Hey Readers👩💻,

DeFi (Decentralized Finance) the buzzword within blockchain for 2020 and maybe even 2021. One of the primary aims for DeFi is to create more equality and accessibility to financial instruments for people worldwide, which is done through implementing blockchain technology.

The economic environment currently confines the wealth creation of global markets and major asset classes to a small range of influential, geographically restricted economic leaders. Financial tooling services and capital-efficient models aren’t accessible for the everyday user, and investing in anything from equities, commodities, or real estate can be very hard. However, tokenization of assets on permissionless blockchain networks might be the solution that reduces entry barriers to global markets and increases efficiency. And that brings us to the Mirror Protocol, created by the Terra Money team.

For those unfamiliar with Terra, it is a highly active protocol in the DeFi market and the Cosmos Hub. The Terra Money team is the creator of the Luna Token, Terra Core, Mirror Finance, and the blockchain payment solution CHAI; it is a true innovator to free people from hidden fees embedded into regular payments. The Terra team wants to strip away all inefficiencies by using blockchain technology.

Terra runs on the Tendermint Delegated Proof of Stake algorithm and Cosmos SDK. It is aimed at becoming a new worldwide financial infrastructure on which unlimited DApps can be created. Additionally, Terra’s stablecoin can be used as the payment method on its blockchain payment solution. The Luna token is the primary digital asset in the Terra and therefore represents mining power.

- For more information on the Terra, click here. And if you’d like to stake $LUNA, visit our guide here.

The Terra Ecosystem is rapidly expanding with new projects, DApps, blockchains, and even entire back-end companies being introduced weekly. Mirror Protocol is one of Terra’s latest introductions, along with Alice Finance, for which a teaser was launched on the 7th of February 2021.

With that said, let’s have a look at the key aspects, token economics, and implementation of the Mirror Protocol.

🧐 Key Characteristics

Mirror Protocol is a Decentralized Finance (DeFi) protocol powered by smart contracts on the Terra network and enables synthetic assets called mAssets (Mirrored Assets). The mAssets follow the fiat assets price behavior and give traders open access to price exposure without the burdens of owning or transacting fiat assets. Some top trading assets on Mirror are mTSLA, mGOOGL (from Alphabet Inc.), mNFLX, and Apple, Microsoft, and Alibaba assets. Interestingly, these assets all overlap traditional assets that are most often bought by millennials, according to TradeTalks. For a full overview of the top trading, assets click here.

Minting mAssets is decentralized and is conducted by users throughout the network by opening a position and depositing collateral. The protocol itself ensures there is always enough collateral within the protocol to cover mAssets and manages markets for mAssets by listing them on Terra swap against UST. In addition to minting synthetic assets, you’re also able to swap, provide liquidity, and more, which we will discuss in the token economics paragraph below.

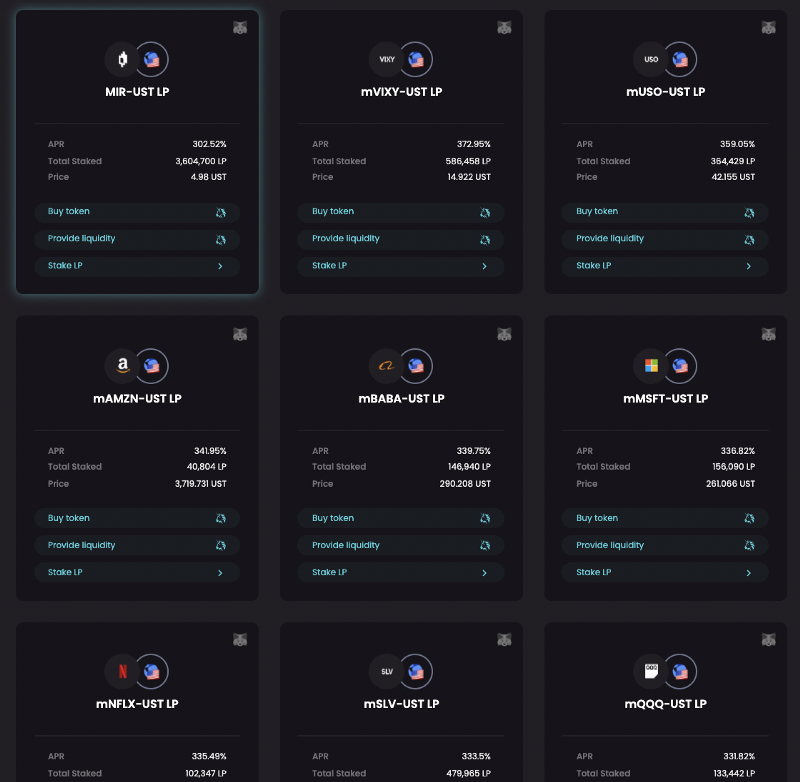

In addition to mAssets, the Mirror Protocol also has its native asset called Mirror Token (MIR), which are minted by the protocol itself and distributed as a reward to reinforce behavior that secures the ecosystem. With this asset, Mirror ensures liquid mAsset markets by rewarding MIR to users who stake LP Tokens obtained through providing liquidity. MIR is valuable as it can be staked to receive voting privileges and earn a share of the protocol’s CDP withdrawal fees.

