU and the US, infrastructure providers, including node operators, sequencer operators, validators, and rollup deployers, are increasingly under scrutiny.

At the same time, more and more fintechs, enterprises, and crypto-native companies are launching their own blockchains. From Robinhood Chain to Base by Coinbase, the strategic goal is clear: own the stack, optimize the experience, reduce cost, and unlock new business models.

Among these use cases, stablecoins are rapidly becoming a cornerstone, especially for cross-border payments and remittances. As highlighted in Axelar’s recent analysis, traditional rails for sending money across borders are slow, expensive, and fragmented, in contrast, stablecoins offer faster, cheaper, and more transparent alternatives.

To support next-generation use cases like global payments, enterprise treasuries, or sovereign stablecoins, infrastructure must meet regulatory-grade requirements, provide high availability, and integrate across chains, regions, and compliance frameworks.

This is where specialized infrastructure partners like Stakin come in, managing the full operational lifecycle of custom blockchains through ChainOps-as-a-Service.

Europe: MiCA and Operational Oversight

The MiCA regulation, which took effect in June 2024 and will be fully implemented in 2025, is Europe’s most comprehensive crypto framework to date. While often associated with stablecoins and token issuers, it also has significant implications for infrastructure service providers.

- Operational resilience is a legal requirement: infrastructure providers must implement robust business continuity and disaster recovery plans.

- Governance & accountability: entities running core infrastructure (like sequencers or validators on private chains) must have clear organizational structures and internal controls.

- Geographical oversight: European institutions may require infrastructure to be operated within the EU or by providers that comply with EU laws.

- Third-party risk must be managed: builders must vet and document their infrastructure partners' reliability, including SLAs and auditability.

Under MiCA, decentralized infrastructure has become a formal part of the compliance strategy for any organization deploying chains that touch the EU market.

United States: The GENIUS Act sets a Federal Stablecoin Standard

In the U.S., regulation of digital assets has often been fragmented, but the GENIUS Act, signed into law in July 2025, marks a major shift toward regulatory clarity. While its primary focus is on stablecoin oversight, it sends a strong signal on the importance of blockchain infrastructure in financial markets.

The Act establishes a federal framework for USD-backed stablecoins, requiring full 1:1 reserves in liquid assets like cash and U.S. Treasuries, alongside mandatory monthly disclosures. It enforces Bank Secrecy Act compliance, mandates anti-illicit finance controls, and introduces mechanisms for token freezing and seizure under lawful orders.

Beyond stablecoins, the GENIUS Act reinforces the U.S. commitment to blockchain-based financial infrastructure, encouraging public-private coordination on risk mitigation, particularly for critical infrastructure such as sequencers, rollups, and data availability layers. This aligns with a broader policy direction to treat such actors as critical infrastructure providers, especially when tied to digital identity, tokenized finance, or payment systems.

As the U.S. positions itself to lead the next phase of global digital finance, infrastructure providers supporting regulated financial activity are likely to face heightened expectations on uptime, transparency, key management, and operational resilience.

| European Union (MiCA) | United States (GENIUS Act) | |

|---|---|---|

| Status | Introduced in June 2024, implementation in 2025 | Signed into law in July 2025 |

| Focus | Stablecoins, infra providers, enterprise chains | USD-backed stablecoins, financial infrastructure, digital identity, tokenized finance |

| Infra requirements | Resilience, disaster recovery, internal controls | Uptime, node location, key management, and incident response |

| Risk Management | Mandatory SLAs, audit trails, third-party risk checks | Sets higher standards for infrastructure partners serving financial institutions |

What Is ChainOps-as-a-Service?

