Hey 👩💻,

We figured it was time to dive into the topic of the Centralization of Stake in PoS. With many different blockchain ecosystems and networks striving for decentralization, we wanted to give you a quick overview of their current centralization status.

🤓 Part 1 — PoS Explained

First things first, let’s start by glancing at what Proof of Stake (PoS) means precisely. For those of you who are more familiar with the concept, scroll down to part two.

When the blockchain was invented, a concept called Proof of Work (PoW) was introduced with it. The first modern blockchain application was submitted in 1996 by Adam Back under the name of “Hashcash”. But the concept became more famous after the introduction of Bitcoin.

PoW is designed as a way to assure the security of the blockchain network. In PoW, in a process called mining, the creation of the next block is attributed to the one solving a very complex computer equation. The more computing power one has, the higher the chances to solve this equation. Because thousands of nodes compete with computing power for the next block, it becomes very expensive to attack the network. This is what secures the network. It’s also a very high-energy consuming process. For instance, Bitcoin mining is estimated to represent 0.3% of global energy consumption. Other blockchain systems, have therefore switched to Proof of Stake.

PoS was first introduced in 2012 by Sunny King; this mechanism elects stakeholders to validate transactions. In PoS, the creator of the next block is chosen through a lottery process. Validators and delegators have to lock tokens in the network. The more tokens you have locked up / staked in the network, the higher the chances of winning the lottery and getting the next block. When the new block is created, tokens are rewarded and added to the network. In PoS, it is the amount of staked tokens that secures the network vs. the computing power in PoW. Attacking the network would mean acquiring a large stake in the network, which would be expensive and wouldn’t make sense to get such a long exposure to attack the network. Thus, it is both secure and energy-efficient.

💡Part 2 — Centralization of Stake in PoS

Now that you know what PoS means, let’s quickly look at centralization and decentralization. In essence, when something is centralized, there’s a single point that does all of the work involved in any given action. This point is also a single point of failure. Decentralization is the exact opposite; there are multiple points that divide all the work and no single point of failure.

An often discussed point on many blockchain forums is that Proof-of-Stake always leads to centralization. The reasoning behind this is simple. The PoS system favors entities with a higher amount of tokens, above those with lower amounts. Meaning, that more substantial stakeholders end up with larger profit margins, and if rationally approached, he would keep his coins to increase the production ability. So a more substantial stakeholder grows faster than a small stakeholder. At a certain point, the cost of being part of the mining operation would start to be too high, causing small stakeholders to drop out, causing centralization.

The more decentralized a network or ecosystem is, the better. If a system is too centralized, it will be too similar to a Web 2.0 Database. Besides that, centralized networks can be manipulated by those who control it — whether this is a cartel or one individual.

- 👉 The rise of crypto exchanges (e.g., Binance, Coinbase, and Huobi) and infrastructure providers such as Bison Trails are a significant risk to the centralization of the stake in PoS. This because infrastructure providers typically operate the same infra for multiple clients, which increases the risk of coordinated/simultaneous downtimes.

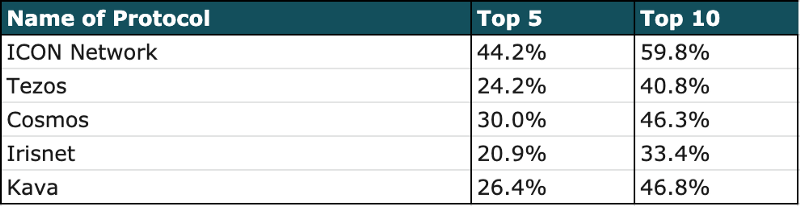

🕵️♂️ Top 10 Concentrations Across Key Protocols

We’ve taken a look at the different concentrations across critical protocols such as Tezos, Cosmos, and ICON.

