In the world of blockchain and cryptocurrency, decentralized finance (DeFi) represents one of the most promising use cases this technology has to offer. However, as the DeFi ecosystem continues its expansion toward delivering on that promise, there remain important challenges to be overcome. Chief among these challenges is fragmentation - the isolation of individual, siloed blockchain networks and the decentralized finance-focused tools, platforms, and tokens emerging within them. This fragmentation has long been a stumbling block for users and developers in the DeFi arena, hindering the seamless flow of assets and information across different chains within the larger DeFi ecosystem.

Enter deBridge Finance, a groundbreaking protocol that's not just bridging the gaps in the current decentralized finance ecosystem – it's reimagining the very fabric of inter-blockchain communication.

What is deBridge Finance?

At its core, deBridge Finance is, and always has been, a generic messaging and cross-chain interoperability protocol. But, to truly understand deBridge’s significance, we need to take a closer look at what this really means for the larger DeFi landscape, its users, and the developers looking to build out decentralized finance’s promising future.

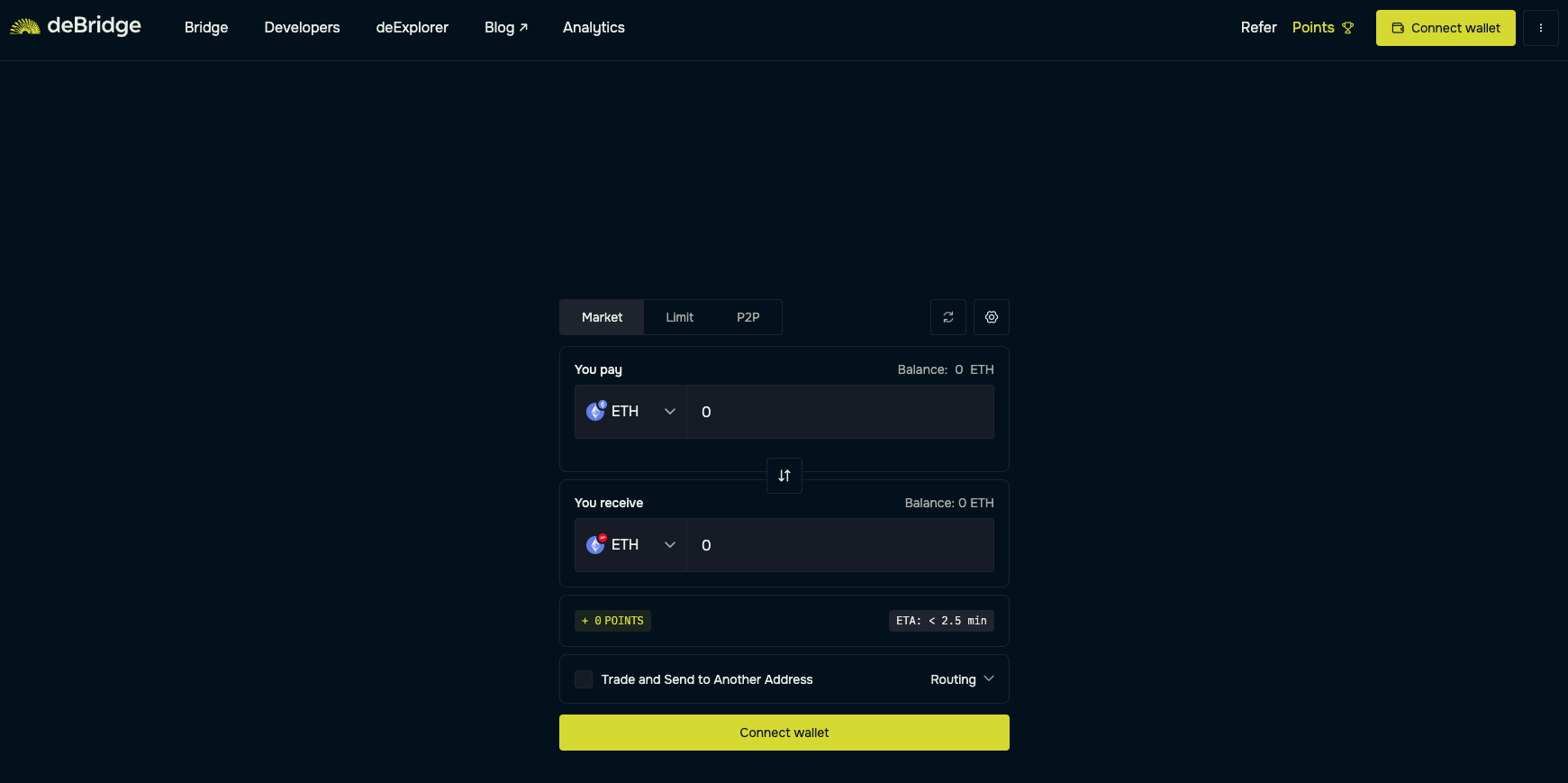

deBridge enables the decentralized transfer of both arbitrary data and assets between multiple blockchain networks. These transfers aren’t limited to simple token transfers, though. deBridge was designed to facilitate complex cross-chain interactions between the blockchain ecosystems it supports, opening up new possibilities for decentralized applications (dApps), DeFi protocols, and the developers bringing them to life.

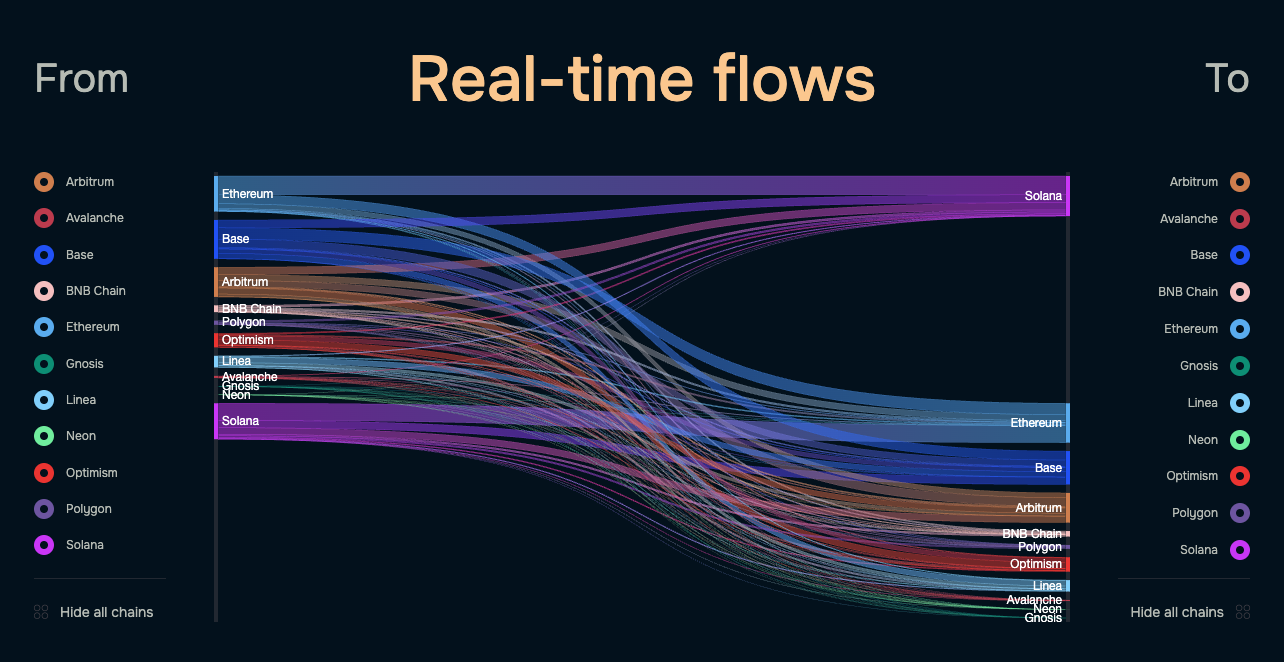

deBridge’s protocol currently supports more than 10 major blockchain networks, including Ethereum, Arbitrum, Avalanche, Solana, Polygon, and Base. This wide range of supported chains positions deBridge as a crucial hub in the growing, complex, and increasingly important web of blockchain interoperability.

