This is a quick and easy guide on staking SEDA with Keplr wallet.

SEDA is a modular data layer that sets a new standard for data transport, access, and querying any data type from any source. SEDA’s approach eliminates the need for native deployment required by Oracles, enabling seamless, chain-agnostic integrations featuring protocol-led data feed configuration and customizable pricing models. Any protocol can access SEDA on a 100% permissionless basis promoting immediate integrations with same-day data access.

Keplr is an open-source web app, mobile application, and browser extension wallet that supports the Cosmos interchain ecosystem.

Step 1 - Set your Keplr wallet account

Ensure you are logged in to your Keplr wallet (this assumes you already have a Keplr wallet account. If you don't have a Keplr wallet account yet, you can download Keplr wallet from keplr.app and then follow this quick and easy tutorial on how to set up your Keplr wallet account).

Step 2 - Fund your Keplr wallet

Before you stake SEDA tokens, you must top up your Keplr wallet. You can purchase your SEDA on any centralized exchange (CEX), such as Binance or Bybit, or swap from another token using a decentralized exchange (DEX), such as Osmosis Swap. In this instance, we recommend topping up your wallet with a centralized exchange.

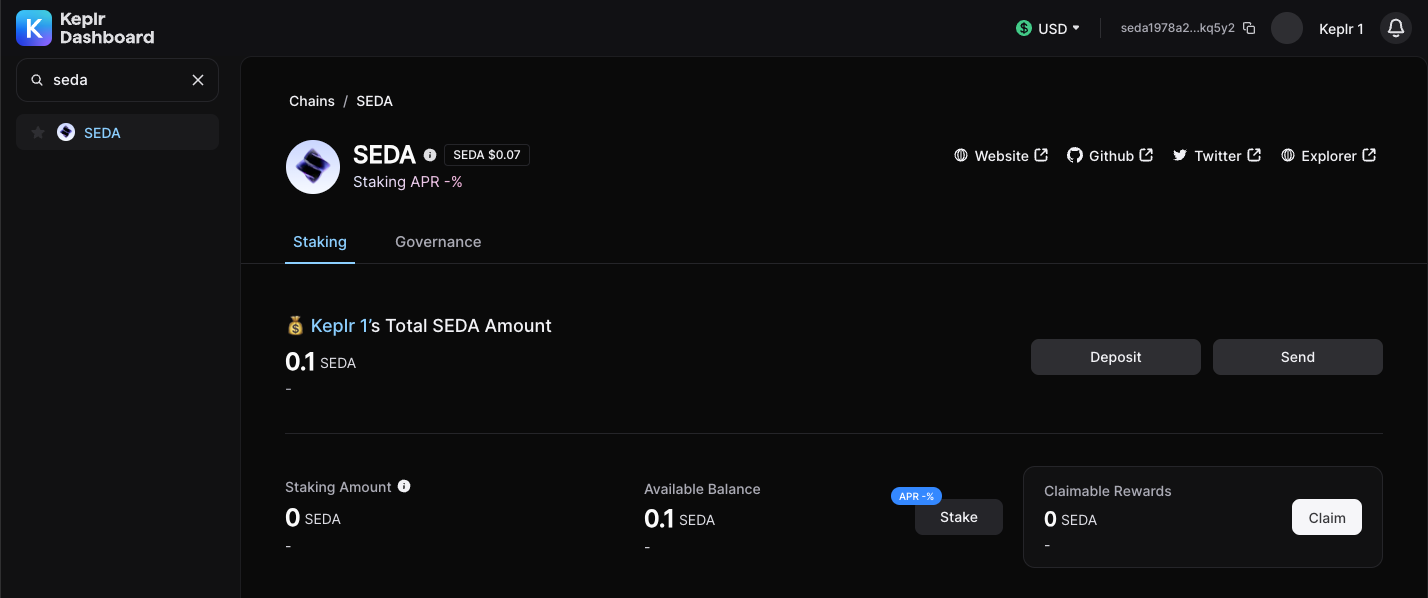

Go to: https://wallet.keplr.app/

Locate SEDA's staking dashboard by typing “SEDA” in the Search Chains textbox in the upper left corner.

Deposit your SEDA tokens from your centralized exchange account to your Keplr wallet by clicking the "Deposit" button under the Stake tab on Keplr's dashboard.

Copy your Keplr wallet address and paste it on Binance (or any other centralized exchange from which you buy your SEDA tokens) to transfer them from Binance to Keplr.

