Babylon leverages Bitcoin's security to enhance security on PoS (Proof-of-Stake) blockchains. It was developed by the Stanford Tse Lab and led by David Tse, a reputed professor at Stanford University and advisor of Bain Capital Crypto. Babylon uses Bitcoin for trust and timestamping. Its core mission is to improve the security of other blockchains without compromising their autonomy.

How Babylon Unlocks Bitcoin’s Full Potential for Web3

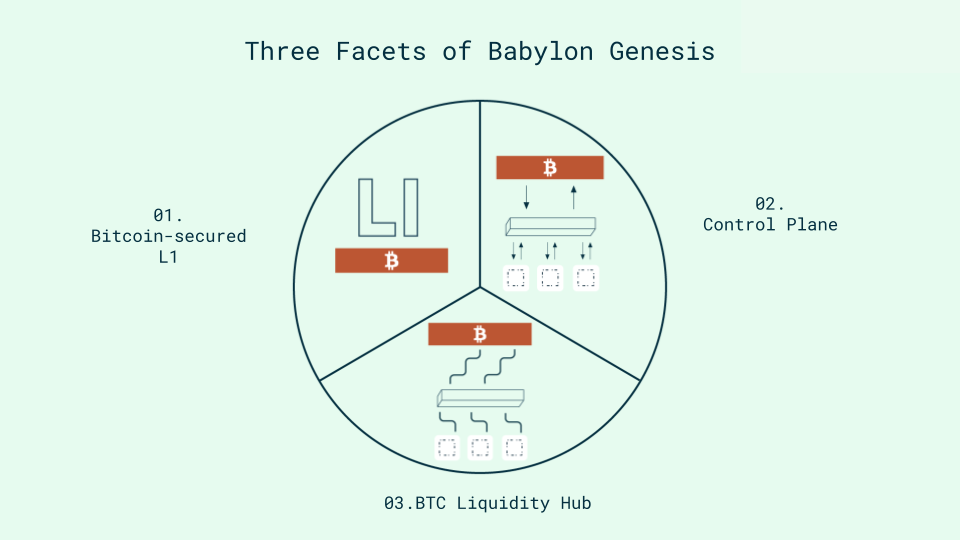

Babylon brings a distinctive value proposition to the Web3 ecosystem by extending Bitcoin´s unmatched economic security to a new generation of decentralized networks. Through its protocol, the vast untapped security potential of Bitcoin can now be shared across multiple Bitcoin-Secured Networks (BSNs), enabling them to inherit Bitcoin´s credibility without compromising their decentralization or flexibility.

Beyond security, Babylon also plays a central role in distributing rewards from BSNs back to BTC stakers. This mechanism not only incentivizes long-term participation but also aligns Bitcoin holders with the growth of the broader Web3 ecosystem. Additionally, Babylon is paving the way for trust-minimized bridges that can unlock liquidity from Liquid Staking Tokens (LSTs), offering a foundation for decentralized finance applications that are secure, composable, and scalable. By reimagining Bitcoin´s role beyond a passive store of value, this protocol enables to become a dynamic force for shared security and cross-chain collaboration.

Babylon’s Vision: Combining PoW and PoS

Babylon aims to combine Bitcoin´s trust-minimized security with the speed and efficiency of PoS chains. To achieve this, it leverages two core mechanisms:

- Bitcoin Timestamping: Succinct and verifiable timestamps of PoS chains and verifiable timestamps of PoS chains are recorded on Bitcoin, helping identify the canonical chain and enhancing censorship resistance. Babylon uses this mechanism to anchor events from other blockchains onto Bitcoin, adding an extra layer of trust and data integrity. By recording these timestamps on Bitcoin´s ledger, Babylon establishes a permanent and tamper-proof link between the two chains. This approach also mitigates risks commonly found in PoS networks, such as long-range attacks and double-signing, by leveraging the robustness of Bitcoin´s consensus model.

- Bitcoin Staking allows BTC holders to trustlessly and without bridges or wrapping stake their assets to secure PoS chains and earn rewards.

What Makes Babylon Different

Designed with a set of advanced features, the protocol serves as a strong foundation for decentralized security and cross-chain interoperability. Its architecture and native integration with Bitcoin introduce capabilities that go beyond traditional blockchain models, offering a scalable and trust-minimized infrastructure.

- Native Bitcoin Integration: Babylon connects directly to the Bitcoin network, enabling trustless staking and timestamping through advanced Bitcoin scripts. This integration ensures secure and efficient participation without the need for intermediaries.

- Innovative Staking Mechanism: Utilizing Extractable One-Time Signatures (EOTS), the protocol introduces a more streamlined and resilient staking system. Participants benefit from a smooth staking experience that balances robustness with performance.