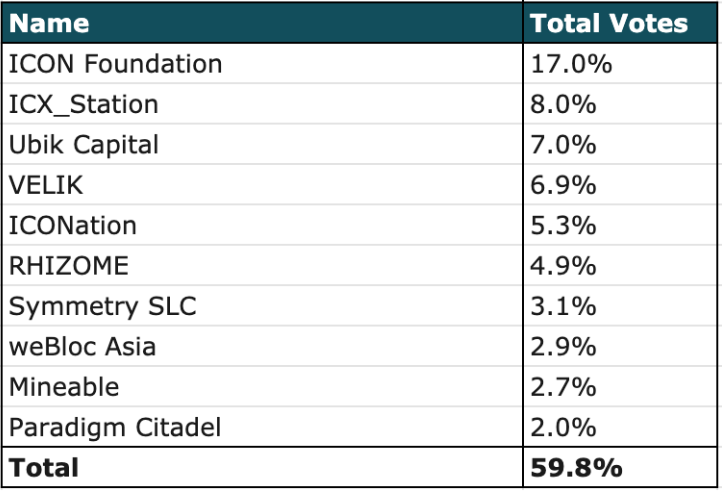

The table below shows the ICON Network’s percentages when it comes to delegation. The current number of P-Reps (validators) of the ICON Network is 100, with an additional 15 candidates listed. The top five validators have a total vote percentage of 44.2%, the top ten a shocking percentage of 59.8%.

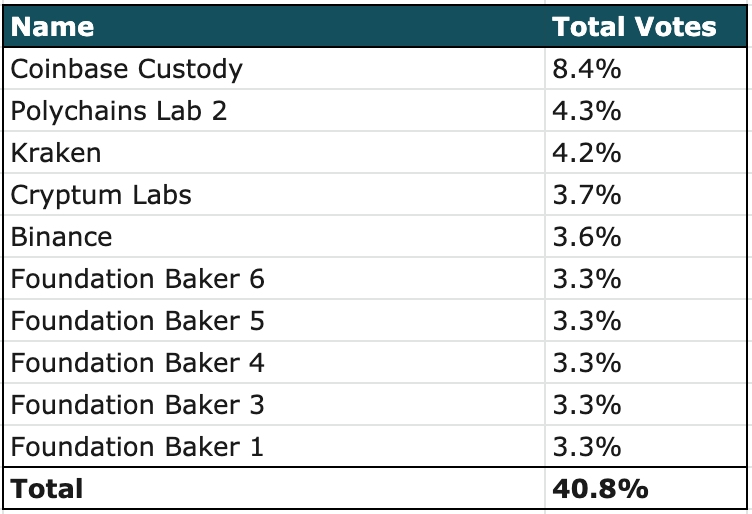

When we take a look at the Tezos ecosystem (see table below), we can see that the top five validators have 24.2% of the voting power, the top ten 40.8%. The Tezos ecosystem currently has 429 active bakers.

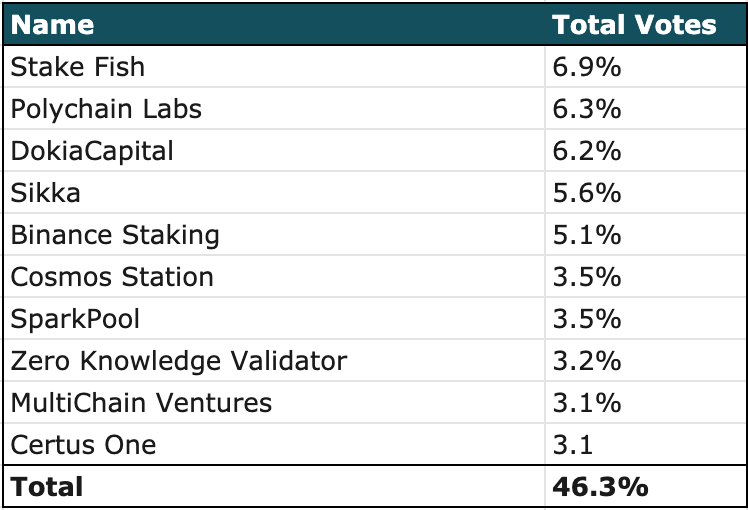

Cosmos’ ecosystem has a voting power delegation of 30% for the top five validators. The top ten have a combined voting power percentage of 46.3%. Cosmos has 125 active bakers, the total number of possible bakers is 245. In such a big ecosystem, one is inclined to say that this is a high risk of centralization.

