Hey Readers,

In today’s article, we’re looking at an unbelievably popular protocol amongst the Proof-of-Stake blockchain enthusiasts, and that is the Mina Protocol. If you’re unfamiliar with Mina, please look at our previous article to know all about the protocol.

Now, before we dive into staking your $MINA assets, let’s look at the network’s token economics.

As you might know, Mina is known for being the world’s lightest blockchain. It is a public and decentralized blockchain that anyone in the world can actively or passively participate in. Individuals or businesses can contribute to network security by becoming nodes or block producers. They can contribute to transaction cost reduction by becoming SNARK producers, or they can do both. The MINA token is the Mina blockchain’s native currency, and it is required to participate in block production and purchase SNARK proofs via the Snarketplace.

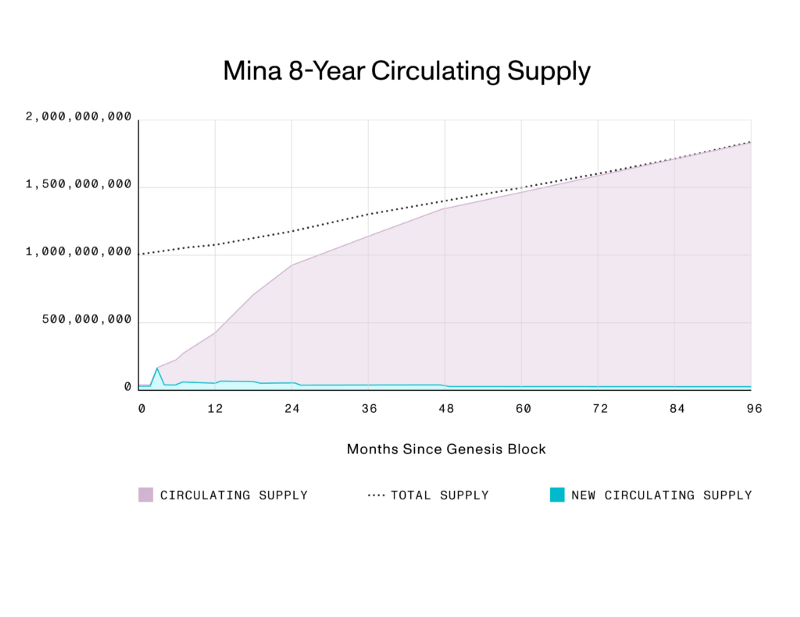

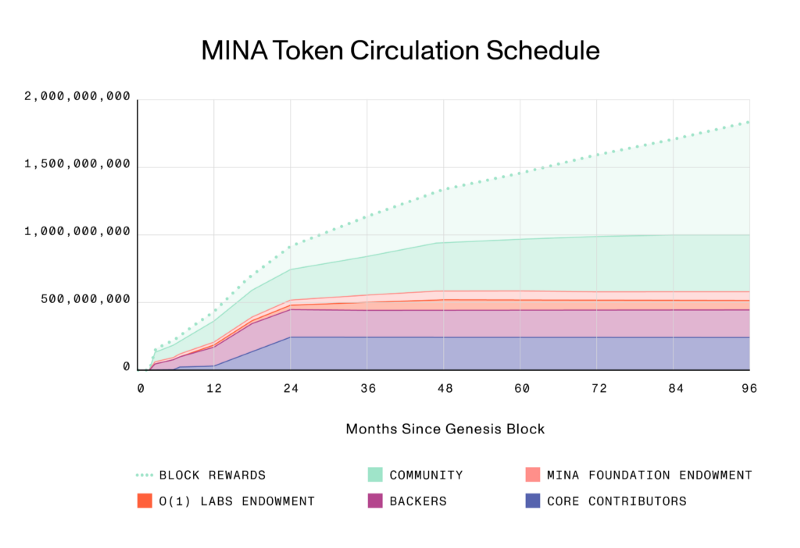

$MINA is an inflationary currency with no supply cap. All token holders can stake or delegate to receive their proportional fraction of the inflation, with no lockup or bonding required to do so. There will be up to 1 billion MINA tokens (excluding future block rewards) distributed at launch, which will fully unlock over eight years. (“Initial Distribution”). And during the first year of mainnet, accounts with lock-ups will receive block rewards to annual target purchase inflation of 12%. The inflation rate will decrease over time, eventually reaching 7% at steady-state.

During the first 15 months of mainnet, unlocked accounts will receive up to double the block rewards that locked accounts receive. This encourages new network participants and unlocked token holders to remain loyal to the ecosystem. The images below are first published by Mina and illustrate the 8-year circulating supply and the token circulation schedule.

Let’s Get To Staking!

