This is a quick and easy guide on staking BounceBit tokens on Stakin, with Metamask wallet.

BounceBit is a BTC restaking infrastructure that provides a foundational layer for different restaking products, secured by the regulated custody of Mainnet Digital (a premier asset management and fintech platform) and Ceffu (a secure environment for storing digital currencies for institutional entities). BounceBit supports the seamless transition of pure BTC into more agile forms such as BTCB on the BNB chain and Wrapped Bitcoin (WBTC), facilitating their entry into productive activities.

MetaMask is a widely used cryptocurrency wallet that supports multiple blockchains, including Ethereum, Binance Smart Chain, and multiple Layer 2 networks like Arbitrum, Polygon, etc.

Step 1 - Connect your Metamask wallet account with BounceBit

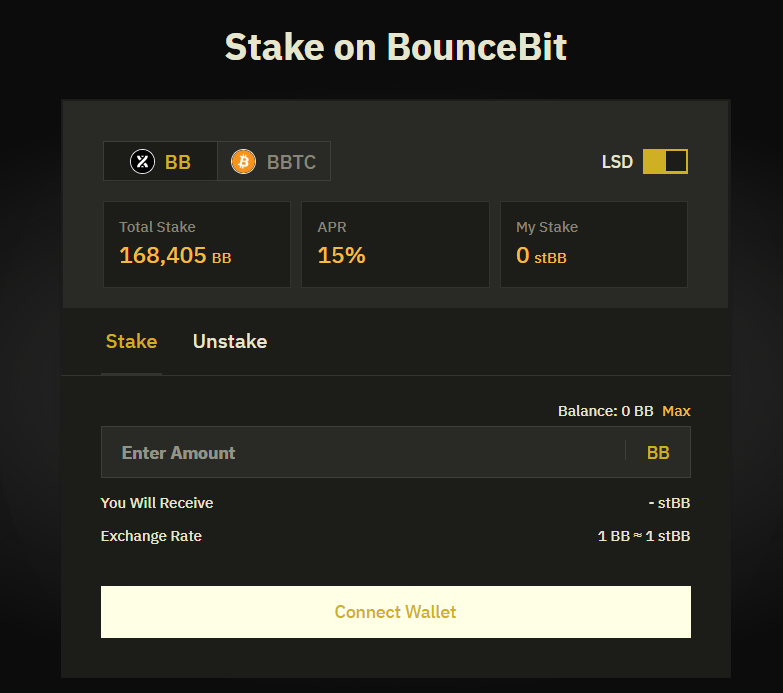

Head to https://bbscan.io/stake.

Next, click the "Connect Wallet" button and choose Metamask from the list of suggested wallets.

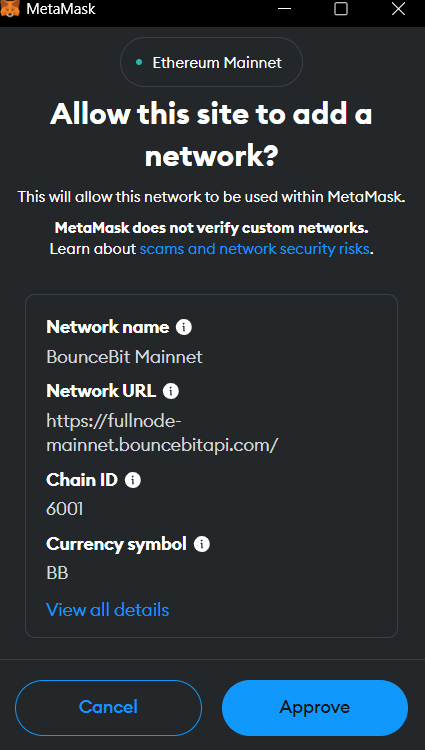

Finally, you will be prompted to add BounceBit to Metamask. Click “Approve.” If your Metamask is set to Ethereum by default, the next popup will prompt you to switch to BounceBit mainnet. Click “Switch network.”

You have now connected your Metamask wallet with BounceBit.

Step 2 - Stake your BounceBit tokens

Before you proceed with staking BounceBit BB tokens, you first need to top up your Metamask wallet account. You can do so by purchasing or swapping existing tokens with BB tokens on a centralized or a decentralized exchange of your choice.

