Today we take a deep dive into UX (formerly, Umee), a cross-chain DeFi Hub that lets you collateralize assets on one blockchain, so you can borrow them on another blockchain. Users can utilize assets as collateral for lending across different blockchains. This permissionless platform serves all types of users and projects throughout their DeFi journey.

Built using the Cosmos SDK, UX Chain is interoperable with IBC-compatible chains, including Terra, Secret Network, Osmosis, etc. UX Chain uses the Tendermint BFT (Byzantine Fault Tolerant) consensus mechanism.

As a base-layer DeFi protocol, UX Chain (Umee) plans to provide the necessary means for users and builders to access cross-chain leverage and liquidity. Additionally, UX Chain plans to connect various ecosystems and develop financial products on top of it. UX incorporates tools like layer two scaling solutions, side-chain architectures, tools from the roll-ups ecosystem, and alternative base layer protocols for connecting between blockchain networks. Furthermore, the DeFi hub offers a space to experiment with interest-rate instruments and other new financial initiatives that act as a foundational infrastructure for the ever-evolving crypto market.

UX Chain is a Proof-of-Stake network with decentralized governance, and its native asset is called $UX (Umee). The asset exists as a Cosmos SDK chain asset and an ERC20 token for the Ethereum-based chains.

A key distinguishing feature of UX is the ability to collateralize staked assets for borrowing across blockchains, as users will have a choice to continue earning stakes when engaging in DeFi (Cool, isn’t it?).

Here’s how it works, you stake ATOM onto the Cosmos network; meanwhile, you earn block rewards from your staked assets. You can utilize your staked ATOM as collateral to borrow USDC on the Ethereum blockchain. Then you can use that USDC for DeFi on Ethereum or use it to buy more ATOM or ETH.

Another cool feature is that UX lets you pay the interest from borrowed assets using your staking rewards. So if your staking rewards are enough, you might be able to pay 0% interest on what you have borrowed.

uToken and token

UX takes the Proof-of-Stake mechanism into a vital feature of its borrowing and lending protocol design. It does this by implementing the use of two collateral tokens: the uToken and meToken. meTokens represent staked positions participating in a consensus of another blockchain. These can be used as collateral by UX to take a loan position on any other chain.

The meToken allows the transition from staking to borrowing; it lets you pay down interest payments from lending. This token system allows UX's Lending and borrowing function to achieve the best possible capital efficiency and yield generation while contributing to the Proof-of-Stake blockchain’s security.

Minted uTokens can be used as collateral to borrow assets on another blockchain. For example, if You use ETH as collateral; you will get uETH in return. The Gravity Bridge is an essential part of the operation of UX (Umee); it allows asset transfers between the Cosmos ecosystems and Ethereum. ERC 20 tokens will be able to participate in Cosmos-based networks, and Cosmos SDK-based tokens will exist as native ERC20s to participate in Ethereum DeFi. UX lets you convert your Native UX Tokens to Their ERC-20 form and vice versa.

Users can withdraw their staking rewards whenever they choose. Users must start the unbonding process; days will vary based on the token (usually takes 14 days to 28 days).

The UX (Umee) Web App

Remember that the UX token exists in two forms: the native UX token, native to the UX blockchain, and the ERC-20 UX token, native to Ethereum.

It would be best if you had the UX native token or convert your ERC 20 $UX into Native UX to participate in the PoS network or earn rewards for staking or paying for gas in the UX network,

Suppose you want to use your Native UX on Ethereum. In that case, you must use the app to convert your native UX to their ERC20 representation on ETH. All done using UX's web app here.

IBC, Gravity Bridge, and Peggo

The Inter-Blockchain Communication Protocol (IBC) allows different sovereign blockchains like UX to communicate with one another and thus supports the transfer of data and tokens between various networks in a decentralized manner. For example, UX and OSMO, ATOM, or any other IBC chain token can be deposited or withdrawn between UX and their respective blockchains.

Quick note, all lending, and borrowing features currently take place on Ethereum. Moreover, when you transfer your assets to Ethereum, it can take several minutes, hours, or days, depending on the number of transactions sent to Ethereum and gas prices. These transactions are sent in batches to ETH, so single users can avoid high fees on Ethereum.

Gravity Bridge is a bridge that allows assets to be moved between chains like Cosmos and Ethereum, using Proof of Stake consensus powered by a network of decentralized validators. The Gravity Bridge is engineered to be as secure as the Cosmos Hub while allowing transfers between the ecosystems. Thanks to Gravity Bridge, ERC 20 tokens can participate in Cosmos-based networks. Cosmos SDK-based tokens can exist as ERC20s to participate in Ethereum DeFi.

Peggo acts as a relayer between a Cosmos and Ethereum chain and is responsible for relaying transactions between the two chains and updating the Gravity Bridge contract on Ethereum with the latest updates that happen on the Cosmos side.

