Hi Readers👩💻,

For those of you who aren’t so established in the world of cryptocurrency investing, you might be wondering how it is possible to generate yield with crypto assets. Today, we’d like to discuss how you can potentially create passive income over time — when measured in cryptocurrencies. As a Staking-as-a-Service provider, we believe that staking is one of these opportunities allowing you to earn extra cryptocurrencies passively. While staking can be lucrative, it is essential to note that digital assets are highly volatile instruments, and thus, not suitable for everyone. Therefore, before we get started, I’d like to point out that this article is no means meant as financial advice, and we strongly recommend that you do your research before getting started with staking.

👉 Now, let’s take a quick look as to what we mean when we say “passive income.” In this article, passive income will refer to income that you are not directly involved in. For example, earnings from things such as rental property, partnership, or investment in companies can all be passive incomes.

There are many different ways when it comes to the cryptocurrency market to generate passive incomes potentially. Think about mining, lending assets, running a lightning node, or even affiliate marketing (promoting blockchain networks for a small fee). However, today, we’re focussing on staking crypto assets.

✅ Staking

What is staking exactly? One familiar with PoS blockchains could say that staking is a less resource-intensive substitute for cryptocurrency mining. Often, it involves keeping funds in a wallet and performing different network functions to receive staking rewards. The most common ways to earn these rewards are by voting for validators, governance proposals, etc.

The fact that staked tokens are locked-up contributes to aligning the interests of all stakeholders. In a nutshell, if enough entities have digital assets staked in a network, they all have an interest in keeping that network going and growing. Otherwise, they’ll simply lose the money they’ve invested when they bought these digital assets or used their time to earn through development.

Staking is only possible on Proof-of-Stake consensus algorithms, and while there are many versions of it, typically, staking involves having a wallet and holding the currencies it. It is as easy as that. For more information on the different PoS consensus methods, read our article here.

📈 Crypto compounding

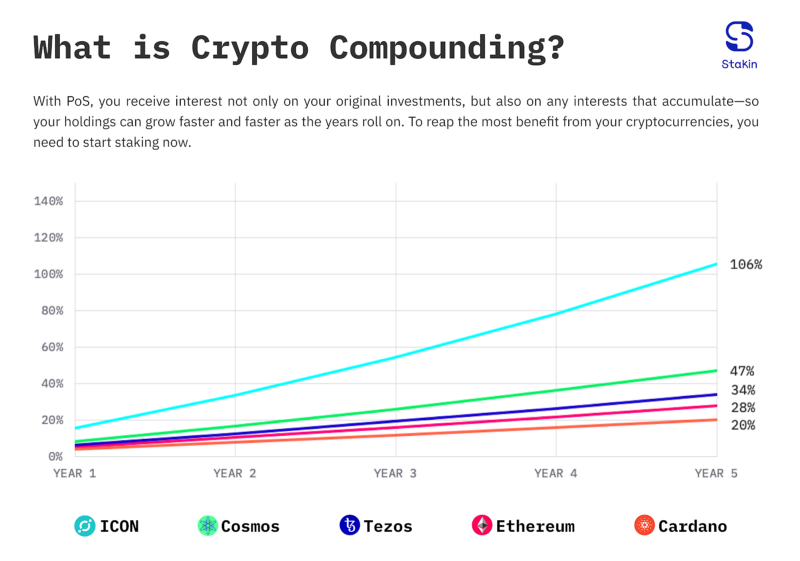

Digital assets offer various opportunities to generate extra incomes despite the volatility of this asset class. Proof-of-Stake (PoS) cryptocurrencies allow you to earn rewards depending on the size of your holdings and the inflation rate of the protocol. As you receive these rewards, you can choose to spend them, or “reinvest” them.

Compounding is the process of reinvesting the earnings of your assets, to generate extra earnings over time. It is traditionally conducted in financial markets, where volatility is lower compared to assets like cryptocurrencies.

Suppose you invest $10,000 into The Super Startup (TSS). In the first year, the shares rise by 25%. Your investment is now worth $12,500. Happy with that good performance, you hold the stock. In the second year, the shares appreciate another 25%. Hence, your $12,500 grows to $15,625. Rather than your shares appreciating an additional $2,500 as they did in the first year, they appreciate an additional $3,125 because the $2,500 you gained in the first year grew by 25% too.

The image below shows how, year after year, your reinvested incomes will progressively add up and allow you to generate higher returns.

🔺 Risks

However, like any financial adventure, staking digital assets doesn’t come without risks. Here are some of the things you should keep in mind when it comes to staking:

- Blockchain networks are still experimental technologies. The blockchain industry isn’t something of many centuries, and years, it is, in essence, still in its infancy stage. Many different blockchain protocols, all with their vision and value propositions, have popped up over the last few years. However, maintaining and growing these networks requires a lot of technical expertise and not to mention patience. Investing in digital assets might not be for everyone until these services evolve to be more mainstream user-friendly and require less technical knowledge.

- Buying low-quality assets. Some networks have artificially inflated and maybe even misleading return rates that can seem almost too good to be true. Some networks adopt a multi-token system where rewards get paid in a second token, which means you’ll have to sell them to earn the right reward token. Secondly, there are just like in any other investment market, no guarantees. You might be investing in a token that starts with a worth of $USD 1 and turns into $USD 1,000, but it might also happen that eventually, your token is only worth $USD 0.00001.

- Lock-up periods are involved in many different PoS blockchain networks. These periods require you to lock up your funds for a certain amount of time, such as 21 days. Doing so makes your holdings effectively less liquid, leaving you somewhat vulnerable in the event of an adverse price impact on your assets.

- Slashing is brought in to place for PoS-type consensus systems. It is vital to establish control within these systems to prevent and punish behavior that could damage a system and its stakeholders. Furthermore, slashing is used to ensure balance within networks as well. So, what is slashing exactly? In a nutshell, slashing is an event in which the validator gives up a specific number of staked assets, that are then burned. Sometimes instead of burning staked tokens, they get distributed equally among stakeholders.

🕵️♂️ Conclusion

Staking is an excellent way to earn passive income, especially if you have the patience and a long-term investment horizon. While staking yourself is likely to cost you a lot of time and computing power, a good alternative is to select a staking service provider of your liking. They can help you stake your digital assets, without you having to worry about maintaining a highly available and secure infrastructure. Of course, there are some risks to keep in mind. Among which, lock-up periods, buying low-quality assets, the maturity of many crypto networks, as well as slashing risks on some protocols. However, using staking as a way to earn passive income, is possible, and, if you’re interested in cryptocurrencies, even fun.

DISCLAIMER — This is not financial advice. Staking, delegation, and cryptocurrencies involve a high degree of risk, and there is always the possibility of loss, including the loss of all staked digital assets. Additionally, delegators are at risk of slashing in case of security or liveness faults on some protocols. We advise you to do your due diligence before choosing a validator.