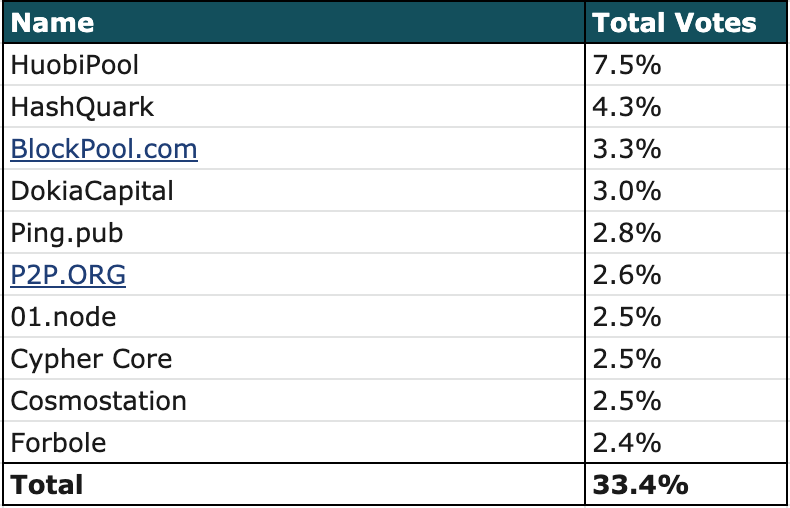

The fourth blockchain network we’ve taken a look at was the Irisnet ecosystem. The Irisnet voting power is at the time of writing at a total of 20.9% for the top five validators, and 33.4% for the top ten. Irisnet has a total of 90 active validators at the time of writing.

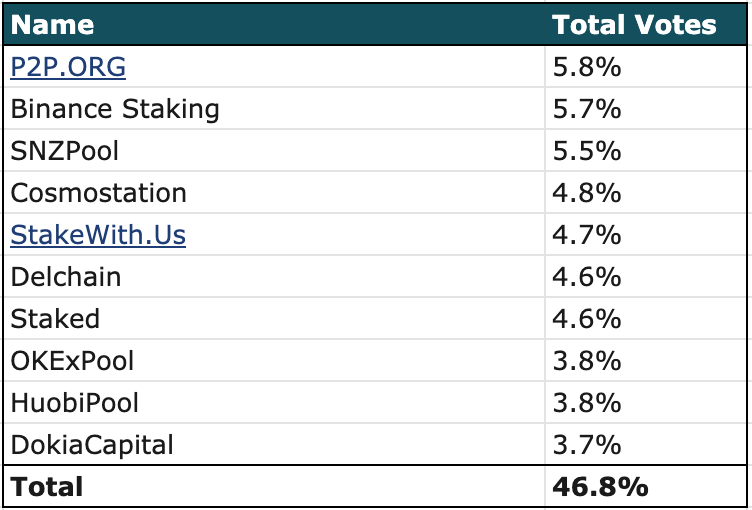

The last blockchain network we analyzed is Kava. The network has 94 active validators. As seen in the table below, Kava’s top five validators have around 26,44% of the voting power. When we take the top ten into account, the percentage rises to 46.8%.

Once we’ve taken a look at these different ecosystems, it is clear why the discussion about PoS Protocols leading to centralization is such a prominent one. If only the top five of a leading network already have more than 20% of the voting power, we could agree to say that decentralization is something to strive for but not yet achieved.

🧐 Irisnet’s decentralization is currently the best, with 33.4% of the voting power in the hands of the top ten validators. The ICON Network, however, has the most work to do, if they strive for decentralization since their top ten validators own almost 60% of the voting power.

More Info & Sources

- ICON Website

- Github Icon Network

- ICON Tracker

- Cosmos Website

- Forum Cosmos

- Cosmos, Kava and Irisnet Tracker

- Tezos Website

- Tezos Tracker

- Irisnet Website

- Github Irisnet

- Kava Website

- Github Kava

DISCLAIMER: This is not financial advice. Staking, delegation, and cryptocurrencies involve a high degree of risk, and there is always the possibility of loss, including the loss of all staked digital assets. Additionally, delegators are at risk of slashing in case of security or liveness faults on some protocols. We advise you to do your due diligence before choosing a validator.