Hey Readers👩💻,

We at Stakin have been working with the Kava Labs Network since Testnet #1, and we thought it was time for a quick overview of the network, its goals, and the latest achievements.

🕵️♂️ What is KAVA Labs?

KAVA Labs is the first DeFi platform to have been built on the Cosmos Network. KAVA Labs is developed to take on four different opportunities, as they call it. The first one is that they want to become the first-ever dedicated DeFi platform to offer multi-collateralized loans and stable coins for significant crypto assets. The second goal is to serve the crypto community by being able to offer decentralized leverage and stability to users.

The third KAVA goal was to be the first to market. They obtained this goal when they launched. Their last and final goal is to become the number one DeFi application. But what does that mean? To understand the entire concept, let’s first look at DeFi as a whole.

🔗 DeFi as a Whole

DeFi stands for Decentralized Finance and is, in essence, conventional financial tools built on a blockchain (often the Ethereum Blockchain Network). DeFi works the best on open-source protocols and modular frameworks to create digital assets. They are designed to create advantages of operating on public blockchains, such as better access to financial services. Three services have created the biggest waves in the financial service industry:

- Open Lending Protocols, such as the MakerDAO and BlockFi, are Peer-to-Peer lending services. For the most significant part, they work the same as other, off-chain lending services. The main differences being the removal of intermediaries and a reduction in counterparty risks.

- Stable Coins, this is the most well-known and talked about service. Stable coins are cryptocurrency coins that are pegged to FIAT currencies such as USD or EUR.

- Issuance and Investment Protocols, as the idea of ‘flexible securities’ spreads, platforms such as TokenSets and UMA Protocol might become just as popular as open lending protocols.

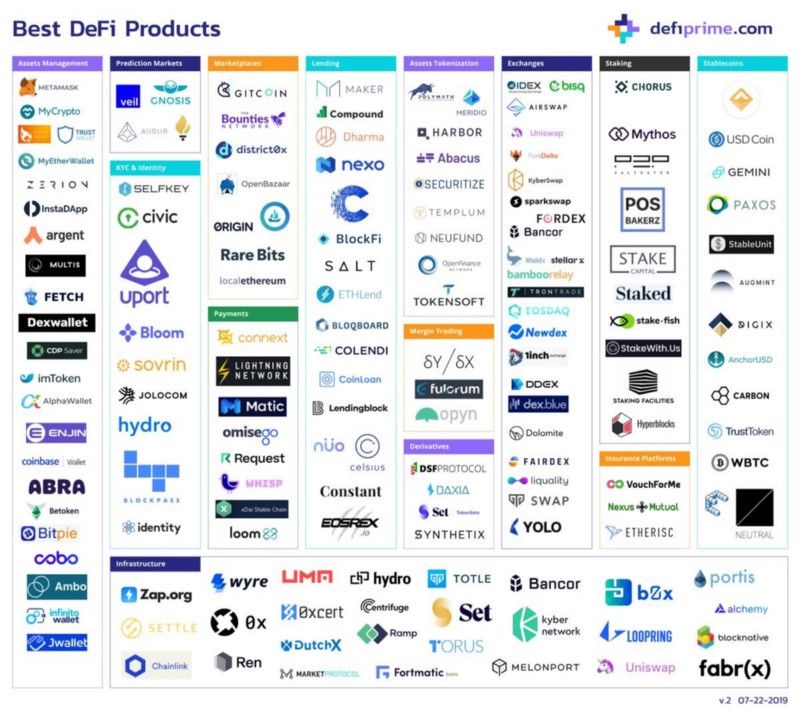

Although these are some of the main categories, DeFi also covers other subsets of the financial industry. For a more thorough view of the DeFi landscape, you can check projects on Defiprime.com.

According to KAVA Labs itself, lending is currently the only DeFi category with significant traction, which is why they decided to focus on this aspect first. The platform offers multi collateral debt positions, accepting most major cryptocurrencies like BTC and ATOM. Furthermore, users can instruct the KAVA network to issue loans to themselves (self-issues loans).