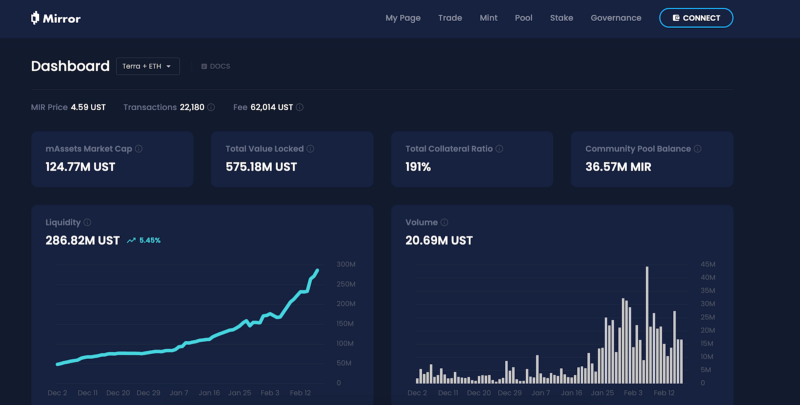

Since its launch, the Mirror Protocol has been growing extensively. Currently, the total value locked in smart-contracts is 575.18M (on the 18th of February 2021) which comes around to a little under 20 million USD (based on the price of TerraUSD on coinmarketcap.com on the 18th of February 2021). Additionally, the 24-hour trading volume of MIR was $13.718.263,60 on the 18th of February, according to coinmarketcap.com.

⛓ Protocol Participants & Governance

Within the Mirror Protocol, there are five distinct roles known as trader, minter, liquidity provider, staker, and oracle feeder. As the name suggests, the trader engages in buying and selling mAssets against UST through Terraswap and benefits from price exposure via mAssets.

The minter enters into a collateralized debt position (CDP) to obtain newly minted mAssets. CDP’s accept collateral in UST or mAssets and always maintain a specific ratio above the mAssets minimum (set by governance). You can withdraw your collateral as long as the CDP’s ratio remains above the minimum. Minters can adjust the CDP’s collateral ratio by burning mAssets or depositing more collateral.

The liquidity provider adds equal amounts of a mAsset and UST to a corresponding Terraswap pool, increasing liquidity for that market. The staker users their LP tokens or MIR assets to earn staking rewards. LP token stakers earn rewards from new MIR tokens from inflation; MIR tokens earn staking rewards from CDP withdrawal fees. If you own MIR assets, you can participate in governance and receive voting power weighted by total assets. LP Tokens can be unstaked at any time, but MIR tokens can only be unstaked when they are not used to represent a vote on a pending governance poll.

Lastly, the oracle feeder is a designated Terra account responsible for providing an accurate and up-to-date price feed for a specific mAsset. It is the only party that is permitted to update the registered reported price of the asset. The oracle feeder is elected through governance.

There are no admin keys with privileged access. After the initial bootstrapping of contracts, the Gov contract is set to be the Mirror Protocol contract owner, and all changes must be made through the governance with the procedure defined in this section. The MIR asset serves as the governance asset, and as mentioned above, only users with staked MIR can participate in voting. Voting is done through polls, which are the new governance proposals in Mirror.

Any user can create a poll by paying an initial deposit of MIR tokens. If the poll then fails to pass the minimum votes needed, the MIR deposit is given to MIR stakers and distributed proportionally according to their relative stake.

Once submitted, a poll can be voted on by the community until its voting period has concluded. When the poll passes quorum and threshold conditions, which can be found here, it is ratified and automatically applied.

💰 Token Economics

There are three different tokens in the Mirror Protocol, the MIR token, the mAsset, and the LP token.

The LP tokens are for Liquidity Providers whenever they add liquidity to the mAsset-UST or MIR-UST pools. Each pool has a unique LP asset associated with it and can’t be combined with LP assets from other pools. This asset serves primarily as a unit of account, representing the pool’s liquidity providers’ shares. Holders of the asset receive a portion of MIR rewards.

LP tokens’ token supply works as follows: there is a different LP token for each mAsset-UST’s Terraswap pool and the MIR-UST pool.

Then there is the mAsset, which are blockchain assets that behave like a “mirror” version of real-world assets through reflecting the exchange prices on-chain. Unlike the more traditional asset, MIR, mAssets are purely synthetic and only capture the corresponding asset’s price movement. The registered prices are reported by the Oracle Feeder, which is mainly used for determining the CDP and doesn’t affect the trading price on the Terraswap.