The story of deBridge began in the spring of 2021, when it emerged from the Chainlink Global Hackathon. deBridge’s victory at Chainlink was more than just an accolade, however; it was a validation of the increasingly pressing need for robust cross-chain solutions in the blockchain space writ large. Following this initial success, the deBridge team worked tirelessly to transform their concept into a fully-fledged, production-ready protocol. Their efforts bore fruit in early 2022 with the launch of the deBridge Mainnet, marking the beginning of a new era in cross-chain interoperability.

The Problem deBridge Solves

Blockchain networks, for all their revolutionary potential, have traditionally operated as isolated ecosystems. This isolation has led to several significant challenges in the DeFi space, namely:

- Fragmented Liquidity: Assets locked in one blockchain cannot be easily utilized in another, leading to inefficient capital allocation across the DeFi space.

- Limited Interoperability: dApps on one chain cannot easily interact with or leverage the capabilities of protocols on another chain, stifling innovation.

- Complex User Experiences: Users often need to navigate multiple bridges and exchanges to move assets between chains, resulting in a cumbersome and costly process.

- Siloed Data: Important on-chain data and state information remain confined to their native blockchains, limiting the potential for cross-chain applications and services.

- Security Risks: Many existing bridge solutions have been vulnerable to hacks and exploits, eroding user trust in cross-chain operations.

deBridge addresses these challenges by creating a secure, decentralized bridge that not only allows for the transfer of assets but also enables the exchange of arbitrary data between different blockchain networks. This comprehensive approach to interoperability is what sets deBridge apart in the crowded field of blockchain bridge solutions.

How deBridge Works: A Closer Look

The deBridge protocol operates on a two-layer architecture, with each layer playing a crucial role in ensuring secure and efficient cross-chain interactions. This dual-layer system consists of deBridge’s “Protocol Layer” and its “Infrastructure Layer”.

The Protocol Layer forms the on-chain backbone of deBridge. It consists of smart contracts deployed across all supported blockchain networks. These contracts are responsible for asset management, handling the locking and unlocking of assets on the source chain, as well as the minting and burning of corresponding assets on the destination chain. They also manage cross-chain transaction routing, ensuring that transactions are correctly routed between chains and maintaining the integrity of cross-chain operations. Additionally, this layer is responsible for transaction validation, verifying the validity of cross-chain transactions through a consensus mechanism involving multiple validators. Lastly, it handles governance execution, implementing protocol upgrades and parameter changes as decided by the governance process.

The Infrastructure Layer, on the other hand, represents the off-chain component of deBridge. It consists of a network of independent validators who play a crucial role in the protocol's operation. These validators run deBridge nodes alongside full nodes of all supported blockchains, ensuring real-time monitoring of on-chain events. They are also responsible for transaction signing, where each cross-chain transaction is assigned a unique identifier, which validators must sign with their private keys. The signed transaction data is then stored on the InterPlanetary File System (IPFS), a decentralized storage network, ensuring transparency and accessibility.

This dual-layer architecture ensures that deBridge remains both decentralized and secure, with no single point of failure. It allows for the seamless execution of cross-chain operations while maintaining the highest standards of security and reliability.