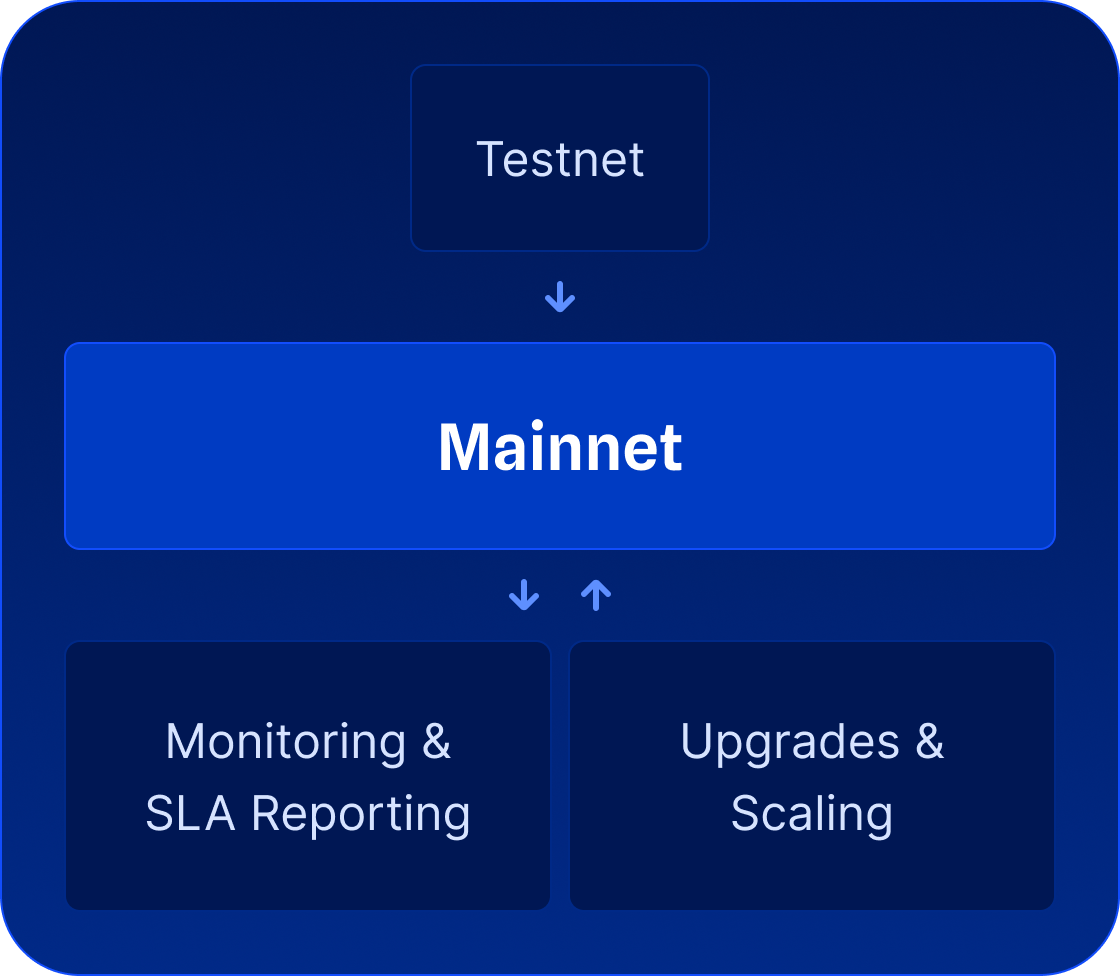

ChainOps-as-a-Service is a secure, compliant, enterprise-ready solution to manage the full lifecycle of your blockchain from testnet to mainnet and beyond.

Whether you're building with Arbitrum Orbit, OP Stack, Polygon CDK, Cosmos SDK, or Celestia, we handle the operational complexity so you can focus on innovation.

At Stakin, we provide the full operational stack:

- High-availability sequencer hosting, with built-in security and regional failover

- 24/7 monitoring and incident response, with real-time observability and automated alerts

- Multi-regional infrastructure setups with jurisdiction-specific deployment options

- Protocol upgrades and hard forks, coordinated seamlessly across environments

- Data availability (DA) integrations with Celestia, EigenDA, Avail, and Ethereum

- Bridge setup and cross-chain message relaying for interoperability

- Validator bootstrapping and decentralization planning for governance alignment

- Performance analytics, SLA tracking, and dashboards to meet compliance and KPI goals

We take care of the infrastructure so you don’t have to build your own DevOps team just to deploy a blockchain.

Why the Right ChainOps Partner Matters

As an infrastructure operator across 40+ Proof of Stake networks, we’re already aligned with global enterprise and regulatory standards:

- ISO 27001-aligned internal security practices

- Multi-region infrastructure with data residency and jurisdiction-aware deployment

- Enterprise SLAs with 99.99% uptime commitments

- Distributed key management and access controls

- Audit-ready operational reports and incident response protocols

Whether you're a financial institution, fintech innovator, or crypto-native team entering regulated markets, we deliver infrastructure that’s not just scalable, but auditable, secure, and built to last.

Get in Touch

ChainOps is the future of enterprise blockchain adoption.

Let us run your infrastructure, so you can focus on building the future.