Fun fact: The name UX comes from the Japanese word “Umi”, which translates to the ocean. They use this water analogy to refer to the vision that transactions can happen without being restricted to specific systems.

Tokenomics of $UX (Umee)

The $UX token is used in various parts of the network; validators use them to secure the Proof-of-Stake network. Users can delegate their tokens to their preferred validator to secure the underlying network. $UMEE is also used to pay for network fees and gives you the right to participate in the governance of the protocol. Some governance proposals extend to define DeFi parameters of applications that sit on top of UX Chain, community grants, and future development.

The token economics goes like this: there is a total supply of 10 billion UX tokens, uncapped, which means the cap of tokens is not defined yet. It has a dynamic inflation and deflation mechanism based on the amount of staking rate. For example, if the network has more than the targeted staking rate, the inflation rate will decrease gradually until it reaches 7%; conversely, if the network has less staked, the inflation rate will increase gradually until it reaches 14%.

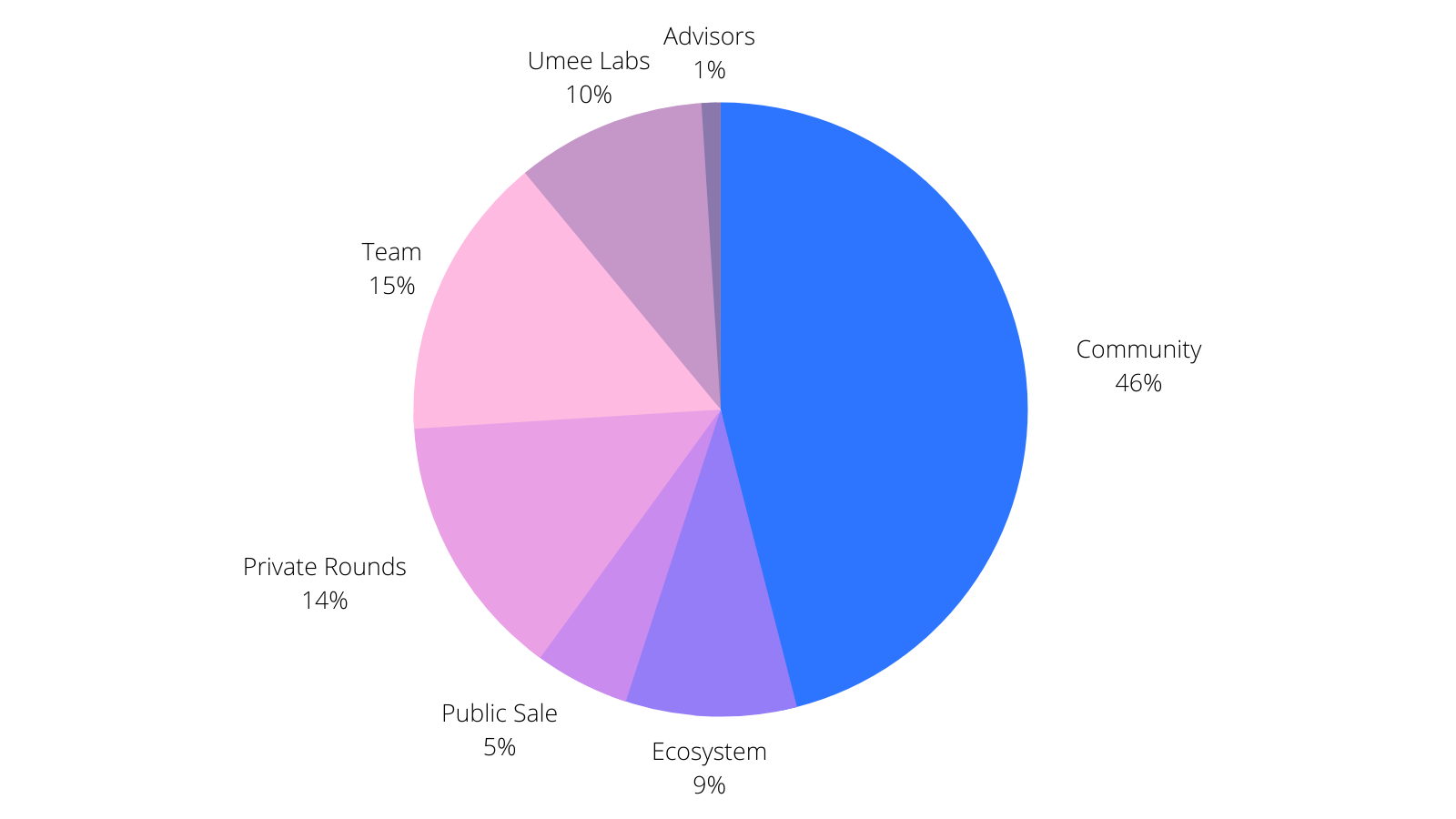

Look at the token distribution below, taken from UX's official documentation here.