Make sure you are still located at https://bbscan.io/stake

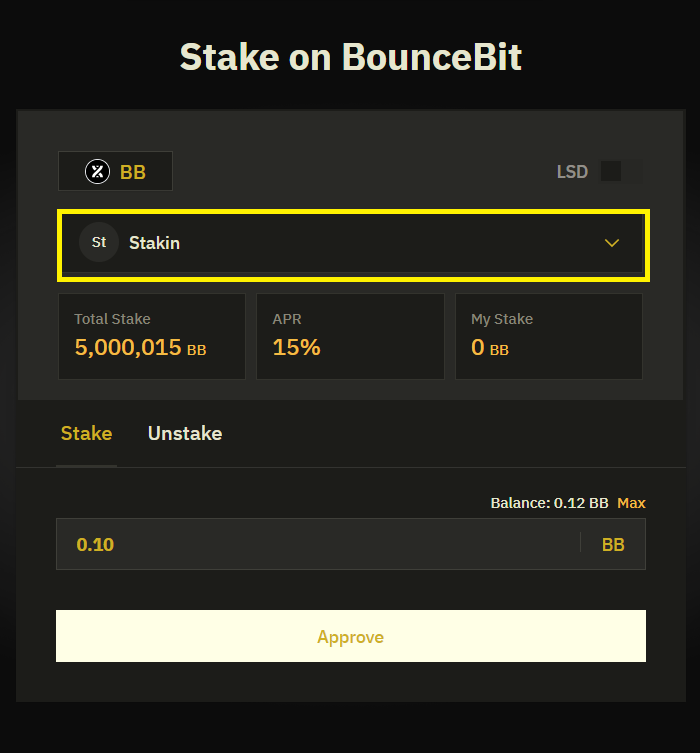

Select Stakin as a validator by typing “stakin” in the validator search box, as marked below.

Next, specify the amount to stake, leaving enough balance to cover transaction fees and avoiding a "not enough gas" error.

Important: Make sure the LSD toggle on the top right of the window is turned off.

Click “Stake.”

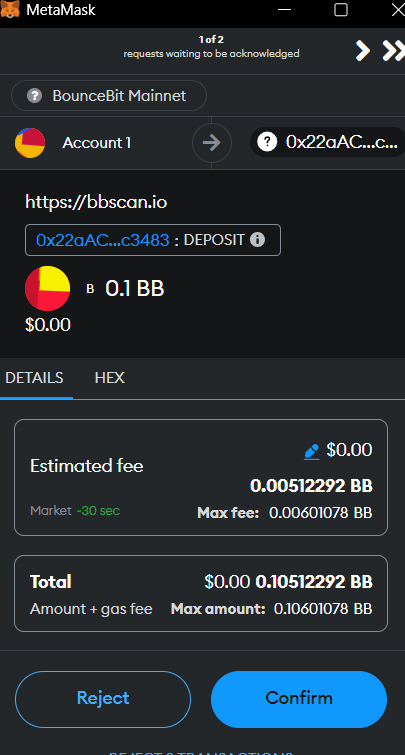

A few moments later, a Metamask popup window will prompt you to sign the staking transaction. Click “Confirm.”

Congratulations - You have staked your BounceBit tokens and will soon start accruing rewards from the network inflation.

The unstaking process is pretty straightforward, as the Stake and Unstake buttons are nested next to each other.

Why stake your BounceBit tokens with Stakin?

- Enterprise-grade staking infrastructure. We distribute our servers across various locations and partner with premier bare metal and cloud providers. We also provide Institutional-grade SLAs with uptime and slashing guarantees.

- You contribute to decentralization. By delegating to Stakin, you contribute to network decentralization by choosing a smaller validator.

BounceBit staking for institutional investors

As an institutional-grade BounceBit node operator, Stakin has a full range of staking services and advantages to cater to the needs of enterprises and investors, such as asset managers, company treasuries, exchanges, VCs and hedge funds, wallets, custodians, and liquid staking services:

- Institutional grade SLAs with 99.5%+ uptime guarantees and slashing guarantees

- Integration with custodians, such as Fireblocks (via raw signing)

- Information about potential airdrops that you may be eligible for by staking with us so that stakers can maximize your staking yield

- Dedicated Account Manager to answer all your technical and commercial questions

- 24/7 monitoring and alerting with a private dashoard for dedicated and Whitelabel nodes

- Free premium access to Stakin Dashboard, which includes staking data visualization across any validator and premium historical data features (on selected networks)

DISCLAIMER: This is not financial advice. Staking and cryptocurrency investment involve a certain degree of risk, and there is always the possibility of loss, including the loss of all staked digital assets. Additionally, delegators are at risk of slashing in case of security or liveness faults on some PoS protocols. We advise you to DYOR before choosing a validator.