Thirdly, the KAVA network creates a stablecoin when credits are issued, which means that USDX (USD pegged stablecoin) are backed by large-cap digital assets such as BTC and ATOM.

🧐 How KAVA Labs works

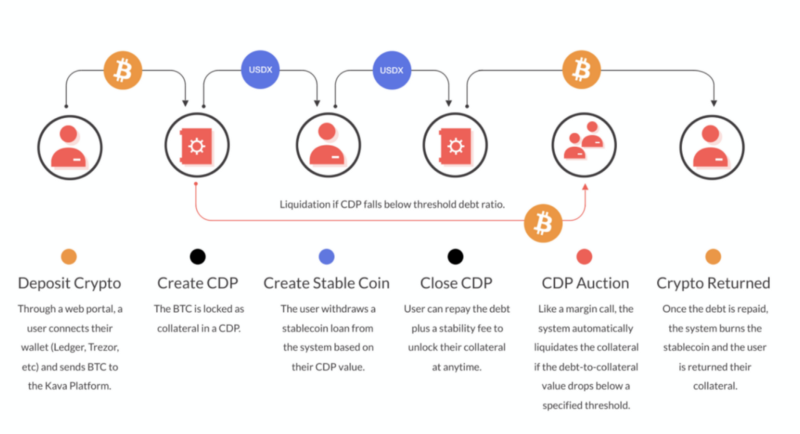

Now, let’s take a look at how the KAVA Lab protocol works. It all starts with depositing crypto, which can be done by connecting your wallet — such as Ledger — and sending the tokens to the KAVA platform. The KAVA tokens are locked as collateral in a CDP, after which a stable coin loan is created.

CDP stands for Collateralized Debt Position.CDPs allow you to lock-up digital assets into a vault and get a loan against the deposited amount. In the case of Kava, locking-up volatile assets in the CDP allows getting a loan in stablecoin in exchange. If you want to unlock these assets, you simply have to pay back the loan. The amount of stable coin that you’ll be able to withdraw from the system depends on the amount locked.

💰 The KAVA token

The KAVA Labs token is called KAVA; the token is a governance and validation token, staked by validators, who vote on blocks and participate in governance.

- The initial KAVA token supply is 102,080,765, of which, at the time of writing, the amount staked is 87,562,677 KAVA (86%).

- Staking rewards — bonded KAVA can earn a variable of 3% — 20% APR depending on the amount staked in the network. Currently, the annual rewards, as noted by Stakingrewards.com, is 9.43%.

All KAVA transactions require fees without exception. At the end of each block, transaction fees are split between validators and delegators according to their weighted stake. Within the KAVA network, it is possible to earn fees from CDP. However, these fees can be burned to reduce the overall amount of KAVA. Furthermore, those who are running validator notes can charge commissions to users that delegate stake to them.

KAVA Governance: holders can vote on proposals to make changes within the blockchain network or the system parameters. Examples are the total amount of USDX that can be issued, the collateral-to-depth ratio for a CDP, and liquidation penalties for when a CDP goes below the required ratio.

👉 Latest Developments

The KAVA Labs team announced an investment of $1.2 million in Venture Capital at the end of February 2020. This funding will go towards continuing the development of the Interledger solutions for blockchain technology.

On February 17th this year, the key generation on KAVA Mainnet changes where announced. What happened is that when starting off, KAVA used the same coin type as the Cosmos Network. At the time, this made sense because it was expected that most Cosmos chains would work similarly to Ethereum coins and DApps. However, this turned out not to be the case and the same coin type actually caused problems with different wallet providers. Therefore, the new coin type 459 was introduced.

Furthermore, in a development update made on March 18th, 2020, the shipping of Kava Testnet 4000 with CDP functionality was mentioned. This milestone will provide a valuable testing ground for improving docs, catching bugs, and getting feedback.

More Information & Sources

DISCLAIMER: This is not financial advice. Staking and cryptocurrencies investment involves a high degree of risk and there is always the possibility of loss, including the loss of all staked digital assets. Additionally, delegators are at risk of slashing in case of security or liveness faults on some PoS protocols. We advise you to DYOR before choosing a validator.