Step 3 - Stake your SEDA tokens

You have connected your Keplr wallet to the SEDA blockchain, then topped up your Keplr wallet with SEDA tokens from a centralized or a decentralized exchange. You are now ready to stake your SEDA.

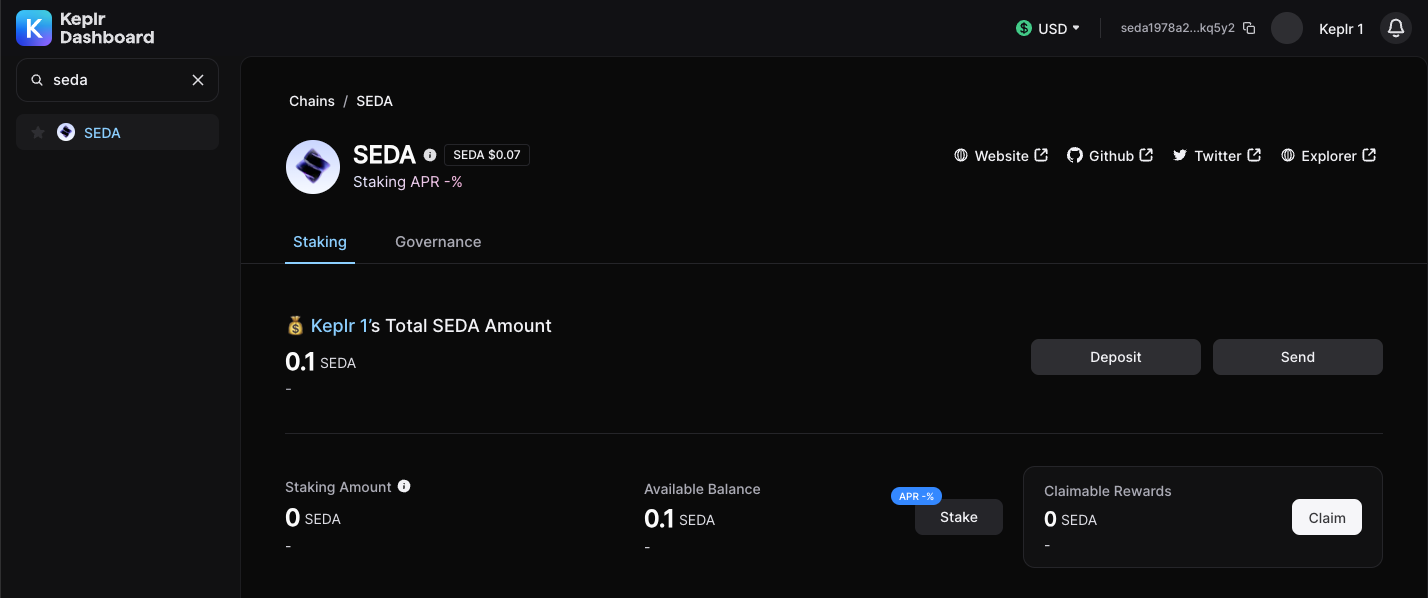

Check if you are still located on https://wallet.keplr.app/

Make sure you are on the SEDA's staking dashboard – you can locate that by typing “SEDA” in the Search Chains textbox in the upper left corner.

To proceed, click the "Stake" button.