Key Features and Developments

deBridge's functionality - as it exists today - extends far beyond simple asset transfers. Here are some of its additional key features and innovations:

- Cross-Chain Asset Transfers:

- Lock-and-mint mechanism for seamless asset transfers

- 1:1 parity maintained between locked and minted assets

- Prevents inflation and maintains economic stability

- deBridge Hooks:

- Real-time, trustless data transfers between blockchains

- Reduces cross-chain messaging delay from 15 minutes to near-instantaneous

- Enables complex, multi-step operations across different chains in a single transaction

- Ecosystem Integration:

- Integration with Solflare Wallet for seamless user interactions

- Collaboration with Zeta Markets, showcasing potential in cross-chain derivatives

- Security and Reliability:

- Zero security incidents or downtime since mainnet launch

- Rigorous validator selection and consensus mechanism

These features collectively position deBridge as a comprehensive solution for the challenges of cross-chain interoperability in the DeFi space.

The deBridge Token (DBR): Powering Decentralized Governance

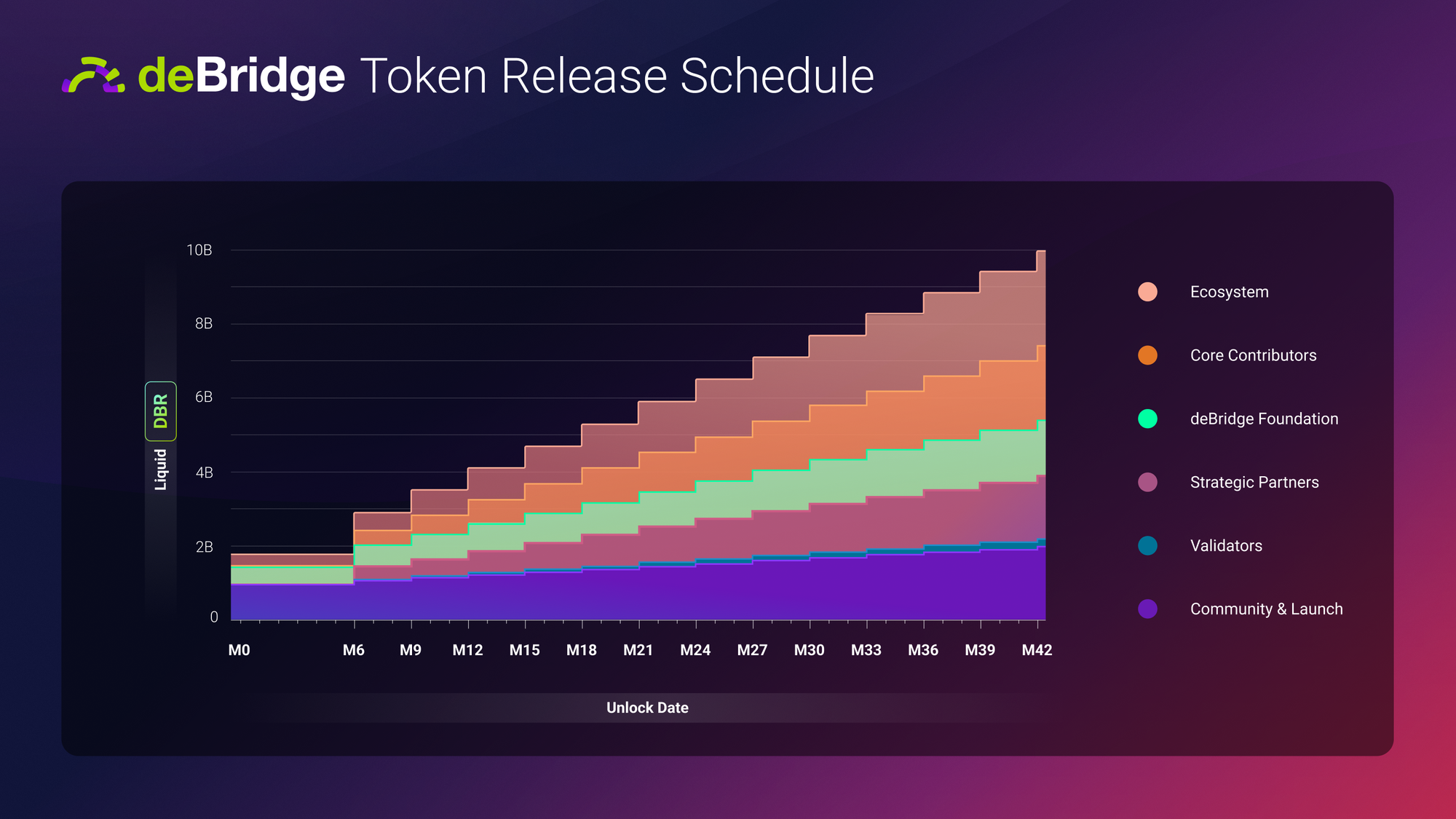

As deBridge moves towards greater decentralization, the introduction of its native token, DBR, marks a significant milestone. Launching on October 17th, 2024, DBR plays a pivotal role in the protocol's governance and economic model.

DBR is not just a speculative asset; it's a crucial component of the deBridge ecosystem. Token holders are able to participate in deBridge governance, voting on key protocol decisions ranging from parameter adjustments to major upgrades. Users can also stake DBR to support network validators, enhancing the protocol's security and decentralization. Additionally, holding DBR may offer users discounts on cross-chain transaction fees, incentivizing long-term engagement with the protocol.

The total supply of DBR is capped at 10 billion tokens, with an initial circulating supply of 1.8 billion. The distribution strategy is designed to ensure a balance of interests across different stakeholder groups:

- 20% for Community & Launch: Rewarding early adopters and supporting initial liquidity

- 26% for Ecosystem Development: Funding grants, partnerships, and long-term growth initiatives

- 20% for Core Contributors: Incentivizing the team behind deBridge's development

- 17% for Strategic Partners: Aligning interests with key ecosystem players

- 15% for the deBridge Foundation: Supporting ongoing research and development

- 2% for Validators: Rewarding the backbone of the deBridge network

This balanced distribution aims to create a robust, decentralized ecosystem from day one.