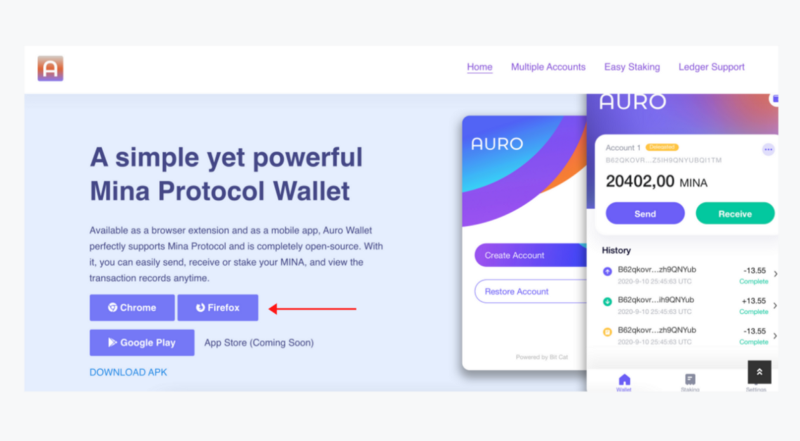

At the time of writing, there are only two wallets that offer Mina staking. The first is clor.io, and the second is https://www.aurowallet.com/. As we at Stakin feel that the Auro Wallet seems more user-friendly, we will be using this wallet for the guide.

The Auro Wallet is available as a browser extension and a mobile app; it supports mina protocol and is entirely open-source. The wallet lets you easily send, receive, and stake your $MINA and view the transaction records at any time.

To get started, visit: https://www.aurowallet.com/ and select the download option of your choice (see image below).

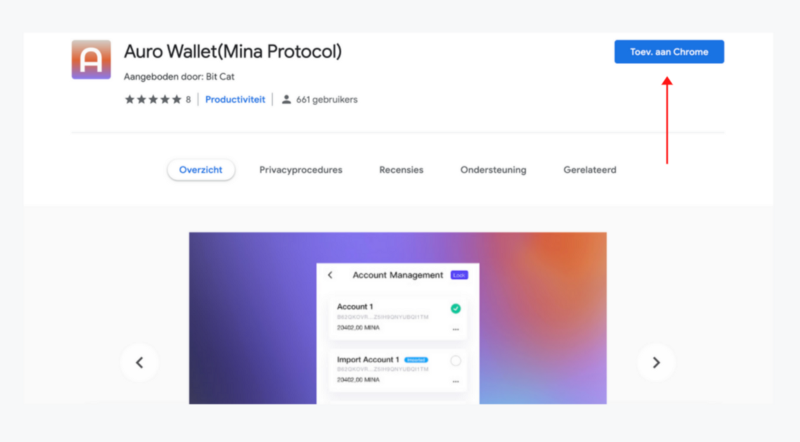

In this case, I use Chrome, and thus, after selecting “Chrome,” the extension app store opens. Select “Add to Chrome” to continue the download of the extension.

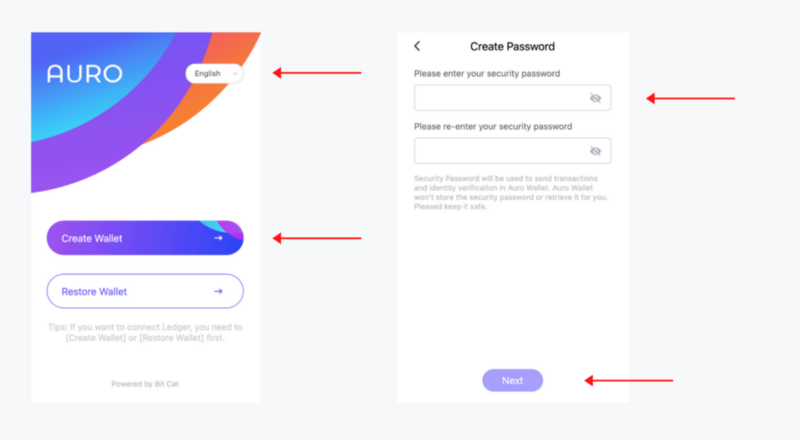

Next, open the extension, select the language of your choice, and press “Create Wallet”. Fill out the password of your choice and select “Next”.

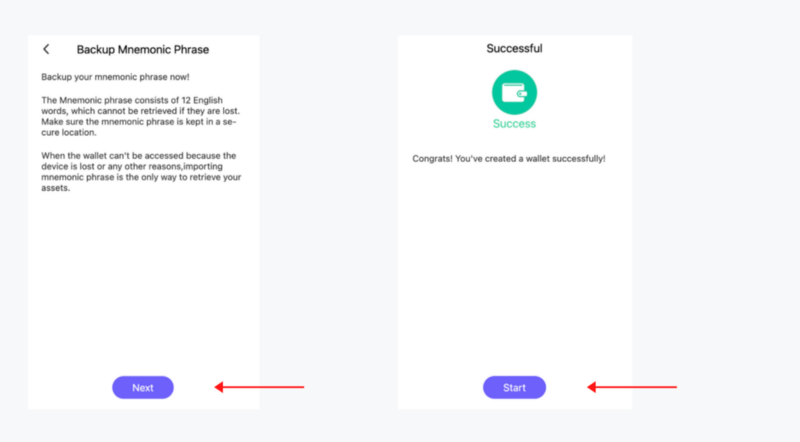

Now, this is where you have to pay attention. You will be asked to write down your mnemonic phrase. Select “Next” to be shown your phrase; make sure that you write it down, preferably in offline storage. Remember that when you lose the phrase, you will no be able to restore your wallet.