Prices are only considered valid for 60 seconds. If no new prices are published after the data has expired, Mirror will disable CDP operations like mint, burn, deposit, and withdraw until the price feed resumes.

Finally, the native asset of the Mirror Protocol, the Mirror Token, must be staked to vote on active polls and is required as a deposit for making new governance polls. In the future, it will also serve purposes for the protocol that increase its utility and value. Users who stake MIR earn rewards generated from withdrawing collateral from CDP positions within the protocol.

MIR is also used to incentivize users to farm yields by staking LP tokens, which were minted by providing liquidity for MIR and mAssets. Yield is paid to the users from MIRs that are newly minted through annual inflation, which gradually increases the total supply of MIR until the end of 4th year.

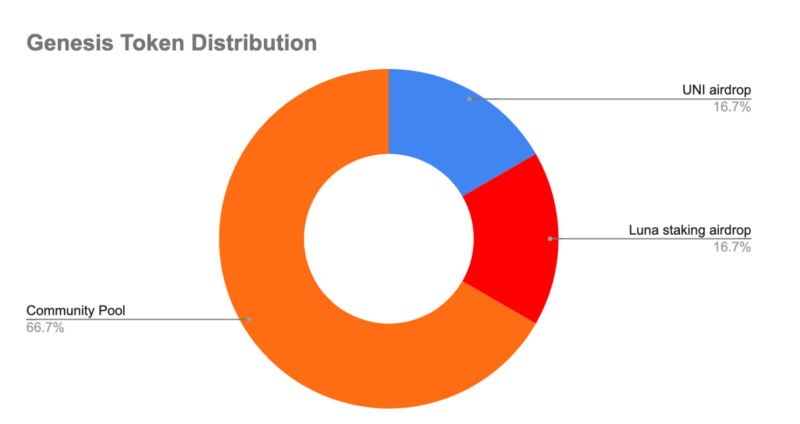

- The total token distribution is planned at 370,575,000 MIR tokens, released over four years.

💻 Mirror Implementation

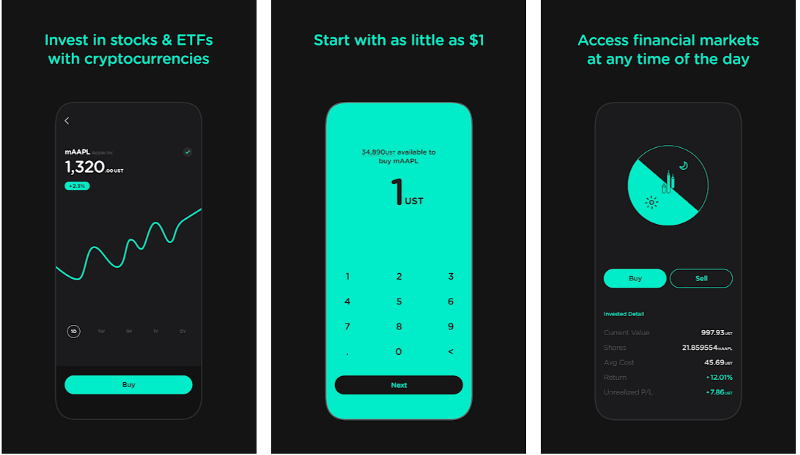

The Mirror Protocol has its wallet, the Mirror Wallet, which ATQ Capital manages. The wallet can be used to invest in stocks, and ETF’s with crypto assets and lets users access financial markets at any time of the day. The Mirror Wallet is a very straightforward wallet that connects you with the protocol and offers a wide range of synthetic investment options. For example, through the Mirror application, you can:

- Make informed decisions by access real-time market data and financial news.

- Manage opportunities through global, open access to a 24-hour market.

- Instant deposit and withdrawal

Apart from a mobile investment wallet, the Mirror Protocol has set up a web application platform that you can use to connect with the Terra Network. For a full guide on using the web app, click here.

🎆 The Future Of Mirror Protocol

In an interview with DeFi prime, the Mirror Protocol expanded on their immediate and future goals. Initially, the team will be focussing on improving usability for both Terra and Ethereum users. That also includes incorporating dashboard metrics, fixing initial points of friction, and attracting more liquidity.

Additionally, the team will be improving and simplifying the existing process of adding new assets onto the protocol through the governance and proposals of the Protocol’s users. Furthermore, beyond the Mirror Protocol, the Terra team is working on Anchor, a low-volatility benchmark rate savings protocol on Terra, which addresses many of the problems currently facing the DeFi market (variable-rate yields derived from speculatory yield farming and improving liquidation models to protect borrower collateral in periods of significant market volatility).

DISCLAIMER: This is not financial advice. Staking, delegation, and cryptocurrencies involve a high degree of risk, and there is always the possibility of loss, including the failure of all staked digital assets. Additionally, delegators are at risk of slashing in case of security or liveness faults on some protocols. We advise you to do your due diligence before choosing a validator.