The Road Ahead: deBridge's Vision for the Future

With the launch of DBR and the transition toward DAO governance, deBridge is poised to enter an exciting new phase of growth and innovation. The project's overarching vision is to create a "liquid Internet" for DeFi – a seamless, interconnected ecosystem where assets and information flow freely across blockchain boundaries.

The newly established deBridge Foundation will play a crucial role in this next phase. It will be responsible for ecosystem grants, funding innovative projects built on deBridge infrastructure. The Foundation will also spearhead research initiatives, exploring new frontiers in cross-chain technology and DeFi applications. Additionally, it will focus on community building, fostering a global community of developers, users, and DeFi enthusiasts.

Since its mainnet launch, deBridge has demonstrated impressive traction, underlining its growing importance in the DeFi landscape. The protocol has settled over $2.35 billion in transaction volume, attracted 385,000 unique users, and maintained a perfect record of zero security incidents or downtime. These metrics highlight not only deBridge's reliability but also its rapid adoption and the strong demand for efficient cross-chain solutions in the DeFi space.

Final Thoughts

deBridge Finance represents more than just another DeFi protocol; it's a fundamental infrastructure layer that's reshaping the very nature of blockchain interaction in the DeFi space. By enabling seamless cross-chain communication, deBridge is breaking down the silos that have historically constrained the potential of decentralized finance.

As the blockchain ecosystem continues to expand and diversify, the need for robust, secure, and efficient cross-chain solutions will only grow. With its strong technical foundation, innovative features like deBridge Hooks, and a clear vision for community-driven development, deBridge is well-positioned to claim a crucial place at the forefront of this ongoing evolution.

We stand on the threshold of a new and important era for decentralized finance, and one thing is clear: the bridges we build today will shape the decentralized landscapes of tomorrow. And in this endeavor, deBridge Finance appears poised to lead the way, one cross-chain transaction at a time.

DISCLAIMER: This is not financial advice. Staking, delegation, and cryptocurrencies involve a high degree of risk, and there is always the possibility of loss, including the failure of all staked digital assets. Additionally, delegators are at risk of slashing in case of security or liveness faults on some protocols. We advise you to do your due diligence before choosing a validator.