As you can see in the image above, the token distribution for $UX is as follows:

- 46% of Genesis Supply is reserved for the community; how and when these tokens are distributed is decided via governance voting.

- 9% of Genesis Supply is for Ecosystem maintenance; the UX community will decide how these tokens are distributed to developers to further build on top of the UX blockchain via governance voting.

- 5% of the supply went to Public Sales, Private Sales had 14% reserved for it, respectively.

- 15% is for the UX Team.

- 10% is reserved for UX Labs.

- Finally, an additional 1% is reserved for any advisors of the UX project.

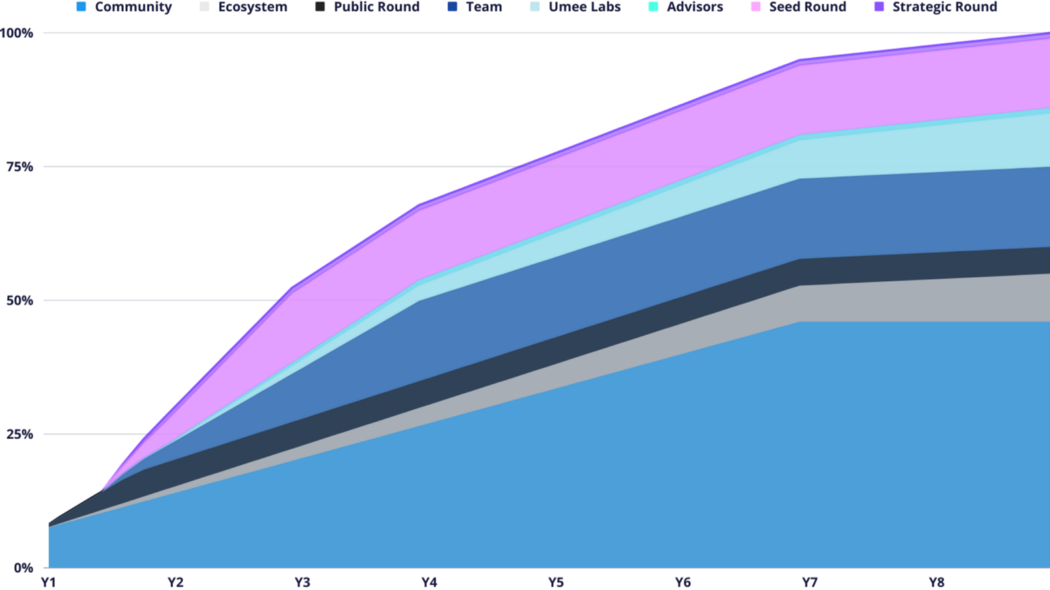

The $UX Token Release Schedule

UX token release schedule will unfold in an 8-year window. The tokens distributed to the team, community, ecosystem, and public and private sales even have a vesting period. The period ranges between six months and up to eighty-four months, which translates into a commitment from the team to further develop the platform to its full potential.

Please note: all lending, and borrowing features currently take place on Ethereum. Furthermore, when you transfer your assets to Ethereum, it can take several minutes, hours, or days, depending on the number of transactions sent to Ethereum and gas prices. These transactions are sent in batches to ETH, so single users can avoid high fees on Ethereum. In order not to wait for long hours or days you should choose high fee while converting your native $UX tokens to ERC 20 UX or vice versa.

In conclusion

UX is set to help users and builders experience the real power of cross-chain DeFi; with its rules, Team, and committed community, a bright future lies ahead. Institutions and retailers will be able to take advantage of this platform and use their assets without selling them.

The goal of the UX team is to attract and collaborate with the best talents and groups around the globe. A portion of the team tokens is set aside for ongoing grants to support the development of UX. The platform has a Collateral Management Protocol to keep track of the collateral affiliated with borrower positions and ensure that the loan-to-value ratios are sufficient. The idea behind UX is to become a hub that offers a space for experimenting with interest-rate instruments and other new financial initiatives.

For the rest of 2022, we can expect UX to continue working on its roadmap and, soon, will have lending and borrowing apps for other networks like Polygon, Solana, and BSC.

If you’d like to learn more about UX, keep an eye on their Twitter. Or join the Stakin Discord Group and ask us all your questions!

DISCLAIMER: This is not financial advice. Staking, delegation, and cryptocurrencies involve a high degree of risk, and there is always the possibility of loss, including the failure of all staked digital assets. Additionally, delegators are at risk of slashing in case of security or liveness faults on some protocols. We advise you to do your due diligence before choosing a validator.