After safely writing down your mnemonic phrase, you will be asked to fill it out in the correct order as confirmation. Do so, then select “Next” once again. If successful, you will be shown the right screen below. Select “Start” to go to your newly created wallet.

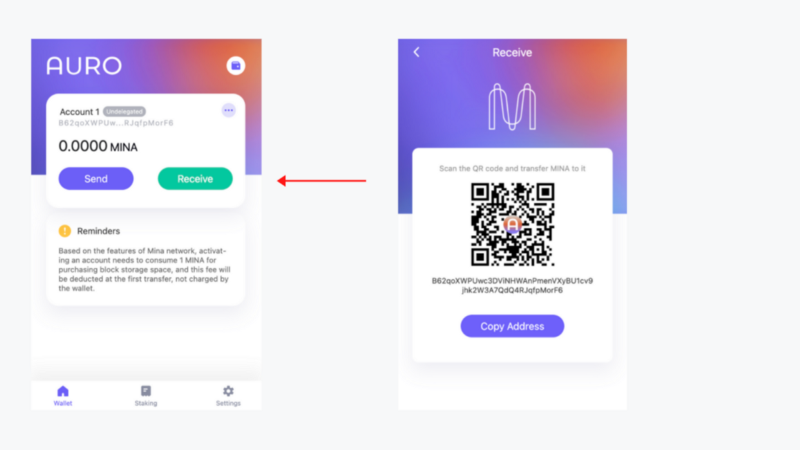

On the dashboard, select “receive” to send $MINA to your wallet address. Copy the public address or scan the QR-code and use this code in your exchange or wallet holding $MINA to send it to your new wallet.

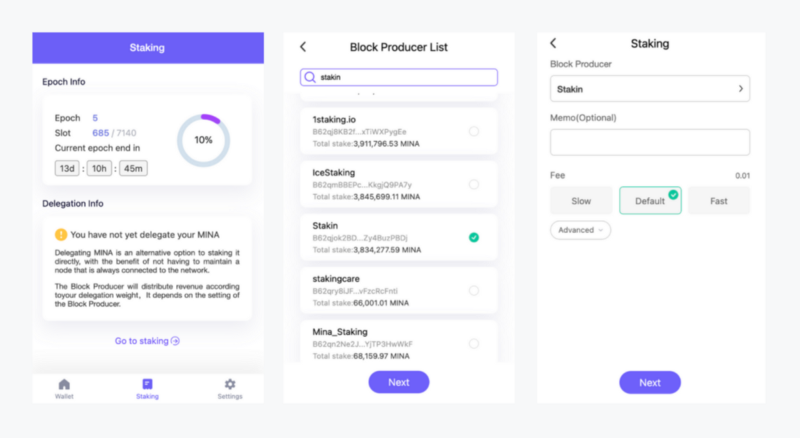

Once you’ve received your $MINA, select “Staking” in the bottom menu of the extension dashboard, a screen like the one illustrated below will show you all the current details of staking on Mina. Select “Go to Staking” to continue.

You will now see the “Block Producer List”. In the list, select the validator of your choice, and then select “Next”. Fill out the fee you’d like to pay and leave a memo if needed. Then, select “Next” once again.

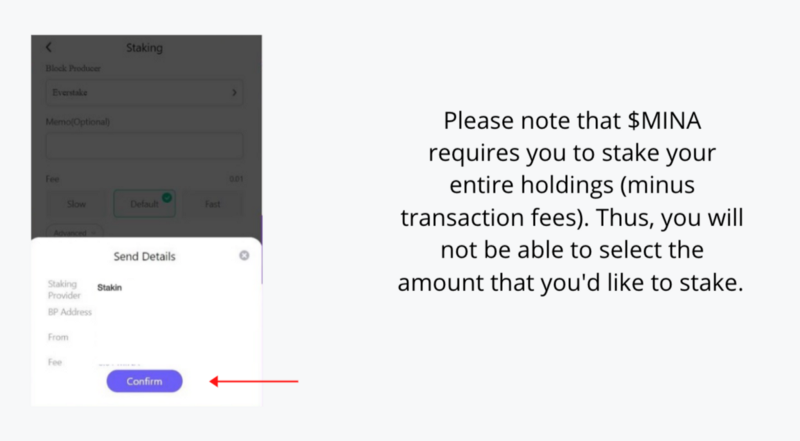

Finally, you will be asked to confirm the transaction (see image below).

And that’s all, folks! You’ve now staked your $MINA! Congrats!

DISCLAIMER: This is not financial advice. Staking, delegation, and cryptocurrencies involve a high degree of risk, and there is always the possibility of loss, including the loss of all staked digital assets. Additionally, delegators are at risk of slashing in case of security or liveness faults on some protocols. We advise you to do your due diligence before choosing a validator.