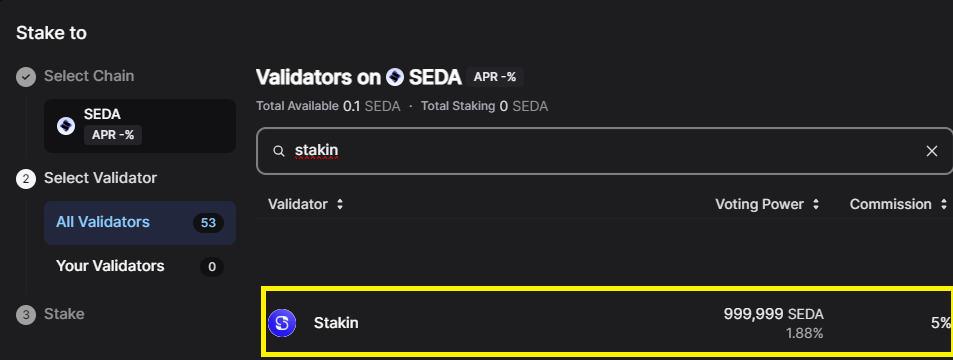

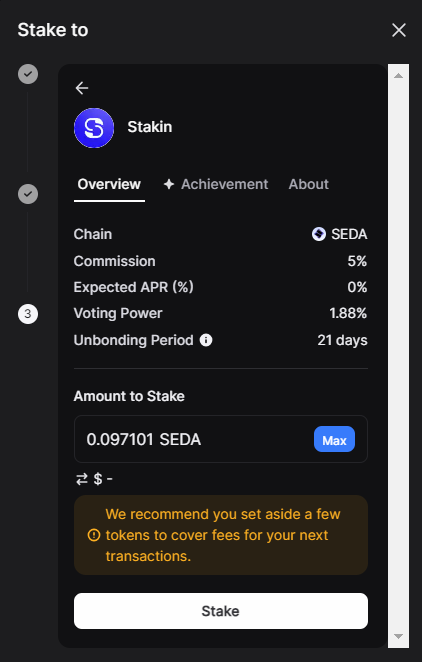

Next, select Stakin from the list of available validators by typing “Stakin'' in the Search validator search box.

On the newly opened popup, click “Stake”. Next, fill out the number of SEDA you want to stake and click “Stake” again.

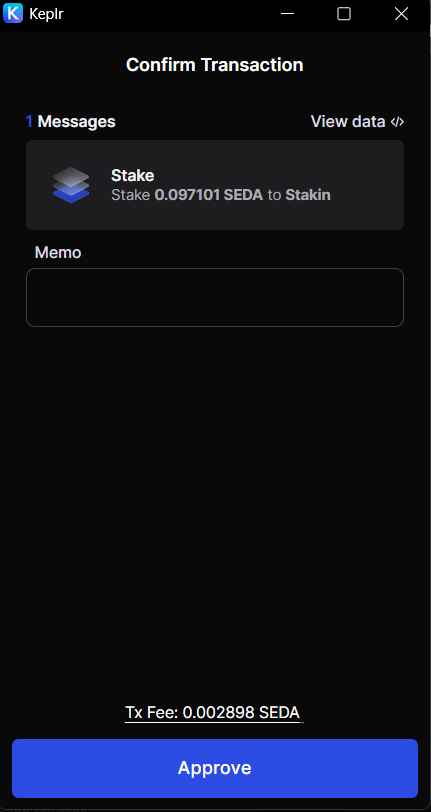

A new popup will prompt you to sign the staking transaction on-chain. Check the transaction details and select “Approve.”

Congratulations - You have staked your SEDA tokens with Stakin. You will soon start seeing your staking awards being accrued.

If you wish to unstake your SEDA tokens, you can do so from the Seda staking page on the Keplr dashboard.

Please note that in order to secure the network and protect against attacks, there is a 21-day unbonding period before your tokens become liquid again.

Why stake your SEDA with Stakin?

- Network expertise. Stakin was an active participant in SEDA testnet and already supports 20+ Cosmos networks, reflecting our dedication to the development of the SEDA ecosystem.

- Enterprise-grade staking infrastructure. We distribute our servers across various locations and partner with premier bare metal and cloud providers. We also provide Institutional-grade SLAs with uptime and slashing guarantees.

- You contribute to decentralization. By delegating to Stakin, you contribute to network decentralization by choosing a smaller validator.

SEDA staking for institutional investors

As an institutional-grade SEDA network node operator, Stakin has a full range of staking services and advantages to cater to the needs of enterprises and investors, such as asset managers, company treasuries, exchanges, VCs and hedge funds, wallets, custodians, and liquid staking services.

- Institutional grade SLAs with 99.5%+ uptime guarantees and slashing guarantees

- Integration with custodians, such as Fireblocks (via raw signing)

- Dedicated Account Manager to answer all your technical and commercial questions

- Information about potential airdrops that you may be eligible for by staking with us so that stakers can maximize your staking yield

- Whitelabel and dedicated nodes with dedicated infrastructure that can be deployed in your preferred region to fit decentralization or compliance needs

- Automated commission and reward management with clear reporting

- 24/7 monitoring and alerting with a private dashboard for dedicated and Whitelabel nodes

- Free premium access to Stakin Dashboard, which includes staking data visualization across any validator and premium historical data features (on selected networks)

DISCLAIMER: This is not financial advice. Staking and cryptocurrency investment involve a certain degree of risk, and there is always the possibility of loss, including the loss of all staked digital assets. Additionally, delegators are at risk of slashing in case of security or liveness faults on some PoS protocols. We advise you to DYOR before choosing a validator.