- Multi-Staking Capability: it supports multi-staking, allowing a single BTC stake to simultaneously secure multiple Bitcoin-Secured Networks (BSNs), This model maximizes capital efficiency while supporting scalability across the ecosystem.

- Scaling Transactions: By aggregating timestamps and checkpoints, Babylon significantly reduces Bitcoin's on-chain transaction volume and associated costs. This strategy ensures long-term viability for network participants without compromising integration with the Bitcoin base layer.

- Interoperability via IBC: As a Cosmos-native chain, Babylon fully supports the Inter-Blockchain Communication (IBC) protocol. This allows it to seamlessly interact with other IBC-enabled networks, encouraging cross-chain collaboration and unlocking broader utility within the Web3 ecosystem.

Introducing the BABY Token

As of April 2025, Babylon has officially launched its mainnet, marking a major milestone in its roadmap. With this launch, Babylon introduced the BABY token, which is a utility and governance token designed to reward BTC stakers and secure the Babylon ecosystem.

This launch also marks Babylon´s transition from Phase 1 to Phase 2 of its long-term vision. In the first phase, Bitcoin holders were able to stake BTC using a secure, self-custodian script directly on the Bitcoin network, with over 57,000 BTC staked, signaling strong early community support. Participants earned Babylon Points as a reward for helping secure the protocol.

Now in Phase two, those BTC stakers are actively contributing to the security of Babylon Genesis and are migrating into a new reward system based on the BABY token. This stage also serves as a live implementation of Babylon´s slashing mechanisms and validator incentives, setting the foundation for an expanded ecosystem of Bitcoin-Secured Networks in the future.

You may also be interested in:

- Stakin Commences Validator Operations on Babylon Testnet

- How to Stake BTC with Babylon using Staking Rewards

The BABY Token: Utility and Stakin

The BABY token is the native token of the Babylon Genesis chain and plays a central role in the network´s economic and governance design. It was introduced with the mainnet launch in April 2025, marking the transition to Phase 2 of Babylon´s rollout. BABY is designed to reward participants, secure the chain, and enable decentralized governance, making it a foundational element of the Babylon ecosystem.

BABY has an initial supply of 10 billion tokens, with a 6-decimal denomination ( 1 BABY = 1,000,000 ubbn). The network applies an 8% annual inflation rate, evenly split between BTC staking rewards and BABY staking rewards. This dual incentive model allows both BTC stakers and native BABY stakers to contribute to the protocol and earn ongoing rewards.

In addition to being earned through BTC staking via Finality Providers, BABY tokens can be staked independently. This means users who hold BABY can delegate their tokens to a validator, like Stakin, and begin earning rewards directly on the Babylon chain. One of the standout features of BABY staking is its fast unbonding period: thanks to Babylon´s use of Bitcoin timestamping, stakers can unbond in approximately two days, a significant improvement over the industry standard of 21 days.

Beyond its staking utility, BABY also serves as the token for gas fees and governance. Holders can vote on proposals that influence the future of the protocol, such as parameter changes or ecosystem initiatives. If a holder chooses not to vote directly, their voting power is automatically passed on to their selected validator.

BABY can already be staked using Cosmos-compatible wallets such as Keplr, Leap, and Cosmostation, making it easy for users to participate in network security and governance. As the Babylon ecosystem continues to evolve, BABY is expected to play an increasingly important role in securing its infrastructure and aligning community incentives.

Stakin’s Role in the Babylon Ecosystem

At Stakin, we are proud to support Babylon’s mission to integrate Bitcoin’s security into the broader Proof-of-Stake landscape, and we are actively participating in two key roles: as a Finality Provider for BTC staking and as a Validator for BABY staking.

As a Finality Provider, Stakin contributes to the security and finality of PoS chains by offering trustless BTC staking infrastructure. In Phase 1, this involved helping BTC stakers earn Babylon Points. Now, with the network’s transition to Phase 2, those staking BTC through eligible Finality Providers — including Stakin — will begin earning BABY tokens instead. Only the top 60 Finality Providers by BTC delegation are selected to actively participate in this phase.

In parallel, Stakin operates as a validator on the Babylon Genesis chain, helping to secure the network and support decentralized governance. BABY token holders can delegate their tokens to Stakin and start earning rewards while contributing to the security of the chain.

We’re committed to helping users navigate this ecosystem with confidence. In the coming weeks, we’ll be publishing educational content and step-by-step guides on how to stake BABY tokens and participate in Babylon’s governance through our validator services.

DISCLAIMER: This is not financial advice. Staking, delegation, and cryptocurrencies involve a high degree of risk, and there is always the possibility of loss, including the failure of all staked digital assets. Additionally, delegators are at risk of slashing in case of security or liveness faults on some protocols. We advise you to do your due diligence before choosing a validator.