Hi Readers,

Recently we shared a guide about using the new app of the Balanced Network. Today, we’re having a look at another very popular use for the Balanced App which is yield farming. But before we do that, let’s have a look at what yield farming is.

Yield farming, in a nutshell, is a process that allows digital asset holders to lock up their tokens, which then in turn provides them with rewards. Additionally, this process is specific to the Decentralized Finance or DeFi market, and lets you earn either fixed or variable interest through investing.

If you think about it, yield farming is basically a way to earn a yield on your digital assets using decentralized applications and blockchains. (in Balanced case, the ICON Network). Many protocols incentivize users by giving them extra rewards in the form of their own tokens (in Balanced case, BALN). Depending on the protocols, you can yield farm by borrowing, lending, as well as providing liquidity. Loans that are made via banks using fiat money, need to be paid back with interest rates. With yield farming, the concept is the same, thus digital assets that would otherwise be sitting in an exchange or wallet are lent out via a DeFi protocol (therefore locked into a smart contract) to get a better return.

If you’re still not sure what yield farming is, have a look at the video below for a further explanation.

Keep in mind that, like many other applications in the blockchain, DeFi and yield farming are tools available for use that come with risks and rewards. It is therefore important that you do your own research and determines whether or not a given application is for you. That said, let’s have a look at yield farming with Balanced.

Yield Farming on Balanced

The fastest way to yield farm (or mine liquidity) is by implementing the borrowing and liquidity mining strategy. So, let’s say there is an asset pair on Balanced that doesn’t have that much liquidity but does have a lot of trading activity. This means that you can earn a decent amount of BALN rewards. The current token pairs on Balanced are sICX/bnUSD, BALN/bnUSD and sICX/ICX. Respectively the APY ranges from 30% to 360% at the time of writing.

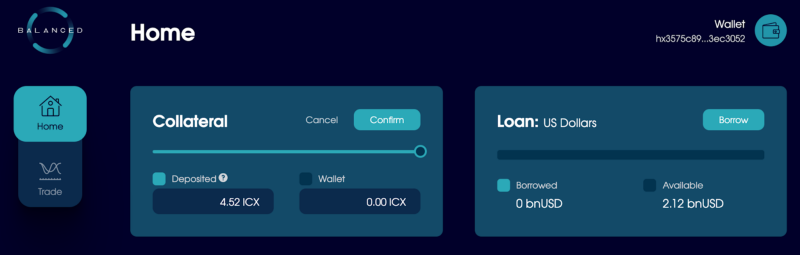

So let’s say you hold ICX. You will need sICX or BALN to provide liquidity, but you’re not that willing to sell your ICX. You then go to the Balanced dashboard and deposit your ICX as collateral and loan bnUSD (see image below).

Now you can use that bnUSD and a portion of your remaining ICX to provide liquidity to one of the pools mentioned above, earning BALN tokens as a reward. And, since you borrowed bnUSD you will also receive bnUSD assets.

Since in order to borrow bnUSD you are paying an interest rate to Balanced. You will need to figure out if the BALN you are earning is enough offset to the rate that you’re paying. Sometimes it might be worth it; other times it might not. It is vital to do your own research before making that decision.

For more information on Balanced or how to use the app, visit our previous article.

If you choose to borrow on Balanced DAO, you should also read about risks including the rebalancing and retirement process as it will affect your position. When borrowing, your loan will be repaid progressively using some of your locked collateral. This video from community member Fez provides helpful tips on how to optimize and monitor your positions for rebalancing.

DISCLAIMER: This is not financial advice. Staking, delegation, and cryptocurrencies involve a high degree of risk, and there is always the possibility of loss, including the loss of all staked digital assets. Additionally, delegators are at risk of slashing in case of security or liveness faults on some protocols. We advise you to do your due diligence before choosing a validator.